Decoding The Falling Wedge: A Complete Information To This Highly effective Chart Sample

Decoding the Falling Wedge: A Complete Information to This Highly effective Chart Sample

Associated Articles: Decoding the Falling Wedge: A Complete Information to This Highly effective Chart Sample

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the Falling Wedge: A Complete Information to This Highly effective Chart Sample. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Falling Wedge: A Complete Information to This Highly effective Chart Sample

The world of technical evaluation is replete with chart patterns, every providing a novel perspective on market sentiment and potential future value actions. Amongst these, the falling wedge stands out as a bullish reversal sample, usually signaling a major shift in momentum from bearish to bullish. Understanding its formation, interpretation, and limitations is essential for any dealer in search of to leverage its predictive energy. This text delves deep into the intricacies of the falling wedge chart sample, offering a complete information for each novice and skilled merchants.

Understanding the Falling Wedge Formation:

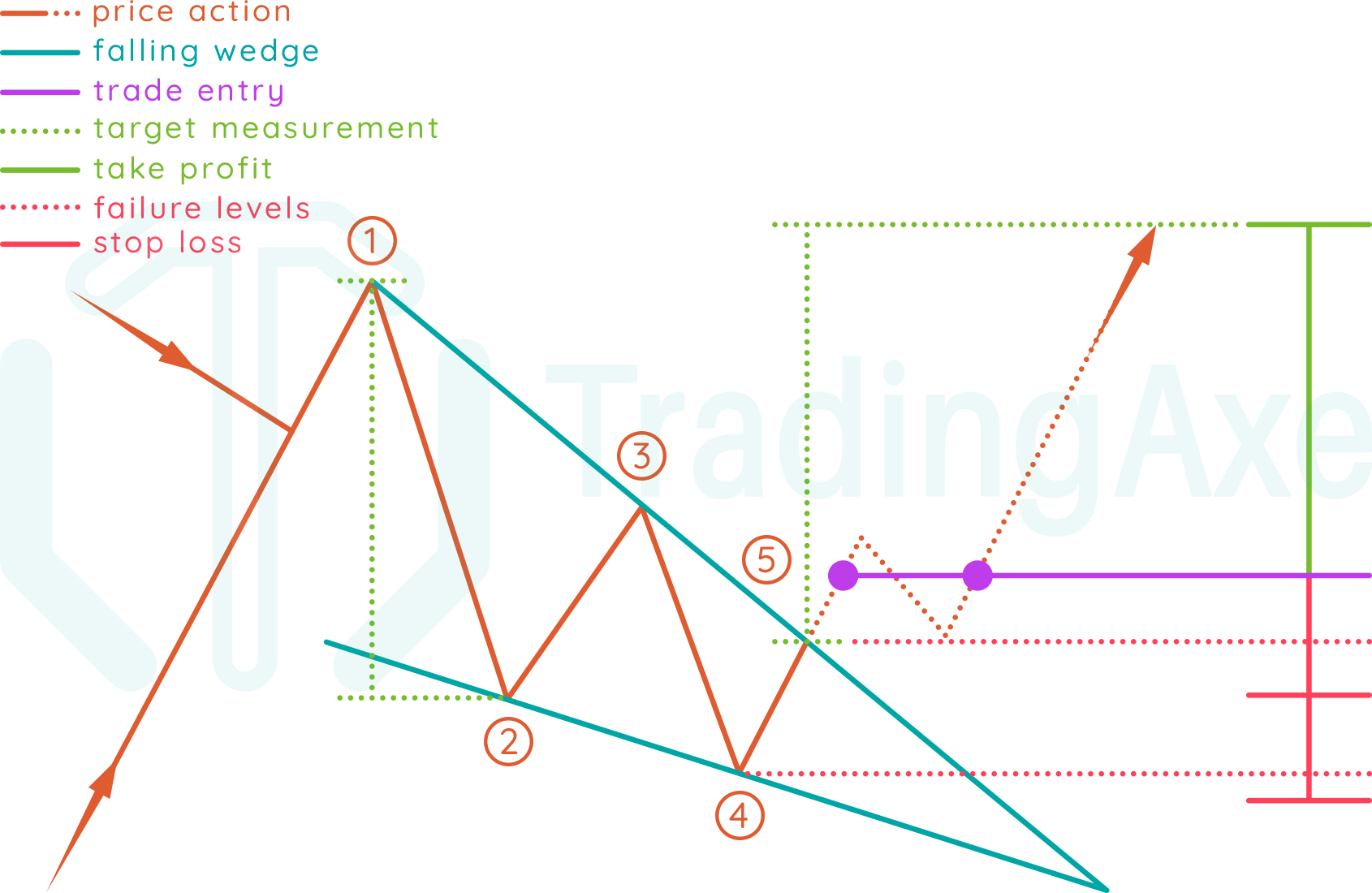

A falling wedge is a chart sample characterised by two converging trendlines: a downward-sloping higher trendline and a downward-sloping decrease trendline. Crucially, the decrease trendline has a gentler slope than the higher trendline, inflicting the strains to converge in direction of a degree sooner or later. This convergence creates a wedge form that seems to be shrinking in dimension as value motion unfolds.

The sample varieties throughout a interval of declining value motion, usually inside a downtrend. Nevertheless, the important thing differentiating issue is the lowering volatility inside the wedge. Whereas costs are nonetheless trending downwards, the vary between the highs and lows turns into progressively smaller. This narrowing vary displays diminishing promoting stress and probably rising indecision amongst market members.

Figuring out a Falling Wedge:

Figuring out a legitimate falling wedge requires cautious statement and adherence to particular standards:

-

Two Converging Trendlines: Essentially the most basic side is the presence of two downward-sloping trendlines. At the very least two swing highs and two swing lows are wanted to attract these trendlines precisely. Swing highs and lows are vital value factors that mark momentary reversals within the value development.

-

Lowering Volatility: The gap between the higher and decrease trendlines ought to progressively slim because the sample develops. This shrinking vary is a visible indication of lowering value volatility.

-

Minimal Period: Whereas there is not any mounted timeframe, a falling wedge usually develops over a number of weeks or months to be thought-about vital. Shorter-term wedges may be much less dependable.

-

Quantity Affirmation: Ideally, quantity ought to lower because the wedge varieties. This corroborates the lowering volatility and suggests waning promoting stress. Nevertheless, quantity affirmation will not be at all times current and should not be the only real criterion for figuring out a falling wedge.

-

Breakout Affirmation: Essentially the most essential side is the eventual breakout above the higher trendline. This breakout, ideally accompanied by elevated quantity, alerts the potential reversal of the downtrend.

Deciphering the Falling Wedge:

The falling wedge is a bullish reversal sample. The narrowing value vary suggests a weakening of the promoting stress, and the eventual breakout above the higher trendline confirms this shift in momentum. As soon as the worth breaks above the higher trendline, the goal value is usually calculated utilizing the wedge’s peak. That is accomplished by measuring the vertical distance between the higher and decrease trendlines on the widest level of the wedge and projecting that distance upwards from the breakout level.

Utilizing Fibonacci Retracements and Extensions:

Merchants usually incorporate Fibonacci retracements and extensions to refine their value targets and stop-loss ranges. Fibonacci retracements can be utilized to determine potential help ranges inside the wedge, whereas extensions may also help challenge potential value targets past the preliminary breakout.

Frequent Errors in Figuring out and Buying and selling Falling Wedges:

A number of frequent errors can result in inaccurate interpretations and unsuccessful trades:

-

False Breakouts: Costs could briefly break above the higher trendline solely to revert again inside the wedge. These false breakouts can entice merchants who enter lengthy positions prematurely. Confirming the breakout with elevated quantity and sustained value motion above the trendline is essential.

-

Ignoring Quantity: Whereas not at all times definitive, a major lower in quantity in the course of the wedge formation and a rise in quantity on the breakout considerably enhances the sample’s reliability.

-

Misinterpreting the Pattern: A falling wedge is a reversal sample, however it solely alerts a possible reversal inside an present downtrend. It does not negate the broader market context.

-

Overreliance on a Single Indicator: The falling wedge must be used at the side of different technical indicators and basic evaluation to substantiate the buying and selling sign.

Falling Wedge vs. Different Chart Patterns:

The falling wedge can generally be confused with different chart patterns:

-

Symmetrical Triangle: Whereas each patterns contain converging trendlines, the symmetrical triangle has each upward and downward sloping trendlines, leading to a symmetrical form. The falling wedge, then again, has each trendlines sloping downwards.

-

Ascending Triangle: It is a bullish continuation sample, the place the higher trendline is horizontal and the decrease trendline slopes upwards. The falling wedge is a reversal sample.

-

Descending Triangle: It is a bearish continuation sample, with a horizontal decrease trendline and a downward-sloping higher trendline. The falling wedge is a reversal sample.

Threat Administration and Commerce Technique:

Profitable buying and selling utilizing the falling wedge sample requires a sturdy danger administration technique:

-

Cease-Loss Order: Place a stop-loss order beneath the decrease trendline of the wedge to restrict potential losses if the breakout fails.

-

Take-Revenue Order: Use the projected value goal based mostly on the wedge’s peak, mixed with Fibonacci extensions, to find out your take-profit degree.

-

Place Sizing: By no means danger greater than a small proportion of your buying and selling capital on a single commerce.

-

Affirmation from Different Indicators: Use different technical indicators like RSI, MACD, or transferring averages to substantiate the bullish sign and filter out false breakouts.

Examples of Falling Wedges in Completely different Market Contexts:

Falling wedges have appeared in varied markets, together with shares, foreign exchange, and cryptocurrencies. Analyzing historic charts can present priceless insights into how this sample has performed out in several market situations. As an example, analyzing the efficiency of a selected inventory after a falling wedge breakout can reveal the standard value actions and the reliability of the sample in that individual asset. Equally, evaluating the sample’s efficiency throughout totally different asset lessons may also help merchants perceive its versatility and limitations.

Conclusion:

The falling wedge chart sample is a strong device for figuring out potential bullish reversals. Nevertheless, it is essential to keep in mind that no chart sample ensures success. Thorough evaluation, together with affirmation from different indicators, strong danger administration, and a deep understanding of the market context are important for profitable buying and selling utilizing this sample. By combining technical evaluation with basic evaluation and disciplined danger administration, merchants can considerably enhance their possibilities of cashing in on falling wedge breakouts. Steady studying and adapting to market dynamics are key to mastering the artwork of technical evaluation and successfully using chart patterns just like the falling wedge.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Falling Wedge: A Complete Information to This Highly effective Chart Sample. We recognize your consideration to our article. See you in our subsequent article!