Decoding The Gasoline Wholesale Worth Chart: A Complete Information

Decoding the Gasoline Wholesale Worth Chart: A Complete Information

Associated Articles: Decoding the Gasoline Wholesale Worth Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Gasoline Wholesale Worth Chart: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Gasoline Wholesale Worth Chart: A Complete Information

The gasoline wholesale worth chart, a seemingly easy graph, really represents a posh interaction of worldwide economics, geopolitical occasions, refining capability, seasonal demand, and hypothesis. Understanding its fluctuations is essential for companies reliant on gasoline, from trucking firms to fuel stations, and even for particular person shoppers not directly impacted by worth adjustments. This text delves deep into the intricacies of the gasoline wholesale worth chart, explaining its parts, influencing elements, and how one can interpret its developments.

Understanding the Chart’s Fundamentals:

A typical gasoline wholesale worth chart shows the worth of gasoline (often expressed in {dollars} per gallon or barrel) over a selected interval, starting from days to years. The chart usually makes use of a line graph, with the x-axis representing time and the y-axis representing the worth. Completely different charts might present numerous grades of gasoline (e.g., common, mid-grade, premium), every with its personal worth curve. The information factors are often derived from numerous sources, together with business reporting companies, authorities information, and buying and selling platforms.

Key parts typically included in a complete chart are:

- Date/Time: The x-axis clearly signifies the time interval coated, permitting for the evaluation of worth actions over time.

- Worth per Unit: The y-axis shows the worth, often in {dollars} per gallon or barrel. The dimensions needs to be clearly marked for simple interpretation.

- Knowledge Supply: A good chart will all the time specify the supply of the information, permitting customers to evaluate the reliability and accuracy of the knowledge.

- Grade of Gasoline: The chart ought to clearly establish the particular grade of gasoline being represented (e.g., unleaded common, unleaded mid-grade, unleaded premium, diesel).

- Location: The value is often particular to a area or market (e.g., New York Harbor, Gulf Coast). Wholesale costs fluctuate considerably relying on location as a result of transportation prices and regional demand.

- Common vs. Spot Costs: The chart may show common costs over a interval (e.g., month-to-month common) or spot costs, which characterize the worth for speedy supply.

Components Influencing Wholesale Gasoline Costs:

The value of gasoline on the wholesale stage is a dynamic determine, influenced by a mess of interconnected elements:

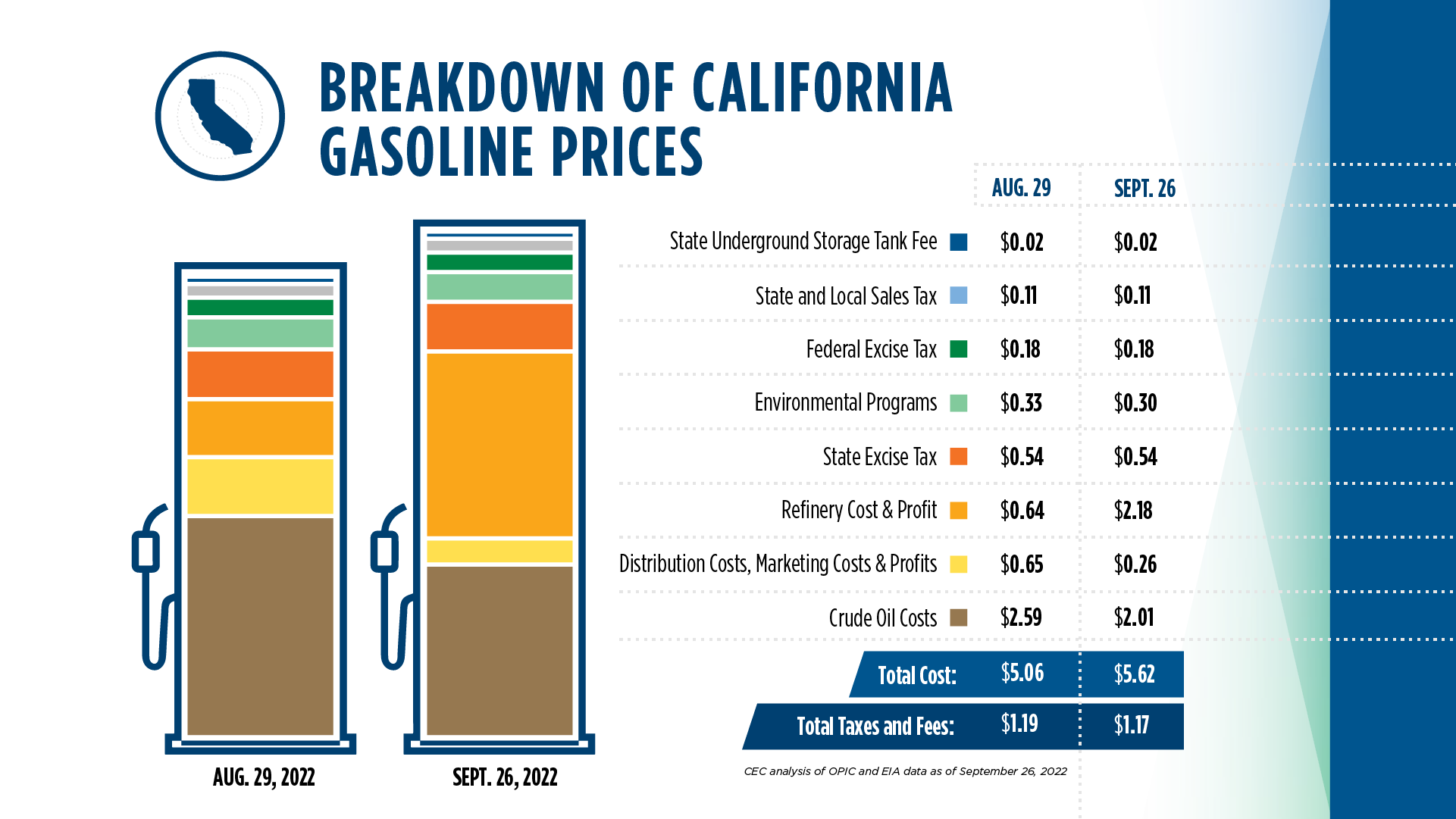

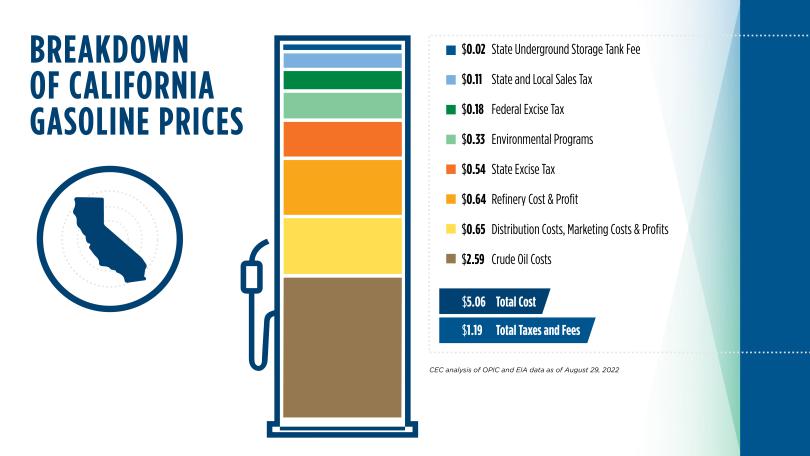

1. Crude Oil Costs: That is probably the most important issue. Crude oil is the uncooked materials for gasoline, and its worth instantly impacts the price of refining and subsequently the wholesale worth. World crude oil costs are influenced by provide and demand dynamics, OPEC manufacturing quotas, geopolitical instability (wars, sanctions), and hypothesis within the futures market. An increase in crude oil costs nearly all the time interprets to increased gasoline wholesale costs.

2. Refining Capability and Utilization: The effectivity and capability of refineries play an important function. If refineries are working at full capability or going through upkeep points, the availability of gasoline could also be constrained, resulting in increased costs. Technological developments in refining processes may also affect effectivity and, consequently, costs.

3. Seasonal Demand: Gasoline demand fluctuates all year long. Driving will increase throughout summer time trip durations, resulting in increased demand and doubtlessly increased costs. Conversely, demand tends to be decrease throughout winter months.

4. Authorities Rules and Taxes: Authorities insurance policies, together with environmental laws and taxes on gasoline, can considerably have an effect on wholesale costs. Larger taxes instantly improve the price of gasoline. Rules on emissions requirements can affect refining processes and prices.

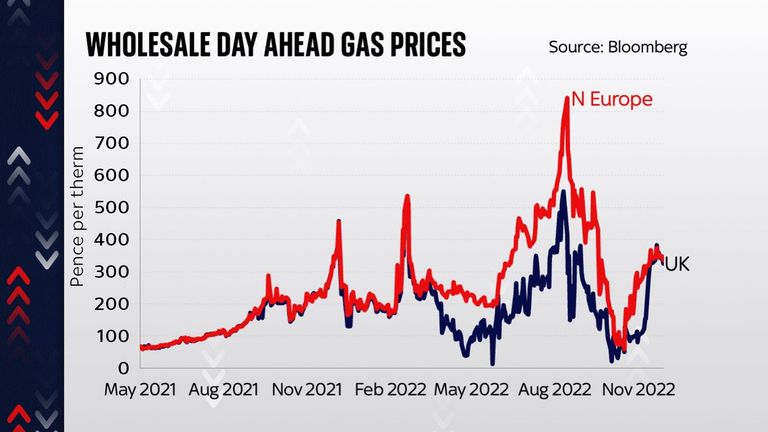

5. Geopolitical Occasions: Political instability in main oil-producing areas, sanctions, wars, or disruptions to provide chains can dramatically affect crude oil costs and consequently gasoline wholesale costs. These occasions typically result in worth volatility and uncertainty.

6. Financial Situations: Total financial power influences gasoline demand. A powerful economic system typically results in increased demand and doubtlessly increased costs. Recessions, however, can cut back demand and put downward stress on costs.

7. Hypothesis and Futures Markets: The futures marketplace for gasoline and crude oil permits for hypothesis on future worth actions. Merchants’ expectations and actions can affect costs, typically independently of basic provide and demand elements. This will result in worth volatility, notably within the brief time period.

8. Transportation Prices: The price of transporting gasoline from refineries to distribution facilities and finally to fuel stations is a major factor of the general worth. Components like gasoline prices for transportation, pipeline capability, and infrastructure limitations can all affect wholesale costs.

9. Stock Ranges: The extent of gasoline stock held by refineries and distributors influences costs. Low stock ranges can sign potential shortages, pushing costs upward. Conversely, excessive stock ranges can recommend ample provide, placing downward stress on costs.

Deciphering the Chart and Predicting Developments:

Analyzing a gasoline wholesale worth chart requires cautious consideration of the elements talked about above. In search of developments and patterns is essential:

- Figuring out Developments: Are costs typically growing, lowering, or fluctuating inside a spread? Figuring out the general pattern helps in understanding the dominant forces at play.

- Analyzing Volatility: How a lot do costs fluctuate from day after day or week to week? Excessive volatility suggests a market influenced by important uncertainty or hypothesis.

- Evaluating to Historic Knowledge: Evaluating present costs to historic information gives context and helps assess whether or not present costs are unusually excessive or low.

- Contemplating Exterior Components: Take note of information and occasions which may affect crude oil costs or refining capability. This helps in anticipating potential worth actions.

- Understanding Seasonality: Acknowledge the seasonal patterns in demand and alter your interpretation accordingly. Summer time worth spikes, for example, are sometimes anticipated.

The Significance of Correct Knowledge and Dependable Sources:

Dependable information is essential for correct evaluation. Utilizing information from respected sources, comparable to authorities companies (e.g., EIA within the US), business organizations, and established monetary information retailers, is important. Be cautious of charts from unreliable sources that will include biased or inaccurate data.

Conclusion:

The gasoline wholesale worth chart is a dynamic illustration of a posh market. Understanding the varied elements that affect these costs is important for companies and people alike. By fastidiously analyzing the chart, contemplating exterior elements, and counting on dependable information sources, one can acquire useful insights into the present market circumstances and doubtlessly anticipate future worth actions. Nevertheless, it is essential to keep in mind that predicting future costs with full accuracy is inconceivable as a result of inherent volatility and the multitude of unpredictable occasions that may affect the market. Constant monitoring and a radical understanding of the underlying dynamics are key to navigating the complexities of the gasoline wholesale market.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Gasoline Wholesale Worth Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!