Decoding The Diesel Gas Value Chart: A Complete Evaluation

Decoding the Diesel Gas Value Chart: A Complete Evaluation

Associated Articles: Decoding the Diesel Gas Value Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the Diesel Gas Value Chart: A Complete Evaluation. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Diesel Gas Value Chart: A Complete Evaluation

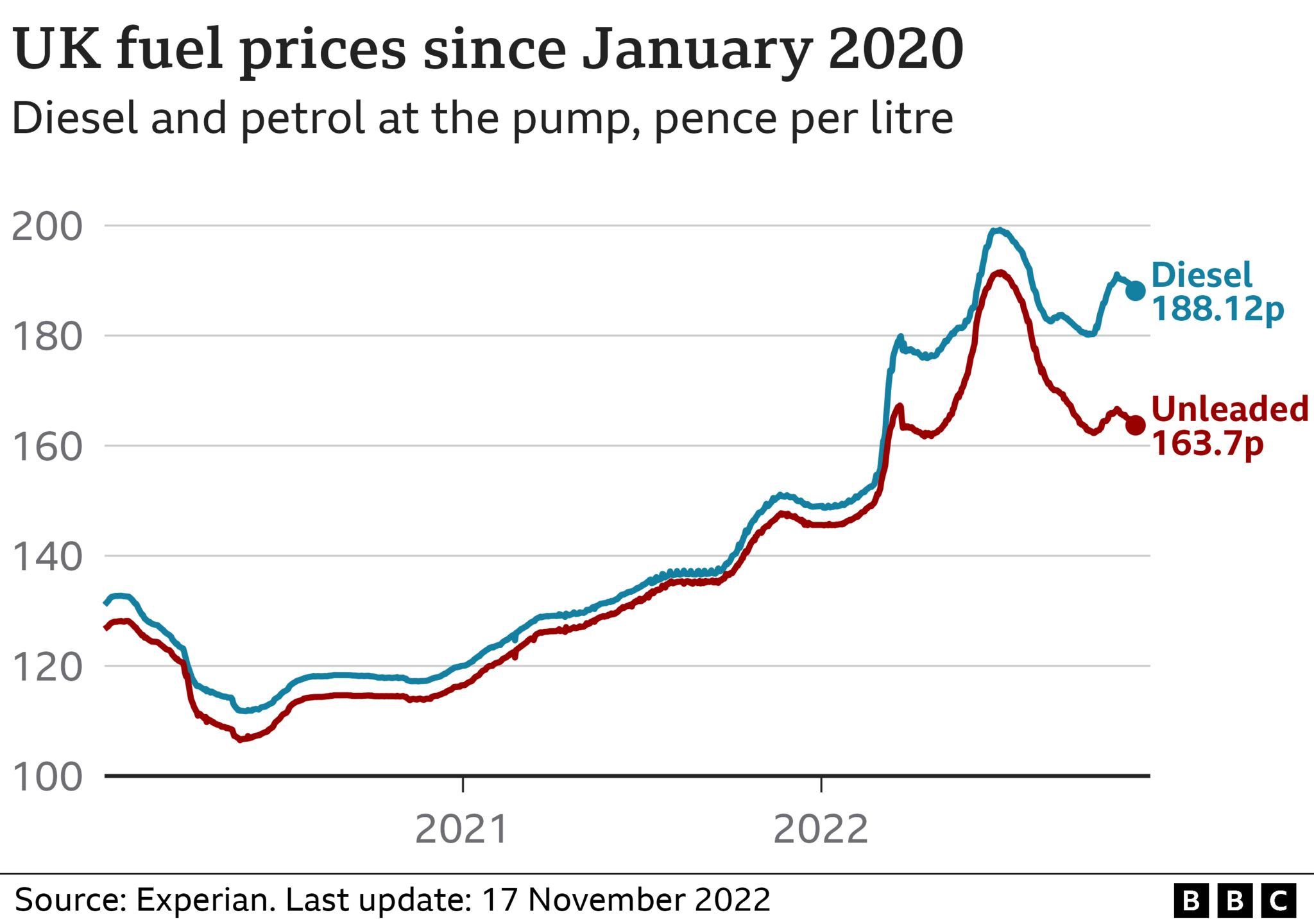

Diesel gasoline, a crucial element of world transportation and trade, displays worth fluctuations that ripple via economies worldwide. Understanding these fluctuations, as depicted in a diesel gasoline worth chart, is essential for companies, customers, and policymakers alike. This text delves into the intricacies of diesel worth charts, analyzing the components driving worth adjustments, deciphering widespread chart patterns, and exploring the implications of worth volatility for varied stakeholders.

Understanding the Diesel Gas Value Chart:

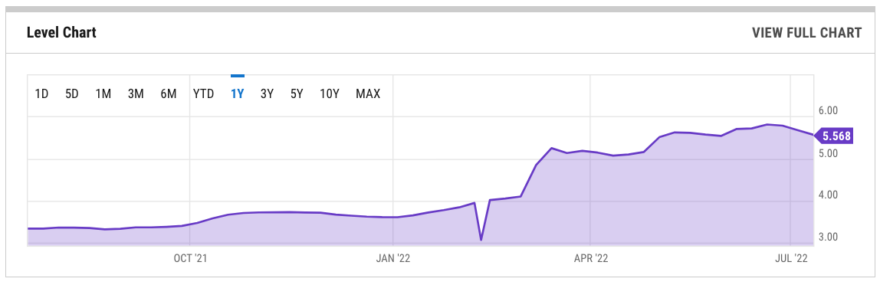

A typical diesel gasoline worth chart shows the worth of diesel gasoline over a particular interval, often plotted in opposition to time (days, weeks, months, or years). The chart can take varied varieties, together with line graphs, bar charts, and candlestick charts, every providing a novel perspective on worth actions. The vertical axis represents the worth per unit (e.g., per gallon, per liter), whereas the horizontal axis represents time. Key components usually included are:

- Value Knowledge: The precise worth of diesel gasoline at particular time limits. This information is often sourced from respected market information suppliers or authorities businesses.

- Transferring Averages: These strains clean out short-term worth fluctuations, revealing underlying developments. Widespread transferring averages embrace 50-day, 100-day, and 200-day averages.

- Pattern Strains: These strains join important worth highs or lows, highlighting the general course of the worth motion (uptrend, downtrend, or sideways development).

- Help and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt via. Help ranges signify worth flooring, whereas resistance ranges signify worth ceilings.

- Indicators: Technical indicators, equivalent to Relative Energy Index (RSI) and Transferring Common Convergence Divergence (MACD), could be overlaid on the chart to supply extra insights into worth momentum and potential reversals.

Components Influencing Diesel Gas Costs:

The worth of diesel gasoline is a posh interaction of assorted components, making correct prediction difficult. Key influences embrace:

- Crude Oil Costs: Diesel gasoline is refined from crude oil, making the worth of crude oil essentially the most important driver of diesel costs. An increase in crude oil costs immediately interprets to larger diesel costs, and vice versa. Geopolitical occasions, OPEC manufacturing quotas, and international provide and demand dynamics considerably influence crude oil costs.

- Refining Prices: The method of refining crude oil into diesel gasoline includes important prices, together with vitality consumption, labor, and upkeep. Adjustments in these prices immediately influence the ultimate worth of diesel.

- Demand: Sturdy financial development and elevated industrial exercise result in larger demand for diesel gasoline, pushing costs upward. Conversely, financial downturns or seasonal differences can scale back demand and decrease costs.

- Provide: International provide disruptions, equivalent to refinery outages, pipeline points, or geopolitical instability in main oil-producing areas, can constrict provide and drive costs larger. Elevated manufacturing capability, then again, can result in decrease costs.

- Authorities Rules and Taxes: Taxes and environmental laws, equivalent to emission requirements, can considerably influence diesel costs. Larger taxes or stricter laws can improve the price of diesel gasoline.

- Seasonality: Demand for diesel gasoline usually varies seasonally. For instance, larger demand throughout the peak agricultural season or winter months can result in worth will increase.

- Hypothesis and Market Sentiment: Investor sentiment and hypothesis within the futures market can affect diesel costs, typically main to cost swings that aren’t completely justified by elementary components.

- Forex Change Charges: The worth of crude oil is often quoted in US {dollars}. Fluctuations in trade charges can influence the price of diesel in nations with totally different currencies.

Decoding Chart Patterns:

Analyzing diesel worth charts requires understanding widespread chart patterns that may sign future worth actions. Some key patterns embrace:

- Uptrends: A sequence of upper highs and better lows suggests a bullish development, indicating rising costs.

- Downtrends: A sequence of decrease highs and decrease lows suggests a bearish development, indicating falling costs.

- Sideways Traits (Consolidation): A interval of worth stability inside an outlined vary, usually previous a big worth breakout in both course.

- Head and Shoulders: A reversal sample suggesting a possible worth decline.

- Double Tops/Bottoms: Reversal patterns that point out potential adjustments within the prevailing development.

- Triangles: Continuation patterns that counsel a continuation of the prevailing development after a interval of consolidation.

Implications of Value Volatility:

Diesel worth volatility has important implications for varied stakeholders:

- Transportation Firms: Fluctuating diesel costs immediately influence transportation prices, affecting profitability and probably main to cost will increase for items and companies. Hedging methods, equivalent to utilizing futures contracts, can assist mitigate these dangers.

- Agriculture: Diesel gasoline is essential for agricultural equipment, making farmers susceptible to cost swings. Excessive diesel costs can scale back profitability and influence meals costs.

- Manufacturing and Trade: Many industries rely closely on diesel-powered tools, making them prone to cost fluctuations. Elevated diesel prices can result in larger manufacturing prices and probably influence competitiveness.

- Customers: Larger diesel costs translate to larger prices for items and companies, as transportation prices are handed on to customers.

- Governments: Governments usually implement insurance policies to handle diesel worth volatility, equivalent to gasoline subsidies or tax changes.

Conclusion:

The diesel gasoline worth chart is a worthwhile software for understanding the dynamics of this significant commodity. By analyzing the varied components influencing costs and deciphering chart patterns, companies, customers, and policymakers can higher anticipate worth actions and develop methods to mitigate the dangers related to worth volatility. Nevertheless, it is essential to keep in mind that predicting future costs with certainty is inconceivable. Cautious evaluation, mixed with an intensive understanding of the underlying financial and geopolitical components, is important for navigating the complexities of the diesel gasoline market. Steady monitoring of the chart, coupled with a complete understanding of the influencing components, is paramount for knowledgeable decision-making on this dynamic market.

![Petrol and diesel prices from July to November 1, 2022 [Infographic]](https://citinewsroom.com/wp-content/uploads/2022/11/9C8F0585-39F6-4D0B-9494-35F81F538A13-1024x890.jpeg)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Diesel Gas Value Chart: A Complete Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!