Decoding The MassMutual 401(okay) Chart: A Complete Information For Members

Decoding the MassMutual 401(okay) Chart: A Complete Information for Members

Associated Articles: Decoding the MassMutual 401(okay) Chart: A Complete Information for Members

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the MassMutual 401(okay) Chart: A Complete Information for Members. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the MassMutual 401(okay) Chart: A Complete Information for Members

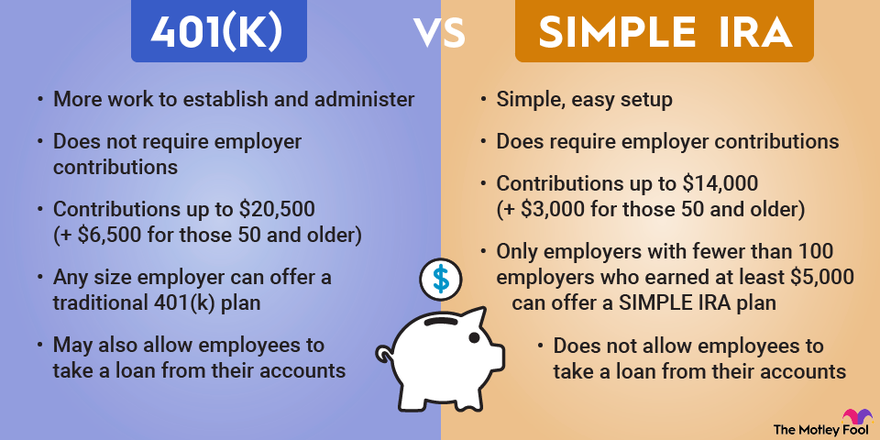

MassMutual, a famend monetary providers firm, gives 401(okay) plans to quite a few employers, offering an important software for workers to construct their retirement financial savings. Understanding the intricacies of your MassMutual 401(okay) plan, notably deciphering the funding choices introduced, is paramount to reaching your retirement objectives. This text goals to offer a complete information to navigating your MassMutual 401(okay) chart, explaining the completely different funding decisions, charges, and techniques for maximizing your returns.

Understanding the MassMutual 401(okay) Chart Construction:

The particular construction of your MassMutual 401(okay) chart will range relying in your employer’s plan design. Nevertheless, most charts will typically embrace the next data:

- Funding Choices: A listing of accessible mutual funds, index funds, and probably different funding automobiles like target-date funds or managed accounts. Every possibility could have a singular ticker image or fund identify.

- Fund Descriptions: Transient summaries of every funding possibility, highlighting the funding technique (e.g., large-cap progress, worldwide bonds), expense ratio, and historic efficiency knowledge.

- Expense Ratios: The annual charges charged to handle every funding possibility. Decrease expense ratios typically translate to larger returns over time.

- Asset Allocation: Info on the underlying belongings of every fund (e.g., shares, bonds, actual property). This helps you perceive the chance profile of every funding.

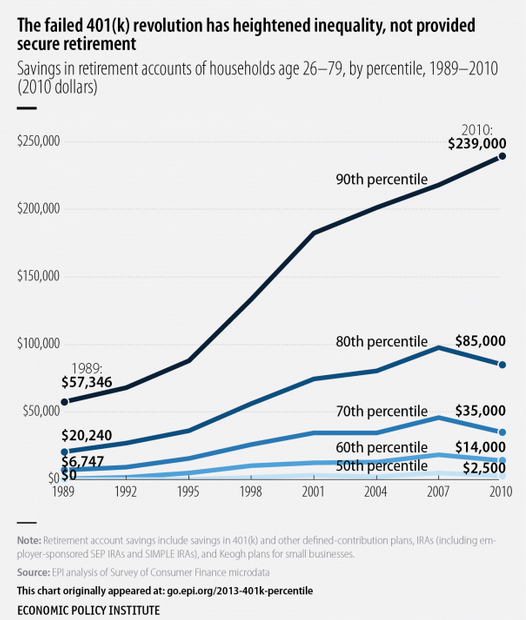

- Efficiency Information: Historic efficiency figures, normally introduced as year-to-date, 1-year, 3-year, 5-year, and 10-year returns. It’s essential to keep in mind that previous efficiency is just not indicative of future outcomes.

- Fund Supervisor Info: Particulars concerning the funding administration firm liable for every fund.

Deciphering the Funding Choices:

MassMutual 401(okay) plans sometimes supply a various vary of funding choices categorized by asset class and threat degree. Widespread classes embrace:

-

Shares (Equities): These signify possession in firms. Subcategories embrace:

- Massive-Cap Shares: Investments in massive, established firms. Typically thought-about much less unstable than smaller firms.

- Mid-Cap Shares: Investments in medium-sized firms, providing a steadiness between progress potential and stability.

- Small-Cap Shares: Investments in smaller firms, providing larger progress potential but additionally larger threat.

- Worldwide Shares: Investments in firms outdoors america, providing diversification and publicity to world markets.

-

Bonds (Mounted Earnings): These signify loans to governments or firms. They typically supply decrease returns than shares however are much less unstable. Subcategories embrace:

- Authorities Bonds: Bonds issued by authorities entities, thought-about comparatively low-risk.

- Company Bonds: Bonds issued by firms, providing larger yields however probably larger threat.

-

Goal-Date Funds: These funds routinely modify their asset allocation primarily based in your goal retirement date, turning into extra conservative as you strategy retirement. They provide a simplified strategy to investing.

-

Index Funds: These funds observe a particular market index (e.g., S&P 500), offering broad market publicity at low value.

-

Managed Accounts: These are professionally managed portfolios tailor-made to your particular person threat tolerance and monetary objectives. They sometimes include larger charges.

Analyzing Expense Ratios and Charges:

Expense ratios are an important issue to think about when deciding on investments. They signify the annual value of managing the fund, expressed as a proportion of belongings beneath administration. Even small variations in expense ratios can considerably impression your long-term returns. At all times evaluate the expense ratios of various funds earlier than making a call. Moreover, pay attention to any administrative charges charged by MassMutual or your employer for managing the 401(okay) plan itself.

Creating an Efficient Funding Technique:

Making a well-diversified funding portfolio is vital to maximizing your retirement financial savings. This entails spreading your investments throughout completely different asset lessons to cut back threat and probably improve returns. Contemplate these elements:

- Threat Tolerance: Assess your consolation degree with market fluctuations. Youthful buyers can typically tolerate extra threat, whereas these nearer to retirement ought to prioritize capital preservation.

- Time Horizon: The longer your time horizon, the extra threat you’ll be able to typically afford to take. Youthful buyers have extra time to get better from market downturns.

- Monetary Objectives: Decide how a lot it’s worthwhile to save for retirement and modify your funding technique accordingly.

- Asset Allocation: Allocate your investments throughout completely different asset lessons primarily based in your threat tolerance, time horizon, and monetary objectives. A standard strategy is to make use of a target-date fund, which simplifies this course of. Alternatively, you’ll be able to create a customized portfolio utilizing a mixture of shares and bonds.

Using MassMutual Assets:

MassMutual typically gives assets to assist members perceive and handle their 401(okay) plans. These assets could embrace:

- On-line Account Entry: Gives entry to your account steadiness, transaction historical past, and funding efficiency knowledge.

- Instructional Supplies: Gives data on investing, retirement planning, and different associated subjects.

- Monetary Advisors: Some plans supply entry to monetary advisors who can present customized steerage.

Vital Concerns:

- Diversification: Do not put all of your eggs in a single basket. Diversify your investments throughout completely different asset lessons to cut back threat.

- Common Contributions: Make common contributions to your 401(okay) plan, even when it is a small quantity. The facility of compounding over time is important.

- Employer Matching: Take full benefit of any employer matching contributions. That is primarily free cash.

- Rebalancing: Periodically rebalance your portfolio to take care of your required asset allocation.

- Charges: Pay shut consideration to expense ratios and different charges. Excessive charges can considerably erode your returns.

Conclusion:

Understanding your MassMutual 401(okay) chart and the funding choices it gives is essential for constructing a safe retirement. By fastidiously contemplating your threat tolerance, time horizon, and monetary objectives, and by using the assets offered by MassMutual, you’ll be able to create a well-diversified funding technique that helps you obtain your retirement aims. Keep in mind to seek the advice of with a professional monetary advisor when you want customized steerage. This text gives common data and shouldn’t be thought-about monetary recommendation. At all times conduct thorough analysis and search skilled recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has offered useful insights into Decoding the MassMutual 401(okay) Chart: A Complete Information for Members. We thanks for taking the time to learn this text. See you in our subsequent article!