Decoding The Nifty Chart On TradingView: A Complete Information

Decoding the Nifty Chart on TradingView: A Complete Information

Associated Articles: Decoding the Nifty Chart on TradingView: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Nifty Chart on TradingView: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Nifty Chart on TradingView: A Complete Information

The Nifty 50 index, a benchmark for Indian equities, is a dynamic beast, consistently reacting to international occasions, home insurance policies, and investor sentiment. Understanding its actions is essential for anybody concerned within the Indian inventory market, and TradingView supplies a strong platform to investigate this complicated instrument. This text delves deep into using TradingView’s options to successfully chart, analyze, and commerce the Nifty 50.

I. Navigating the Nifty Chart on TradingView:

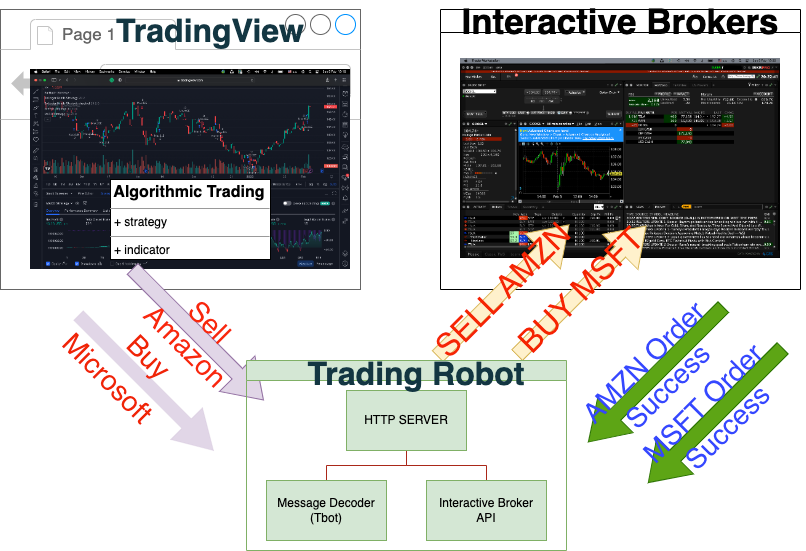

Step one is accessing the Nifty 50 chart on TradingView. Merely seek for "NIFTY 50" or its ticker image (often "^NSEI") within the search bar. You may be introduced with a candlestick chart, displaying the index’s worth actions over a selected timeframe. TradingView gives a plethora of customizable choices:

-

Timeframes: From intraday (1-minute, 5-minute, 15-minute, and so on.) to every day, weekly, and month-to-month charts, permitting you to investigate the Nifty’s efficiency throughout numerous time horizons. Understanding the nuances of every timeframe is essential. Intraday charts reveal short-term volatility, whereas longer-term charts spotlight underlying developments.

-

Chart Sorts: Past the usual candlestick chart, TradingView gives different chart sorts like line charts (less complicated illustration of worth), Heikin Ashi (smooths out worth fluctuations), and Renko charts (focuses on worth adjustments somewhat than time). Experimenting with totally different chart sorts can present distinctive insights.

-

Indicators: That is the place TradingView actually shines. An enormous library of technical indicators permits you to overlay numerous analytical instruments onto the chart. These indicators may help determine potential entry and exit factors, predict future worth actions (with warning!), and ensure present developments. Well-liked indicators for Nifty evaluation embrace:

-

Transferring Averages (MA): Easy Transferring Common (SMA), Exponential Transferring Common (EMA), and Weighted Transferring Common (WMA) are used to clean out worth knowledge and determine developments. Crossovers between totally different MAs can sign purchase or promote alerts. Generally used mixtures are 50-day SMA and 200-day SMA.

-

Relative Power Index (RSI): A momentum indicator that measures the magnitude of latest worth adjustments to judge overbought and oversold situations. RSI values above 70 are typically thought of overbought, whereas values beneath 30 recommend oversold situations.

-

MACD (Transferring Common Convergence Divergence): Tracks the connection between two transferring averages to determine momentum shifts and potential development reversals. MACD crossovers and divergences can present useful buying and selling alerts.

-

Bollinger Bands: Plot customary deviations round a transferring common, indicating worth volatility. Value bounces off the bands can sign potential reversals.

-

Quantity Indicators: On-Stability Quantity (OBV) and Chaikin Cash Movement (CMF) are used to investigate buying and selling quantity in relation to cost actions, offering insights into the power of a development.

-

II. Superior Charting Methods for Nifty Evaluation:

Past primary indicator utilization, TradingView empowers superior evaluation:

-

Drawing Instruments: Make the most of instruments like Fibonacci retracements, help and resistance traces, development traces, and channels to determine potential worth targets, reversal factors, and continuation patterns. These instruments assist visualize worth motion and ensure buying and selling alerts from indicators.

-

A number of Timeframe Evaluation: Concurrently viewing a number of timeframes (e.g., a every day chart alongside a 1-hour chart) permits for a complete understanding of the Nifty’s development throughout totally different time horizons. This helps verify alerts and keep away from whipsaws.

-

Backtesting: TradingView permits for backtesting methods utilizing its Pine Script editor. This allows you to simulate your buying and selling technique on historic Nifty knowledge to judge its efficiency earlier than risking actual capital. This can be a essential step in refining your strategy.

-

Alerting System: Arrange custom-made alerts based mostly on worth actions, indicator crossovers, or different situations. This lets you obtain notifications when particular buying and selling alternatives come up, even once you’re not actively monitoring the chart.

-

Pine Scripting: For skilled customers, TradingView’s Pine Script permits for the creation of customized indicators and methods. This gives unparalleled flexibility in tailoring your evaluation to your particular wants. This requires programming information however supplies immense energy.

III. Deciphering Nifty Chart Patterns:

Recognizing chart patterns is an important talent for profitable Nifty buying and selling. Some frequent patterns embrace:

-

Head and Shoulders: A reversal sample indicating a possible development change.

-

Double Tops/Bottoms: Much like head and shoulders, these patterns recommend potential development reversals.

-

Triangles: Consolidation patterns that always precede a breakout in both route.

-

Flags and Pennants: Continuation patterns suggesting a continuation of the prevailing development.

-

Cup and Deal with: A bullish continuation sample.

Understanding these patterns, along with technical indicators, can considerably enhance your buying and selling accuracy. Do not forget that no sample ensures future worth actions; they’re merely probabilistic indicators.

IV. Danger Administration and Buying and selling Psychology:

Even with essentially the most subtle evaluation, threat administration is paramount. By no means make investments greater than you may afford to lose. Make the most of stop-loss orders to restrict potential losses on every commerce. Place sizing is equally essential – decide the suitable quantity to spend money on every commerce based mostly in your threat tolerance and capital.

Buying and selling psychology performs a vital position. Keep away from emotional decision-making. Keep on with your buying and selling plan and keep away from chasing losses or letting worry dictate your trades. Commonly evaluation your buying and selling efficiency and regulate your technique accordingly.

V. Combining Elementary and Technical Evaluation:

Whereas this text focuses on technical evaluation utilizing TradingView, a holistic strategy incorporates basic evaluation. Understanding macroeconomic components (GDP progress, inflation, rates of interest), authorities insurance policies, and company-specific information can present useful context for deciphering Nifty’s worth actions. Technical evaluation helps determine entry and exit factors, whereas basic evaluation supplies a broader understanding of the underlying market forces.

VI. Conclusion:

TradingView supplies a strong toolkit for analyzing the Nifty 50 index. By mastering its options, from primary charting to superior scripting, merchants can acquire a major edge. Nonetheless, do not forget that technical evaluation just isn’t a crystal ball. It is a software to enhance your chances, not assure income. Mix technical evaluation with basic understanding, sound threat administration, and disciplined buying and selling psychology for the perfect possibilities of success within the dynamic world of Nifty buying and selling. Steady studying and adaptation are essential for navigating the ever-evolving market panorama. At all times do not forget that previous efficiency just isn’t indicative of future outcomes. Buying and selling includes inherent dangers, and losses are potential.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Nifty Chart on TradingView: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!