Decoding The Inverse Head And Shoulders: A Complete Information To This Highly effective Reversal Sample

Decoding the Inverse Head and Shoulders: A Complete Information to This Highly effective Reversal Sample

Associated Articles: Decoding the Inverse Head and Shoulders: A Complete Information to This Highly effective Reversal Sample

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Inverse Head and Shoulders: A Complete Information to This Highly effective Reversal Sample. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Inverse Head and Shoulders: A Complete Information to This Highly effective Reversal Sample

The world of technical evaluation is brimming with chart patterns, every whispering potential future value actions. Amongst these, the inverse head and shoulders (IHS) stands out as a dependable indicator of bullish reversals. Whereas seemingly complicated at first look, understanding its formation, identification, and implications can considerably improve a dealer’s capability to capitalize on market turning factors. This text delves deep into the intricacies of the inverse head and shoulders sample, equipping you with the information to confidently determine and commerce this highly effective reversal sign.

Understanding the Fundamentals: What’s an Inverse Head and Shoulders?

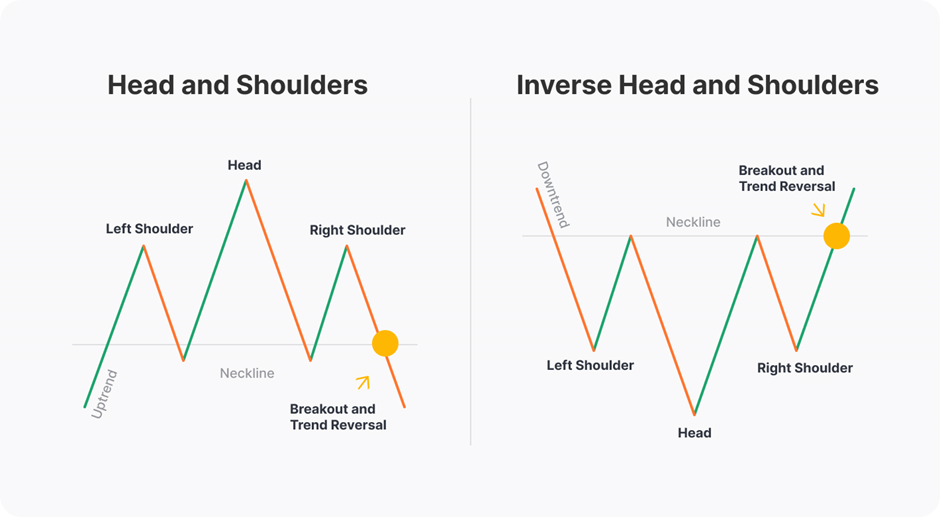

The inverse head and shoulders is a bullish reversal sample that signifies a possible shift from a downtrend to an uptrend. It is characterised by a "W" formed formation on the value chart, mirroring the inverted picture of its bearish counterpart, the top and shoulders sample. This "W" consists of three troughs (the left shoulder, the top, and the best shoulder) linked by two peaks (the neckline and the best peak).

The important thing components of an IHS sample are:

-

Left Shoulder: The preliminary trough representing a brief value low. This signifies the beginning of the potential reversal.

-

Head: The bottom level of the sample, representing a major value decline. That is the deepest trough and is normally extra pronounced than the shoulders.

-

Proper Shoulder: A subsequent trough, mirroring the left shoulder, however usually barely increased. This indicators a weakening of the downtrend.

-

Neckline: A trendline connecting the highs of the left and proper shoulders. This line acts as a vital assist degree. A breakout above the neckline confirms the sample and triggers the bullish reversal sign.

-

Breakout: The worth transferring decisively above the neckline. That is the affirmation sign for the IHS sample. The upper the breakout, the stronger the bullish sign.

Figuring out a Legitimate Inverse Head and Shoulders Sample:

Whereas the visible illustration is useful, a number of standards contribute to the validity and reliability of an IHS sample:

-

Clear Formation: The sample’s elements (shoulders, head, and neckline) must be clearly outlined and simply identifiable. Ambiguous or poorly fashioned patterns must be prevented.

-

Neckline Consistency: The neckline must be comparatively constant and horizontal or barely upward sloping. A sharply angled neckline reduces the sample’s reliability.

-

Shoulder Symmetry: Whereas excellent symmetry is not required, the left and proper shoulders ought to ideally be comparatively comparable in depth and period. Important discrepancies can weaken the sign.

-

Quantity Affirmation: A lower in quantity through the formation of the top, adopted by a rise in quantity through the breakout, strongly helps the sample’s validity. This means a shift in market sentiment.

-

Head Depth: The top must be considerably decrease than the shoulders. A shallow head weakens the bullish sign.

-

Timeframe Concerns: IHS patterns can seem on varied timeframes, from short-term (e.g., 15-minute charts) to long-term (e.g., weekly or month-to-month charts). The timeframe dictates the potential period and magnitude of the next value motion.

Buying and selling Methods with the Inverse Head and Shoulders:

As soon as an IHS sample is recognized and confirmed, a number of buying and selling methods could be employed:

-

Breakout Buying and selling: The commonest technique entails coming into an extended place after the value decisively breaks above the neckline. A stop-loss order must be positioned beneath the neckline to restrict potential losses if the breakout fails.

-

Neckline Help: Conservative merchants could await a retest of the neckline as assist earlier than coming into an extended place. This reduces the danger of a false breakout.

-

Goal Worth Calculation: The worth goal is often calculated by measuring the gap between the top and the neckline and including it to the breakout level. It is a widespread technique, however it’s essential to keep in mind that it is only a potential goal, not a assured value degree.

-

Danger Administration: Correct threat administration is paramount. Cease-loss orders ought to all the time be used to restrict potential losses. Place sizing must be fastidiously thought of primarily based on the dealer’s threat tolerance and account measurement.

False Indicators and Avoiding Pitfalls:

Whereas the IHS sample is a robust indicator, it is not foolproof. False indicators can happen, resulting in losses if not correctly managed. Listed below are some widespread pitfalls to keep away from:

-

False Breakouts: The worth would possibly briefly break above the neckline however rapidly reverse, leading to a failed breakout. Because of this affirmation is essential.

-

Poor Sample Formation: Ambiguous or poorly fashioned patterns can result in misinterpretations. Deal with clear and well-defined patterns.

-

Ignoring Market Context: Analyzing the IHS sample in isolation is inadequate. Think about broader market developments, financial indicators, and information occasions to realize a extra complete perspective.

-

Over-reliance on a Single Indicator: Do not solely depend on the IHS sample. Mix it with different technical indicators and elementary evaluation for a extra strong buying and selling technique.

Combining IHS with Different Indicators:

The effectiveness of the IHS sample could be considerably enhanced by combining it with different technical indicators:

-

Shifting Averages: Affirmation from transferring averages (e.g., 50-day and 200-day) can strengthen the bullish sign.

-

Relative Power Index (RSI): A bullish divergence between the value and RSI can point out a possible reversal, supporting the IHS sample.

-

Quantity Indicators: Analyzing quantity adjustments alongside the IHS sample can present additional affirmation of the breakout’s energy.

-

MACD: A bullish crossover within the MACD histogram can additional assist the bullish sign supplied by the IHS sample.

Conclusion:

The inverse head and shoulders sample is a beneficial instrument in a dealer’s arsenal, providing a high-probability setup for bullish reversals. By understanding its formation, identification standards, and potential pitfalls, merchants can considerably enhance their capability to determine and capitalize on these market turning factors. Nonetheless, keep in mind that no technical indicator is ideal, and mixing the IHS sample with different indicators and sound threat administration practices is essential for profitable buying and selling. Diligent examine, observe, and a disciplined strategy are key to mastering this highly effective reversal sample and maximizing its potential advantages. At all times keep in mind that buying and selling entails threat, and losses are a risk, whatever the technical indicators used.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Inverse Head and Shoulders: A Complete Information to This Highly effective Reversal Sample. We hope you discover this text informative and useful. See you in our subsequent article!