Decoding The Market: A Complete Information To Chart Studying For Inventory Choice

Decoding the Market: A Complete Information to Chart Studying for Inventory Choice

Associated Articles: Decoding the Market: A Complete Information to Chart Studying for Inventory Choice

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Market: A Complete Information to Chart Studying for Inventory Choice. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Chart Studying for Inventory Choice

The inventory market, a fancy ecosystem of fluctuating values and unpredictable developments, can appear formidable to the uninitiated. Whereas elementary evaluation, specializing in an organization’s monetary well being, offers an important perspective, technical evaluation, primarily centered on chart studying, gives a complementary lens by which to grasp market sentiment and potential worth actions. This text serves as a complete information to chart studying for inventory choice, protecting important ideas, indicators, and techniques.

Understanding the Fundamentals: Chart Sorts and Timeframes

Earlier than diving into advanced indicators, greedy the basics of chart varieties and timeframes is crucial. The most typical chart varieties are:

-

Line Charts: These charts show the closing worth of a safety over a given interval. They’re easy and efficient for figuring out general developments however lack the element of different chart varieties.

-

Bar Charts: Every bar represents a particular time interval (e.g., every day, weekly). The bar’s top signifies the value vary, with the highest representing the excessive, the underside the low, and a small line inside exhibiting the closing worth. Bar charts supply a extra complete view than line charts.

-

Candlestick Charts: These are an evolution of bar charts, offering even richer info. The "physique" of the candlestick represents the value vary between the open and shut. A inexperienced (or white) physique signifies a closing worth larger than the opening worth (a bullish candle), whereas a purple (or black) physique signifies a closing worth decrease than the opening worth (a bearish candle). Wicks (or shadows) extending above and beneath the physique present the excessive and low costs for the interval. Candlestick charts enable for the identification of quite a few patterns, mentioned later.

The timeframe chosen considerably impacts the interpretation. Frequent timeframes embrace:

- Intraday: Charts exhibiting worth actions inside a single buying and selling day. Helpful for short-term buying and selling methods.

- Every day: Charts exhibiting worth actions for every day. Appropriate for short- to medium-term buying and selling.

- Weekly: Charts exhibiting worth actions for every week. Helpful for medium- to long-term buying and selling.

- Month-to-month: Charts exhibiting worth actions for every month. Superb for long-term buyers.

Selecting the suitable timeframe is dependent upon your funding horizon and buying and selling model. Quick-term merchants would possibly give attention to intraday or every day charts, whereas long-term buyers might desire weekly or month-to-month charts.

Key Chart Patterns: Figuring out Potential Turning Factors

Chart patterns are recurring formations that recommend potential future worth actions. Recognizing these patterns can improve your buying and selling selections. Some frequent patterns embrace:

-

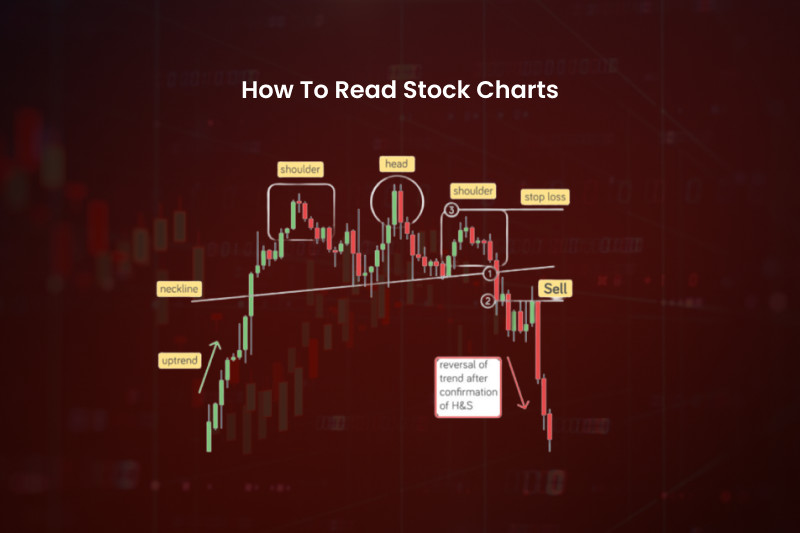

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the "head") being the best. A break beneath the neckline suggests a possible downward pattern.

-

Inverse Head and Shoulders: A bullish reversal sample, the mirror picture of the pinnacle and shoulders sample. A break above the neckline suggests a possible upward pattern.

-

Double Tops and Double Bottoms: These patterns point out potential pattern reversals. A double prime suggests a possible bearish reversal after the value fails to interrupt above a resistance stage twice, whereas a double backside suggests a possible bullish reversal after the value fails to interrupt beneath a help stage twice.

-

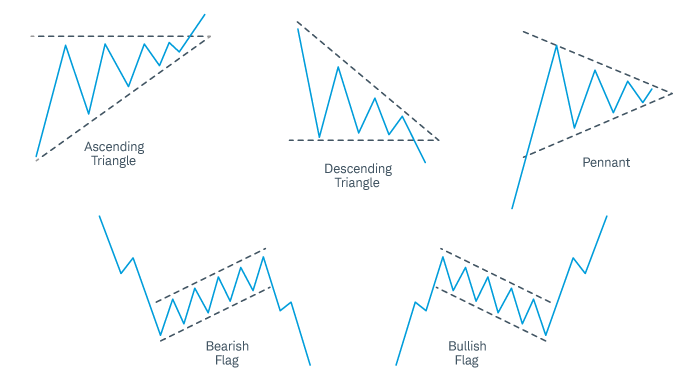

Triangles: These patterns symbolize durations of consolidation. Symmetrical triangles recommend a continuation of the prevailing pattern, whereas ascending triangles recommend a bullish breakout and descending triangles recommend a bearish breakout.

-

Flags and Pennants: These patterns symbolize non permanent pauses in a powerful pattern. Flags are characterised by an oblong sample, whereas pennants are characterised by a triangular sample. Breakouts from these patterns usually recommend a continuation of the underlying pattern.

It is essential to do not forget that chart patterns should not foolproof predictors. They need to be used together with different technical indicators and elementary evaluation to make knowledgeable selections.

Technical Indicators: Including Quantitative Insights

Whereas chart patterns supply visible clues, technical indicators present quantitative information to help your evaluation. Some generally used indicators embrace:

-

Shifting Averages (MA): These easy out worth fluctuations, revealing underlying developments. Generally used MAs embrace the 50-day and 200-day shifting averages. A "golden cross" (50-day MA crossing above the 200-day MA) is usually thought of a bullish sign, whereas a "loss of life cross" (50-day MA crossing beneath the 200-day MA) is usually thought of a bearish sign.

-

Relative Energy Index (RSI): This momentum indicator measures the magnitude of latest worth modifications to guage overbought or oversold circumstances. Readings above 70 are typically thought of overbought, suggesting a possible worth correction, whereas readings beneath 30 are typically thought of oversold, suggesting a possible worth rebound.

-

MACD (Shifting Common Convergence Divergence): This indicator compares two shifting averages to determine momentum modifications. A bullish sign is usually generated when the MACD line crosses above its sign line, whereas a bearish sign is usually generated when the MACD line crosses beneath its sign line.

-

Bollinger Bands: These bands plot normal deviations round a shifting common, exhibiting worth volatility. Costs touching the higher band might recommend an overbought situation, whereas costs touching the decrease band might recommend an oversold situation.

-

Quantity: Analyzing buying and selling quantity alongside worth motion can present useful insights. Excessive quantity throughout worth will increase confirms power, whereas excessive quantity throughout worth decreases confirms weak point. Low quantity throughout worth actions suggests weak conviction.

Combining Chart Studying with Basic Evaluation

Whereas technical evaluation by chart studying gives useful insights into market sentiment and potential worth actions, it should not be utilized in isolation. Basic evaluation, which includes analyzing an organization’s monetary statements, administration workforce, aggressive panorama, and business developments, offers essential context. A robust elementary outlook mixed with optimistic technical indicators considerably will increase the likelihood of profitable funding.

Danger Administration and Self-discipline

Chart studying, like several funding technique, carries inherent dangers. It is essential to implement strong threat administration methods, together with:

-

Place Sizing: By no means make investments greater than you’ll be able to afford to lose. Diversify your portfolio throughout a number of belongings to mitigate threat.

-

Cease-Loss Orders: Set stop-loss orders to restrict potential losses if the value strikes towards your place.

-

Take-Revenue Orders: Set take-profit orders to safe earnings when your funding objectives are met.

-

Emotional Self-discipline: Keep away from making impulsive selections based mostly on worry or greed. Stick with your buying and selling plan and keep away from chasing fast earnings.

Conclusion: A Steady Studying Course of

Mastering chart studying for inventory choice is a steady studying course of. It requires dedication, observe, and a willingness to adapt your methods based mostly on market circumstances. By combining chart studying with elementary evaluation, implementing strong threat administration methods, and sustaining emotional self-discipline, buyers can considerably improve their possibilities of success within the dynamic world of inventory buying and selling. Bear in mind to all the time conduct thorough analysis and take into account in search of recommendation from a professional monetary advisor earlier than making any funding selections. The knowledge offered on this article is for academic functions solely and doesn’t represent monetary recommendation.

Closure

Thus, we hope this text has offered useful insights into Decoding the Market: A Complete Information to Chart Studying for Inventory Choice. We thanks for taking the time to learn this text. See you in our subsequent article!