Decoding The FINNIFTY Reside Chart: A Complete Information For Merchants

Decoding the FINNIFTY Reside Chart: A Complete Information for Merchants

Associated Articles: Decoding the FINNIFTY Reside Chart: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the FINNIFTY Reside Chart: A Complete Information for Merchants. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the FINNIFTY Reside Chart: A Complete Information for Merchants

The Nifty 50 index, a benchmark for the Indian inventory market, gives a broad overview of market efficiency. Nonetheless, for merchants looking for extra centered publicity to the monetary sector, the FINNIFTY index emerges as a vital software. This text delves deep into the FINNIFTY stay chart, exploring its significance, interpretation, and sensible functions for varied buying and selling methods. We are going to look at its elements, historic efficiency, components influencing its motion, and find out how to successfully make the most of the stay chart for knowledgeable decision-making.

Understanding the FINNIFTY Index:

The FINNIFTY index, sometimes called the Nifty Monetary Companies index, is a sub-index of the Nifty 50. It tracks the efficiency of 15 to twenty of the biggest and most liquid monetary companies corporations listed on the Nationwide Inventory Alternate of India (NSE). These corporations signify numerous sectors inside the monetary panorama, together with banking, insurance coverage, monetary know-how (FinTech), and non-banking monetary corporations (NBFCs). This centered illustration makes FINNIFTY a helpful indicator of the well being and dynamism of India’s monetary sector.

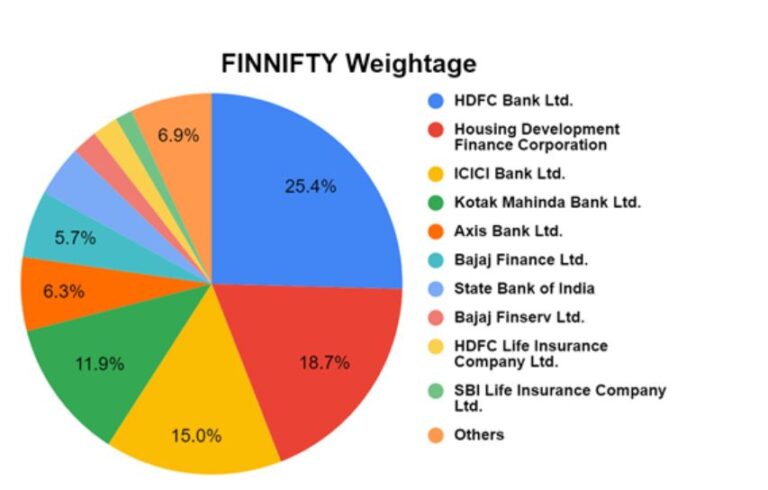

Parts and Weighting:

The particular corporations included within the FINNIFTY index and their weightings are recurrently reviewed and adjusted by NSE Indices based mostly on market capitalization and liquidity. This ensures the index stays consultant of the prevailing market dynamics inside the monetary companies sector. Whereas the precise composition adjustments over time, the index usually consists of outstanding gamers from varied monetary sub-sectors, offering a diversified but concentrated publicity. Understanding the weights assigned to every constituent firm is essential, because it helps in analyzing the impression of particular person firm efficiency on the general index motion.

Accessing the FINNIFTY Reside Chart:

Quite a few on-line platforms present real-time entry to the FINNIFTY stay chart. These embrace buying and selling platforms supplied by brokers, monetary information web sites, and devoted charting functions. These platforms usually supply a spread of charting instruments and indicators, permitting merchants to customise their view and conduct technical evaluation. Selecting a platform with dependable information feeds and a user-friendly interface is essential for efficient chart interpretation.

Decoding the FINNIFTY Reside Chart:

The FINNIFTY stay chart shows the index’s value actions over time, usually represented as a candlestick or line graph. Understanding the assorted components of the chart is essential for efficient interpretation:

- Worth Axis (Y-axis): This shows the index’s value at totally different closing dates.

- Time Axis (X-axis): This represents the time interval lined by the chart, starting from intraday to long-term historic information.

- Candlesticks/Strains: These visually signify value actions over particular time intervals (e.g., 1-minute, 5-minute, hourly, every day). The candlestick physique reveals the opening and shutting costs, whereas the wicks (shadows) signify the excessive and low costs throughout that interval.

- Quantity: Many charts additionally show buying and selling quantity alongside value actions. Excessive quantity usually signifies robust conviction behind value adjustments.

- Indicators: Merchants usually overlay technical indicators onto the chart to establish potential buying and selling alerts, equivalent to shifting averages, Relative Energy Index (RSI), MACD, Bollinger Bands, and others.

Technical Evaluation and the FINNIFTY Reside Chart:

Technical evaluation is an important facet of utilizing the FINNIFTY stay chart. Merchants make the most of varied technical indicators and chart patterns to establish potential entry and exit factors for trades. Some frequent strategies embrace:

- Pattern Evaluation: Figuring out the general route of the index (uptrend, downtrend, or sideways) is prime. Shifting averages are regularly used to substantiate developments.

- Assist and Resistance Ranges: These are value ranges the place the index has traditionally proven problem breaking by way of. They’ll point out potential reversal factors.

- Chart Patterns: Recognizing patterns like head and shoulders, double tops/bottoms, flags, and pennants can supply insights into potential future value actions.

- Oscillators: Indicators like RSI and MACD assist establish overbought and oversold situations, suggesting potential reversal factors.

Elementary Evaluation and its Affect on FINNIFTY:

Whereas technical evaluation focuses on value motion, elementary evaluation considers the underlying financial components influencing the FINNIFTY index. These components embrace:

- Curiosity Fee Modifications: Financial coverage choices by the Reserve Financial institution of India (RBI) considerably impression the monetary sector. Rate of interest hikes typically put downward strain on monetary shares, whereas charge cuts can have the other impact.

- Financial Development: Robust financial progress usually results in elevated demand for monetary companies, positively impacting FINNIFTY.

- Authorities Laws: Modifications in laws associated to banking, insurance coverage, or FinTech can affect the efficiency of particular person corporations and the general index.

- World Financial Situations: World financial occasions and geopolitical components may have an effect on investor sentiment and impression the FINNIFTY index.

- Credit score Scores and Default Charges: The creditworthiness of monetary establishments and general default charges inside the sector are essential components influencing investor confidence.

Danger Administration and Buying and selling Methods:

Efficient threat administration is essential when utilizing the FINNIFTY stay chart for buying and selling. This entails:

- Place Sizing: Figuring out the suitable quantity to spend money on every commerce, limiting potential losses.

- Cease-Loss Orders: Setting stop-loss orders to mechanically exit a commerce if the value strikes towards the dealer’s place.

- Diversification: Spreading investments throughout totally different property to cut back general portfolio threat.

- Buying and selling Plan: Creating a well-defined buying and selling plan that outlines entry and exit methods, threat tolerance, and place sizing.

Completely different Buying and selling Methods with FINNIFTY:

The FINNIFTY stay chart will be utilized for varied buying and selling methods, together with:

- Day Buying and selling: Quick-term buying and selling methods specializing in intraday value actions.

- Swing Buying and selling: Holding positions for a number of days or perhaps weeks, capitalizing on short-to-medium time period value swings.

- Place Buying and selling: Lengthy-term funding methods based mostly on elementary evaluation and long-term market developments.

- Algorithmic Buying and selling: Using automated buying and selling techniques based mostly on pre-defined guidelines and algorithms.

Conclusion:

The FINNIFTY stay chart affords a robust software for merchants looking for publicity to India’s dynamic monetary companies sector. By combining technical and elementary evaluation, creating a strong buying and selling plan, and using efficient threat administration strategies, merchants can leverage the insights offered by the stay chart to make knowledgeable choices and doubtlessly obtain their buying and selling goals. Nonetheless, it is essential to do not forget that buying and selling entails inherent dangers, and previous efficiency will not be indicative of future outcomes. Thorough analysis, steady studying, and disciplined execution are important for fulfillment in buying and selling the FINNIFTY index. At all times seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered helpful insights into Decoding the FINNIFTY Reside Chart: A Complete Information for Merchants. We hope you discover this text informative and useful. See you in our subsequent article!