Decoding The European Fuel Worth Rollercoaster: A Chart-Pushed Evaluation

Decoding the European Fuel Worth Rollercoaster: A Chart-Pushed Evaluation

Associated Articles: Decoding the European Fuel Worth Rollercoaster: A Chart-Pushed Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the European Fuel Worth Rollercoaster: A Chart-Pushed Evaluation. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the European Fuel Worth Rollercoaster: A Chart-Pushed Evaluation

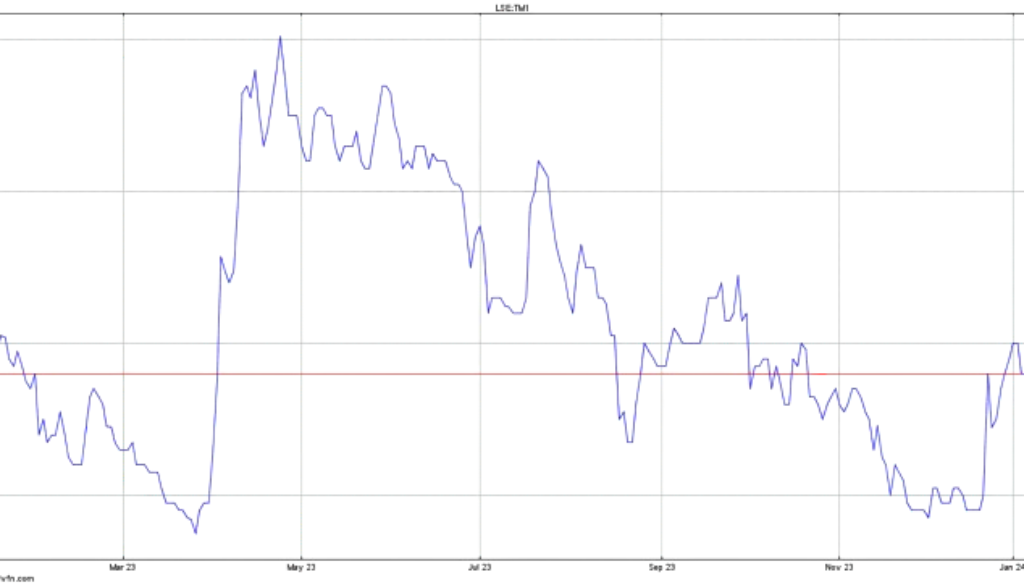

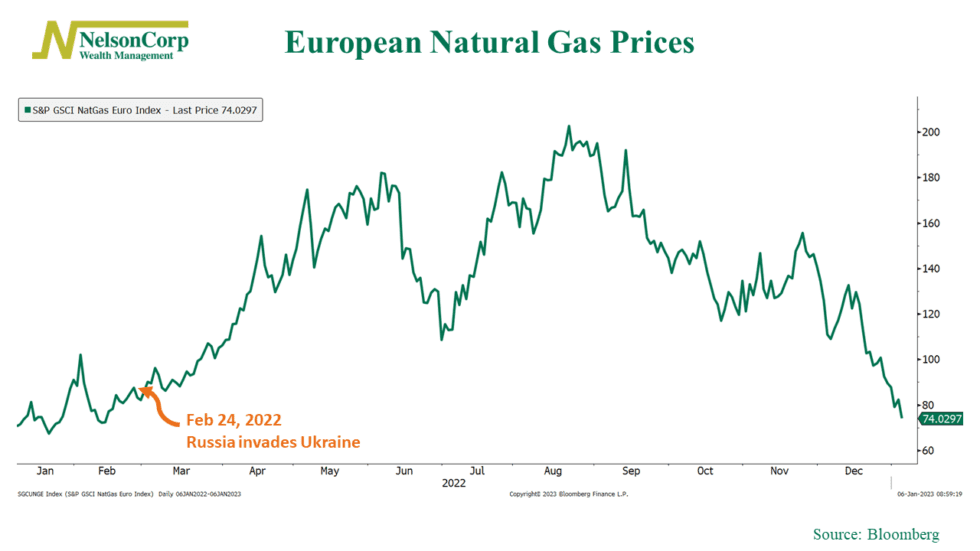

The value of pure gasoline in Europe has been something however steady in recent times, experiencing dramatic swings which have reverberated throughout the continent’s financial system and geopolitical panorama. Understanding these fluctuations requires extra than simply glancing at a chart; it necessitates a deep dive into the underlying components driving the market, the interconnectedness of provide chains, and the implications for shoppers and companies. This text will analyze the trajectory of European gasoline costs, utilizing a hypothetical chart (as real-time knowledge fluctuates quickly) as a framework for dialogue, and discover the important thing drivers behind its risky nature.

(Hypothetical Chart Description: Think about a line chart spanning from 2000 to the current. The chart ought to present a comparatively steady interval from 2000-2020, with some minor fluctuations. Then, from 2021 onwards, the road ought to dramatically improve, peaking sharply in late 2022 earlier than experiencing some volatility and a gradual decline, although remaining considerably greater than pre-2021 ranges. Mark key occasions on the chart, reminiscent of the beginning of the Ukraine struggle, vital pipeline disruptions, and intervals of unusually chilly or heat climate.)

The Pre-2021 Baseline: A Comparatively Steady Market

The interval between 2000 and 2020, as depicted in our hypothetical chart, exhibits a comparatively steady, albeit regularly rising, pattern in European gasoline costs. This relative stability stemmed from a mix of things:

- Diversified Provide Sources: Europe relied on a mixture of suppliers, together with Russia, Norway, Algeria, and the Netherlands, decreasing dependence on any single supply and mitigating the influence of particular person provide disruptions.

- Lengthy-Time period Contracts: A good portion of gasoline purchases have been primarily based on long-term contracts, offering value predictability for each consumers and sellers. These contracts typically concerned fastened costs or value formulation linked to grease costs, providing a level of insulation from short-term market volatility.

- Enough Storage Capability: Europe had enough storage services to handle seasonal demand fluctuations and buffer in opposition to non permanent provide interruptions.

- Comparatively Reasonable Climate Patterns: Whereas climate all the time performs a task, the interval main as much as 2021 noticed comparatively reasonable winters, limiting the pressure on gasoline provides.

The 2021-Current Shock: A Good Storm of Elements

The dramatic surge in European gasoline costs beginning in 2021 represents a major departure from the previous. This era witnessed a confluence of things making a "excellent storm" that overwhelmed the market’s capability to take care of stability:

- The Russian Invasion of Ukraine: This geopolitical occasion served as the first catalyst for the worth spike. Russia, a serious gasoline provider to Europe, drastically decreased its exports, leveraging its vitality sources as a geopolitical weapon. The chart would clearly present a pointy upward trajectory coinciding with the beginning of the struggle.

- Diminished Russian Fuel Flows: The deliberate discount of gasoline flows by way of pipelines like Nord Stream 1, coupled with the whole shutdown of Nord Stream 2, considerably tightened the European gasoline market. This strategic transfer by Russia aimed to exert strain on European nations and undermine their assist for Ukraine.

- Elevated International Demand: The post-pandemic financial restoration led to a surge in international demand for vitality, placing additional strain on already strained provide chains. This international competitors for gasoline exacerbated the scenario in Europe.

- Low Storage Ranges: Going into the winter of 2021-2022, European gasoline storage ranges have been decrease than typical, leaving the continent weak to produce disruptions and value volatility. This low storage was partly on account of a mix of things, together with underinvestment in storage infrastructure and a give attention to cheaper alternate options within the previous years.

- Excessive Climate Occasions: Whereas not the only driver, unusually chilly climate in some elements of Europe additional elevated demand, pushing costs even greater. Conversely, unusually heat climate in different intervals may briefly ease strain, main to cost corrections as seen within the hypothetical chart’s volatility after the height.

- Market Hypothesis: The uncertainty surrounding the geopolitical scenario and the provision disruptions fueled market hypothesis, resulting in additional value will increase. Merchants anticipated continued shortages, driving up futures costs and contributing to the general volatility.

Penalties of the Worth Surge:

The dramatic improve in gasoline costs had profound penalties throughout Europe:

- Power Poverty: Hundreds of thousands of households and companies confronted unaffordable vitality payments, resulting in elevated vitality poverty and social hardship.

- Inflationary Pressures: Excessive gasoline costs contributed considerably to broader inflation throughout the continent, impacting the price of items and companies.

- Industrial Disruptions: Power-intensive industries confronted vital challenges, resulting in manufacturing cuts, job losses, and relocation of some manufacturing actions.

- Geopolitical Implications: The vitality disaster highlighted Europe’s dependence on Russian gasoline and accelerated efforts to diversify vitality sources and improve vitality safety.

- Accelerated Power Transition: The disaster spurred funding in renewable vitality sources and vitality effectivity measures, accelerating the transition in the direction of a extra sustainable vitality system.

The Path Ahead: Diversification and Resilience

The hypothetical chart, exhibiting a gradual decline after the height, displays the efforts undertaken by European nations to mitigate the influence of the disaster. These efforts embody:

- Diversification of Fuel Provides: Europe is actively searching for different gasoline suppliers, together with LNG imports from the US, Qatar, and different areas. This diversification goals to scale back reliance on Russia.

- Elevated Storage Capability: Investments are being made to extend gasoline storage capability, guaranteeing adequate reserves to deal with future provide disruptions.

- Accelerated Renewable Power Deployment: The disaster has accelerated the deployment of renewable vitality sources like wind and solar energy, decreasing reliance on fossil fuels.

- Power Effectivity Measures: Efforts are underway to enhance vitality effectivity in buildings, business, and transportation, decreasing general vitality consumption.

- Strengthened Power Market Regulation: Regulatory reforms are aimed toward enhancing the resilience and transparency of the European vitality market.

Conclusion:

The European gasoline value chart displays a fancy interaction of geopolitical occasions, market dynamics, and climate patterns. Whereas the fast disaster could have eased, the long-term implications stay vital. Europe’s journey in the direction of vitality safety and independence requires sustained funding in diversification, renewable vitality, and vitality effectivity. The volatility of the previous few years serves as a stark reminder of the interconnectedness of vitality markets and the significance of proactive planning to make sure a steady and reasonably priced vitality future for all. The longer term trajectory of the gasoline value chart will rely on the success of those efforts and the unfolding geopolitical panorama. Steady monitoring and evaluation are essential to navigate the complexities of this very important market.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the European Fuel Worth Rollercoaster: A Chart-Pushed Evaluation. We admire your consideration to our article. See you in our subsequent article!