Decoding The Gold Commerce Chart Dwell: A Complete Information

Decoding the Gold Commerce Chart Dwell: A Complete Information

Associated Articles: Decoding the Gold Commerce Chart Dwell: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Gold Commerce Chart Dwell: A Complete Information. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Gold Commerce Chart Dwell: A Complete Information

Gold, a timeless image of wealth and stability, has captivated traders for hundreds of years. Its value, nonetheless, is something however static, fluctuating based mostly on a fancy interaction of worldwide financial components, geopolitical occasions, and market sentiment. Understanding easy methods to interpret a dwell gold commerce chart is essential for anybody navigating this dynamic market, whether or not a seasoned investor or a curious newcomer. This text delves deep into the intricacies of gold charts, explaining the important thing parts, widespread patterns, and instruments used to research its value actions.

Understanding the Fundamentals of a Gold Commerce Chart

A dwell gold commerce chart visually represents the value of gold over a particular interval. Sometimes, it shows the value on the vertical axis (Y-axis) and time on the horizontal axis (X-axis). The most typical chart sorts embody:

-

Line Charts: These present the closing value of gold for every interval (e.g., each day, hourly, minutely). They’re easy to grasp and helpful for figuring out general tendencies.

-

Candlestick Charts: These provide a extra detailed view, displaying the opening, closing, excessive, and low costs for every interval. The "physique" of the candlestick represents the value vary between the opening and shutting costs, whereas the "wicks" (or shadows) prolong to the excessive and low costs. The colour of the candlestick often signifies whether or not the value closed greater (inexperienced or white) or decrease (purple or black) than it opened. Candlestick charts are most popular by many merchants attributable to their capacity to disclose patterns and momentum.

-

Bar Charts: Just like candlestick charts, bar charts characterize the excessive, low, open, and shut costs for a given interval. Nevertheless, they use vertical bars as an alternative of candlesticks.

Whatever the chart kind, most dwell gold commerce charts provide customizable options, permitting merchants to:

-

Select the timeframe: From intraday (minutes, hours) to long-term (each day, weekly, month-to-month). The timeframe chosen considerably impacts the interpretation of the chart.

-

Choose the chart kind: Swap between line, candlestick, and bar charts relying on their analytical wants.

-

Add indicators: Technical indicators, mentioned later, may be overlaid on the chart to supply extra insights.

-

Modify the dimensions: Zoom in or out to deal with particular value ranges or time intervals.

Key Parts to Interpret on a Gold Commerce Chart

Analyzing a gold commerce chart entails figuring out a number of key parts:

-

Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by way of. Help ranges characterize costs the place shopping for stress is robust, stopping additional declines. Resistance ranges characterize costs the place promoting stress is robust, stopping additional advances. Breaks above resistance or beneath assist can sign vital value actions.

-

Pattern Strains: These are strains drawn to attach a sequence of upper highs (uptrend) or decrease lows (downtrend). Pattern strains assist establish the prevailing course of the value.

-

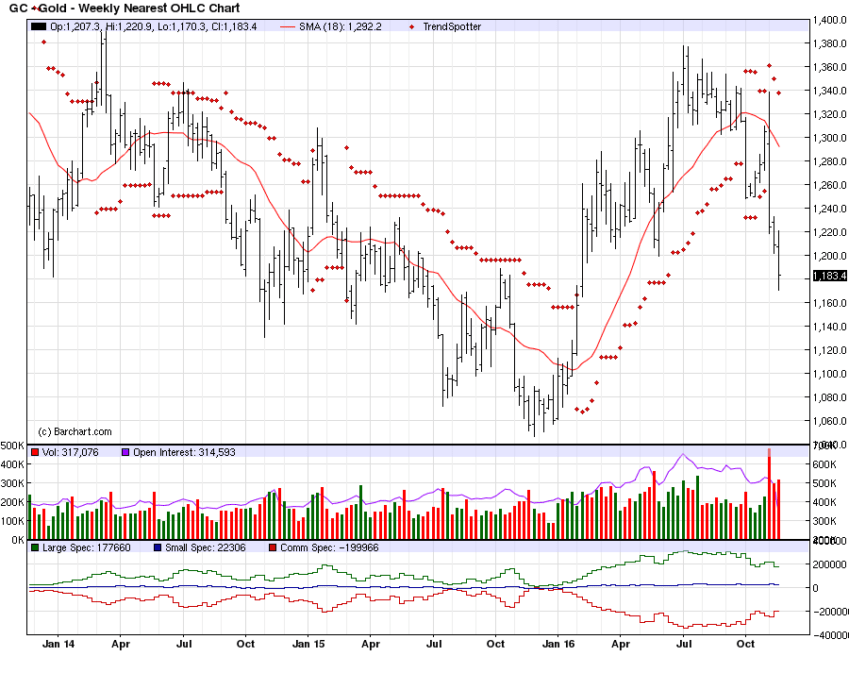

Shifting Averages: These are calculated by averaging the value over a particular interval (e.g., 50-day transferring common, 200-day transferring common). Shifting averages easy out value fluctuations and will help establish tendencies and potential reversal factors. Crossovers between completely different transferring averages (e.g., a 50-day MA crossing above a 200-day MA) are sometimes seen as purchase or promote alerts.

-

Quantity: Quantity represents the variety of gold contracts traded throughout a particular interval. Excessive quantity accompanying a value breakout can affirm the power of the transfer. Low quantity breakouts, then again, could also be much less dependable.

-

Value Patterns: Sure recurring value patterns, equivalent to head and shoulders, double tops/bottoms, flags, and pennants, can present clues about future value actions. These patterns are sometimes recognized on candlestick charts.

Technical Indicators: Enhancing Chart Evaluation

Technical indicators are mathematical calculations utilized to cost knowledge to generate purchase or promote alerts. Some generally used indicators embody:

-

Relative Energy Index (RSI): Measures the magnitude of current value adjustments to judge overbought or oversold circumstances. RSI values above 70 are typically thought-about overbought, whereas values beneath 30 are thought-about oversold.

-

Shifting Common Convergence Divergence (MACD): Identifies adjustments in momentum by evaluating two transferring averages. Crossovers of the MACD strains can generate purchase or promote alerts.

-

Bollinger Bands: Plot normal deviations round a transferring common, displaying value volatility. Value bounces off the bands can point out potential reversals.

-

Stochastic Oscillator: Compares a closing value to its value vary over a given interval, figuring out overbought and oversold circumstances.

It is essential to keep in mind that technical indicators will not be foolproof and must be used at the side of different types of evaluation, together with basic evaluation (contemplating components like financial knowledge and geopolitical occasions).

Elementary Components Influencing Gold Costs

Whereas technical evaluation focuses on value charts, basic evaluation considers the underlying financial and geopolitical components driving gold’s value. These embody:

-

US Greenback Energy: Gold is inversely correlated with the US greenback. A stronger greenback typically places downward stress on gold costs, whereas a weaker greenback tends to assist gold.

-

Inflation: Gold is usually seen as a hedge towards inflation. During times of excessive inflation, traders are likely to flock to gold as a retailer of worth, driving up its value.

-

Curiosity Charges: Greater rates of interest typically scale back the attraction of gold, as traders can earn greater returns on different belongings. Decrease rates of interest can have the other impact.

-

Geopolitical Occasions: Uncertainty and instability in world markets usually result in elevated demand for gold as a secure haven asset.

-

Provide and Demand: The bodily provide of gold is comparatively restricted, which may affect its value. Elevated demand from central banks or traders can drive costs greater.

Buying and selling Methods and Threat Administration

Profitable gold buying and selling requires a well-defined buying and selling technique and efficient danger administration. Some widespread methods embody:

-

Pattern Following: Figuring out and buying and selling within the course of the prevailing pattern.

-

Imply Reversion: Buying and selling on the idea that costs will ultimately revert to their common.

-

Scalping: Making short-term trades to revenue from small value actions.

-

Swing Buying and selling: Holding positions for a number of days or perhaps weeks to capitalize on bigger value swings.

Threat administration is paramount. Merchants ought to:

-

Use stop-loss orders: These robotically exit a commerce if the value strikes towards the dealer’s place, limiting potential losses.

-

Diversify their portfolio: Do not put all of your eggs in a single basket. Put money into different belongings to cut back general danger.

-

Handle place measurement: Keep away from over-leveraging and solely danger a small proportion of your capital on every commerce.

Conclusion:

Mastering the artwork of decoding a dwell gold commerce chart requires a mix of technical and basic evaluation, a well-defined buying and selling technique, and disciplined danger administration. Whereas gold’s value actions may be unpredictable, understanding the important thing parts of the chart, using technical indicators successfully, and staying knowledgeable about macroeconomic occasions can considerably enhance your possibilities of profitable buying and selling. Keep in mind to all the time conduct thorough analysis, observe with a demo account, and by no means make investments greater than you possibly can afford to lose. The gold market presents each vital alternatives and appreciable dangers; cautious evaluation and prudent decision-making are essential for navigating its complexities.

Closure

Thus, we hope this text has offered useful insights into Decoding the Gold Commerce Chart Dwell: A Complete Information. We admire your consideration to our article. See you in our subsequent article!