Decoding The Junk Silver Worth Chart: A Complete Information For Buyers

Decoding the Junk Silver Worth Chart: A Complete Information for Buyers

Associated Articles: Decoding the Junk Silver Worth Chart: A Complete Information for Buyers

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Junk Silver Worth Chart: A Complete Information for Buyers. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Junk Silver Worth Chart: A Complete Information for Buyers

Junk silver, a time period referring to pre-1965 US 90% silver cash, has lengthy captivated traders searching for a tangible asset with inherent worth. In contrast to trendy bullion, these cash boast the next silver content material and a historic significance that provides to their attract. Nonetheless, understanding the fluctuating worth of junk silver requires navigating a posh interaction of things, finest visualized by way of a worth chart. This text will delve into the intricacies of junk silver worth charts, explaining their parts, deciphering traits, and offering insights for potential traders.

Understanding the Elements of a Junk Silver Worth Chart

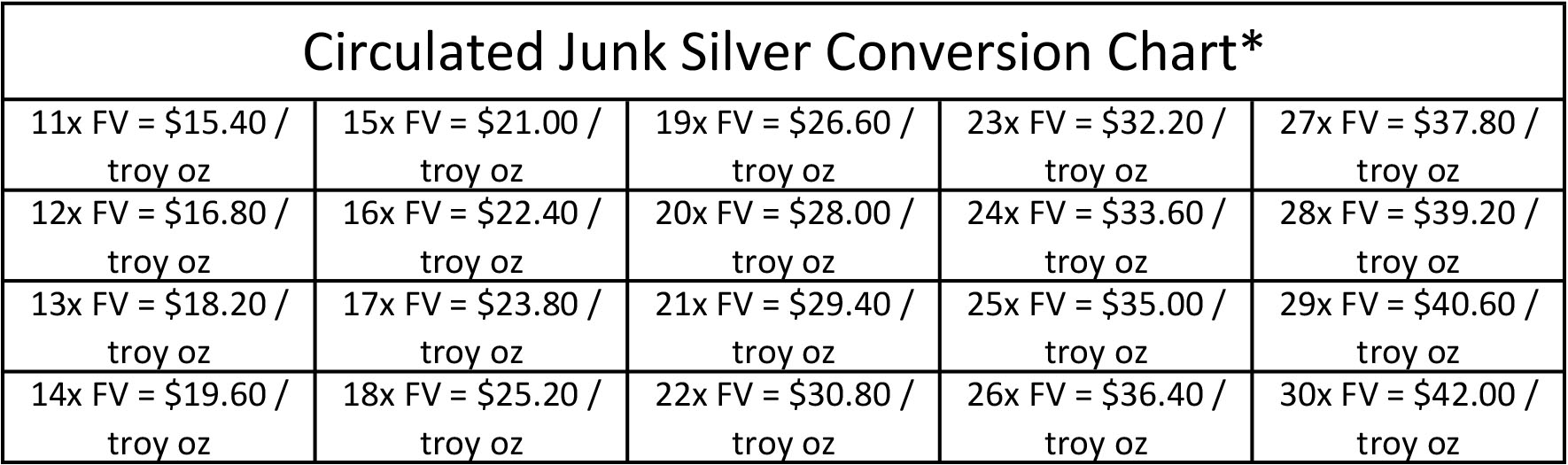

A typical junk silver worth chart shows the value per troy ounce of silver contained inside these cash over a particular interval. It’s essential to grasp that the value is not for the coin itself as a collectible, however for the silver’s intrinsic worth. Subsequently, the chart displays the fluctuating market worth of silver, influenced by numerous world financial components. A typical chart will embody:

-

X-axis (Horizontal): This axis represents time, often displayed in days, weeks, months, or years, relying on the chart’s scope. Longer timeframes present a broader perspective on long-term traits, whereas shorter timeframes spotlight short-term worth fluctuations.

-

Y-axis (Vertical): This axis represents the value, sometimes expressed in US {dollars} per troy ounce of .90 fantastic silver. This implies the value displays the worth of the silver contained within the coin, not the face worth. As an illustration, a 90% silver dime accommodates 0.07234 troy ounces of silver (0.7234 troy ounces x 0.90 = 0.07234 troy ounces).

-

Worth Line: Probably the most outstanding characteristic is the value line, a steady line connecting the closing costs of junk silver for every time interval displayed on the x-axis. This line visually represents the value motion over time, permitting for simple identification of traits.

-

Indicators (Non-compulsory): Some charts incorporate technical indicators like transferring averages (e.g., 50-day, 200-day), relative energy index (RSI), and Bollinger Bands. These indicators assist analyze worth momentum, potential reversals, and volatility, offering extra insights for skilled merchants.

-

Quantity (Non-compulsory): Some charts additionally embody quantity information, indicating the quantity of junk silver traded throughout every interval. Excessive quantity typically accompanies important worth actions, suggesting sturdy market curiosity.

Decoding Traits on a Junk Silver Worth Chart

Decoding a junk silver worth chart requires understanding a number of key ideas:

-

Uptrend: A sustained upward motion within the worth line signifies a bullish market. This means growing demand for silver, doubtlessly pushed by components equivalent to financial uncertainty, industrial demand, or funding curiosity.

-

Downtrend: A sustained downward motion signifies a bearish market, suggesting decreased demand or elevated provide. This may be influenced by components like a robust US greenback, decreased industrial demand, or profit-taking by traders.

-

Consolidation: Intervals of sideways worth motion, the place the value fluctuates inside a comparatively slim vary, point out a interval of market indecision. This may precede a major worth break in both path.

-

Assist and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt by way of. Assist ranges symbolize costs the place shopping for stress tends to outweigh promoting stress, whereas resistance ranges symbolize the alternative. These ranges can present potential entry and exit factors for merchants.

-

Breakouts: A major break above a resistance degree signifies a bullish breakout, suggesting a possible continuation of the uptrend. Conversely, a break under a help degree signifies a bearish breakout, suggesting a possible continuation of the downtrend.

Components Influencing Junk Silver Costs

The worth of junk silver is primarily pushed by the value of silver itself, however a number of different components play a major position:

-

World Silver Provide and Demand: The elemental driver of silver costs is the stability between world provide and demand. Elevated industrial demand (e.g., electronics, photo voltaic power) or decreased mine manufacturing can push costs larger.

-

US Greenback Power: The US greenback is the first foreign money utilized in world commodity markets. A powerful US greenback sometimes places downward stress on silver costs, making it costlier for patrons utilizing different currencies.

-

Inflation and Financial Uncertainty: During times of excessive inflation or financial uncertainty, traders typically flip to tangible belongings like silver as a hedge towards inflation and foreign money devaluation, driving up demand and costs.

-

Authorities Insurance policies and Rules: Authorities insurance policies associated to mining, environmental laws, and commerce can affect silver provide and consequently its worth.

-

Hypothesis and Funding Sentiment: Investor sentiment and hypothesis play a major position in worth volatility. Constructive information or expectations can result in elevated shopping for, whereas adverse information can set off promoting stress.

-

Numismatic Worth (for particular cash): Whereas the chart primarily displays the silver content material, the numismatic worth of sure cash (attributable to rarity or situation) can affect their general market worth above the soften worth. That is much less related for typical junk silver buying and selling however ought to be thought of when coping with particular, higher-value items.

Utilizing Junk Silver Worth Charts for Funding Selections

Junk silver worth charts are invaluable instruments for traders, however they should not be the only real foundation for funding selections. A complete funding technique also needs to take into account:

-

Danger Tolerance: Investing in any commodity includes threat. Junk silver costs can fluctuate considerably, so it is essential to evaluate your threat tolerance earlier than investing.

-

Funding Horizon: Your funding timeframe ought to affect your buying and selling technique. Lengthy-term traders are sometimes much less involved with short-term worth fluctuations, whereas short-term merchants give attention to figuring out short-term worth actions.

-

Diversification: Diversifying your funding portfolio throughout completely different asset courses is essential to mitigate threat. Do not put all of your eggs in a single basket.

-

Storage and Safety: Correct storage and safety of your junk silver are important to guard your funding. Think about using a protected deposit field or different safe storage options.

-

Transaction Prices: Think about shopping for and promoting prices, together with premiums over spot silver worth and any charges related to storage or transportation.

Conclusion:

Junk silver worth charts present a useful visible illustration of worth actions over time, providing insights into market traits and potential funding alternatives. Nonetheless, understanding the underlying components influencing these costs, coupled with a well-defined funding technique and threat administration plan, is essential for making knowledgeable funding selections. By combining chart evaluation with elementary analysis and a transparent understanding of your personal funding targets, you may navigate the complexities of the junk silver market and doubtlessly profit from its long-term worth proposition. Bear in mind to seek the advice of with a monetary advisor earlier than making any important funding selections.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Junk Silver Worth Chart: A Complete Information for Buyers. We hope you discover this text informative and useful. See you in our subsequent article!