Decoding The Market: A Deep Dive Into Brooks’ Encyclopedia Of Chart Patterns

Decoding the Market: A Deep Dive into Brooks’ Encyclopedia of Chart Patterns

Associated Articles: Decoding the Market: A Deep Dive into Brooks’ Encyclopedia of Chart Patterns

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Market: A Deep Dive into Brooks’ Encyclopedia of Chart Patterns. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Market: A Deep Dive into Brooks’ Encyclopedia of Chart Patterns

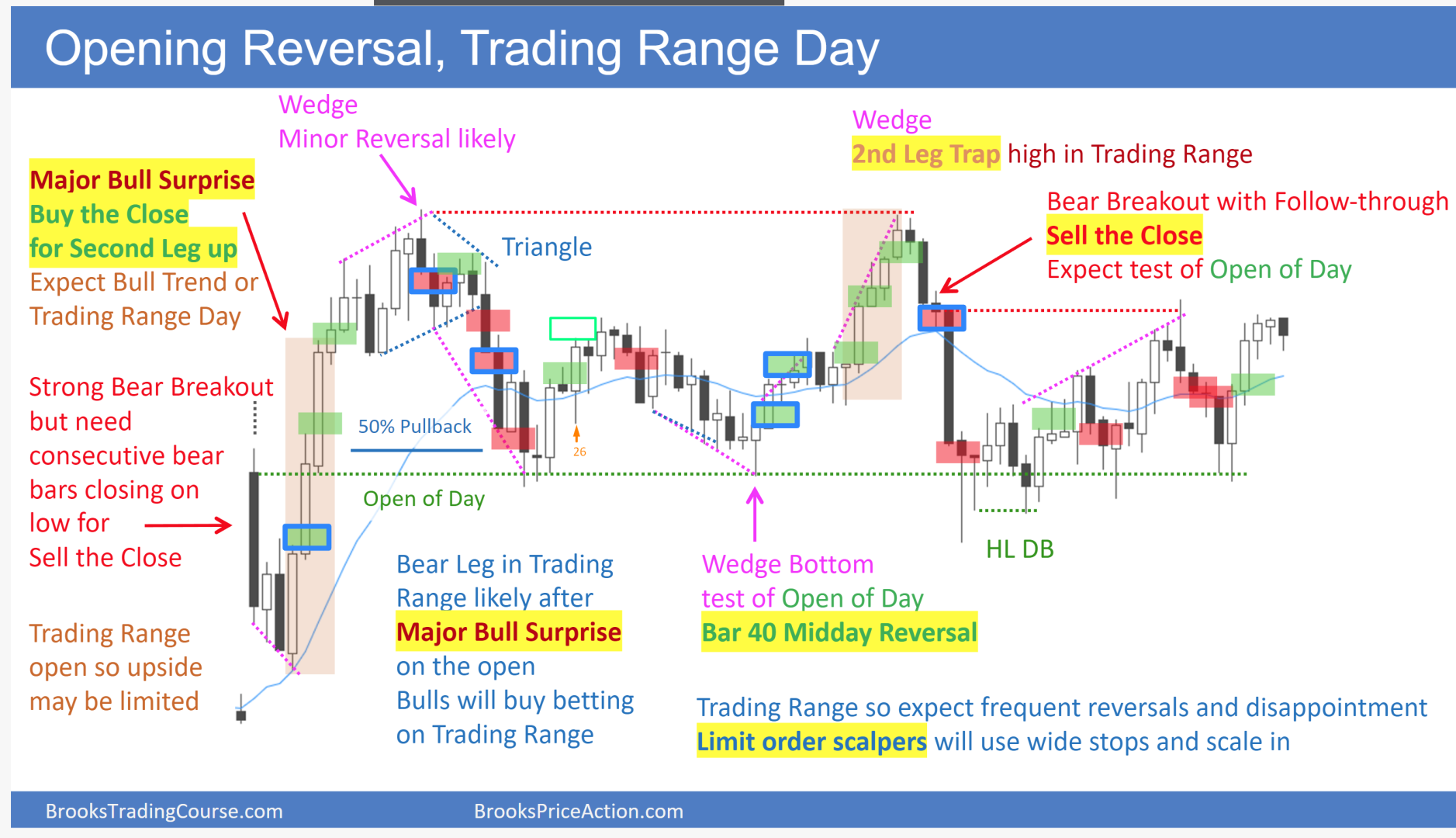

Technical evaluation, the artwork of decoding value charts to foretell future market actions, depends closely on figuring out recurring patterns. These patterns, typically visually recognizable on value charts, counsel potential shifts in momentum, help, and resistance ranges. Brooks’ Encyclopedia of Chart Patterns, a seminal work within the area, gives a complete information to understanding and making use of these patterns to buying and selling methods. Whereas the e book itself is a treasure trove of knowledge, this text goals to delve into its key contributions, exploring the core ideas and the sensible functions of the assorted chart patterns meticulously documented inside its pages.

The Basis: Understanding Chart Sample Evaluation

Brooks’ encyclopedia does not simply record chart patterns; it establishes a framework for understanding their context and significance. The e book emphasizes the significance of contemplating the broader market atmosphere, the particular instrument being analyzed (shares, indices, currencies, and many others.), and the timeframe of the chart. A sample that is bullish in a robust uptrend is perhaps bearish in a downtrend. This contextual consciousness is essential for correct interpretation and avoids misinterpretations resulting in flawed buying and selling selections.

The encyclopedia meticulously categorizes chart patterns into a number of key teams:

-

Continuation Patterns: These patterns counsel that the present pattern will seemingly proceed after a short lived pause or consolidation. Examples embody triangles (symmetrical, ascending, descending), flags, pennants, and rectangles. These patterns are sometimes characterised by a interval of sideways value motion earlier than a breakout within the path of the prevailing pattern.

-

Reversal Patterns: These patterns sign a possible shift within the prevailing pattern, indicating a potential change from uptrend to downtrend or vice versa. Head and shoulders (each inverse and common), double tops and bottoms, and triple tops and bottoms are distinguished examples. These patterns typically contain a transparent value motion that implies exhaustion of the present pattern.

-

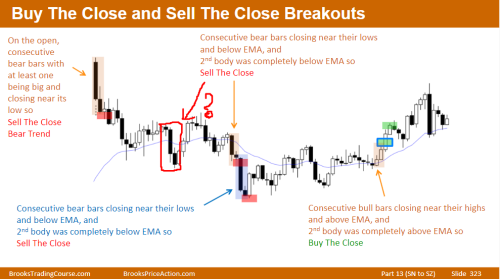

Breakout Patterns: These patterns determine moments the place the value breaks out of an outlined vary or sample, suggesting a robust directional transfer. Examples embody ascending and descending triangles, rectangles, and wedges. The quantity accompanying the breakout is commonly an important consider confirming the validity of the sign.

Key Patterns Detailed in Brooks’ Encyclopedia:

The encyclopedia dedicates vital area to detailed explanations and illustrations of quite a few chart patterns. Among the mostly mentioned and broadly used patterns embody:

-

Head and Shoulders: This basic reversal sample consists of three peaks, with the center peak (the "head") being considerably greater than the opposite two ("shoulders"). A neckline connects the troughs between the peaks. A break under the neckline confirms the bearish reversal. The inverse head and shoulders sample alerts a bullish reversal.

-

Double Tops and Bottoms: These patterns contain two related value peaks (double high) or troughs (double backside) adopted by a break by a help or resistance degree. Double tops point out potential bearish reversals, whereas double bottoms counsel bullish reversals. The gap between the peaks or troughs, and the next breakout, are essential elements in figuring out the potential value motion.

-

Triangles: Triangles are continuation patterns characterised by converging trendlines. Symmetrical triangles typically result in breakouts in both path, whereas ascending triangles counsel bullish continuations, and descending triangles counsel bearish continuations. The quantity conduct in the course of the triangle formation and the breakout is a key indicator.

-

Flags and Pennants: These are continuation patterns characterised by brief durations of consolidation inside a robust pattern. Flags exhibit a roughly parallel channel, whereas pennants are characterised by a converging triangular form. Breakouts from these patterns often affirm the continuation of the prevailing pattern.

-

Rectangles: Rectangles signify durations of consolidation the place the value oscillates between horizontal help and resistance ranges. Breakouts above the resistance counsel bullish continuations, whereas breakouts under the help counsel bearish continuations.

Past Sample Recognition: Context and Affirmation

Brooks’ Encyclopedia of Chart Patterns emphasizes that sample recognition is just one piece of the puzzle. The e book stresses the significance of mixing chart sample evaluation with different types of technical evaluation, akin to:

-

Quantity Evaluation: Excessive quantity throughout breakouts confirms the power of the transfer, whereas low quantity suggests weak conviction. Analyzing quantity in relation to cost motion gives essential context for decoding patterns.

-

Indicator Evaluation: Combining chart patterns with indicators like transferring averages, RSI, MACD, and Bollinger Bands can improve the accuracy of buying and selling alerts. These indicators can present affirmation or divergence, providing additional insights into potential market actions.

-

Fibonacci Retracements: These instruments can assist determine potential help and resistance ranges inside a pattern, offering context for decoding breakouts and reversals.

-

Help and Resistance Ranges: Figuring out key help and resistance ranges based mostly on earlier value motion can assist decide the importance of a sample’s breakout.

Sensible Functions and Threat Administration

The last word aim of utilizing chart patterns is to enhance buying and selling selections. Brooks’ encyclopedia gives steerage on the way to use recognized patterns to develop efficient buying and selling methods, together with:

-

Entry and Exit Methods: Defining exact entry and exit factors based mostly on sample breakouts and help/resistance ranges is essential for maximizing income and minimizing losses.

-

Cease-Loss Orders: Defending capital by stop-loss orders is important. The encyclopedia emphasizes the significance of putting stop-loss orders strategically to reduce potential losses.

-

Threat-Reward Ratios: Evaluating the potential reward relative to the danger is essential for accountable buying and selling. Brooks emphasizes the significance of solely getting into trades with favorable risk-reward ratios.

Conclusion:

Brooks’ Encyclopedia of Chart Patterns is greater than only a catalog of chart formations; it is a complete information to understanding and making use of this highly effective device inside a broader technical evaluation framework. By emphasizing the significance of context, affirmation, and danger administration, the e book equips merchants with the data and abilities crucial to make use of chart patterns successfully to enhance their buying and selling efficiency. Nonetheless, it is essential to do not forget that chart patterns aren’t foolproof predictors of future market actions. They need to be used at the side of different types of evaluation and sound danger administration methods to make knowledgeable buying and selling selections. The e book serves as a useful useful resource for each novice and skilled merchants in search of to reinforce their understanding and utility of technical evaluation.

Closure

Thus, we hope this text has offered useful insights into Decoding the Market: A Deep Dive into Brooks’ Encyclopedia of Chart Patterns. We admire your consideration to our article. See you in our subsequent article!