Decoding The Flipkart Worth Chart: A Deep Dive Into India’s E-commerce Large

Decoding the Flipkart Worth Chart: A Deep Dive into India’s E-commerce Large

Associated Articles: Decoding the Flipkart Worth Chart: A Deep Dive into India’s E-commerce Large

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Flipkart Worth Chart: A Deep Dive into India’s E-commerce Large. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Flipkart Worth Chart: A Deep Dive into India’s E-commerce Large

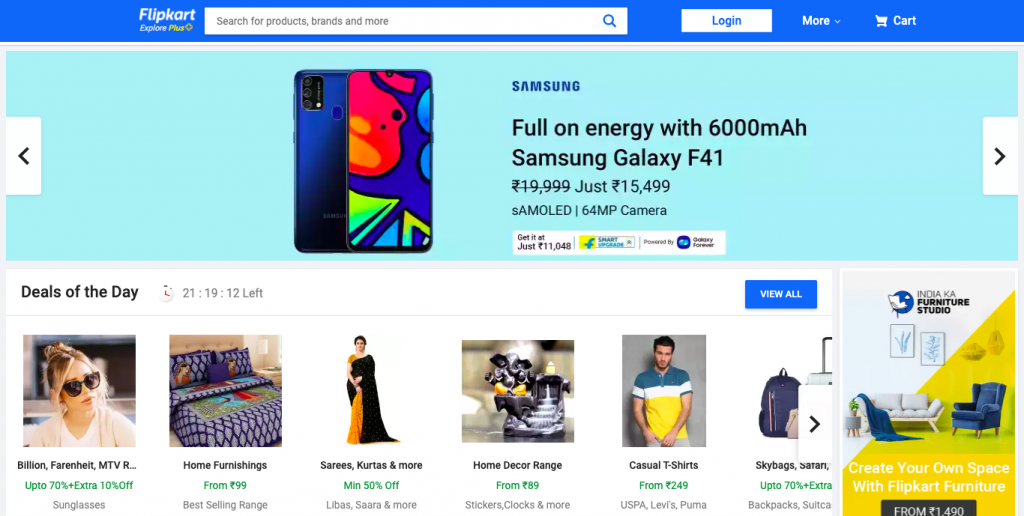

Flipkart, a titan in India’s e-commerce panorama, has witnessed a dramatic journey since its inception. Understanding its worth chart—each historic and projected—is essential for buyers, sellers, and customers alike. This text will delve into the complexities of Flipkart’s pricing methods, the components influencing its worth fluctuations, and the implications for the broader Indian e-commerce market. We’ll analyze the historic trajectory, take into account present market dynamics, and speculate on future developments, acknowledging the inherent uncertainties concerned in such predictions.

Historic Context: From Startup to Market Chief

Flipkart’s preliminary worth chart, reflecting its early days, would present a comparatively gradual and regular progress, mirroring its gradual market penetration. The corporate’s deal with books initially allowed for a managed pricing technique, leveraging economies of scale as gross sales elevated. Nonetheless, as Flipkart expanded its product classes and confronted rising competitors, its worth chart grew to become extra dynamic. The entry of Amazon into the Indian market considerably altered the panorama, triggering a worth warfare that profoundly impacted Flipkart’s pricing methods. This era possible noticed vital worth fluctuations, with aggressive reductions and promotional gives turning into commonplace.

The chart throughout this era would showcase intervals of sharp worth drops adopted by intervals of stabilization and even slight will increase. This volatility mirrored the extraordinary competitors for market share, with each Flipkart and Amazon vying for buyer loyalty by way of aggressive pricing. The acquisition of Myntra and Jabong additional diversified Flipkart’s portfolio and certain influenced its pricing methods throughout varied product classes.

Components Influencing Flipkart’s Worth Chart:

A number of interconnected components affect Flipkart’s worth chart, making it a posh and multifaceted phenomenon:

-

Competitors: Essentially the most vital affect is the extraordinary competitors from Amazon and different e-commerce gamers. Worth wars stay a recurring function, impacting profitability but additionally driving buyer acquisition. The chart would replicate intervals of intense worth competitors with sharp drops, adopted by makes an attempt to stabilize costs as firms search profitability.

-

Provider Relationships: Flipkart’s relationships with its suppliers play a vital position. Negotiated costs with producers and distributors straight impression the retail costs on the platform. Stronger bargaining energy permits Flipkart to supply decrease costs to customers. The chart would possibly present worth drops correlated with profitable provider negotiations.

-

Promotional Actions: Flipkart employs varied promotional methods, together with reductions, gross sales occasions (Massive Billion Day, and so on.), and cashback gives. These actions result in momentary worth drops, creating peaks and troughs within the chart. The frequency and depth of those promotions are key determinants of worth fluctuations.

-

Stock Administration: Environment friendly stock administration is essential for optimum pricing. Extra stock would possibly necessitate worth reductions to clear inventory, whereas shortages may enable for increased costs. The chart would possibly replicate differences due to the season in pricing based mostly on stock ranges and demand.

-

Financial Circumstances: Macroeconomic components like inflation, forex fluctuations, and client spending energy affect pricing. In periods of financial slowdown, customers are extra price-sensitive, forcing firms like Flipkart to regulate their pricing methods. The chart would replicate correlations between financial indicators and worth modifications.

-

Logistics and Supply Prices: The price of logistics and supply considerably impacts the ultimate worth. Fluctuations in gas costs, transportation prices, and warehousing bills can result in worth changes. The chart would probably present a correlation between rising logistics prices and better product costs.

-

Authorities Rules: Authorities insurance policies, taxes, and laws straight impression pricing. Adjustments in GST charges, import duties, or different regulatory measures may cause worth fluctuations. The chart would replicate the impression of such coverage modifications.

Analyzing the Present Market Dynamics:

At the moment, Flipkart operates in a extra mature e-commerce market in comparison with its early days. Whereas intense competitors persists, the main target is shifting in the direction of profitability and sustainable progress. The value chart lately possible exhibits much less volatility in comparison with the sooner, extra aggressive worth warfare period. Nonetheless, promotional occasions proceed to create momentary worth drops, and competitors stays a big issue. The rising penetration of smartphones and web entry in India continues to drive progress, however the focus is on worth propositions past simply low costs.

Future Projections and Traits:

Predicting Flipkart’s future worth chart is inherently speculative, however a number of developments may be thought-about:

-

Concentrate on Profitability: Count on a gradual shift in the direction of much less aggressive worth wars and a deal with attaining sustainable profitability. This would possibly translate to much less frequent and fewer deep reductions.

-

Personalised Pricing: The rising use of knowledge analytics and AI would possibly result in customized pricing methods, providing totally different costs to totally different buyer segments based mostly on their buy historical past and habits.

-

Worth-added Companies: Competitors will possible intensify round value-added providers like sooner supply, higher customer support, and unique product choices. Pricing would possibly replicate the price of these enhanced providers.

-

Development in Tier 2 and three Cities: Enlargement into smaller cities and cities will proceed to drive progress, however pricing methods might want to adapt to the differing buying energy and preferences of those markets.

-

Technological Developments: Automation in logistics and warehousing will possible cut back operational prices, probably resulting in decrease costs for customers.

-

The Rise of Non-public Labels: Flipkart’s personal non-public label manufacturers would possibly play a bigger position, providing aggressive pricing and better revenue margins.

Conclusion:

Flipkart’s worth chart is a dynamic reflection of the aggressive panorama, market forces, and inside methods. Whereas previous efficiency supplies invaluable insights, predicting the long run requires cautious consideration of a number of components. The shift in the direction of profitability, customized pricing, and value-added providers will possible form the long run trajectory of Flipkart’s costs. Understanding these developments is essential for all stakeholders concerned within the Indian e-commerce ecosystem. Analyzing the value chart together with different key efficiency indicators like gross sales quantity, market share, and buyer satisfaction supplies a extra complete understanding of Flipkart’s efficiency and its place within the ever-evolving Indian e-commerce market. Additional analysis into particular product classes and regional variations would supply much more granular insights into the complexities of Flipkart’s pricing methods.

![]()

Closure

Thus, we hope this text has offered invaluable insights into Decoding the Flipkart Worth Chart: A Deep Dive into India’s E-commerce Large. We thanks for taking the time to learn this text. See you in our subsequent article!