Decoding The Market’s Story: A Complete Information To Foreign exchange Candlestick Charts

Decoding the Market’s Story: A Complete Information to Foreign exchange Candlestick Charts

Associated Articles: Decoding the Market’s Story: A Complete Information to Foreign exchange Candlestick Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Market’s Story: A Complete Information to Foreign exchange Candlestick Charts. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Market’s Story: A Complete Information to Foreign exchange Candlestick Charts

The international change (foreign exchange) market, a colossal enviornment of world forex buying and selling, operates with a frenetic power. Understanding its ebb and stream requires refined instruments, and among the many strongest is the candlestick chart. Greater than only a visible illustration of value fluctuations, candlestick charts inform a compelling story of market sentiment, momentum, and potential future value actions. This text will delve deep into the world of foreign exchange candlestick charts, exploring their building, interpretation, and sensible utility in buying and selling methods.

Understanding the Anatomy of a Candlestick:

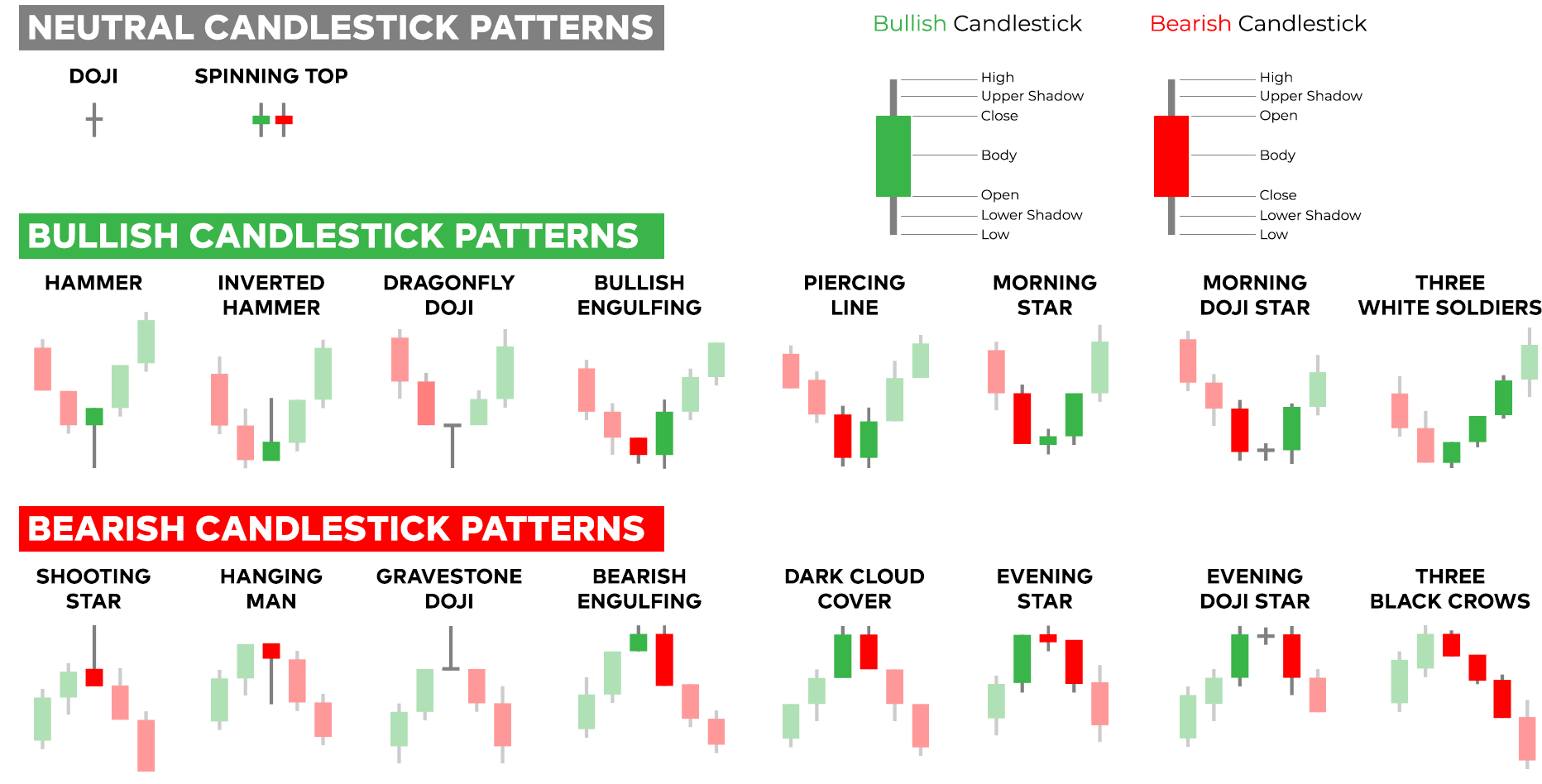

Every candlestick on a chart represents a selected time interval, sometimes starting from one minute to in the future, and even one week or month. The candlestick itself consists of a number of key components:

-

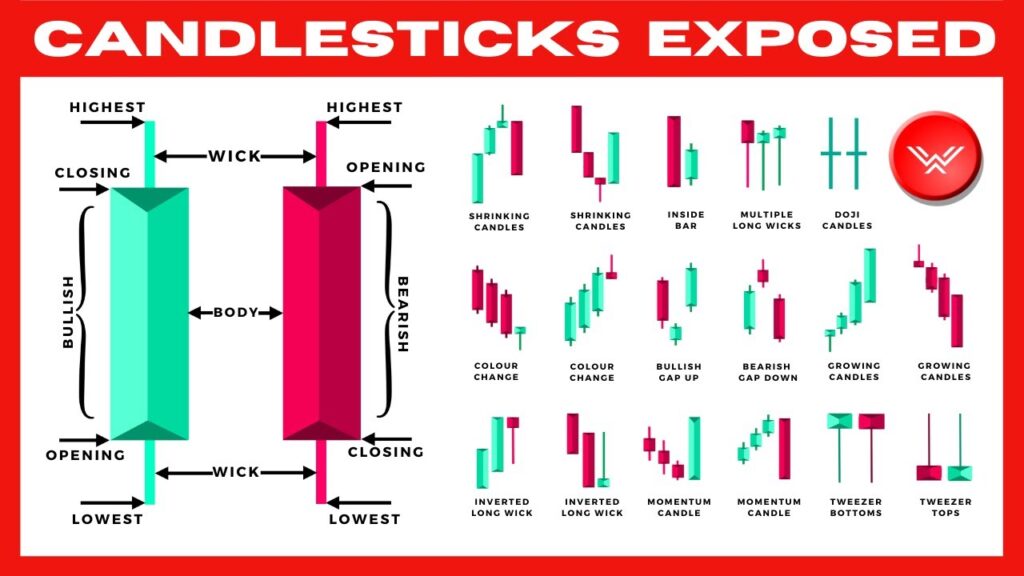

The Physique (Actual Physique): That is the oblong a part of the candlestick, representing the distinction between the opening and shutting costs of the interval. A hole (white or inexperienced) physique signifies a closing value increased than the opening value (a bullish candle), whereas a crammed (black or purple) physique signifies a closing value decrease than the opening value (a bearish candle). The size of the physique displays the magnitude of the worth change throughout that interval.

-

The Wicks (Shadows or Tails): These are the vertical traces extending above and beneath the physique. The higher wick (shadow) reveals the best value reached in the course of the interval, whereas the decrease wick reveals the bottom value. Lengthy wicks recommend important value rejection at these ranges, hinting at potential assist or resistance.

Deciphering Candlestick Patterns:

The ability of candlestick charts lies of their skill to disclose patterns that recommend potential future value actions. These patterns are shaped by the mix of particular person candlesticks, offering merchants with precious insights into market sentiment and momentum. A number of the commonest and extensively used patterns embrace:

-

Doji: This candlestick has a really small or non-existent physique, with the opening and shutting costs being just about equivalent. It alerts indecision or a steadiness between consumers and sellers, usually previous a big value transfer in both route. Several types of Doji exist, such because the Dragonfly Doji (lengthy decrease wick, small higher wick), Headstone Doji (lengthy higher wick, small decrease wick), and Lengthy-legged Doji (lengthy higher and decrease wicks).

-

Hammer and Hanging Man: These are single-candlestick reversal patterns. A hammer is a bullish reversal sample characterised by a small physique close to the highest of the candlestick and an extended decrease wick, suggesting consumers stepped in to push the worth up after a decline. Conversely, a dangling man is a bearish reversal sample with a small physique close to the highest and an extended decrease wick, indicating a possible reversal after an upward pattern. The important thing distinction lies within the context; a hammer seems on the backside of a downtrend, whereas a dangling man seems on the prime of an uptrend.

-

Engulfing Sample: This sample consists of two candlesticks. A bullish engulfing sample happens when a big bullish candle fully engulfs the earlier bearish candle, suggesting a possible reversal from a downtrend. A bearish engulfing sample is the other, with a big bearish candle engulfing the earlier bullish candle, indicating a possible reversal from an uptrend.

-

Piercing Sample and Darkish Cloud Cowl: These are two-candlestick patterns that sign potential reversals. A piercing sample is a bullish reversal sample, the place a small bearish candle is adopted by a big bullish candle that closes at the least midway up the physique of the earlier candle. A darkish cloud cowl is a bearish reversal sample, the place a big bullish candle is adopted by a bearish candle that opens above the excessive of the earlier candle and closes at the least midway down the physique of the earlier candle.

-

Morning Star and Night Star: These are three-candlestick reversal patterns. A morning star is a bullish reversal sample that seems on the backside of a downtrend, consisting of a bearish candle, a small indecisive candle (usually a Doji), and a bullish candle that gaps up from the earlier candle. A night star is a bearish reversal sample that seems on the prime of an uptrend, with a bullish candle adopted by a small indecisive candle and a bearish candle that gaps down from the earlier candle.

-

Three White Troopers and Three Black Crows: These are three-candlestick patterns that point out robust traits. Three white troopers is a bullish sample characterised by three consecutive bullish candles with every candle’s open being above the earlier candle’s shut. Three black crows is a bearish sample with three consecutive bearish candles, every opening beneath the earlier candle’s shut.

Combining Candlestick Patterns with Different Technical Indicators:

Whereas candlestick patterns present precious insights, they’re simplest when used along with different technical indicators. Combining candlestick patterns with indicators like transferring averages, Relative Power Index (RSI), MACD, and Bollinger Bands can considerably improve the accuracy of buying and selling alerts. For instance, figuring out a bullish engulfing sample close to a assist degree, confirmed by a bullish crossover of transferring averages and an RSI studying beneath 30, may recommend a high-probability lengthy entry.

Limitations of Candlestick Evaluation:

It is essential to know that candlestick evaluation isn’t foolproof. False alerts can happen, and relying solely on candlestick patterns might be dangerous. A number of elements can contribute to false alerts, together with:

- Market Noise: Quick-term fluctuations can create deceptive patterns.

- Context is Essential: The interpretation of a sample relies upon closely on the broader market context and pattern.

- Affirmation is Key: It is vital to verify candlestick alerts with different technical indicators and basic evaluation.

Sensible Utility in Foreign exchange Buying and selling:

Candlestick charts are a precious software for foreign exchange merchants of all ranges. They can be utilized to:

- Establish potential entry and exit factors: By recognizing patterns and understanding market sentiment, merchants can establish opportune moments to enter and exit trades.

- Handle danger: Understanding candlestick patterns can assist merchants set applicable stop-loss and take-profit ranges.

- Develop buying and selling methods: Candlestick evaluation kinds the premise of many profitable buying and selling methods.

Conclusion:

Foreign exchange candlestick charts provide a strong visible language for decoding market dynamics. By understanding the anatomy of candlesticks, recognizing frequent patterns, and mixing candlestick evaluation with different technical indicators, foreign exchange merchants can considerably enhance their decision-making course of and improve their buying and selling efficiency. Nonetheless, it’s important to do not forget that candlestick evaluation is a software, not a crystal ball. Steady studying, disciplined danger administration, and a holistic method incorporating basic evaluation are very important for fulfillment within the foreign exchange market. Constant apply and a deep understanding of market habits will enable merchants to harness the ability of candlestick charts and navigate the complexities of the foreign exchange world with larger confidence and talent.

Closure

Thus, we hope this text has supplied precious insights into Decoding the Market’s Story: A Complete Information to Foreign exchange Candlestick Charts. We thanks for taking the time to learn this text. See you in our subsequent article!