Decoding The Flicker: A Complete Information To Studying Candle Chart Studying

Decoding the Flicker: A Complete Information to Studying Candle Chart Studying

Associated Articles: Decoding the Flicker: A Complete Information to Studying Candle Chart Studying

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Flicker: A Complete Information to Studying Candle Chart Studying. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Flicker: A Complete Information to Studying Candle Chart Studying

Candle charts, these visually putting representations of value actions, are a cornerstone of technical evaluation. In contrast to bar charts, which merely present the excessive, low, open, and shut costs, candles visually signify this information in a approach that makes figuring out tendencies and potential reversals considerably simpler. Mastering candle chart studying unlocks a deeper understanding of market sentiment and empowers merchants to make extra knowledgeable choices. This complete information will stroll you thru the basics, superior strategies, and important concerns for efficiently studying this significant ability.

Half 1: Understanding the Anatomy of a Candle

Every candle on a chart represents a selected time interval – this may very well be a minute, an hour, a day, every week, or perhaps a month, relying in your chosen timeframe. Understanding the elements of a single candle is step one in direction of deciphering the story it tells.

- Open Worth: The highest of the skinny line (or "wick") on the backside of the candle represents the opening value of the asset throughout that interval.

- Shut Worth: The highest of the primary physique of the candle represents the closing value.

- Excessive Worth: The highest of the higher wick exhibits the best value reached in the course of the interval.

- Low Worth: The underside of the decrease wick exhibits the bottom value reached in the course of the interval.

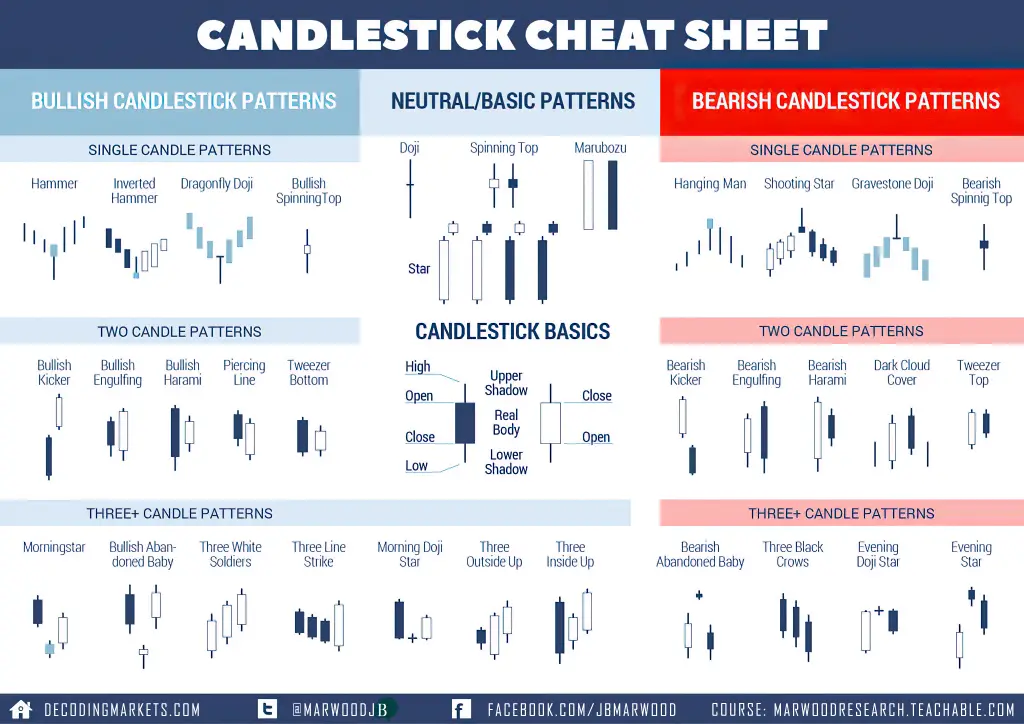

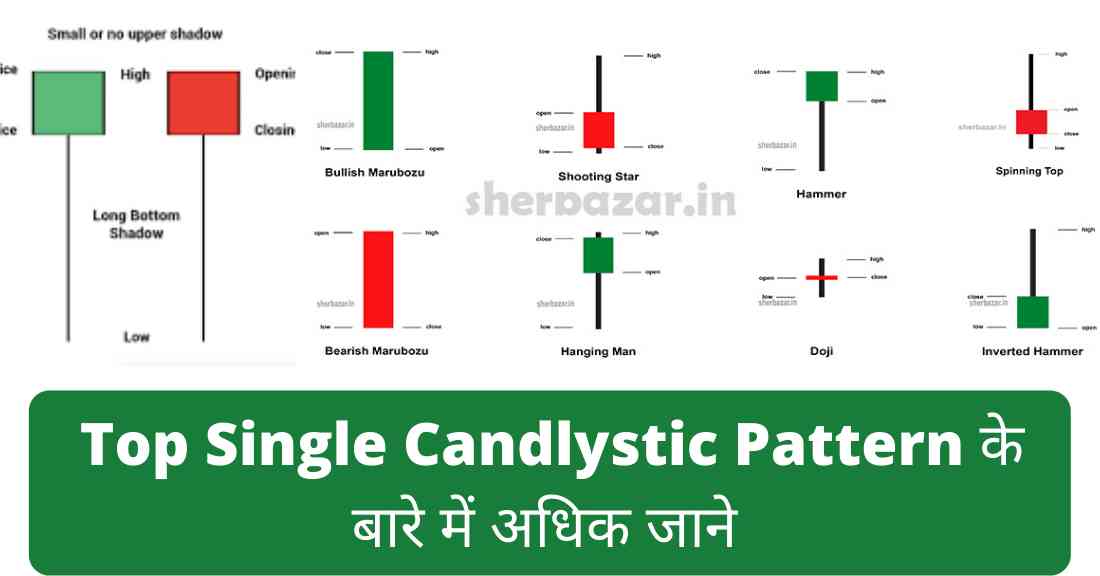

Forms of Candles:

The connection between the open and shut costs determines the candle’s colour and its significance:

- Bullish (Inexperienced/White Candles): These candles point out that the closing value was larger than the opening value, suggesting shopping for strain dominated in the course of the interval. The longer the physique, the stronger the bullish sign.

- Bearish (Crimson/Black Candles): These candles present that the closing value was decrease than the opening value, indicating that promoting strain prevailed. Once more, an extended physique signifies stronger bearish sentiment.

- Doji: A Doji candle has nearly the identical opening and shutting costs, leading to a small or non-existent physique. It is a impartial sign, suggesting indecision out there and potential reversal. Numerous kinds of Doji exist (e.g., long-legged Doji, dragonfly Doji, headstone Doji), every with refined nuances.

- Spinning High: Much like a Doji, however with a small physique and comparatively lengthy wicks on each ends. This means indecision and potential volatility.

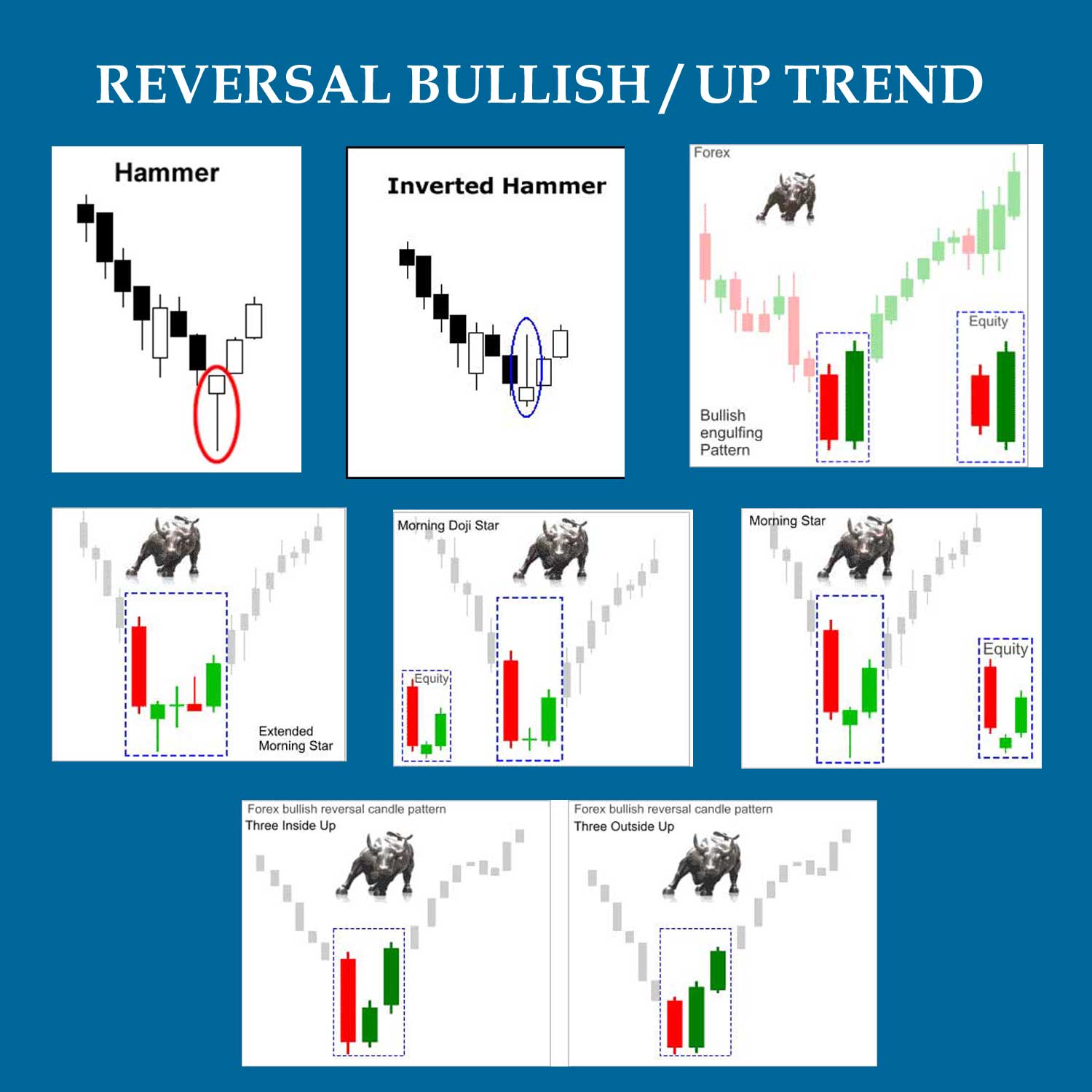

- Hammer and Hanging Man: These are single-candle patterns characterised by a small physique and an extended decrease wick (Hammer) or an extended higher wick (Hanging Man). Hammers are bullish reversal patterns, whereas Hanging Males are bearish reversal patterns. Context is essential; affirmation from different indicators is crucial.

Half 2: Figuring out Candle Patterns

Particular person candles present beneficial info, however the actual energy of candle chart studying comes from figuring out patterns fashioned by a number of candles. These patterns provide insights into potential development reversals, continuations, and market momentum. Listed below are some basic patterns:

- Engulfing Patterns: A bullish engulfing sample happens when a bearish candle is adopted by a bullish candle whose physique utterly engulfs the earlier candle’s physique. A bearish engulfing sample is the other. These patterns sign potential development reversals.

- Piercing Sample: A two-candle bullish reversal sample the place a bearish candle is adopted by a bullish candle that closes not less than midway up the earlier candle’s physique.

- Darkish Cloud Cowl: A two-candle bearish reversal sample the place a bullish candle is adopted by a bearish candle that opens above the earlier candle’s shut and closes considerably under its midpoint.

- Morning Star and Night Star: Three-candle reversal patterns. The Morning Star is a bullish reversal sample, whereas the Night Star is bearish. They contain a spot between candles and a major value change.

- Three White Troopers and Three Black Crows: Three consecutive bullish (Troopers) or bearish (Crows) candles with progressively larger (Troopers) or decrease (Crows) closes. These patterns point out robust momentum within the prevailing development.

Half 3: Combining Candle Chart Studying with Different Indicators

Whereas candle chart studying is a strong software, it is not often utilized in isolation. Efficient technical evaluation entails combining candle patterns with different indicators to verify alerts and cut back false alerts. Some generally used indicators embody:

- Transferring Averages: These easy out value fluctuations and assist establish tendencies. Generally used shifting averages embody the 50-day and 200-day shifting averages.

- Relative Power Index (RSI): A momentum oscillator that measures the magnitude of latest value modifications to guage overbought or oversold situations.

- MACD (Transferring Common Convergence Divergence): One other momentum indicator that identifies modifications in development momentum.

- Quantity: Analyzing quantity alongside candle patterns offers essential context. Excessive quantity confirms a transfer, whereas low quantity suggests weak point.

Half 4: Sensible Utility and Concerns

Studying candle chart studying is a journey, not a vacation spot. Constant observe and expertise are key to mastering this ability. Listed below are some sensible ideas:

- Begin with Longer Timeframes: Start by analyzing each day or weekly charts to get a grasp of the broader tendencies earlier than shifting to shorter timeframes.

- Follow on Demo Accounts: Earlier than risking actual cash, observe studying charts and implementing methods on a demo buying and selling account.

- Give attention to Sample Recognition: The extra patterns you acknowledge, the higher you may turn into at figuring out potential buying and selling alternatives.

- Handle Danger: By no means threat greater than you may afford to lose. Use stop-loss orders to guard your capital.

- Develop a Buying and selling Plan: A well-defined buying and selling plan outlines your entry and exit methods, threat administration guidelines, and total buying and selling strategy.

- Backtesting: Check your methods on historic information to guage their effectiveness earlier than implementing them in reside buying and selling.

- Steady Studying: The monetary markets are continuously evolving. Keep up to date on new strategies and indicators.

Half 5: Avoiding Frequent Pitfalls

A number of frequent errors can hinder your progress in studying candle chart studying:

- Over-reliance on Single Candles: Keep away from making buying and selling choices primarily based solely on a single candle. Search for affirmation from different candles and indicators.

- Ignoring Context: Candle patterns needs to be interpreted throughout the broader market context. A sample which may sign a reversal in a sideways market may merely be a continuation in a powerful development.

- Affirmation Bias: Be cautious of affirmation bias, the place you solely concentrate on info that confirms your pre-existing beliefs.

- Ignoring Danger Administration: Failing to handle threat can result in vital losses. All the time use stop-loss orders and place sizing strategies.

- Chasing Losses: Attempting to get well losses shortly typically results in even greater losses. Keep on with your buying and selling plan and keep away from emotional decision-making.

Mastering candle chart studying requires dedication, persistence, and steady studying. By understanding the anatomy of candles, figuring out frequent patterns, combining them with different indicators, and constantly working towards, you may considerably improve your buying and selling expertise and enhance your possibilities of success within the monetary markets. Do not forget that it is a ability that develops over time, so be affected person with your self and rejoice your progress alongside the way in which. Constant effort and a dedication to studying are the keys to unlocking the insights hidden throughout the flicker of the candles.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Flicker: A Complete Information to Studying Candle Chart Studying. We hope you discover this text informative and useful. See you in our subsequent article!