Decoding The Dow Jones Futures Chart On TradingView: A Complete Information

Decoding the Dow Jones Futures Chart on TradingView: A Complete Information

Associated Articles: Decoding the Dow Jones Futures Chart on TradingView: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Decoding the Dow Jones Futures Chart on TradingView: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Dow Jones Futures Chart on TradingView: A Complete Information

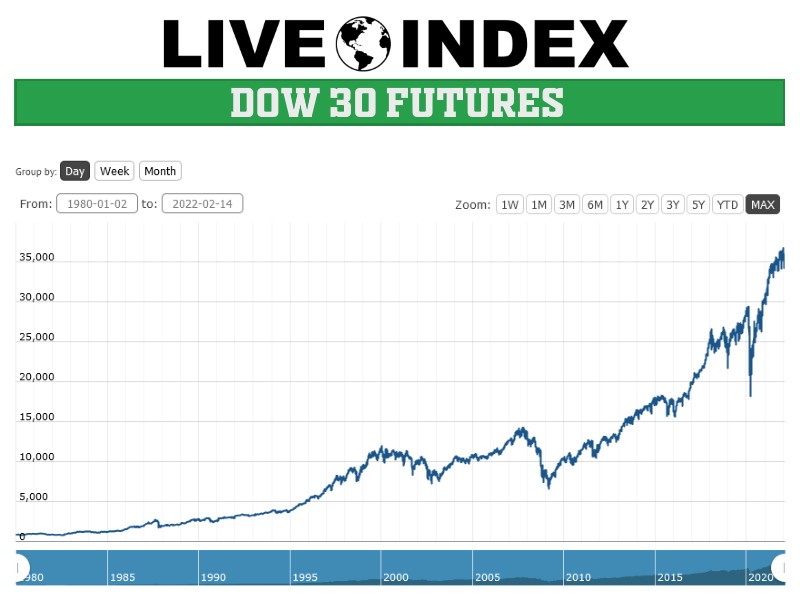

The Dow Jones Industrial Common (DJIA), a benchmark for the US economic system, is a strong indicator for merchants worldwide. Understanding its actions is essential for navigating the market successfully. Whereas many deal with the precise DJIA’s intraday efficiency, buying and selling its futures contracts presents distinctive benefits, together with prolonged buying and selling hours and the flexibility to leverage positions. TradingView, a preferred charting platform, gives a wealth of instruments to investigate the Dow Jones futures chart, empowering merchants of all expertise ranges. This text delves into the intricacies of utilizing TradingView to investigate Dow Jones futures, overlaying key indicators, chart patterns, and danger administration methods.

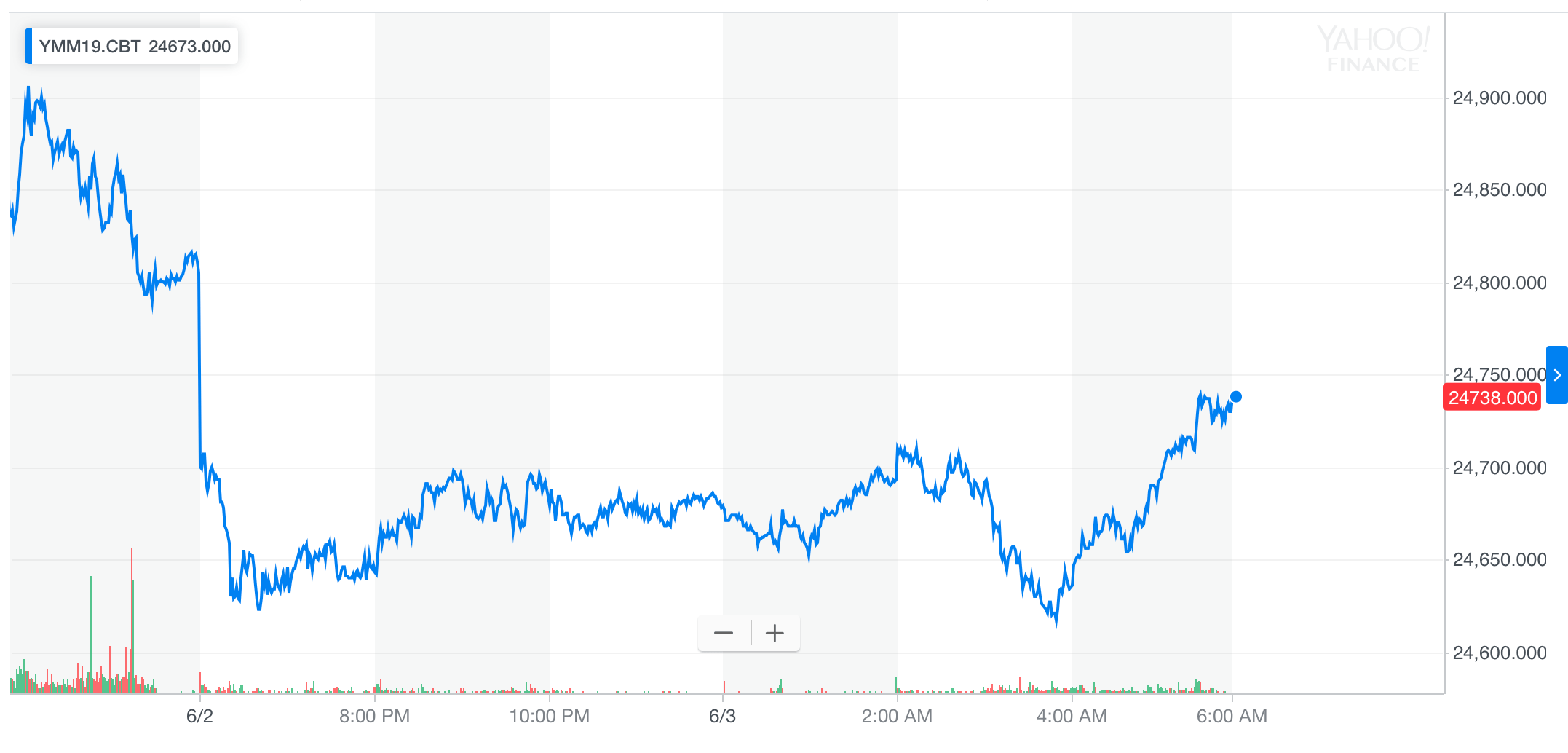

Understanding Dow Jones Futures on TradingView

TradingView presents a streamlined interface for accessing and analyzing Dow Jones futures knowledge. Yow will discover the contract beneath its ticker image, usually YM (for the E-mini Dow Jones futures contract). As soon as you’ve got chosen the image, you are offered with a complete chart displaying value motion, quantity, and a plethora of customizable indicators. The platform’s energy lies in its flexibility – you possibly can regulate the timeframe (from intraday to month-to-month), select totally different chart varieties (candlestick, line, bar), and overlay a wide selection of technical indicators.

Key Indicators for Dow Jones Futures Evaluation:

Efficient Dow Jones futures buying and selling depends on a mix of basic and technical evaluation. Whereas basic evaluation focuses on macroeconomic elements, technical evaluation makes use of chart patterns and indicators to foretell future value actions. TradingView facilitates each by offering a platform for charting and incorporating various indicators. Listed here are some key indicators generally used:

-

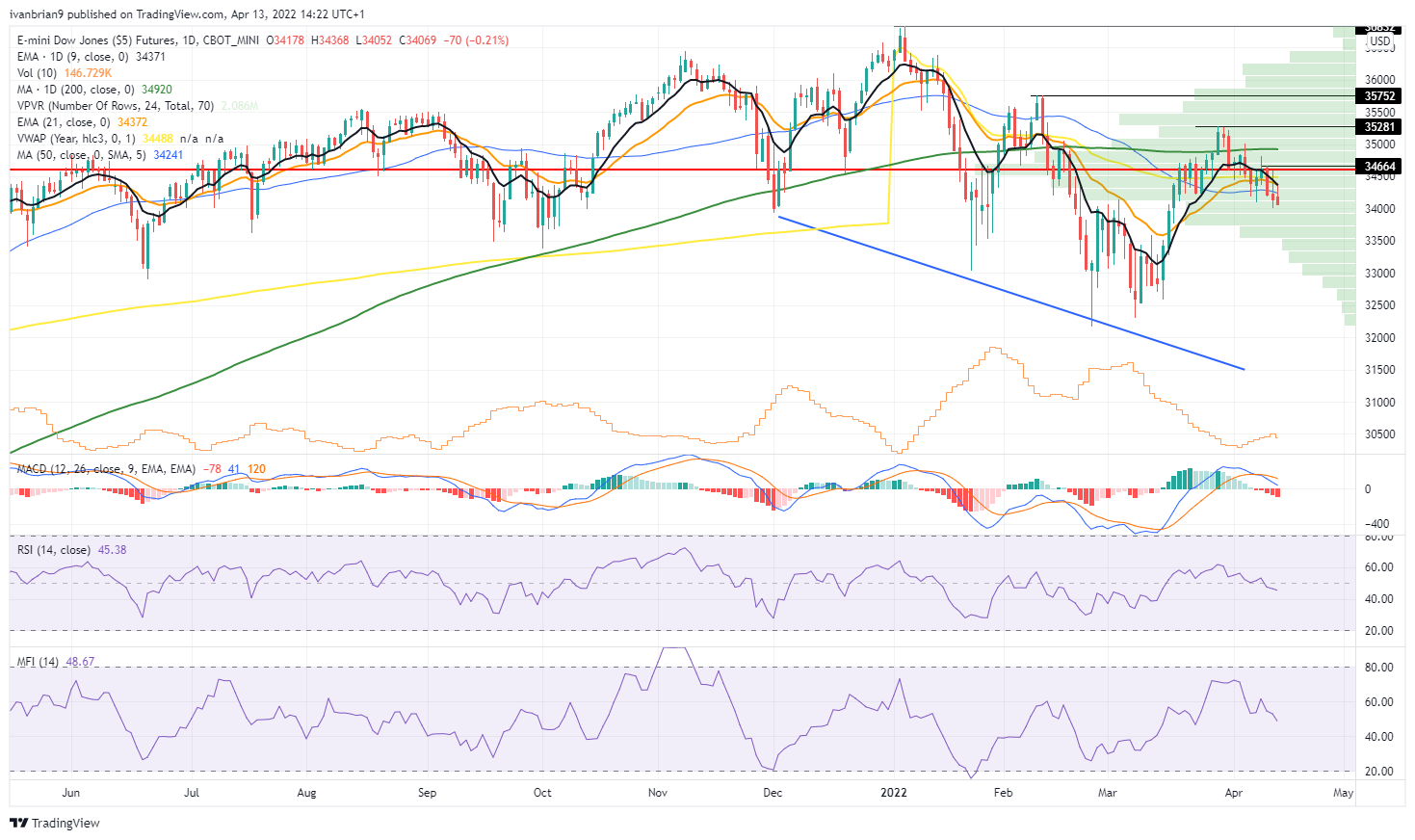

Transferring Averages (MA): Easy Transferring Averages (SMA) and Exponential Transferring Averages (EMA) clean out value fluctuations, highlighting traits. Merchants typically use a number of MAs (e.g., 50-day and 200-day) to determine assist and resistance ranges and ensure pattern course. A bullish crossover happens when a shorter-term MA crosses above a longer-term MA, suggesting a possible uptrend. Conversely, a bearish crossover signifies a possible downtrend.

-

Relative Energy Index (RSI): This momentum indicator measures the magnitude of latest value adjustments to guage overbought and oversold circumstances. Readings above 70 usually counsel an overbought market, indicating potential for a value correction. Readings beneath 30 counsel an oversold market, indicating potential for a value rebound. RSI divergences, the place value and RSI transfer in reverse instructions, will also be vital buying and selling alerts.

-

MACD (Transferring Common Convergence Divergence): MACD is a trend-following momentum indicator that reveals the connection between two transferring averages. It consists of a MACD line and a sign line. Crossovers between these strains, together with divergences, can present purchase or promote alerts.

-

Bollinger Bands: These bands plot normal deviations round a transferring common, indicating value volatility. When costs contact the higher band, it’d counsel an overbought situation, whereas touching the decrease band would possibly point out an oversold situation. Breakouts above or beneath the bands can sign robust directional strikes.

-

Quantity: Analyzing quantity alongside value motion is essential. Excessive quantity confirms value actions, whereas low quantity suggests weak momentum and potential for a reversal.

Chart Patterns and Their Significance:

Recognizing chart patterns is one other important side of technical evaluation on TradingView. These patterns typically present clues about future value actions. Some generally noticed patterns embrace:

-

Head and Shoulders: This reversal sample suggests a pattern change. A "head" shaped by a peak, adopted by two smaller "shoulders," signifies a possible downtrend after the appropriate shoulder.

-

Double Tops/Bottoms: These patterns point out potential pattern reversals. A double high suggests a possible downtrend, whereas a double backside suggests a possible uptrend.

-

Triangles: These patterns are continuation patterns, suggesting a interval of consolidation earlier than a breakout within the course of the prevailing pattern.

-

Flags and Pennants: These patterns are additionally continuation patterns that point out a brief pause in a powerful pattern.

-

Channels: Value motion contained inside parallel strains suggests a pattern continuation. Breakouts above or beneath the channel can point out a pattern change.

Using TradingView’s Superior Options:

TradingView presents a number of superior options to reinforce your Dow Jones futures evaluation:

-

Drawing Instruments: Use instruments like Fibonacci retracements, assist/resistance strains, and pattern strains to determine key value ranges and potential buying and selling alternatives.

-

Pine Script: For skilled customers, Pine Script permits creating customized indicators and methods, tailoring your evaluation to particular wants.

-

Alerts: Arrange value alerts to obtain notifications when the Dow Jones futures value reaches a predetermined degree, enabling well timed entry or exit choices.

-

Backtesting: Whereas in a roundabout way out there for futures contracts on TradingView, you need to use historic knowledge to backtest your methods utilizing related devices or indices. This helps consider the effectiveness of your method earlier than risking capital.

Threat Administration in Dow Jones Futures Buying and selling:

Buying and selling Dow Jones futures entails vital danger. Efficient danger administration is paramount:

-

Place Sizing: By no means danger greater than a small share of your buying and selling capital on any single commerce. This limits potential losses and protects your general account stability.

-

Cease-Loss Orders: At all times use stop-loss orders to mechanically exit a commerce if the worth strikes towards your place. This prevents vital losses.

-

Take-Revenue Orders: Set take-profit orders to lock in earnings when your goal value is reached.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your buying and selling throughout totally different property to scale back general danger.

-

Emotional Self-discipline: Keep away from emotional buying and selling choices. Follow your buying and selling plan and keep away from impulsive actions primarily based on worry or greed.

Conclusion:

TradingView gives a strong platform for analyzing Dow Jones futures charts. By combining technical evaluation utilizing varied indicators and chart patterns, leveraging TradingView’s superior options, and implementing sturdy danger administration methods, merchants can enhance their probabilities of success. Nevertheless, keep in mind that futures buying and selling is inherently dangerous, and no technique ensures earnings. Steady studying, observe, and disciplined danger administration are important for long-term success on this dynamic market. At all times conduct thorough analysis and contemplate in search of recommendation from a professional monetary advisor earlier than participating in futures buying and selling. The data offered on this article is for academic functions solely and doesn’t represent monetary recommendation.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Dow Jones Futures Chart on TradingView: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!