Decoding The Double High Chart Sample: A Complete Information For Merchants

Decoding the Double High Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the Double High Chart Sample: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Double High Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Double High Chart Sample: A Complete Information for Merchants

The double prime chart sample is a basic reversal sample in technical evaluation, signifying a possible shift from an uptrend to a downtrend. Its visually distinctive form, resembling two peaks of roughly equal top, makes it comparatively simple to establish, however understanding its nuances and correct utility requires a deeper dive. This text will comprehensively discover the double prime sample, overlaying its formation, identification, affirmation, buying and selling methods, and customary pitfalls.

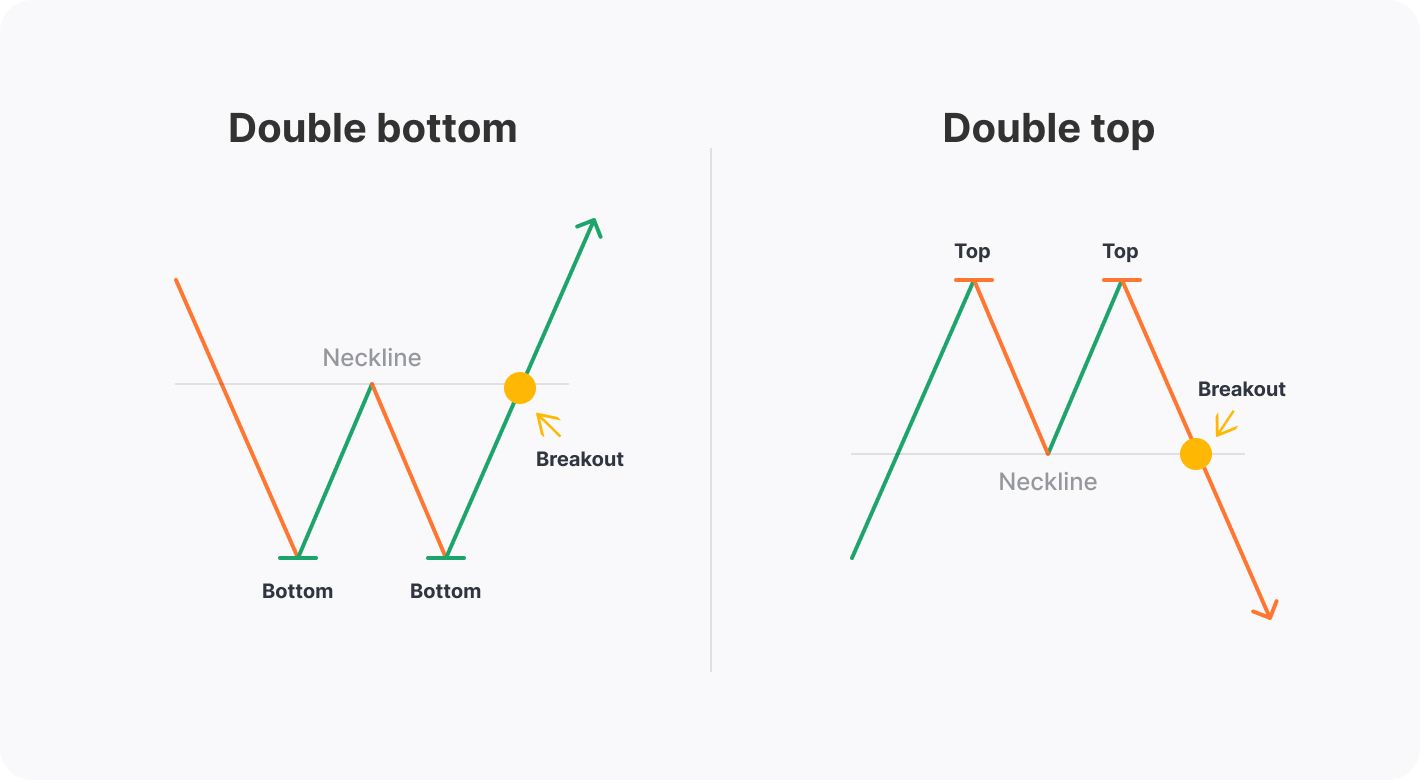

Understanding the Formation of a Double High

A double prime sample varieties throughout an uptrend. As the value approaches resistance, it encounters promoting stress, inflicting a short lived pullback. Nonetheless, consumers step in, pushing the value again as much as problem the earlier excessive (the primary peak). This second try to interrupt by means of the resistance degree fails, leading to one other pullback, mirroring the earlier one. This second peak, roughly equal in top to the primary, completes the double prime formation. The neckline, a vital factor of the sample, is fashioned by connecting the lows of the 2 pullbacks.

The important thing traits of a double prime are:

- Two distinct peaks: The 2 peaks ought to be comparatively shut in worth and time, ideally inside 10-20% of one another. Vital discrepancies can weaken the sample’s predictive energy.

- A neckline: This horizontal or barely upward sloping line connects the lows of the 2 pullbacks. It serves as essential assist in the course of the uptrend and as a possible breakout level for the downtrend.

- Clear pullbacks: The pullbacks between the peaks ought to be vital sufficient to display a short lived lack of momentum. Shallow pullbacks can solid doubt on the validity of the sample.

- Quantity affirmation: Whereas not at all times obligatory, a lower in quantity on the second peak in comparison with the primary peak can strengthen the bearish sign. This means waning shopping for curiosity.

- Worth motion across the neckline: The worth motion across the neckline in the course of the formation of the sample gives helpful perception. A transparent bounce off the neckline in the course of the uptrend reinforces its significance.

Figuring out a Double High on a Chart

Figuring out a double prime requires cautious commentary of worth motion and quantity. This is a step-by-step information:

- Determine the Uptrend: The sample varieties throughout a longtime uptrend. Search for a interval of constant worth will increase.

- Spot the Peaks: Search for two peaks of roughly equal top. Minor discrepancies are acceptable, however vital variations weaken the sample’s reliability.

- Draw the Neckline: Join the lows of the 2 pullbacks to kind the neckline. This line is essential for figuring out the potential worth goal.

- Assess the Pullbacks: Study the pullbacks between the peaks. They need to be vital sufficient to point a short lived lack of shopping for momentum.

- Analyze Quantity: Evaluate the quantity on the two peaks. Lowering quantity on the second peak suggests weakening shopping for stress.

- Think about the Total Context: Do not analyze the sample in isolation. Think about broader market developments, financial indicators, and company-specific information which may affect worth actions.

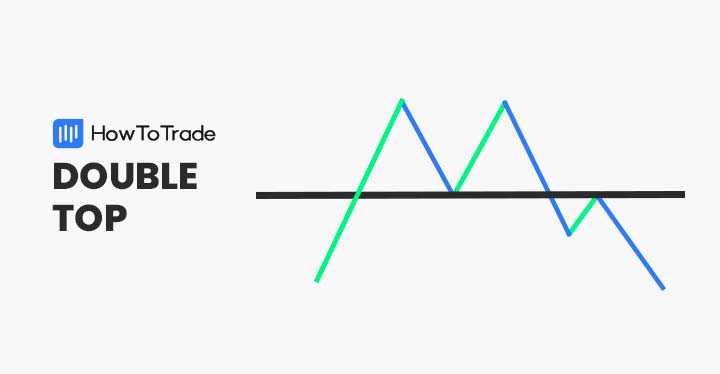

Affirmation of the Double High Sample

Figuring out a possible double prime is simply step one. Affirmation is essential earlier than coming into a brief place. Key confirmations embody:

- Neckline Breakout: A decisive break beneath the neckline is a very powerful affirmation sign. This means a transparent shift in momentum. The break ought to be accompanied by elevated quantity, signifying robust promoting stress.

- Worth Goal: The worth goal for a double prime sample is usually calculated by measuring the space between the neckline and the very best peak after which subtracting that distance from the neckline. This gives a possible worth goal for the downtrend.

- RSI and MACD Divergence: Bearish divergence between worth and momentum indicators just like the Relative Power Index (RSI) and Shifting Common Convergence Divergence (MACD) can verify the sample’s bearish implications. This happens when worth makes increased highs, however the indicators fail to substantiate with increased highs.

- Candlestick Patterns: Affirmation can be present in bearish candlestick patterns showing at or close to the neckline breakout, reminiscent of engulfing patterns or bearish harami.

Buying and selling Methods for the Double High Sample

As soon as the double prime sample is confirmed, a number of buying and selling methods could be employed:

- Brief Promoting: The most typical technique is to brief promote the asset after a confirmed neckline breakout. This entails borrowing the asset and promoting it, hoping to purchase it again at a cheaper price later.

- Cease-Loss Order: A stop-loss order is essential to restrict potential losses. Place it barely above the neckline to reduce danger.

- Take-Revenue Order: A take-profit order ought to be positioned on the calculated worth goal to safe earnings.

- Trailing Cease-Loss: As the value strikes in your favor, a trailing stop-loss might help shield earnings and robotically modify the stop-loss order to lock in beneficial properties.

Frequent Pitfalls to Keep away from

Whereas the double prime sample is a helpful software, it is essential to keep away from widespread pitfalls:

- False Breakouts: The worth might briefly break beneath the neckline earlier than recovering. It is a false breakout, and it is essential to differentiate it from a real breakout. Search for affirmation of the break with elevated quantity and sustained worth motion.

- Asymmetrical Peaks: Vital variations within the top of the 2 peaks weaken the sample’s reliability.

- Ignoring Context: Analyzing the sample in isolation can result in inaccurate predictions. Think about broader market developments, financial indicators, and company-specific information.

- Over-Reliance on the Sample: The double prime sample will not be a foolproof predictor. Use it along with different technical indicators and elementary evaluation for a extra complete buying and selling technique.

- Improper Danger Administration: Failing to make use of stop-loss orders and correct place sizing can result in vital losses even with a appropriately recognized sample.

Conclusion:

The double prime chart sample is a robust software for figuring out potential development reversals. Nonetheless, its profitable utility requires a radical understanding of its formation, affirmation indicators, and related dangers. By combining a eager eye for chart patterns with sound danger administration methods and a holistic strategy that includes different indicators and elementary evaluation, merchants can considerably enhance their probabilities of efficiently using the double prime sample of their buying and selling methods. Do not forget that no technical sample ensures success, and diligent analysis and danger administration are paramount for accountable buying and selling.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Double High Chart Sample: A Complete Information for Merchants. We admire your consideration to our article. See you in our subsequent article!