Decoding The M Sample: A Complete Information To Chart Sample Buying and selling

Decoding the M Sample: A Complete Information to Chart Sample Buying and selling

Associated Articles: Decoding the M Sample: A Complete Information to Chart Sample Buying and selling

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the M Sample: A Complete Information to Chart Sample Buying and selling. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the M Sample: A Complete Information to Chart Sample Buying and selling

The world of technical evaluation is brimming with chart patterns, every providing distinctive insights into potential market actions. Amongst these, the M sample stands out as a dependable indicator of potential worth reversals. This text delves deep into the M sample, explaining its formation, identification, affirmation methods, threat administration strategies, and sensible purposes, equipping merchants with the information to leverage this highly effective instrument successfully.

Understanding the M Sample: A Reversal Signpost

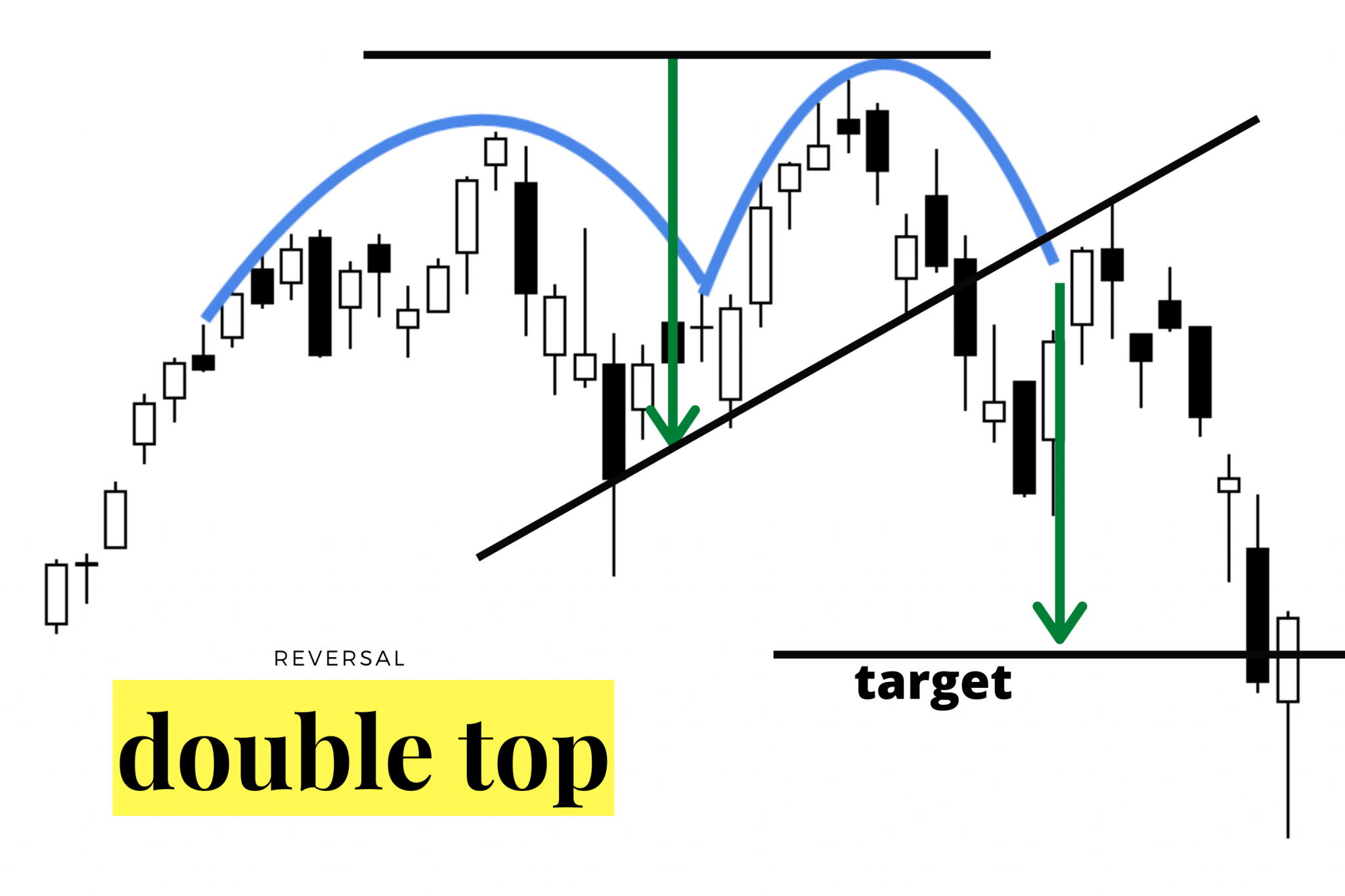

The M sample, also called a double prime, is a bearish reversal chart sample. It alerts a possible shift from an uptrend to a downtrend. Its title derives from its visible resemblance to the letter "M" on a worth chart. The sample consists of two distinct peaks (or "tops") separated by a trough (or "valley"), with the second peak ideally decrease than the primary. This visible illustration displays a weakening of shopping for strain and the emergence of promoting strain.

Key Elements of the M Sample:

-

Peak 1 (Left Shoulder): The primary peak marks the preliminary excessive of the uptrend. That is the place shopping for strain is at its strongest earlier than encountering resistance.

-

Trough (Valley): The valley represents a brief pullback or consolidation interval. That is the place the worth retraces earlier than making an attempt one other rally. The depth of the trough is essential in figuring out the sample’s validity and potential worth goal.

-

Peak 2 (Proper Shoulder): The second peak, ideally barely decrease than Peak 1, confirms the weakening of the uptrend. This signifies that patrons are dropping momentum and sellers are gaining management.

-

Neckline: The neckline is a vital component. It is a trendline connecting the lows of the trough and the previous worth motion. A break under this neckline confirms the sample and triggers the bearish sign.

Figuring out a Legitimate M Sample:

Figuring out a real M sample requires cautious statement and adherence to particular standards:

-

Form: The sample ought to resemble the letter "M" as carefully as doable. Important deviations from this form may point out a false sign.

-

Quantity: Analyzing quantity is essential. Usually, quantity ought to be excessive at Peak 1, reasonable through the trough, and comparatively excessive once more at Peak 2. Excessive quantity confirms the energy of each the uptrend and the next reversal.

-

Neckline Affirmation: The break under the neckline is a very powerful affirmation sign. A decisive break, accompanied by elevated quantity, strengthens the bearish sign.

-

Retracement: The depth of the trough is essential. A deeper trough typically signifies a extra vital worth reversal. Nevertheless, an excessively deep trough may counsel a distinct sample altogether.

-

Time Body: The timeframe on which the M sample kinds influences its significance. A bigger timeframe (e.g., weekly or month-to-month) usually signifies a extra substantial worth motion.

Affirmation Methods:

Whereas a break under the neckline is the first affirmation, merchants usually search extra affirmation alerts to boost their buying and selling choices:

-

Technical Indicators: Indicators like Relative Power Index (RSI), Transferring Common Convergence Divergence (MACD), and Stochastic Oscillator may help affirm the bearish momentum. These indicators can spotlight oversold circumstances, suggesting a possible reversal.

-

Value Motion Affirmation: Search for bearish candlestick patterns (like bearish engulfing patterns or night stars) forming close to the neckline break. These patterns reinforce the bearish sign.

-

Assist and Resistance Ranges: Observe whether or not the neckline break coincides with a key help stage, which provides additional weight to the bearish sign.

-

Elementary Evaluation: Whereas primarily a technical sample, correlating the M sample with underlying basic elements can improve confidence within the commerce setup.

Figuring out Value Targets and Cease-Loss Ranges:

As soon as the M sample is confirmed, merchants want to find out their worth targets and stop-loss ranges to handle threat successfully:

-

Value Goal: A standard methodology for figuring out the worth goal is measuring the vertical distance between Peak 1 and the neckline and projecting that distance downwards from the neckline break.

-

Cease-Loss: The stop-loss order ought to be positioned barely above Peak 2. This protects in opposition to false breakouts and minimizes potential losses if the sample fails to materialize.

Danger Administration and Place Sizing:

Efficient threat administration is essential in any buying and selling technique. For M sample buying and selling:

-

Place Sizing: By no means threat greater than a small share (e.g., 1-2%) of your buying and selling capital on a single commerce.

-

Cease-Loss Placement: At all times use stop-loss orders to restrict potential losses.

-

Commerce Administration: Monitor the commerce carefully after entry and alter your stop-loss or take revenue ranges as wanted primarily based on market circumstances.

M Sample Variations and Issues:

Whereas the traditional M sample is well recognizable, variations exist:

-

Asymmetrical M Patterns: These patterns deviate barely from the symmetrical form, with one peak considerably larger or decrease than the opposite.

-

Broader M Patterns: These patterns have a wider base, indicating an extended consolidation interval.

-

Shallow M Patterns: These patterns have a much less pronounced trough, making them much less dependable.

False Alerts and Avoiding Pitfalls:

It is essential to acknowledge that not all M patterns result in profitable trades. False alerts can happen attributable to:

-

Market Noise: Random worth fluctuations can create patterns resembling an M, however missing the underlying affirmation alerts.

-

Lack of Quantity Affirmation: Inadequate quantity on the peaks and neckline break signifies weak momentum, growing the danger of a false sign.

-

Insufficient Affirmation: Relying solely on the M sample with out corroborating proof from different indicators or worth motion will increase the likelihood of a false sign.

Sensible Purposes and Examples:

The M sample may be utilized throughout varied asset courses, together with shares, foreign exchange, and cryptocurrencies. By combining the M sample with different technical evaluation instruments and threat administration strategies, merchants can considerably enhance their buying and selling efficiency. Historic chart examples can illustrate the sample’s profitable software and spotlight its predictive energy in figuring out potential reversals. Nevertheless, previous efficiency will not be indicative of future outcomes.

Conclusion:

The M sample is a invaluable instrument in a dealer’s arsenal, offering insights into potential worth reversals. Nevertheless, profitable software requires a radical understanding of its formation, affirmation methods, threat administration strategies, and the potential for false alerts. By combining technical evaluation with self-discipline and threat administration, merchants can successfully leverage the M sample to boost their buying and selling choices and enhance their total profitability. Keep in mind that constant studying, follow, and adaptation are key to mastering any buying and selling technique, together with these primarily based on chart patterns just like the M sample. At all times conduct thorough analysis and think about consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the M Sample: A Complete Information to Chart Sample Buying and selling. We hope you discover this text informative and useful. See you in our subsequent article!