Decoding The Day Dealer’s Roadmap: Mastering Chart Patterns For Revenue

Decoding the Day Dealer’s Roadmap: Mastering Chart Patterns for Revenue

Associated Articles: Decoding the Day Dealer’s Roadmap: Mastering Chart Patterns for Revenue

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Day Dealer’s Roadmap: Mastering Chart Patterns for Revenue. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Day Dealer’s Roadmap: Mastering Chart Patterns for Revenue

Day buying and selling, the artwork of shopping for and promoting belongings throughout the similar buying and selling day, calls for velocity, precision, and a eager understanding of market dynamics. Whereas basic evaluation performs a job, technical evaluation, notably the identification and interpretation of chart patterns, kinds the bedrock of profitable day buying and selling methods. This text delves into a few of the most dependable and worthwhile chart patterns employed by seasoned day merchants, offering insights into their formation, recognition, and sensible software.

Understanding Chart Patterns: The Language of the Market

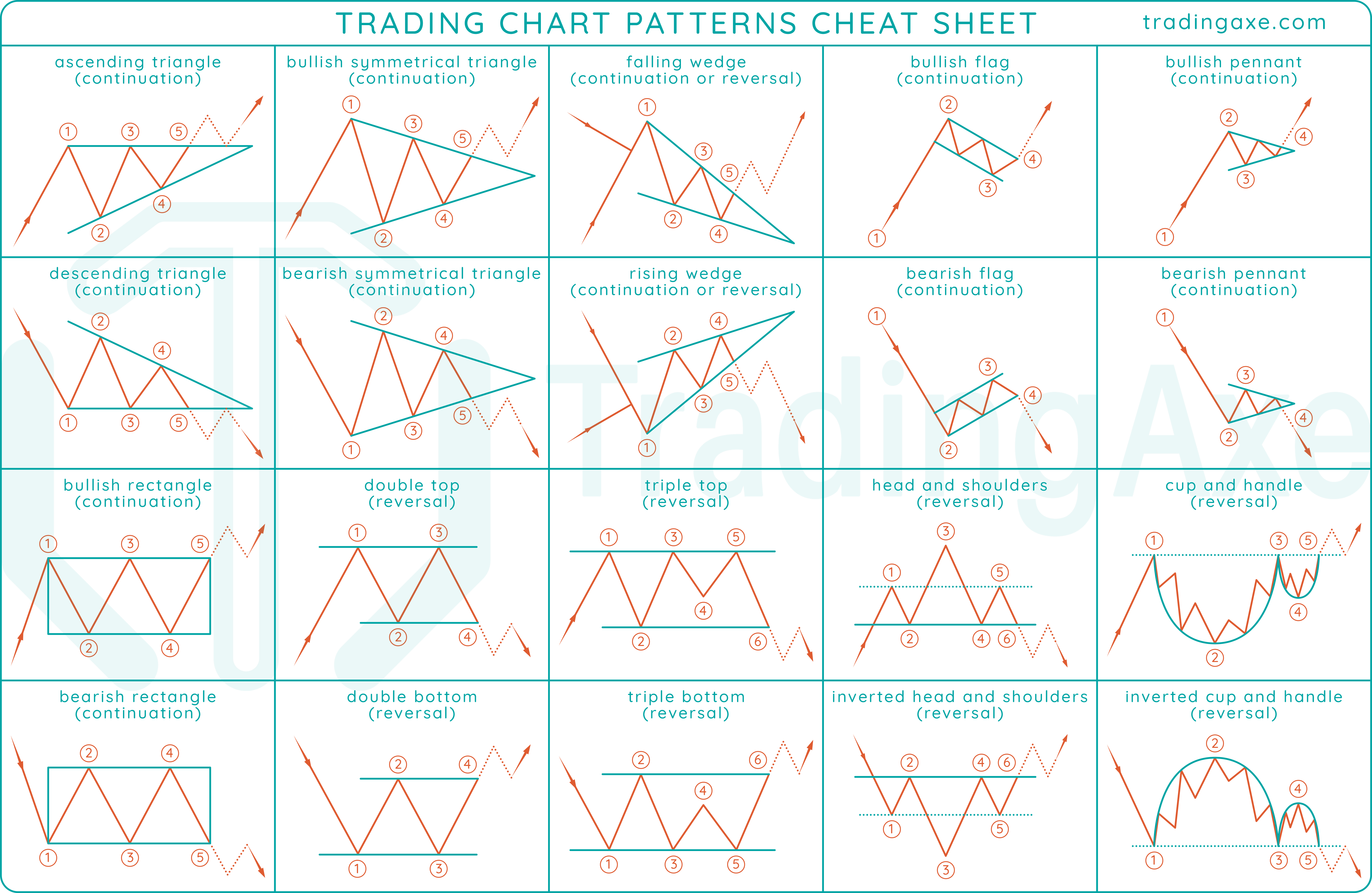

Chart patterns are visually identifiable formations on value charts that usually precede particular value actions. They symbolize the collective conduct of market contributors, revealing shifts in sentiment and potential future value motion. Recognizing these patterns permits day merchants to anticipate potential breakouts, reversals, or continuations, offering invaluable clues for entry and exit factors. These patterns are usually not foolproof predictors, however they considerably enhance the likelihood of profitable trades when mixed with different technical indicators and danger administration methods.

I. Continuation Patterns: Driving the Wave

Continuation patterns recommend that the prevailing pattern will seemingly resume after a short lived pause or consolidation. These patterns supply wonderful alternatives for day merchants to capitalize on ongoing momentum.

-

Flags and Pennants: These patterns resemble miniature flags or pennants connected to a flagpole (the previous pattern). Flags are characterised by parallel trendlines, creating an oblong form, whereas pennants are triangular, converging trendlines. Each point out a short lived pause within the pattern, adopted by a resumption within the unique path. Merchants search for a breakout past the sample’s higher or decrease trendline, relying on the path of the previous pattern. Quantity sometimes contracts throughout the sample and expands upon the breakout.

-

Triangles: Triangles are characterised by converging trendlines, making a triangular form. There are three fundamental sorts: symmetrical, ascending, and descending. Symmetrical triangles recommend a continuation of the pattern, with the breakout path unsure till it happens. Ascending triangles point out bullish continuation, whereas descending triangles recommend bearish continuation. The breakout sometimes happens close to the apex of the triangle, with elevated quantity confirming the transfer.

-

Rectangles (or Consolidation Patterns): Rectangles are characterised by two horizontal trendlines, representing a interval of value consolidation. The worth oscillates between these traces earlier than finally breaking out within the path of the prevailing pattern. Merchants search for a decisive break above the higher trendline for a bullish continuation or beneath the decrease trendline for a bearish continuation, with elevated quantity confirming the breakout.

II. Reversal Patterns: Turning the Tide

Reversal patterns recommend a possible shift within the prevailing pattern. Figuring out these patterns is essential for day merchants seeking to capitalize on pattern reversals.

-

Head and Shoulders: This can be a basic reversal sample. It consists of three peaks, with the center peak (the "head") being considerably increased than the opposite two ("shoulders"). A neckline connects the lows of the 2 shoulders. A break beneath the neckline confirms the bearish reversal, offering a possible shorting alternative. The gap from the top to the neckline typically offers a goal for the worth decline.

-

Inverse Head and Shoulders: That is the mirror picture of the top and shoulders sample, indicating a bullish reversal. It consists of three troughs, with the center trough being considerably decrease than the opposite two. A break above the neckline confirms the bullish reversal, offering a possible shopping for alternative.

-

Double Tops and Double Bottoms: Double tops are fashioned when the worth reaches an identical excessive twice, adopted by a decline. Double bottoms are fashioned when the worth reaches an identical low twice, adopted by an increase. These patterns recommend a possible pattern reversal. A break beneath the neckline (double high) or above the neckline (double backside) confirms the reversal.

-

Triple Tops and Triple Bottoms: These patterns are just like double tops and bottoms however with three situations of comparable highs or lows. They sometimes sign a stronger reversal than their double counterparts.

III. Different Vital Chart Patterns for Day Buying and selling

Past the basic patterns, different formations can present invaluable insights for day merchants:

-

Wedges: Wedges are converging trendlines, just like triangles, however they are often both bullish or bearish, relying on their slope. Bullish wedges slope upwards, whereas bearish wedges slope downwards. Breakouts from wedges can sign continuation or reversal, relying on the context.

-

Gaps: Gaps are value discontinuities, the place the worth opens considerably increased or decrease than yesterday’s shut. Gaps will be vital indicators of robust market momentum or vital information occasions. They typically get crammed (the worth retraces to shut the hole) however not all the time. Day merchants needs to be cautious of buying and selling gaps, as they are often unpredictable.

-

Doji: A Doji is a candlestick sample the place the open and shut costs are just about the identical, making a small, horizontal line. Dojis typically sign indecision out there and might precede a pattern reversal or continuation.

Making use of Chart Patterns in Day Buying and selling: A Sensible Method

Whereas recognizing chart patterns is crucial, profitable day buying and selling requires a holistic method. Here is find out how to successfully combine chart patterns into your buying and selling technique:

-

Affirmation is Key: Do not rely solely on chart patterns. Verify your evaluation with different technical indicators like quantity, transferring averages, RSI, MACD, and many others. Elevated quantity throughout a breakout is a powerful affirmation sign.

-

Danger Administration is Paramount: All the time use stop-loss orders to restrict potential losses. Place your stop-loss order strategically, typically beneath the assist degree (for lengthy positions) or above the resistance degree (for brief positions).

-

Context is Essential: Contemplate the broader market context and the precise asset’s traits earlier than getting into a commerce. A sample that works properly in a trending market won’t be as efficient in a sideways market.

-

Apply and Endurance: Mastering chart sample recognition requires time and observe. Begin by backtesting your methods on historic knowledge and regularly transfer to stay buying and selling with small positions. Endurance is essential; not each sample will end in a worthwhile commerce.

-

Embrace Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different belongings and buying and selling methods to cut back danger.

Conclusion:

Chart patterns present a robust instrument for day merchants to anticipate market actions and enhance their buying and selling selections. Nevertheless, they aren’t a assured path to riches. By combining chart sample recognition with a sturdy danger administration technique, thorough market evaluation, and steady studying, day merchants can considerably improve their probabilities of success on this dynamic and difficult market atmosphere. Keep in mind that constant studying, self-discipline, and adaptation are essential for long-term success in day buying and selling. All the time prioritize danger administration and by no means make investments greater than you may afford to lose.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Day Dealer’s Roadmap: Mastering Chart Patterns for Revenue. We thanks for taking the time to learn this text. See you in our subsequent article!