Decoding The Jio Monetary Companies Share Worth Chart: A Deep Dive

Decoding the Jio Monetary Companies Share Worth Chart: A Deep Dive

Associated Articles: Decoding the Jio Monetary Companies Share Worth Chart: A Deep Dive

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Jio Monetary Companies Share Worth Chart: A Deep Dive. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Jio Monetary Companies Share Worth Chart: A Deep Dive

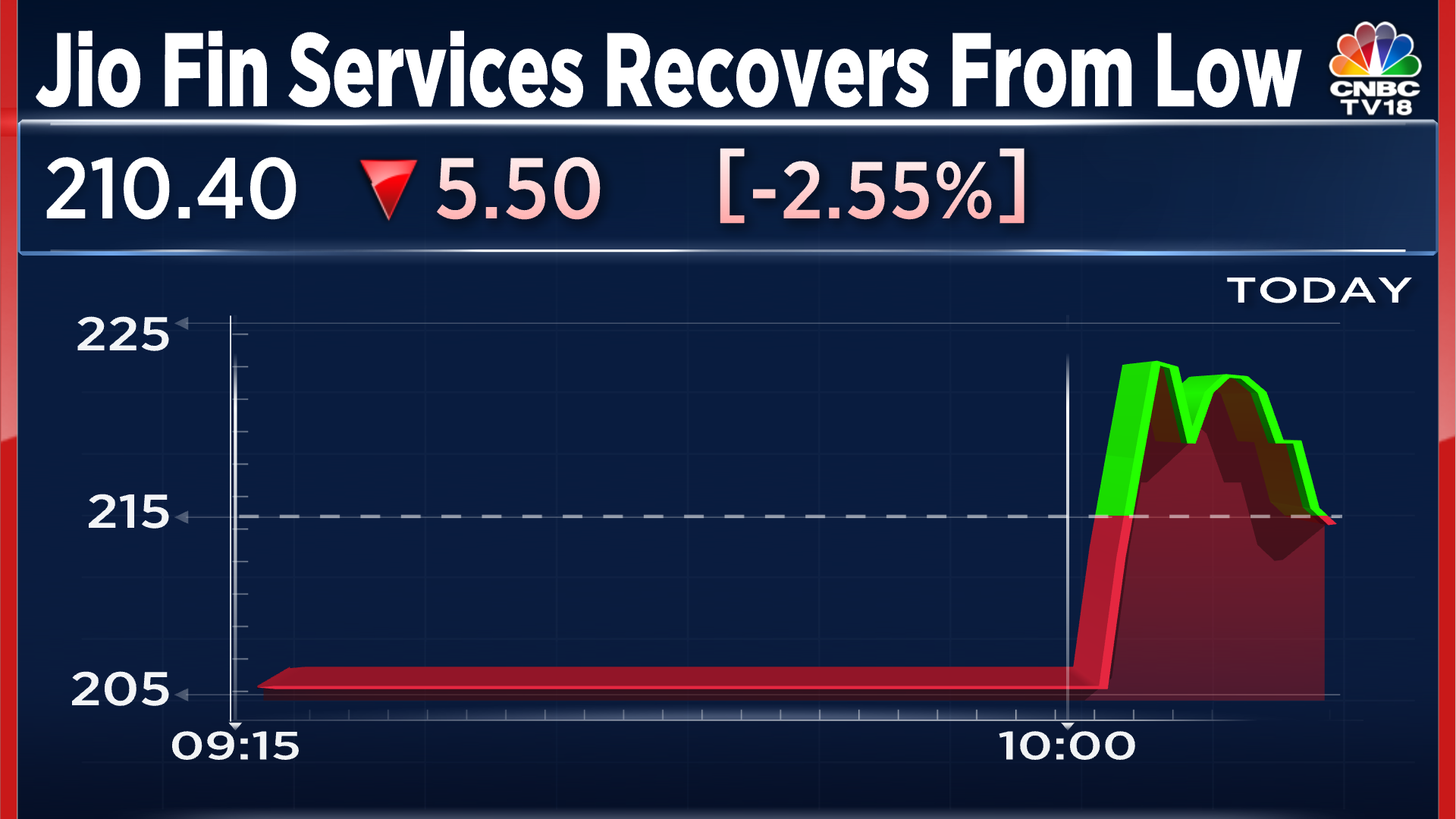

Jio Monetary Companies (JFSL), the monetary providers arm of Reliance Industries, made a much-anticipated debut on the Indian inventory exchanges in August 2023. Nevertheless, its journey hasn’t been with out its twists and turns, making its share value chart an interesting case examine for traders. This text will delve deep into the JFSL share value chart, analyzing its efficiency, influencing components, and potential future trajectories. We are going to discover each the technical and basic elements to supply a complete understanding for each seasoned and novice traders.

The Preliminary Public Providing (IPO) and the Demerger:

The JFSL journey started with its demerger from Reliance Industries. This was a major occasion, separating the monetary providers enterprise from the dad or mum firm’s core operations. The demerger itself generated appreciable market curiosity, and the following itemizing was eagerly awaited. The preliminary itemizing value was set at ₹265, triggering a flurry of exercise on the exchanges. Nevertheless, the preliminary buying and selling days noticed a substantial drop in value, a phenomenon noticed in a number of demerged entities. This preliminary value volatility was largely attributed to the distinctive circumstances of the demerger and the comparatively excessive preliminary itemizing value.

Analyzing the JFSL Share Worth Chart: Key Tendencies and Patterns:

The JFSL share value chart presents a fancy narrative. As a substitute of a easy, regular incline, we observe distinct phases:

-

Preliminary Volatility: The preliminary interval post-listing was marked by important value fluctuations. This volatility stemmed from a mixture of things, together with profit-booking by early traders, uncertainty surrounding the corporate’s future efficiency, and speculative buying and selling. The chart throughout this era reveals sharp upward and downward actions, indicating a excessive diploma of market sentiment affect.

-

Consolidation Section: Following the preliminary volatility, the chart reveals a interval of consolidation. The worth oscillated inside an outlined vary, suggesting a interval of market indecision. This section is essential for understanding the underlying help and resistance ranges. Technical analysts usually concentrate on this era to determine potential breakout factors.

-

Gradual Upward Pattern (if relevant): Relying on the interval being analyzed, the chart may reveal a gradual upward development following the consolidation section. This upward motion signifies rising investor confidence within the firm’s prospects. This development, if current, can be supported by optimistic developments comparable to sturdy monetary outcomes, strategic partnerships, and enlargement into new market segments.

-

Affect of Macroeconomic Components: The JFSL share value chart, like some other inventory, is considerably impacted by macroeconomic components. Adjustments in rates of interest, inflation ranges, and general financial sentiment can affect investor conduct and consequently have an effect on the share value. Durations of financial uncertainty usually result in value corrections, whereas optimistic financial information can enhance investor confidence and drive costs upwards.

-

Influence of Sector-Particular Information: The monetary providers sector is dynamic and vulnerable to regulatory adjustments and aggressive pressures. Information associated to regulatory reforms, adjustments in lending charges, or the efficiency of competitor firms can considerably influence the JFSL share value. Analyzing sector-specific information is essential for understanding the value actions noticed within the chart.

Technical Evaluation of the JFSL Share Worth Chart:

Technical evaluation entails finding out previous value and quantity information to foretell future value actions. A number of technical indicators might be utilized to the JFSL share value chart:

-

Shifting Averages: Shifting averages, such because the 50-day and 200-day shifting averages, assist determine developments and potential help and resistance ranges. Crossovers between these shifting averages can sign potential purchase or promote indicators.

-

Relative Power Index (RSI): The RSI is a momentum indicator that helps determine overbought and oversold situations. An RSI above 70 suggests the inventory is overbought, whereas an RSI under 30 signifies it is oversold.

-

Help and Resistance Ranges: Figuring out key help and resistance ranges on the chart is essential for understanding potential value reversal factors. Help ranges characterize value factors the place shopping for strain is anticipated to outweigh promoting strain, whereas resistance ranges characterize the alternative.

-

Candlestick Patterns: Analyzing candlestick patterns can present insights into the market sentiment and potential future value actions. Patterns like hammer, engulfing, and doji can supply useful clues.

Elementary Evaluation of JFSL:

Elementary evaluation focuses on assessing the intrinsic worth of an organization based mostly on its monetary efficiency, enterprise mannequin, and aggressive panorama. Key components to contemplate for JFSL embrace:

-

Monetary Efficiency: Analyzing JFSL’s monetary statements, together with income, profitability, and debt ranges, is essential for understanding its monetary well being and development potential.

-

Enterprise Mannequin: Understanding JFSL’s enterprise mannequin, its goal market, and its aggressive benefits is important for assessing its long-term viability.

-

Administration Crew: The expertise and competence of JFSL’s administration group play an important position in its success.

-

Aggressive Panorama: Analyzing the aggressive panorama, together with the presence of established gamers and new entrants, is essential for understanding the challenges and alternatives going through JFSL.

-

Regulatory Setting: The regulatory surroundings within the monetary providers sector can considerably influence JFSL’s operations and profitability.

Future Outlook and Funding Concerns:

Predicting the long run trajectory of the JFSL share value is difficult. Nevertheless, by combining technical and basic evaluation, traders could make knowledgeable selections. Components to contemplate embrace:

-

Execution of Enterprise Technique: JFSL’s success will rely on its means to execute its enterprise technique successfully.

-

Market Penetration: The corporate’s means to penetrate the Indian market and broaden its buyer base shall be essential for its development.

-

Technological Innovation: Adapting to technological developments and leveraging expertise to enhance effectivity and buyer expertise shall be important.

-

Regulatory Adjustments: The influence of regulatory adjustments on JFSL’s operations must be rigorously thought of.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of as monetary recommendation. Investing within the inventory market entails dangers, and traders ought to conduct their very own analysis and seek the advice of with a monetary advisor earlier than making any funding selections. The evaluation introduced right here relies on publicly obtainable data and previous efficiency isn’t indicative of future outcomes. The JFSL share value chart must be analyzed along side different related data earlier than making any funding selections. The knowledge supplied is topic to alter with out discover.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Jio Monetary Companies Share Worth Chart: A Deep Dive. We thanks for taking the time to learn this text. See you in our subsequent article!