Decoding The EMI: Your Information To EMI Chart Calculators And Good Monetary Planning

Decoding the EMI: Your Information to EMI Chart Calculators and Good Monetary Planning

Associated Articles: Decoding the EMI: Your Information to EMI Chart Calculators and Good Monetary Planning

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the EMI: Your Information to EMI Chart Calculators and Good Monetary Planning. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the EMI: Your Information to EMI Chart Calculators and Good Monetary Planning

Equated Month-to-month Installments (EMIs) are the lifeblood of contemporary financing. Whether or not you are shopping for a home, a automobile, or financing a big buy, understanding EMIs is essential for accountable monetary administration. An EMI chart calculator simplifies this course of, providing a transparent, visible illustration of your reimbursement schedule and permitting you to make knowledgeable selections. This text delves deep into the world of EMI chart calculators, explaining their performance, advantages, and the way they empower you to take management of your funds.

Understanding EMIs: The Fundamentals

An EMI is a set month-to-month cost made to repay a mortgage over a specified interval. This cost covers each the principal quantity borrowed and the curiosity accrued on the excellent steadiness. The calculation entails a posh components that considers a number of elements:

- Principal Mortgage Quantity (P): The entire amount of cash borrowed.

- Curiosity Fee (r): The annual rate of interest charged on the mortgage, often expressed as a proportion. That is essential because it immediately impacts the entire curiosity paid over the mortgage tenure.

- Mortgage Tenure (n): The entire reimbursement interval, usually expressed in months. An extended tenure means smaller EMIs however greater whole curiosity paid.

The usual components for calculating EMI is:

EMI = [P x R x (1+R)^N] / [(1+R)^N-1]

The place:

- P = Principal Mortgage Quantity

- R = Month-to-month rate of interest (Annual rate of interest/12/100)

- N = Mortgage tenure in months

The Energy of EMI Chart Calculators: Past Easy Calculations

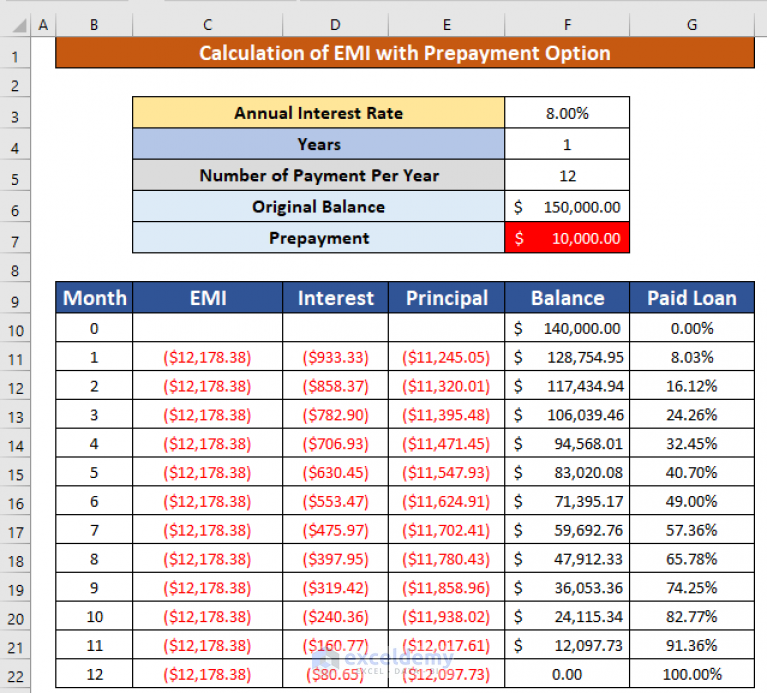

Whereas the components above permits for calculating the EMI, it solely supplies a single determine. An EMI chart calculator goes past this by offering an in depth, month-by-month breakdown of your reimbursement schedule. This chart usually consists of:

- Month Quantity: Sequential numbering of every month within the reimbursement schedule.

- Starting Stability: The excellent mortgage quantity in the beginning of the month.

- EMI Quantity: The fastened month-to-month cost.

- Principal Paid: The portion of the EMI allotted in the direction of decreasing the principal mortgage quantity.

- Curiosity Paid: The portion of the EMI allotted in the direction of paying the curiosity.

- Ending Stability: The remaining mortgage quantity after the month-to-month cost.

This detailed breakdown affords a number of benefits:

- Transparency: You acquire a transparent understanding of how your funds are allotted between principal and curiosity. This transparency is crucial for monitoring your progress and managing your funds successfully.

- Monetary Planning: The chart permits you to visualize your reimbursement journey, enabling higher budgeting and monetary planning. You may see precisely how a lot you may owe every month and plan your bills accordingly.

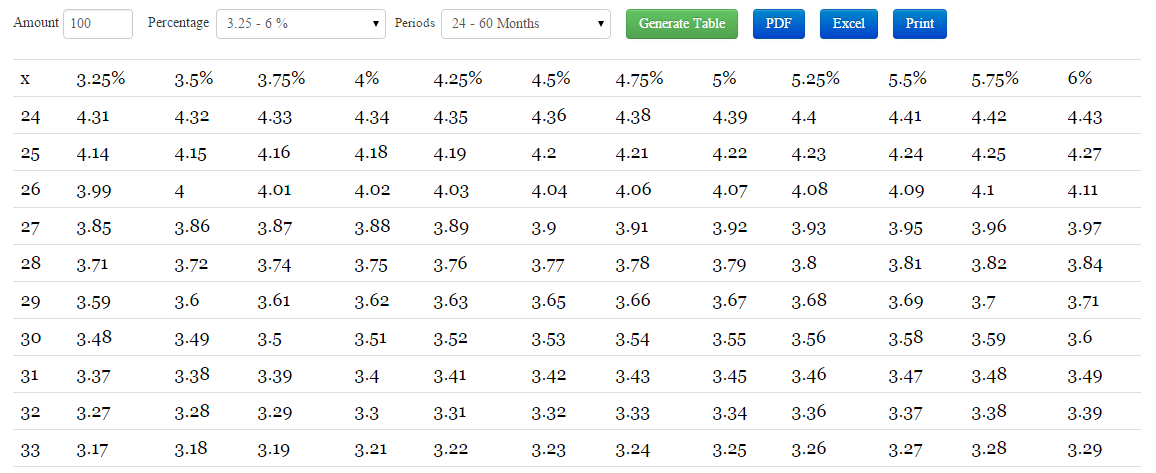

- Comparability Procuring: When evaluating mortgage affords from totally different lenders, an EMI chart calculator permits for a direct comparability of reimbursement schedules, serving to you select the best option based mostly in your monetary state of affairs.

- Prepayment Planning: The chart helps you perceive the impression of prepaying your mortgage. You may simply calculate how a lot it can save you in curiosity by making additional funds.

- Figuring out Potential Points: By visualizing the reimbursement schedule, you’ll be able to determine potential points early on, equivalent to unexpectedly excessive curiosity funds or problem managing month-to-month bills.

Forms of EMI Chart Calculators

EMI chart calculators are available on-line and thru numerous monetary establishments. They often fall into two classes:

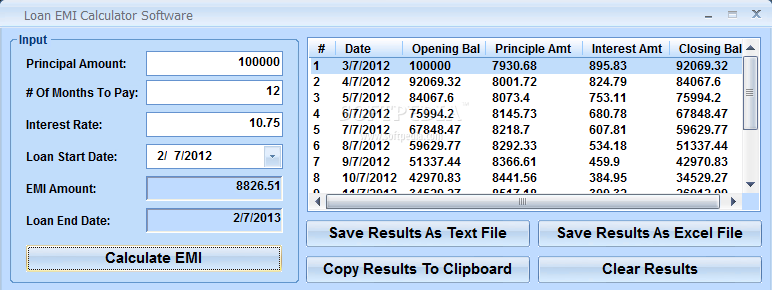

- Easy Calculators: These calculators require you to enter the principal quantity, rate of interest, and mortgage tenure. They then calculate the EMI and supply a primary reimbursement schedule.

-

Superior Calculators: These calculators supply extra options, equivalent to:

- Versatile Tenure Choices: Permits you to discover totally different mortgage tenures and their impression on EMIs.

- Prepayment Calculations: Simulates the impact of prepaying a portion of the mortgage.

- Totally different Compensation Frequency: Some calculators accommodate bi-weekly or quarterly funds.

- Tax Implications: Some superior calculators even think about tax implications, offering a extra complete image of your general monetary burden.

- Mortgage Comparability Instruments: These instruments permit you to examine a number of mortgage affords side-by-side, making knowledgeable selections simpler.

Selecting the Proper EMI Chart Calculator

When deciding on an EMI chart calculator, take into account the next elements:

- Accuracy: Make sure the calculator makes use of the right components and supplies correct outcomes.

- Consumer-Friendliness: The interface needs to be intuitive and straightforward to navigate, even for customers with restricted monetary data.

- Options: Think about the options you want, equivalent to prepayment calculations, comparability instruments, and totally different reimbursement frequencies.

- Safety: If utilizing a web-based calculator, guarantee the web site is safe and protects your private data. Respected monetary establishments are usually a protected wager.

Past the Numbers: Accountable Borrowing

Whereas EMI chart calculators are invaluable instruments, it is essential to keep in mind that they’re only one piece of the puzzle. Accountable borrowing requires cautious consideration of a number of elements:

- Affordability: Make sure the EMI matches comfortably inside your month-to-month price range, leaving sufficient room for different important bills. Keep away from overextending your self financially.

- Credit score Rating: Your credit score rating considerably impacts your rate of interest. The next credit score rating interprets to decrease rates of interest and extra favorable mortgage phrases.

- Hidden Charges: Pay attention to any hidden charges or prices related to the mortgage, equivalent to processing charges or prepayment penalties.

- Lengthy-Time period Monetary Targets: Think about how the mortgage will impression your long-term monetary objectives, equivalent to saving for retirement or investing.

Conclusion: Empowering Monetary Selections

EMI chart calculators are highly effective instruments that empower debtors to make knowledgeable monetary selections. By offering a transparent and complete image of your reimbursement schedule, these calculators promote transparency, facilitate higher monetary planning, and allow you to navigate the complexities of mortgage reimbursement with confidence. Nonetheless, keep in mind that accountable borrowing goes past merely understanding your EMI. Cautious planning, budgeting, and a sensible evaluation of your monetary state of affairs are important for making certain a easy and profitable mortgage reimbursement journey. Use the calculator as a information, however at all times prioritize accountable monetary administration.

![]()

Closure

Thus, we hope this text has offered precious insights into Decoding the EMI: Your Information to EMI Chart Calculators and Good Monetary Planning. We hope you discover this text informative and useful. See you in our subsequent article!