Decoding The Market’s Pulse: A Complete Information To Inventory Market Buying and selling Quantity Charts

Decoding the Market’s Pulse: A Complete Information to Inventory Market Buying and selling Quantity Charts

Associated Articles: Decoding the Market’s Pulse: A Complete Information to Inventory Market Buying and selling Quantity Charts

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Market’s Pulse: A Complete Information to Inventory Market Buying and selling Quantity Charts. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Market’s Pulse: A Complete Information to Inventory Market Buying and selling Quantity Charts

:max_bytes(150000):strip_icc()/dotdash_final_Price_by_Volume_Chart_PBV_Dec_2020-01-fa603cf762884966b3011aab59426e24.jpg)

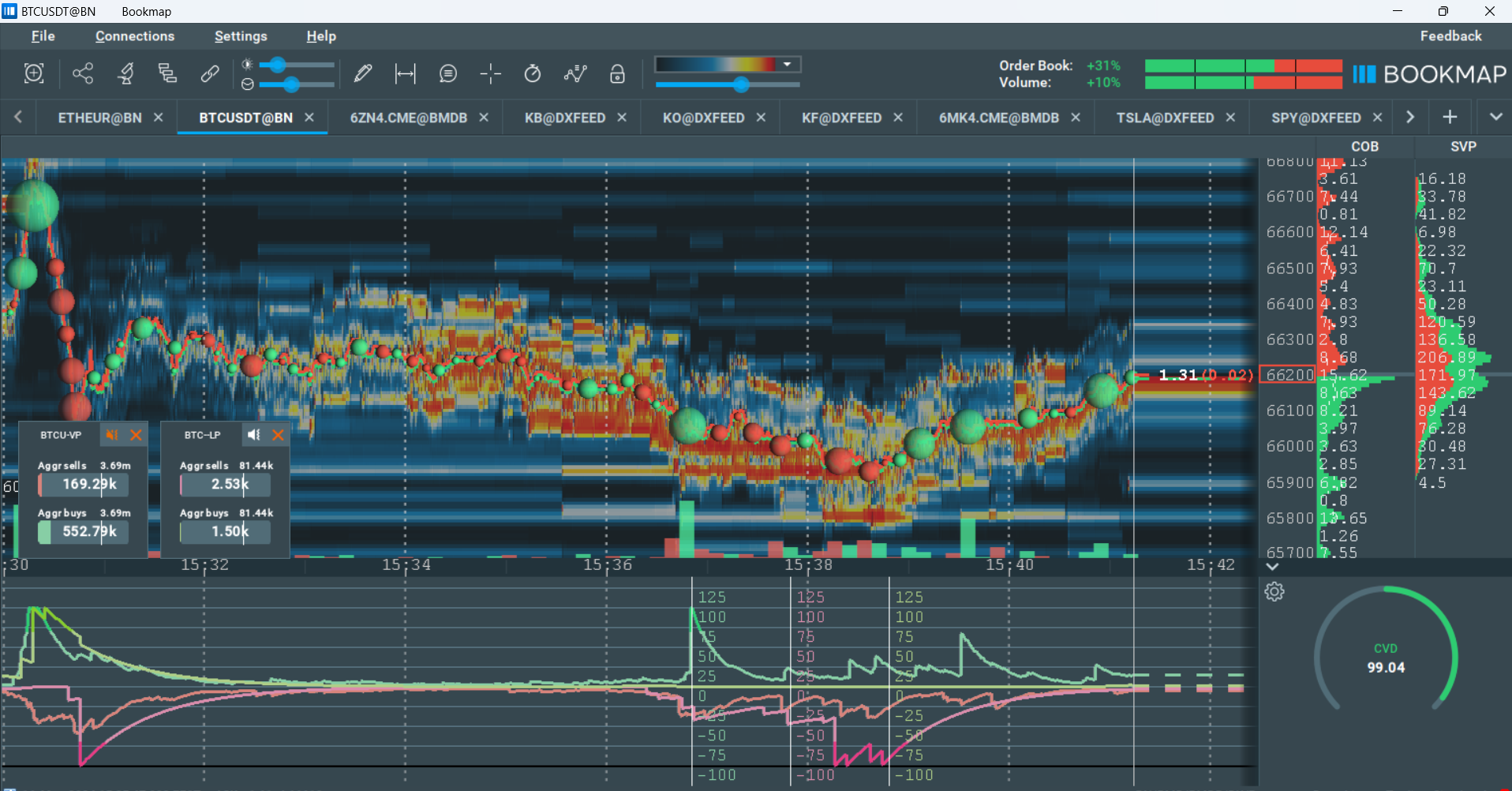

The inventory market is a posh ecosystem pushed by the collective actions of tens of millions of patrons and sellers. Whereas value charts present a visible illustration of asset worth fluctuations, they solely inform half the story. The opposite, equally essential, half is revealed by means of buying and selling quantity. Buying and selling quantity, merely put, represents the variety of shares or contracts traded inside a particular timeframe. Analyzing buying and selling quantity charts alongside value charts presents invaluable insights into market sentiment, development power, and potential reversals, empowering merchants to make extra knowledgeable choices. This text delves deep into the world of inventory market buying and selling quantity charts, exploring their interpretation, numerous chart varieties, and sensible functions.

Understanding the Significance of Buying and selling Quantity

Quantity acts as a affirmation indicator for value actions. A major value improve accompanied by excessive quantity suggests sturdy shopping for strain, indicating a doubtlessly sustainable uptrend. Conversely, a big value drop with excessive quantity signifies sturdy promoting strain, suggesting a doubtlessly lasting downtrend. Low quantity throughout a value motion, nonetheless, casts doubt on the sustainability of that development. A big value improve on low quantity is likely to be the results of a couple of giant institutional trades, and this value surge is likely to be simply reversed as soon as these positions are liquidated.

The interaction between value and quantity reveals the market’s conviction. Excessive quantity confirms the value motion, whereas low quantity suggests an absence of conviction and potential weak spot. This dynamic is essential for figuring out breakouts, figuring out potential exhaustion factors in a development, and anticipating reversals.

Kinds of Buying and selling Quantity Charts

A number of chart varieties can show buying and selling quantity knowledge, every providing a singular perspective:

-

Bar Charts: These are the most typical strategy to show quantity. Every bar represents the buying and selling quantity for a particular interval (e.g., day by day, hourly, and so on.). The peak of the bar corresponds to the amount traded. This easy illustration permits for fast visible comparisons of quantity throughout completely different durations.

-

Candlestick Charts with Quantity: Combining candlestick charts with quantity supplies a robust visible instrument. The candlestick chart reveals the open, excessive, low, and shut costs, whereas the amount bar under every candlestick supplies context for the value motion. This mixture permits for a holistic evaluation of each value motion and quantity.

-

Line Charts: Whereas much less widespread for quantity, line charts also can symbolize quantity knowledge. A line connects the amount knowledge factors, offering a easy visible illustration of quantity traits over time. That is helpful for figuring out long-term quantity patterns.

-

Level & Determine Charts: Whereas in a roundabout way displaying quantity, Level & Determine charts not directly mirror quantity by means of the dimensions and frequency of bins. A bigger field signifies a extra vital value motion, usually correlating with increased quantity.

Deciphering Buying and selling Quantity Charts: Key Strategies

Efficient interpretation of quantity charts requires understanding a number of key methods:

-

Quantity Affirmation: Excessive quantity accompanying a value improve confirms the power of the uptrend, whereas excessive quantity accompanying a value lower confirms the power of the downtrend. Low quantity throughout a value motion suggests weak conviction and a possible reversal.

-

Quantity Divergence: This happens when value makes a brand new excessive (or low), however quantity fails to substantiate the transfer. For instance, if the value makes a better excessive, however the quantity accompanying this new excessive is decrease than the amount of a earlier excessive, it suggests weakening shopping for strain and a possible bearish divergence. This usually precedes a value reversal.

-

Quantity Spikes: Sudden, dramatic will increase in quantity usually sign vital information or occasions affecting the asset. These spikes can point out breakouts, breakdowns, or vital shifts in market sentiment. Analyzing the context of the spike is essential to know its implications.

-

On-Steadiness Quantity (OBV): This can be a cumulative quantity indicator that provides quantity on up days and subtracts quantity on down days. It helps establish traits in shopping for and promoting strain over time. Divergences between OBV and value may be sturdy indicators of potential reversals.

-

Accumulation/Distribution: This indicator makes use of quantity and value adjustments to establish durations of accumulation (shopping for strain) and distribution (promoting strain). It may assist establish potential assist and resistance ranges.

-

Figuring out Help and Resistance with Quantity: Excessive quantity at assist and resistance ranges confirms their significance. A breakout by means of a assist or resistance stage with excessive quantity signifies a stronger development continuation. Conversely, a failure to interrupt by means of a stage with excessive quantity suggests the extent’s power.

Sensible Functions of Quantity Evaluation

Quantity evaluation supplies a number of sensible functions for merchants:

-

Pattern Affirmation: Excessive quantity confirms a development’s power, whereas low quantity suggests weak spot and potential reversal.

-

Figuring out Breakouts and Breakdowns: Excessive quantity accompanying a breakout or breakdown suggests a robust transfer is underway.

-

Recognizing Reversals: Quantity divergence, low quantity throughout value actions, and different quantity patterns can sign potential reversals.

-

Evaluating Help and Resistance: Excessive quantity at assist and resistance ranges confirms their significance.

-

Enhancing Threat Administration: Understanding quantity may also help merchants establish doubtlessly weak traits and handle their danger accordingly.

-

Figuring out Potential Buying and selling Alternatives: Combining quantity evaluation with different technical indicators may also help merchants establish high-probability buying and selling setups.

Limitations of Quantity Evaluation

Whereas quantity evaluation is a robust instrument, it is important to acknowledge its limitations:

-

Quantity is a lagging indicator: Quantity displays previous exercise, not future value actions.

-

Interpretation may be subjective: Totally different merchants might interpret quantity patterns in another way.

-

Market manipulation can distort quantity: Synthetic quantity spikes can happen because of wash buying and selling or different manipulative actions.

-

Totally different timeframes yield completely different insights: The interpretation of quantity can range relying on the timeframe used (day by day, weekly, month-to-month).

Conclusion:

Buying and selling quantity charts are an indispensable instrument for any severe inventory market dealer. By understanding the interaction between value and quantity, merchants can achieve deeper insights into market sentiment, development power, and potential reversals. Whereas quantity evaluation is just not a standalone technique, incorporating it right into a broader buying and selling strategy can considerably enhance decision-making, danger administration, and general buying and selling efficiency. Nevertheless, keep in mind to mix quantity evaluation with different technical and elementary indicators for a extra complete and sturdy buying and selling technique. Steady studying and apply are essential to mastering the artwork of decoding buying and selling quantity charts and harnessing their energy to attain constant buying and selling success. Bear in mind, understanding the context of quantity inside the broader market setting is simply as essential as understanding the amount itself. Keep knowledgeable, keep disciplined, and at all times handle your danger successfully.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the Market’s Pulse: A Complete Information to Inventory Market Buying and selling Quantity Charts. We thanks for taking the time to learn this text. See you in our subsequent article!