Decoding The House Depot Inventory Chart: A Deep Dive Into HD’s Efficiency And Future Prospects

Decoding the House Depot Inventory Chart: A Deep Dive into HD’s Efficiency and Future Prospects

Associated Articles: Decoding the House Depot Inventory Chart: A Deep Dive into HD’s Efficiency and Future Prospects

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the House Depot Inventory Chart: A Deep Dive into HD’s Efficiency and Future Prospects. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the House Depot Inventory Chart: A Deep Dive into HD’s Efficiency and Future Prospects

The House Depot, Inc. (HD) inventory has been a stalwart performer within the retail sector for many years, persistently delivering returns for its buyers. Understanding its inventory chart, nonetheless, requires extra than simply glancing on the worth fluctuations. This text will present a complete evaluation of House Depot’s inventory chart, exploring its historic efficiency, key traits, influencing elements, and potential future trajectory. We’ll delve into technical evaluation, elementary evaluation, and take into account the broader macroeconomic context to color a whole image.

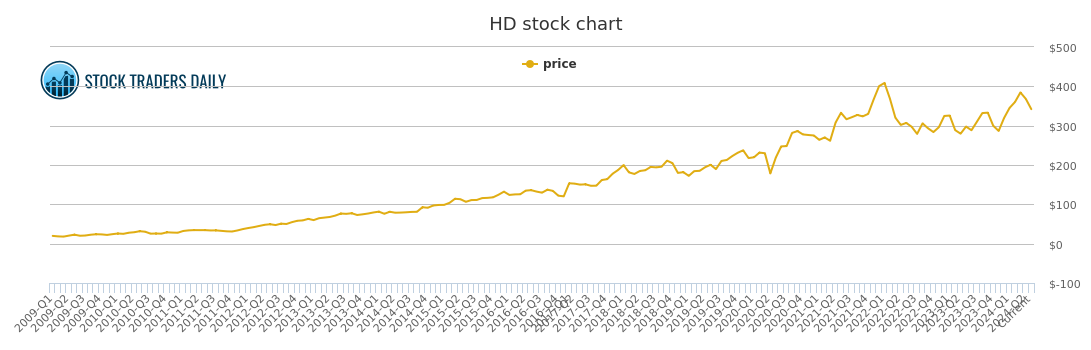

A Historic Perspective: The Lengthy-Time period Development

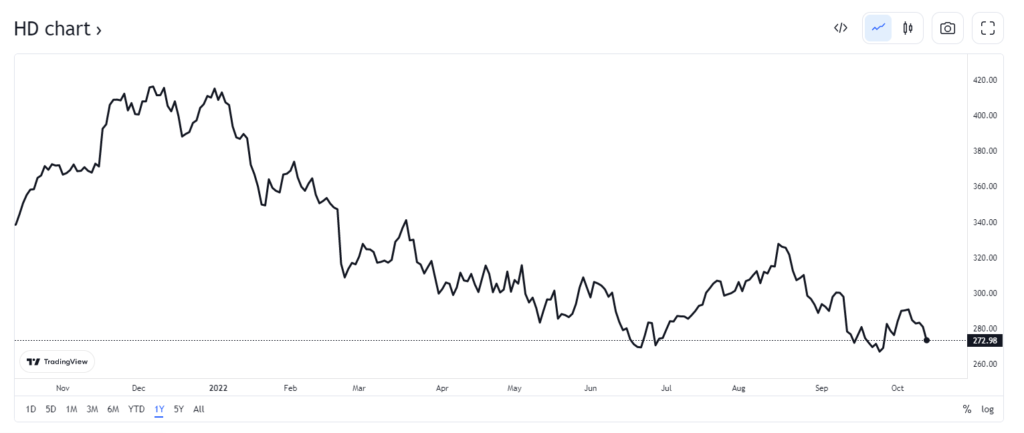

Taking a look at a long-term chart of House Depot’s inventory (spanning no less than 20 years), a transparent upward pattern emerges. This displays the corporate’s constant development and dominance within the residence enchancment retail market. Whereas experiencing periodic corrections and dips, the general trajectory has been remarkably constructive. Key milestones seen on the chart embody:

- Early 2000s Recession: The dot-com bubble burst and subsequent recession impacted HD’s inventory worth, demonstrating the vulnerability of even robust firms to broader financial downturns. Nonetheless, the restoration was swift, highlighting the resilience of the house enchancment sector and House Depot’s market place.

- Housing Market Booms and Busts: The housing market growth of the mid-2000s considerably boosted HD’s efficiency, adopted by a pointy decline throughout the 2008 monetary disaster. This underscores the robust correlation between the housing market and House Depot’s fortunes. The following restoration, although slower, showcased the corporate’s potential to adapt and navigate difficult market circumstances.

- Put up-2010 Progress: The interval after 2010 witnessed constant development, pushed by elements corresponding to low rates of interest, elevated homeownership, and a give attention to residence enchancment tasks. The chart displays this sustained upward pattern, punctuated by occasional intervals of consolidation.

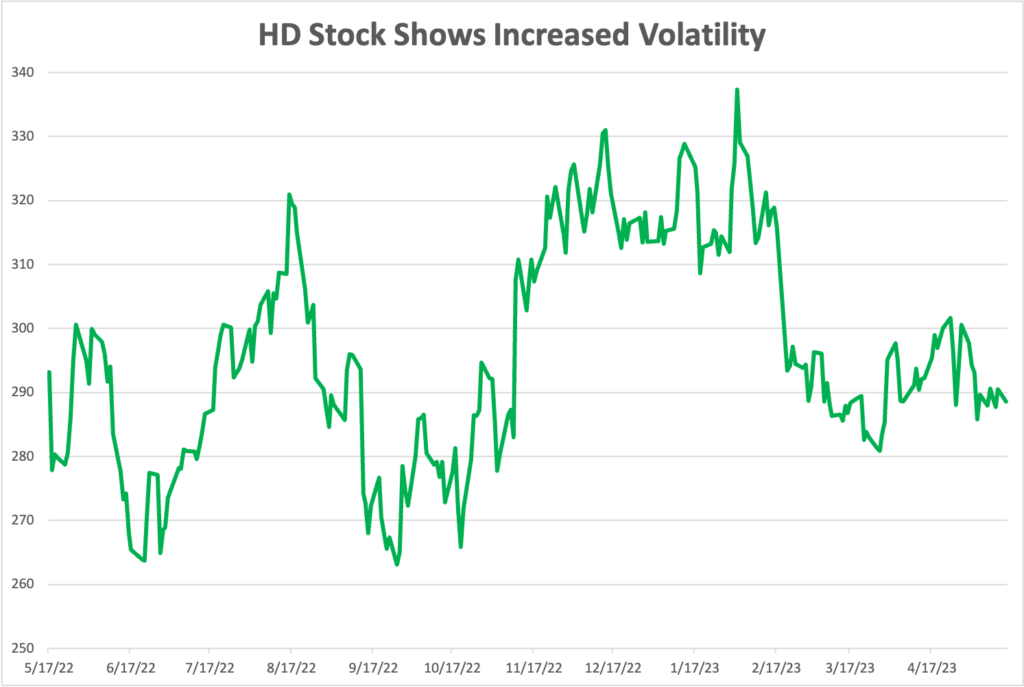

- COVID-19 Pandemic and its Aftermath: The COVID-19 pandemic initially prompted a dip, however rapidly reversed as folks spent extra time at residence and invested in residence enchancment tasks. This resulted in a big surge in HD’s inventory worth, showcasing the corporate’s adaptability and the shocking resilience of the house enchancment sector throughout a worldwide disaster. The following interval has seen a extra normalized development sample, albeit with ongoing volatility.

Technical Evaluation: Chart Patterns and Indicators

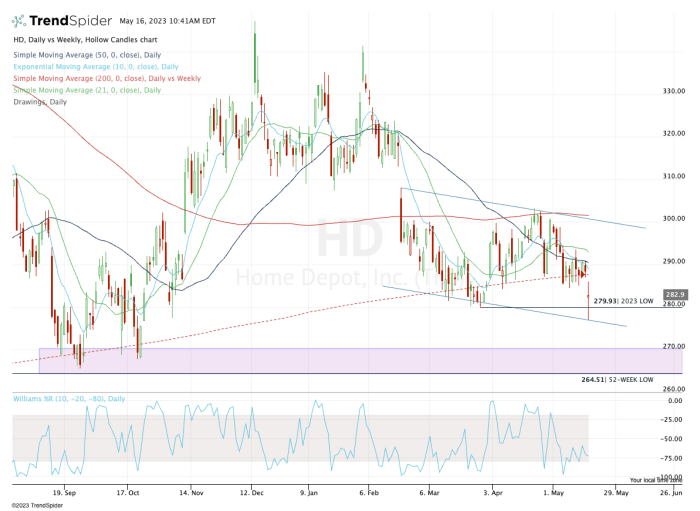

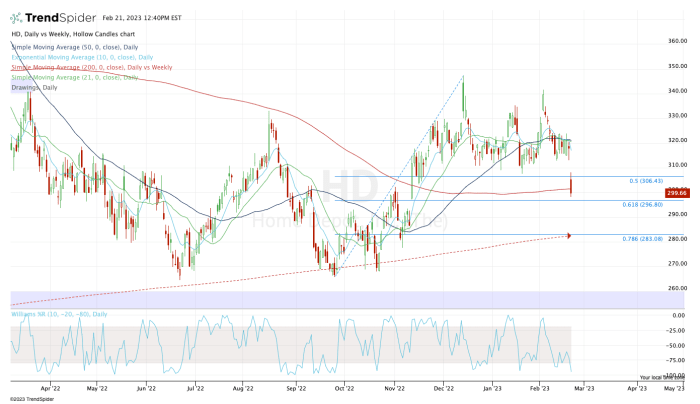

Analyzing House Depot’s inventory chart utilizing technical evaluation includes figuring out patterns and utilizing indicators to foretell future worth actions. Some key elements to contemplate embody:

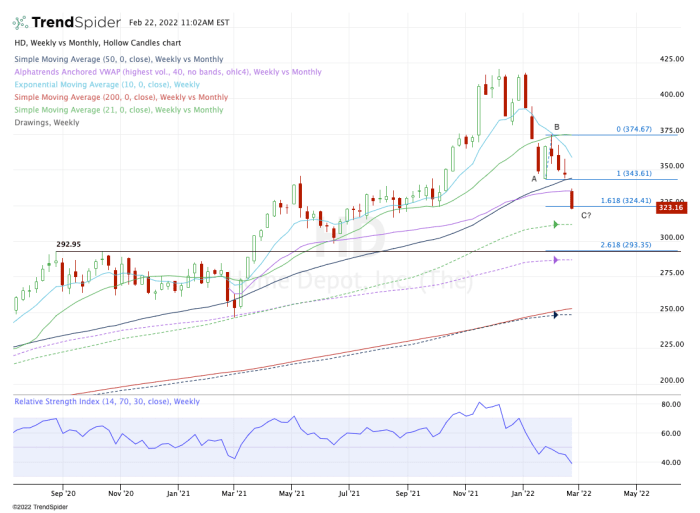

- Help and Resistance Ranges: Figuring out key help and resistance ranges on the chart may also help predict potential worth reversals. These ranges characterize worth factors the place shopping for or promoting stress is especially robust.

- Transferring Averages: Transferring averages, such because the 50-day and 200-day transferring averages, may also help determine the general pattern and potential purchase or promote indicators. Crossovers between these transferring averages usually sign adjustments in momentum.

- Relative Power Index (RSI): The RSI is a momentum indicator that may assist determine overbought or oversold circumstances. Excessive RSI values counsel the inventory could also be overbought and due for a correction, whereas low values counsel it might be oversold and poised for a rebound.

- Quantity Evaluation: Analyzing buying and selling quantity alongside worth actions can present precious insights. Excessive quantity throughout worth will increase confirms the power of the uptrend, whereas excessive quantity throughout worth decreases signifies a probably important sell-off.

- Chart Patterns: Figuring out chart patterns like head and shoulders, double tops/bottoms, and triangles can present clues about potential future worth actions.

Basic Evaluation: Assessing the Underlying Enterprise

Technical evaluation alone is inadequate for an entire understanding of HD’s inventory chart. Basic evaluation examines the underlying monetary well being and efficiency of the corporate. Key metrics to contemplate embody:

- Income and Earnings Progress: Constant income and earnings development are essential indicators of a wholesome and rising enterprise. Analyzing historic knowledge and future projections can present insights into the corporate’s long-term potential.

- Revenue Margins: Analyzing revenue margins helps assess the corporate’s effectivity and pricing energy. Enhancing margins counsel a robust aggressive place and environment friendly operations.

- Debt Ranges: Excessive ranges of debt can pose a danger to the corporate’s monetary stability. Analyzing the corporate’s debt-to-equity ratio and curiosity protection ratio is essential.

- Money Stream: Sturdy money circulation is crucial for a corporation’s potential to put money into development, pay dividends, and handle debt. Analyzing free money circulation is especially necessary.

- Aggressive Panorama: Assessing the aggressive panorama, together with the actions of opponents like Lowe’s, is significant for understanding House Depot’s market place and future prospects.

Macroeconomic Components and Their Affect

House Depot’s inventory efficiency is considerably influenced by broader macroeconomic elements:

- Curiosity Charges: Low rates of interest typically stimulate the housing market and residential enchancment spending, benefiting HD. Larger rates of interest can have the other impact.

- Housing Market Situations: The well being of the housing market is immediately correlated with House Depot’s efficiency. Sturdy housing begins and gross sales typically translate to elevated demand for residence enchancment merchandise.

- Inflation and Client Spending: Inflation can impression shopper spending and have an effect on House Depot’s gross sales. Modifications in shopper confidence additionally play a big function.

- Financial Progress: General financial development influences shopper spending and funding in residence enchancment tasks. Recessions typically negatively impression HD’s efficiency.

Future Prospects and Funding Concerns

Predicting the long run worth of any inventory is inherently difficult, however by combining technical and elementary evaluation with an understanding of macroeconomic elements, buyers could make extra knowledgeable selections. For House Depot, a number of elements will possible form its future efficiency:

- Continued Progress within the House Enchancment Sector: The long-term pattern in direction of homeownership and elevated give attention to residence enchancment suggests continued development within the sector.

- Technological Developments: House Depot’s potential to adapt to technological developments, corresponding to e-commerce and knowledge analytics, can be essential for sustaining its aggressive edge.

- Provide Chain Administration: Efficient provide chain administration can be essential in mitigating disruptions and making certain product availability.

- Inflationary Pressures: House Depot’s potential to handle inflationary pressures and preserve revenue margins can be a key consider its future efficiency.

Conclusion:

Understanding House Depot’s inventory chart requires a multifaceted method, combining technical and elementary evaluation with an understanding of macroeconomic elements. Whereas the long-term pattern has been constructive, buyers should stay vigilant and take into account the potential dangers and uncertainties. By fastidiously analyzing the chart patterns, monetary statements, and broader financial setting, buyers could make extra knowledgeable selections about investing in House Depot inventory and navigate the inherent volatility of the market. Do not forget that this evaluation is for informational functions solely and shouldn’t be thought-about monetary recommendation. Seek the advice of with a professional monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied precious insights into Decoding the House Depot Inventory Chart: A Deep Dive into HD’s Efficiency and Future Prospects. We thanks for taking the time to learn this text. See you in our subsequent article!