Decoding The Golden Alerts: Chart Patterns In Gold Worth Prediction

Decoding the Golden Alerts: Chart Patterns in Gold Worth Prediction

Associated Articles: Decoding the Golden Alerts: Chart Patterns in Gold Worth Prediction

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Golden Alerts: Chart Patterns in Gold Worth Prediction. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Golden Alerts: Chart Patterns in Gold Worth Prediction

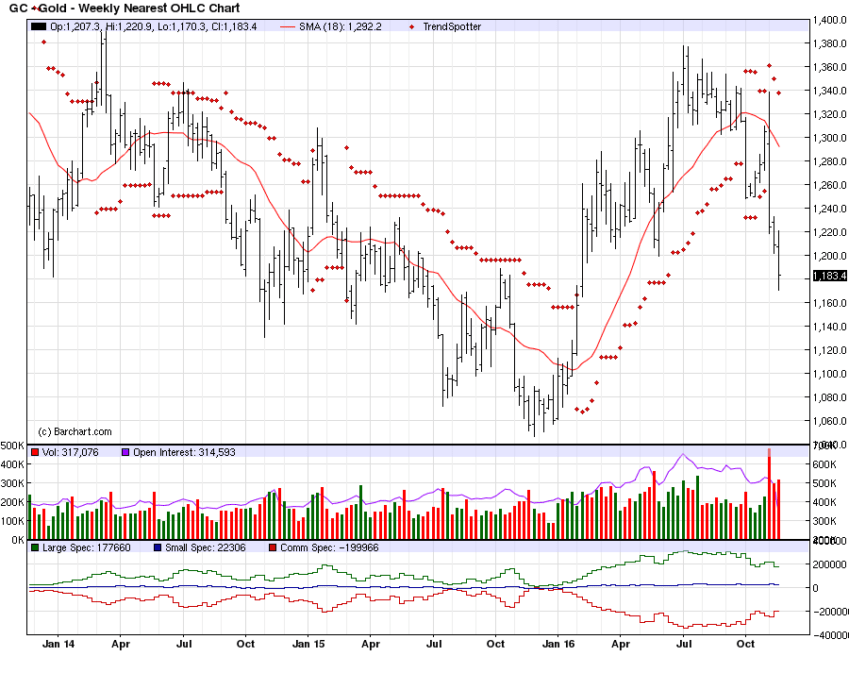

Gold, a timeless haven in turbulent markets, has captivated buyers for millennia. Its worth, nonetheless, dances to a fancy rhythm, influenced by geopolitical occasions, financial indicators, and market sentiment. Whereas predicting its future motion with certainty is not possible, understanding widespread chart patterns can considerably enhance your buying and selling technique and danger administration. This text delves into the world of gold chart patterns, explaining their significance, figuring out key examples, and outlining the right way to incorporate them into your buying and selling strategy.

Understanding Chart Patterns: A Visible Language of the Market

Chart patterns are recurring formations on worth charts that reveal shifts in market momentum and sentiment. They symbolize the collective actions of consumers and sellers, providing visible clues about potential future worth actions. These patterns usually are not foolproof predictors, however they supply useful insights when mixed with elementary evaluation and different technical indicators. Profitable merchants use these patterns to determine potential entry and exit factors, handle danger, and improve their total buying and selling technique.

Gold, being a risky but comparatively predictable asset, lends itself nicely to technical evaluation, making the research of chart patterns notably related. The patterns we talk about under are relevant to varied timeframes, from short-term day buying and selling to long-term funding methods. Nevertheless, the reliability and significance of a sample usually depend upon the timeframe chosen. A sample that is important on a weekly chart may be much less so on a each day chart.

Main Chart Patterns in Gold Buying and selling:

We’ll discover a number of the mostly noticed and dependable chart patterns in gold buying and selling, categorized for readability:

1. Continuation Patterns: These patterns recommend a short lived pause in an present pattern earlier than the value resumes its unique path.

-

Triangles: Triangles are characterised by converging trendlines, forming a triangular form on the chart. There are three foremost sorts: symmetrical, ascending, and descending. Symmetrical triangles point out a interval of consolidation, with the breakout path usually decided by the pre-existing pattern. Ascending triangles recommend bullish continuation, whereas descending triangles trace at bearish continuation. The breakout often happens on the apex of the triangle.

-

Flags and Pennants: These are short-term continuation patterns that resemble flags or pennants hooked up to a flagpole (the previous pattern). Flags are characterised by parallel trendlines, indicating a short lived pause, usually adopted by a continuation of the earlier pattern. Pennants, however, exhibit converging trendlines, much like triangles, however on a smaller scale and often shorter in period.

-

Rectangles: Rectangles are characterised by two horizontal parallel trendlines, representing a interval of consolidation. The breakout from a rectangle usually happens within the path of the pre-existing pattern. The peak of the rectangle can be utilized to undertaking the potential worth motion after the breakout.

2. Reversal Patterns: These patterns sign a possible change within the dominant pattern, from uptrend to downtrend or vice versa.

-

Head and Shoulders: This can be a basic reversal sample. It consists of three peaks, with the center peak (the "head") being the best, and the 2 outer peaks (the "shoulders") being roughly equal in top. A neckline connects the lows between the peaks. A break under the neckline confirms the sample and suggests a bearish reversal.

-

Inverse Head and Shoulders: That is the mirror picture of the Head and Shoulders sample, signaling a possible bullish reversal. It consists of three troughs, with the center trough being the bottom. A break above the neckline confirms the sample and suggests a bullish reversal.

-

Double Tops and Double Bottoms: Double tops include two related worth highs, adopted by a decline. A break under the neckline (connecting the 2 highs) confirms the sample and suggests a bearish reversal. Double bottoms are the mirror picture, with two related worth lows, adopted by an increase. A break above the neckline (connecting the 2 lows) confirms the sample and suggests a bullish reversal.

3. Different Notable Patterns:

-

Wedges: Wedges are characterised by converging trendlines, much like triangles, however with each trendlines sloping in the identical path. Rising wedges are bearish, whereas falling wedges are bullish. The interpretation depends upon the pre-existing pattern.

-

Rounding Bottoms and Rounding Tops: These patterns point out a gradual change in pattern. Rounding bottoms, characterised by a U-shaped curve, recommend a bullish reversal, whereas rounding tops, an inverted U-shape, recommend a bearish reversal. These patterns often take longer to develop than different reversal patterns.

Making use of Chart Patterns to Gold Buying and selling:

Whereas chart patterns present useful insights, they shouldn’t be utilized in isolation. Profitable gold buying and selling requires a holistic strategy that integrates technical evaluation with elementary evaluation.

-

Affirmation: By no means rely solely on a chart sample for buying and selling selections. Verify the sample’s sign with different technical indicators, equivalent to transferring averages, RSI, MACD, and quantity evaluation. Sturdy quantity accompanying a breakout confirms the sample’s validity.

-

Danger Administration: At all times make use of correct danger administration strategies, equivalent to stop-loss orders and place sizing. Even essentially the most dependable chart patterns can fail, and it is essential to guard your capital.

-

Timeframe Consideration: The timeframe you select considerably impacts the reliability and significance of a chart sample. Patterns recognized on longer timeframes (weekly or month-to-month) are typically extra dependable than these on shorter timeframes (each day or hourly).

-

Basic Evaluation: Think about macroeconomic components, geopolitical occasions, and central financial institution insurance policies that may affect gold costs. A robust elementary backdrop strengthens the arrogance in a chart sample’s sign.

-

Apply and Endurance: Mastering chart sample recognition requires apply and endurance. Begin by analyzing historic gold worth charts and figuring out numerous patterns. Backtest your buying and selling methods utilizing historic information to refine your strategy.

Conclusion:

Chart patterns provide a robust instrument for gold merchants to realize insights into market sentiment and potential worth actions. By understanding the traits of various patterns and integrating them with elementary evaluation and different technical indicators, merchants can improve their decision-making course of, handle danger successfully, and enhance their total buying and selling efficiency. Nevertheless, it is essential to do not forget that no buying and selling technique is foolproof. Steady studying, disciplined danger administration, and a holistic strategy are important for fulfillment within the dynamic world of gold buying and selling. At all times do not forget that previous efficiency shouldn’t be indicative of future outcomes, and thorough analysis and cautious consideration are essential earlier than making any funding selections.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Golden Alerts: Chart Patterns in Gold Worth Prediction. We thanks for taking the time to learn this text. See you in our subsequent article!