Decoding The Euro Change Charge Chart: A Complete Information

Decoding the Euro Change Charge Chart: A Complete Information

Associated Articles: Decoding the Euro Change Charge Chart: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Euro Change Charge Chart: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Euro Change Charge Chart: A Complete Information

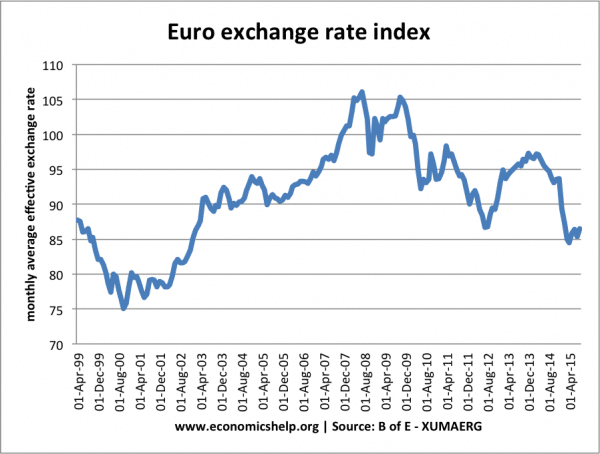

The euro (€), the official forex of 19 European Union member states, performs a pivotal function within the world financial system. Understanding its alternate fee in opposition to different currencies is essential for companies, buyers, vacationers, and anybody concerned in worldwide transactions. This text delves into the intricacies of the euro alternate fee chart, exploring its historic tendencies, influencing components, and sensible implications.

Understanding the Euro Change Charge Chart:

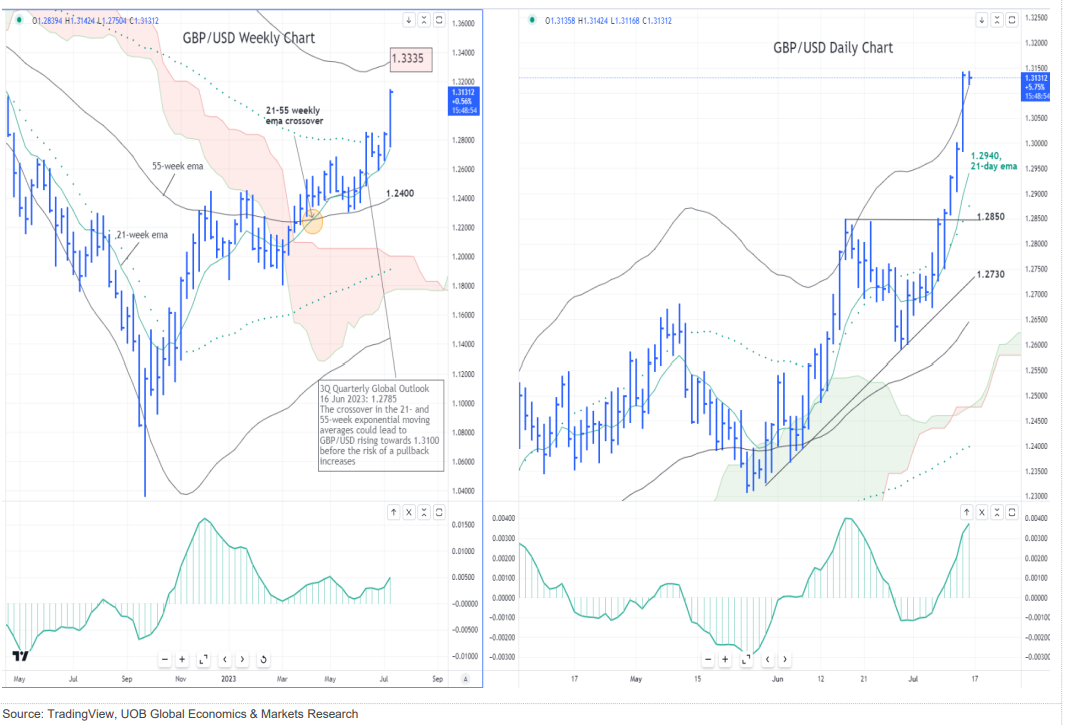

A euro alternate fee chart visually represents the worth of the euro relative to a different forex over a particular interval. It usually shows the alternate fee on the vertical axis and time on the horizontal axis. For example, a EUR/USD chart exhibits the variety of US {dollars} wanted to purchase one euro. The chart may be introduced as a line graph, candlestick chart, or bar chart, every providing a barely completely different perspective on worth actions.

Key Elements of the Chart:

- Change Charge: The core aspect, representing the worth of 1 euro when it comes to the chosen forex.

- Time Interval: The length coated by the chart, starting from just a few days to a number of many years. Completely different timeframes reveal completely different patterns and tendencies.

- Assist and Resistance Ranges: Horizontal traces indicating worth ranges the place the alternate fee has traditionally struggled to interrupt via. Assist ranges symbolize areas the place shopping for strain is powerful, stopping additional worth declines, whereas resistance ranges signify areas the place promoting strain is powerful, hindering upward actions.

- Development Strains: Strains drawn to attach vital highs or lows, illustrating the general route of the alternate fee (uptrend, downtrend, or sideways).

- Indicators: Technical evaluation instruments, equivalent to shifting averages, Relative Energy Index (RSI), and MACD, are sometimes overlaid on the chart to supply further insights into potential future worth actions. These are usually not ensures however instruments to help in interpretation.

Historic Tendencies and Main Occasions:

The euro’s alternate fee has skilled vital fluctuations since its introduction in 1999. A number of key occasions have formed its trajectory:

- Euro’s Launch (1999): The preliminary alternate charges have been set in opposition to different main currencies, establishing a baseline.

- Eurozone Debt Disaster (2010-2012): Issues in regards to the solvency of a number of eurozone international locations led to a big weakening of the euro in opposition to different main currencies.

- International Monetary Disaster (2008-2009): The worldwide monetary disaster triggered widespread market uncertainty, inflicting vital volatility within the euro’s alternate fee.

- Brexit (2016): The UK’s choice to depart the European Union precipitated a pointy decline within the worth of the pound sterling in opposition to the euro, highlighting the interconnectedness of European economies.

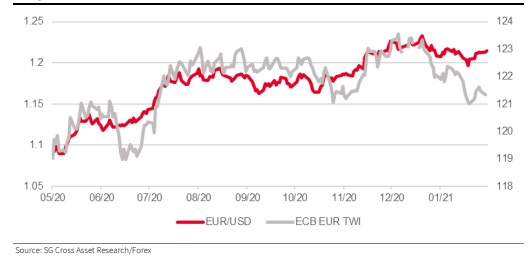

- COVID-19 Pandemic (2020-Current): The pandemic induced vital uncertainty and volatility in world markets, impacting the euro’s alternate fee. Preliminary declines have been adopted by durations of restoration and additional fluctuations.

- Geopolitical Occasions (Ongoing): Ongoing geopolitical tensions, such because the conflict in Ukraine, considerably affect the euro’s worth, usually inflicting fast and unpredictable swings. These occasions ceaselessly set off "flight to security" eventualities, the place buyers transfer their cash into perceived safer property, impacting forex values.

Elements Influencing the Euro Change Charge:

Quite a few components work together to find out the euro’s alternate fee. These may be broadly categorized as:

-

Financial Elements:

- Curiosity Charges: Greater rates of interest within the eurozone relative to different areas have a tendency to draw overseas funding, rising demand for the euro and strengthening its worth. Conversely, decrease rates of interest can weaken the euro. The European Central Financial institution (ECB)’s financial coverage choices are paramount right here.

- Financial Development: Sturdy financial progress within the eurozone boosts investor confidence, resulting in elevated demand for the euro. Recessions or slowdowns have the other impact.

- Inflation: Excessive inflation erodes the buying energy of the euro, making it much less enticing to buyers and doubtlessly weakening its worth. The ECB actively goals to take care of worth stability inside the eurozone.

- Authorities Debt: Excessive ranges of presidency debt in eurozone international locations can increase issues about their fiscal stability, doubtlessly weakening the euro.

- Present Account Steadiness: A surplus within the present account (exports exceeding imports) usually strengthens a forex, whereas a deficit weakens it.

-

Political Elements:

- Political Stability: Political uncertainty inside the eurozone or in main buying and selling companions can negatively influence investor confidence and weaken the euro.

- Geopolitical Occasions: International occasions, equivalent to wars or main political shifts, can considerably affect investor sentiment and have an effect on the euro’s alternate fee. Uncertainty usually results in elevated volatility.

-

Market Sentiment:

- Investor Confidence: Constructive investor sentiment results in elevated demand for the euro, whereas detrimental sentiment can set off promoting strain and weaken its worth. That is usually mirrored in market hypothesis and buying and selling exercise.

- Hypothesis: Foreign money merchants can considerably affect the euro’s alternate fee via hypothesis, shopping for or promoting based mostly on anticipated future actions.

Deciphering the Chart and Making Predictions:

Analyzing the euro alternate fee chart requires a mix of technical and basic evaluation. Technical evaluation focuses on chart patterns, indicators, and historic worth actions to foretell future worth tendencies. Basic evaluation considers the underlying financial and political components influencing the alternate fee.

It is essential to grasp that predicting future alternate charges is inherently unsure. Whereas chart evaluation and basic components present helpful insights, they don’t assure correct predictions. Sudden occasions can considerably influence the alternate fee, rendering even probably the most refined evaluation inaccurate.

Sensible Implications:

Understanding the euro alternate fee chart has a number of sensible implications:

- Worldwide Commerce: Companies engaged in worldwide commerce want to watch the euro’s alternate fee to handle their forex threat. Fluctuations can influence profitability and competitiveness. Hedging methods, equivalent to ahead contracts or choices, can mitigate this threat.

- Funding: Buyers holding euro-denominated property or investing in eurozone markets want to contemplate the influence of alternate fee fluctuations on their returns.

- Journey: Vacationers want to pay attention to the present alternate fee to finances successfully and keep away from pointless prices when exchanging forex.

- Overseas Change Reserves: Central banks maintain overseas alternate reserves, together with euros, to handle their forex values and intervene available in the market if wanted.

Conclusion:

The euro alternate fee chart is a dynamic and complicated device reflecting the interaction of quite a few financial, political, and market components. Whereas predicting future actions with certainty is not possible, understanding the historic tendencies, influencing components, and analytical methods can equip people and companies with the information to navigate the complexities of the worldwide forex market and make knowledgeable choices associated to the euro. Steady monitoring of the chart, alongside a radical understanding of the underlying fundamentals, is essential for efficiently navigating the ever-evolving panorama of the euro’s alternate fee. Bear in mind to seek the advice of with monetary professionals for personalised recommendation tailor-made to your particular wants and threat tolerance.

![[Economics] What is Nominal Exchange Rate? - Class 12 Teachoo](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/69539be2-d133-4211-81db-cc972a943fab/what-are-nominal--and-real-exchange-rate---teachoo.jpg)

Closure

Thus, we hope this text has offered helpful insights into Decoding the Euro Change Charge Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!