Decoding The Japanese Yen To USD Chart: A Complete Evaluation

Decoding the Japanese Yen to USD Chart: A Complete Evaluation

Associated Articles: Decoding the Japanese Yen to USD Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Japanese Yen to USD Chart: A Complete Evaluation. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Japanese Yen to USD Chart: A Complete Evaluation

The Japanese Yen (JPY) to United States Greenback (USD) change price is a dynamic indicator reflecting the advanced interaction of worldwide financial forces, home insurance policies, and market sentiment. Understanding the historic tendencies and present fluctuations of this significant forex pair is important for buyers, companies, and anybody concerned in worldwide commerce or finance. This text delves into the intricacies of the JPY/USD chart, exploring its historic efficiency, key influencing elements, and potential future implications.

Historic Perspective: A Rollercoaster Journey

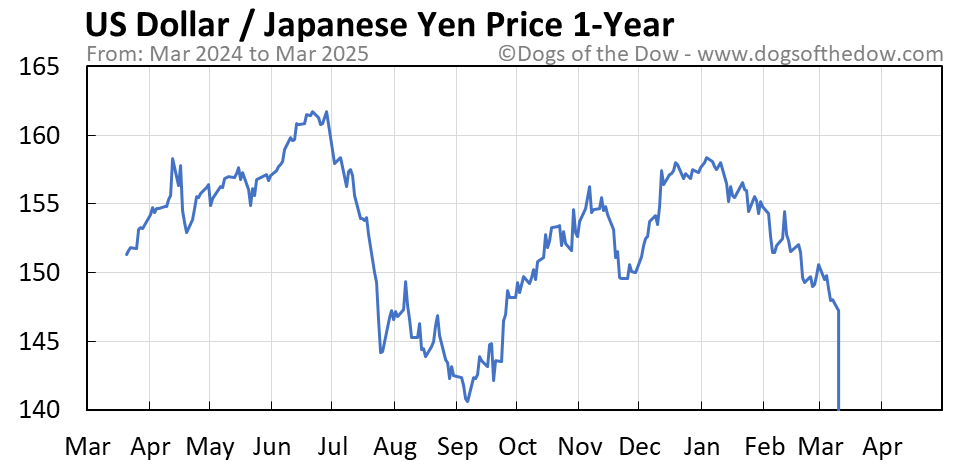

The JPY/USD change price has skilled vital volatility over the previous few a long time. The chart reveals durations of sustained energy for the Yen, typically correlated with durations of financial stability and excessive rates of interest in Japan, and durations of serious weakening, typically linked to international financial crises and shifts in financial coverage.

-

The Nineteen Eighties and the Plaza Accord: The Nineteen Eighties witnessed a dramatic appreciation of the Yen in opposition to the greenback, culminating within the Plaza Accord of 1985. This settlement, signed by the G5 nations (US, Japan, West Germany, France, and the UK), aimed to depreciate the US greenback in opposition to different main currencies, together with the Yen. The following rise within the Yen’s worth had a major influence on the Japanese financial system, resulting in a interval of asset value inflation and finally a bursting of the "bubble financial system" within the early Nineties. The chart from this period exhibits a steep upward trajectory for the Yen.

-

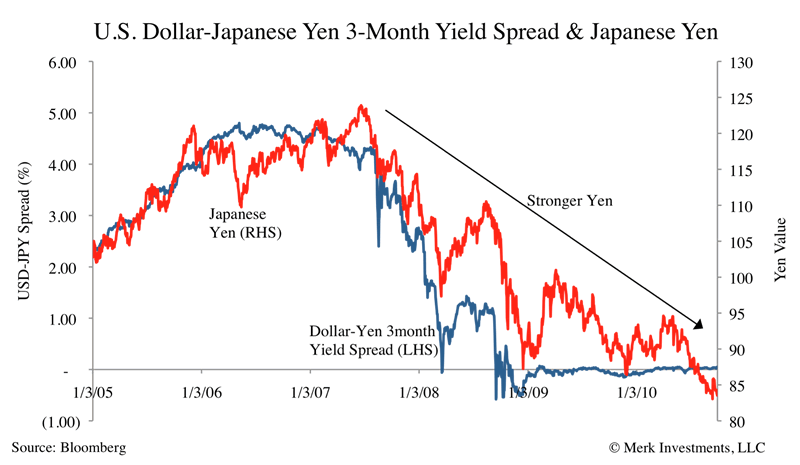

The "Misplaced Decade" and Quantitative Easing: The Nineties and early 2000s noticed a interval of extended financial stagnation in Japan, also known as the "Misplaced Decade." The Yen’s worth fluctuated, however usually remained comparatively robust in comparison with the greenback, reflecting Japan’s comparatively steady financial system regardless of its gradual progress. The introduction of quantitative easing (QE) by the Financial institution of Japan (BOJ) within the aftermath of the 2008 international monetary disaster marked a major shift. QE, involving the injection of huge quantities of liquidity into the financial system, usually put downward strain on the Yen. The chart throughout this era exhibits a gradual weakening of the Yen in opposition to the greenback.

-

Abenomics and the Yen’s Weak spot: The "Abenomics" program launched by Prime Minister Shinzo Abe in 2013 aimed to stimulate the Japanese financial system by means of a mixture of financial easing, fiscal stimulus, and structural reforms. This coverage led to a major depreciation of the Yen in opposition to the greenback, because the BOJ carried out aggressive QE measures to realize its inflation goal. The chart from this era showcases a transparent downward pattern for the Yen.

-

Latest Volatility and the Pandemic: The COVID-19 pandemic and the next international financial downturn added one other layer of complexity to the JPY/USD relationship. The Yen initially strengthened as buyers sought safe-haven belongings, however later weakened as the worldwide restoration unfolded and the BOJ maintained its ultra-loose financial coverage. The chart shows the sharp fluctuations and uncertainty attribute of this era.

Key Elements Influencing the JPY/USD Trade Fee:

A number of interconnected elements affect the JPY/USD change price, making it a posh and difficult market to foretell:

-

Financial Coverage Differentials: The rate of interest differential between the US and Japan is an important determinant of the change price. Larger rates of interest within the US relative to Japan usually appeal to overseas funding, rising demand for the greenback and placing downward strain on the Yen. Conversely, if Japanese rates of interest rise considerably relative to US charges, the Yen tends to understand.

-

Financial Development Differentials: Stronger financial progress within the US in comparison with Japan usually results in a stronger greenback and a weaker Yen. Traders are drawn to economies with larger progress potential, rising demand for the forex of that financial system.

-

Secure-Haven Standing: The Yen is usually thought-about a safe-haven forex, that means buyers are inclined to flock to it throughout occasions of worldwide financial uncertainty or geopolitical instability. This elevated demand for the Yen results in its appreciation in opposition to different currencies, together with the greenback.

-

Authorities Intervention: The Japanese authorities has traditionally intervened within the overseas change market to handle the Yen’s worth, notably when it fluctuates considerably. Intervention can contain shopping for or promoting Yen available in the market to affect its value.

-

Commerce Balances: Japan’s vital commerce surplus or deficit with the US can influence the change price. A big commerce surplus can result in elevated demand for the Yen, whereas a deficit can weaken it.

-

World Danger Urge for food: Modifications in international threat sentiment considerably affect the JPY/USD change price. During times of heightened threat aversion, buyers have a tendency to maneuver in direction of safe-haven belongings just like the Yen, resulting in its appreciation. Conversely, elevated threat urge for food can result in a weaker Yen.

-

Hypothesis and Market Sentiment: Market hypothesis and sentiment play a major position in driving short-term fluctuations within the change price. Information occasions, financial information releases, and political developments can all set off speedy modifications within the JPY/USD pair.

Analyzing the JPY/USD Chart: Instruments and Strategies

Analyzing the JPY/USD chart requires a mixture of technical and elementary evaluation strategies:

-

Technical Evaluation: This entails finding out previous value patterns, tendencies, and indicators to foretell future value actions. Instruments like transferring averages, assist and resistance ranges, and relative energy index (RSI) can present helpful insights.

-

Elementary Evaluation: This entails assessing the underlying financial and political elements that affect the change price. Analyzing macroeconomic indicators, financial coverage choices, and geopolitical occasions is essential for understanding the long-term tendencies.

-

Chart Patterns: Recognizing chart patterns, equivalent to head and shoulders, double tops/bottoms, and triangles, may help establish potential turning factors within the change price.

-

Indicators: Utilizing technical indicators like MACD, Bollinger Bands, and stochastic oscillators may help affirm tendencies and establish potential purchase or promote alerts.

Future Outlook: Uncertainties and Predictions

Predicting the longer term route of the JPY/USD change price is inherently difficult as a result of multitude of things concerned. Nevertheless, a number of elements might considerably affect its trajectory:

-

BOJ’s Financial Coverage: The BOJ’s future financial coverage choices can be essential. Any shift in direction of a much less accommodative stance might result in a strengthening of the Yen.

-

US Financial Development: The tempo of US financial progress will considerably influence the greenback’s energy and consequently the JPY/USD price.

-

World Geopolitical Occasions: Unexpected geopolitical occasions can set off vital volatility within the change price.

-

Inflation Dynamics: The interaction between inflation in Japan and the US will play a key position in figuring out the change price.

Conclusion:

The JPY/USD change price chart is a wealthy tapestry woven from financial fundamentals, market sentiment, and geopolitical occasions. Understanding its historic patterns and the important thing elements influencing it’s important for navigating the complexities of the overseas change market. Whereas predicting the longer term is unattainable, by combining technical and elementary evaluation, and staying knowledgeable about key financial and political developments, buyers and companies can develop knowledgeable methods for managing their publicity to this significant forex pair. The JPY/USD chart stays a dynamic and compelling story, repeatedly unfolding as international forces reshape the financial panorama.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Japanese Yen to USD Chart: A Complete Evaluation. We respect your consideration to our article. See you in our subsequent article!