Decoding The Market: A Complete Information To Crypto Chart Patterns (Cheat Sheet Included)

Decoding the Market: A Complete Information to Crypto Chart Patterns (Cheat Sheet Included)

Associated Articles: Decoding the Market: A Complete Information to Crypto Chart Patterns (Cheat Sheet Included)

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Market: A Complete Information to Crypto Chart Patterns (Cheat Sheet Included). Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Crypto Chart Patterns (Cheat Sheet Included)

The cryptocurrency market, recognized for its volatility and speedy value swings, can appear to be a chaotic panorama to the uninitiated. Nevertheless, seasoned merchants leverage technical evaluation to navigate this turbulence, relying closely on chart patterns to foretell future value actions. Whereas no sample ensures success, understanding and recognizing these patterns considerably improves your buying and selling technique. This text serves as a complete information to frequent crypto chart patterns, accompanied by a downloadable cheat sheet for fast reference.

What are Chart Patterns?

Chart patterns are recurring formations on value charts that, traditionally, have been related to particular value actions. These formations are created by the interaction of provide and demand, reflecting the collective conduct of consumers and sellers. Recognizing these patterns permits merchants to anticipate potential breakouts, reversals, or continuations of developments. They don’t seem to be crystal balls; they supply chances, not certainties. Profitable implementation requires combining sample recognition with different types of technical evaluation, danger administration, and sound buying and selling psychology.

Classes of Chart Patterns:

Chart patterns are broadly categorized into two principal teams: continuation patterns and reversal patterns.

1. Continuation Patterns: These patterns recommend that the present development will seemingly proceed after a brief pause or consolidation.

-

Triangles: Triangles are characterised by converging trendlines, indicating a interval of indecision between consumers and sellers. There are three principal varieties:

- Symmetrical Triangle: Costs oscillate between two converging trendlines with no clear upward or downward bias. A breakout above the higher trendline suggests a continuation of the uptrend, whereas a break under the decrease trendline signifies a continuation of the downtrend.

- Ascending Triangle: The decrease trendline stays comparatively flat, whereas the higher trendline slopes upward. This sample sometimes suggests a bullish continuation, with a breakout above the higher trendline anticipated.

- Descending Triangle: The higher trendline stays comparatively flat, whereas the decrease trendline slopes downward. This sample sometimes suggests a bearish continuation, with a break under the decrease trendline anticipated.

-

Flags and Pennants: These patterns resemble flags or pennants connected to a flagpole, representing a short pause in a robust development.

- Flag: An oblong or barely sloped sample indicating a brief pause in a robust development. A breakout within the path of the previous development is anticipated.

- Pennant: A triangular sample, much like a flag however with converging trendlines, suggesting a continuation of the development after the consolidation.

-

Rectangles: These patterns present a interval of consolidation inside a horizontal vary, bounded by two parallel horizontal trendlines. A breakout above the higher trendline suggests a continuation of the uptrend, whereas a break under the decrease trendline signifies a continuation of the downtrend.

2. Reversal Patterns: These patterns recommend a possible change within the path of the prevailing development.

-

Head and Shoulders: This basic reversal sample consists of three peaks, with the center peak (the "head") being considerably greater than the 2 outer peaks ("shoulders"). A break under the neckline (a trendline connecting the lows of the shoulders) alerts a possible bearish reversal. The inverse, a "Head and Shoulders Inverse," alerts a possible bullish reversal.

-

Double Tops and Double Bottoms: These patterns present two related peaks (double high) or troughs (double backside) at roughly the identical value stage. A break under the neckline of a double high suggests a bearish reversal, whereas a break above the neckline of a double backside suggests a bullish reversal.

-

Triple Tops and Triple Bottoms: Just like double tops and bottoms, however with three peaks or troughs, offering stronger affirmation of the potential reversal.

-

Rounding Bottoms and Rounding Tops: These patterns are characterised by a gradual, U-shaped curve. A rounding backside suggests a possible bullish reversal, whereas a rounding high suggests a possible bearish reversal.

Utilizing Chart Patterns Successfully:

Whereas recognizing chart patterns is essential, a number of elements improve their predictive energy:

-

Quantity Affirmation: A big enhance in buying and selling quantity throughout a breakout confirms the sample’s validity. Low quantity breakouts usually fail.

-

Help and Resistance Ranges: Chart patterns usually work together with help and resistance ranges, reinforcing their significance. Breakouts above resistance or under help are stronger alerts.

-

Indicators: Combining chart patterns with technical indicators (e.g., RSI, MACD, transferring averages) offers extra strong alerts.

-

Danger Administration: At all times use stop-loss orders to restrict potential losses and place sizing to handle danger successfully.

-

Context is Key: Take into account the broader market context, information occasions, and total sentiment when decoding chart patterns. A sample that works effectively in a bull market would possibly fail in a bear market.

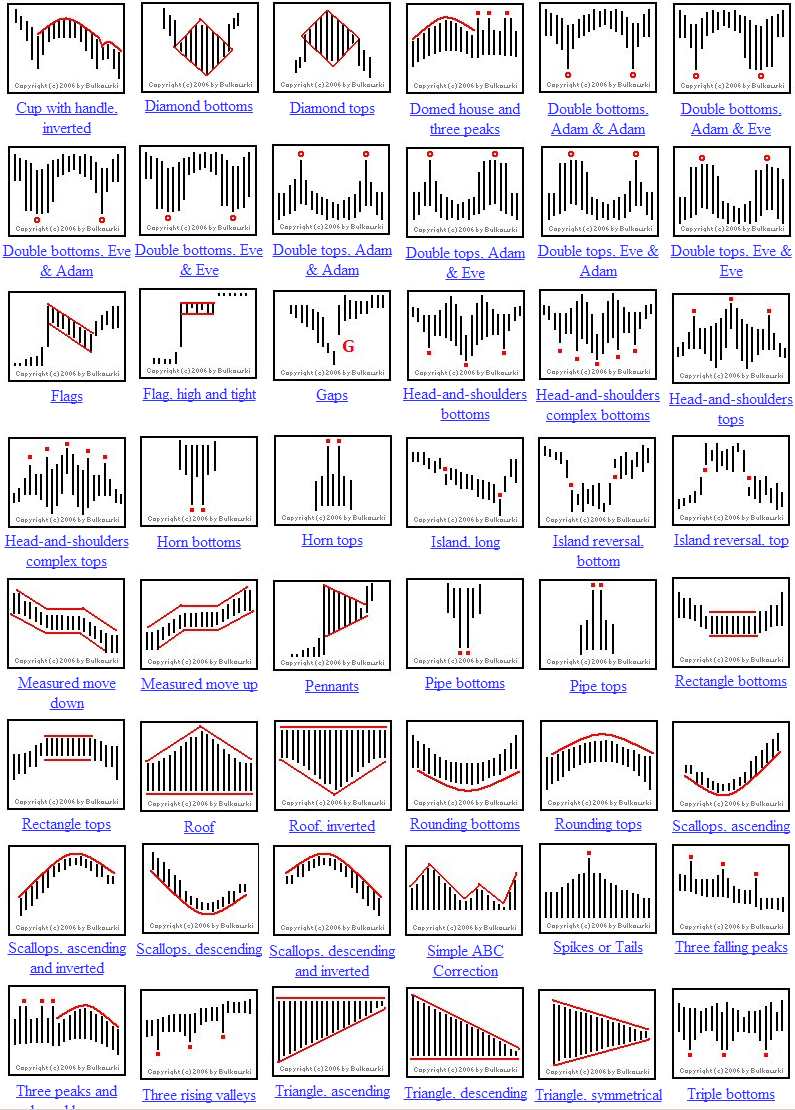

Downloadable Cheat Sheet:

[Here, you would include a link to a downloadable PDF cheat sheet summarizing the key characteristics of each chart pattern discussed above. The PDF should include clear illustrations of each pattern and a concise description of its implications.] The cheat sheet ought to be visually interesting and simply digestible, supreme for fast reference throughout buying and selling classes. It ought to embrace:

- Sample Title: (e.g., Head and Shoulders, Symmetrical Triangle)

- Picture: A transparent chart illustration of the sample.

- Description: A short rationalization of the sample’s formation and interpretation.

- Bullish/Bearish: Indication of whether or not the sample is often bullish or bearish.

- Affirmation Alerts: Key indicators to search for to substantiate the sample’s validity (e.g., quantity, breakout above/under resistance/help).

Conclusion:

Chart patterns are a worthwhile device in a dealer’s arsenal, offering insights into potential value actions. Nevertheless, they aren’t a foolproof methodology for predicting the long run. Profitable utilization requires a mix of sample recognition, technical evaluation, danger administration, and a radical understanding of market dynamics. By combining the data gained from this text and the offered cheat sheet with disciplined buying and selling practices, you’ll be able to considerably enhance your skill to navigate the complexities of the cryptocurrency market. Keep in mind, steady studying and adaptation are key to success on this dynamic surroundings. At all times observe accountable buying and selling and by no means make investments greater than you’ll be able to afford to lose.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Market: A Complete Information to Crypto Chart Patterns (Cheat Sheet Included). We thanks for taking the time to learn this text. See you in our subsequent article!