Decoding The Foreign exchange Market: A Complete Information To Pip Worth And Its Calculation

Decoding the Foreign exchange Market: A Complete Information to Pip Worth and its Calculation

Associated Articles: Decoding the Foreign exchange Market: A Complete Information to Pip Worth and its Calculation

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the Foreign exchange Market: A Complete Information to Pip Worth and its Calculation. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Foreign exchange Market: A Complete Information to Pip Worth and its Calculation

The international alternate (foreign exchange or FX) market, a colossal decentralized community buying and selling currencies globally, presents each immense alternative and important threat. Understanding the intricacies of this market is paramount for profitable buying and selling. One essential factor typically ignored by novice merchants is the pip worth, a seemingly small however critically necessary idea that straight impacts profitability and threat administration. This text delves deep into the world of pip worth, offering a complete information, together with an in depth pip worth chart and numerous calculation strategies.

What’s a Pip?

A pip, brief for "level in proportion," represents the smallest worth motion a foreign money pair could make. For many foreign money pairs, a pip is the fourth decimal place. For instance, if EUR/USD strikes from 1.1000 to 1.1001, that 0.0001 motion represents one pip. Nonetheless, there are exceptions. JPY-based pairs (like USD/JPY) solely have two decimal locations, which means a pip is the second decimal place (e.g., 110.00 to 110.01).

Understanding Pip Worth: Extra Than Only a Level

Whereas a pip represents a small worth motion, its precise financial worth is essential. The pip worth is not a hard and fast quantity; it varies primarily based on a number of components:

- The foreign money pair being traded: Completely different foreign money pairs have totally different pip values attributable to various alternate charges.

- The lot dimension: Lots dimension represents the variety of base foreign money models traded. Commonplace tons (100,000 models), mini tons (10,000 models), micro tons (1,000 models), and nano tons (100 models) all have totally different pip values.

- The account foreign money: The foreign money your buying and selling account is denominated in impacts the pip worth calculation.

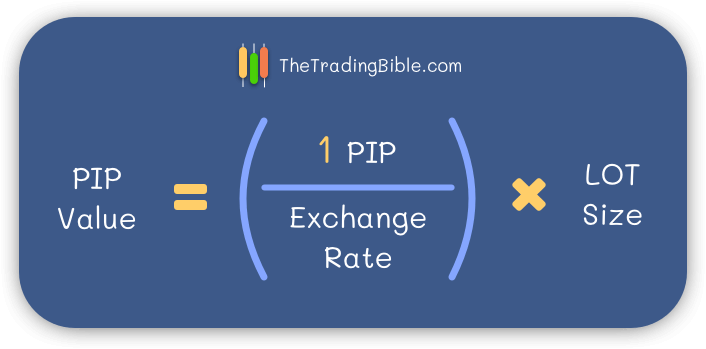

Calculating Pip Worth: A Step-by-Step Information

Calculating the pip worth requires understanding the connection between the quote foreign money and the account foreign money. Here is a breakdown of the calculation for various situations:

Situation 1: Account foreign money is similar because the quote foreign money

That is the only state of affairs. The pip worth is straight associated to the lot dimension.

-

Method: Pip Worth = (Pip in decimal type) x Lot dimension

-

Instance: You are buying and selling EUR/USD (quote foreign money is USD) with a USD account. You commerce one customary lot (100,000 models).

Pip Worth = 0.0001 x 100,000 = $10

Which means that a one-pip motion in EUR/USD will lead to a $10 revenue or loss.

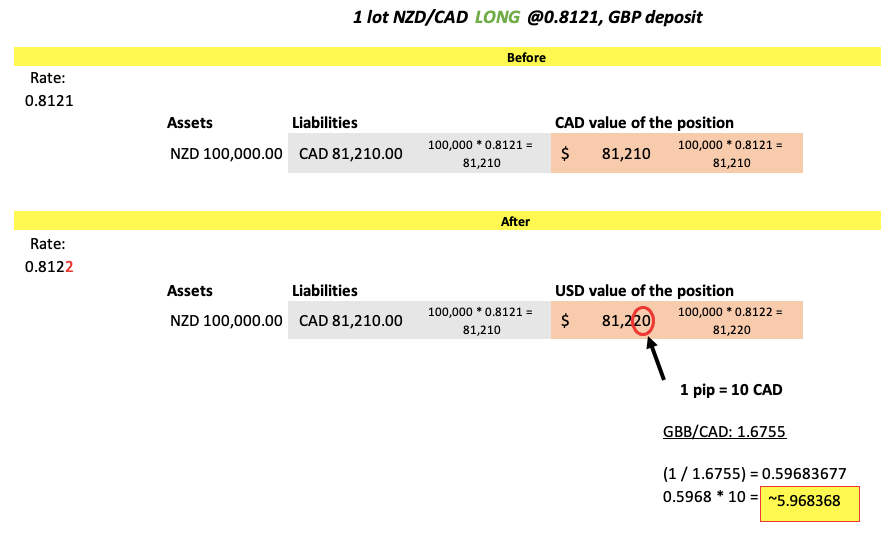

Situation 2: Account foreign money is totally different from the quote foreign money

This state of affairs requires changing the quote foreign money worth of the pip into the account foreign money.

-

Method: Pip Worth = (Pip in decimal type) x Lot dimension x Present alternate fee (Quote foreign money/Account foreign money)

-

Instance: You are buying and selling GBP/USD (quote foreign money is USD) with a EUR account. You commerce one mini lot (10,000 models). The present EUR/USD alternate fee is 1.1200.

Pip Worth = 0.0001 x 10,000 x (1/1.1200) ≈ €8.93

This implies a one-pip motion in GBP/USD will lead to roughly €8.93 revenue or loss. Be aware that we use the inverse of the EUR/USD fee (1/1.1200) as a result of we’re changing from USD to EUR.

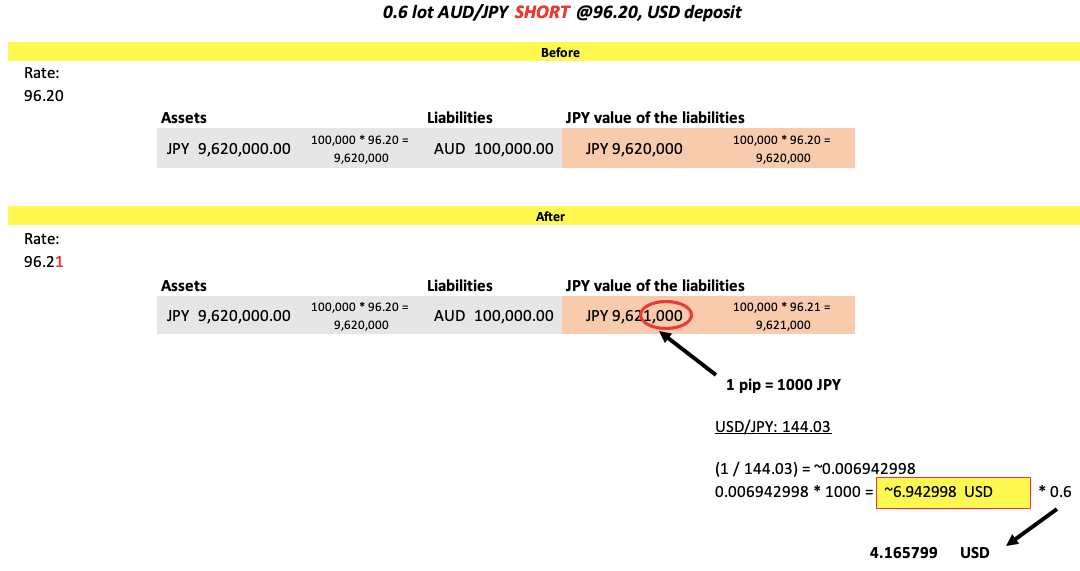

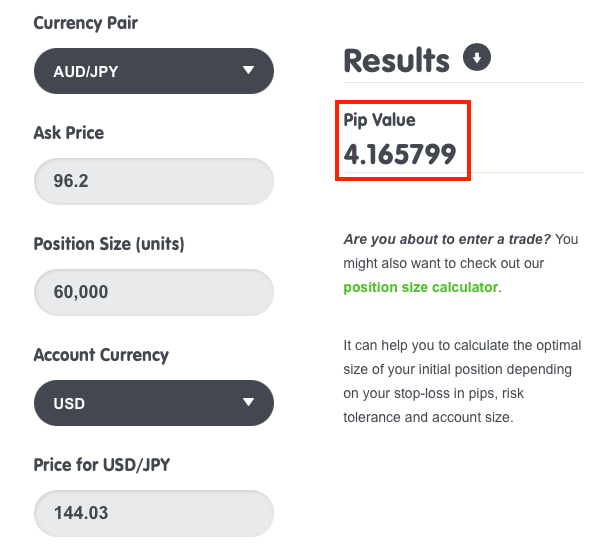

Situation 3: JPY-based pairs

Do not forget that JPY pairs have a unique pip worth.

-

Method: Pip Worth = (Pip in decimal type) x Lot dimension x Present alternate fee (JPY/Account foreign money)

-

Instance: You are buying and selling USD/JPY (quote foreign money is JPY) with a USD account. You commerce one customary lot (100,000 models).

Pip Worth = 0.01 x 100,000 x (1/110.00) ≈ $9.09 (assuming USD/JPY = 110.00)

Foreign exchange Pip Worth Chart (Illustrative)

The next chart gives illustrative pip values for numerous lot sizes and customary foreign money pairs. Keep in mind, these values are approximate and fluctuate primarily based on the present alternate charges. At all times use the present alternate fee for correct calculations.

| Forex Pair | Lot Measurement | Approximate Pip Worth (USD Account) | Approximate Pip Worth (EUR Account) |

|---|---|---|---|

| EUR/USD | 1 Commonplace Lot | $10 | €9 (approx., assuming EUR/USD = 1.1) |

| EUR/USD | 1 Mini Lot | $1 | €0.9 (approx.) |

| EUR/USD | 1 Micro Lot | $0.10 | €0.09 (approx.) |

| GBP/USD | 1 Commonplace Lot | $10 | €9 (approx.) |

| USD/JPY | 1 Commonplace Lot | $9.09 (approx.) | €8.18 (approx.) |

| USD/CHF | 1 Commonplace Lot | $10 | €9 (approx.) |

| AUD/USD | 1 Commonplace Lot | $10 | €9 (approx.) |

Components Affecting Pip Worth Past Trade Charges and Lot Measurement

Whereas the above formulation present the core calculation, a number of different components can subtly affect the precise pip worth you expertise:

- Brokerage Charges and Spreads: Your dealer’s fee or unfold (the distinction between the bid and ask worth) straight impacts your revenue or loss, successfully altering the realized pip worth.

- Slippage: Slippage happens when your order executes at a worth totally different from the one you anticipated. This may negatively impression your pip worth.

- Swap Charges (In a single day Charges): Holding positions in a single day typically incurs swap charges, which may add or subtract out of your general revenue or loss, not directly affecting the realized pip worth.

Significance of Understanding Pip Worth in Danger Administration

Understanding pip worth is essential for efficient threat administration. By calculating the potential revenue or loss per pip, you may precisely decide the suitable lot dimension to commerce primarily based in your threat tolerance. This prevents over-leveraging and minimizes the potential for important losses. For instance, if you happen to solely threat 1% of your account per commerce and your pip worth is $10, you’ll solely commerce rather a lot dimension that leads to a most lack of 1% of your account stability.

Conclusion:

The pip worth is a elementary idea in foreign currency trading. Whereas seemingly minor, its impression on profitability and threat administration is important. Precisely calculating pip worth, contemplating all related components, is crucial for each foreign exchange dealer, no matter expertise degree. By mastering this idea and using the supplied formulation and illustrative chart, merchants could make knowledgeable selections, optimize their buying and selling methods, and navigate the foreign exchange market with higher confidence and management. Keep in mind to at all times use the present alternate charges from a dependable supply for essentially the most correct pip worth calculations. Steady studying and follow are key to growing a robust understanding of this essential facet of foreign currency trading.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Foreign exchange Market: A Complete Information to Pip Worth and its Calculation. We thanks for taking the time to learn this text. See you in our subsequent article!