Decoding The Nifty Subsequent 50: A Deep Dive Into India’s Mid-Cap Powerhouse

Decoding the Nifty Subsequent 50: A Deep Dive into India’s Mid-Cap Powerhouse

Associated Articles: Decoding the Nifty Subsequent 50: A Deep Dive into India’s Mid-Cap Powerhouse

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Nifty Subsequent 50: A Deep Dive into India’s Mid-Cap Powerhouse. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the Nifty Subsequent 50: A Deep Dive into India’s Mid-Cap Powerhouse

The Nifty 50 index, a benchmark for Indian equities, typically captures the lion’s share of investor consideration. Nevertheless, beneath its floor lies a vibrant ecosystem of mid-cap firms, lots of which maintain important progress potential. That is the place the Nifty Subsequent 50 index comes into play, providing a compelling different and diversification alternative for traders searching for publicity to India’s burgeoning economic system. This text delves deep into the Nifty Subsequent 50 chart, exploring its composition, efficiency traits, historic tendencies, and implications for traders.

Understanding the Nifty Subsequent 50:

The Nifty Subsequent 50 index is a free-float market capitalization-weighted index comprising the 50 subsequent largest firms after the Nifty 50. This implies it represents the crème de la crème of India’s mid-cap section, firms which might be usually bigger and extra established than smaller-cap shares however nonetheless provide important progress potential in comparison with their large-cap counterparts. The index is meticulously constructed and usually rebalanced, guaranteeing it displays the evolving panorama of the Indian inventory market. This rebalancing course of entails a rigorous choice methodology that takes under consideration liquidity, market capitalization, and different related elements to take care of a sturdy and consultant index.

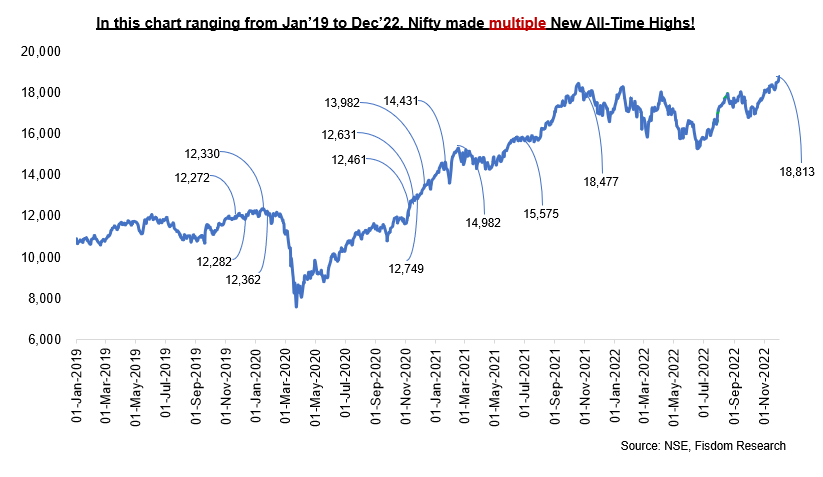

Analyzing the Nifty Subsequent 50 Chart:

Analyzing the Nifty Subsequent 50 chart requires a multifaceted strategy. Merely wanting on the value actions alone is inadequate. A complete evaluation should incorporate a number of key elements:

-

Value Tendencies: Inspecting the long-term and short-term value tendencies helps establish potential help and resistance ranges. Figuring out tendencies utilizing transferring averages, trendlines, and different technical indicators can present useful insights into the index’s momentum and potential future route. As an illustration, a sustained upward development may sign bullish sentiment, whereas a protracted downtrend may point out bearish stress.

-

Quantity: Buying and selling quantity gives essential context to cost actions. Excessive quantity throughout value will increase suggests robust shopping for stress, confirming the upward development. Conversely, excessive quantity throughout value declines signifies important promoting stress, doubtlessly signaling a stronger downturn. Low quantity throughout value actions, then again, can recommend an absence of conviction and doubtlessly a weaker development.

-

Relative Energy Index (RSI): RSI is a momentum indicator that helps establish overbought and oversold situations. An RSI above 70 usually signifies an overbought market, suggesting a possible value correction. Conversely, an RSI under 30 suggests an oversold market, doubtlessly indicating a bounce. RSI, nevertheless, needs to be used together with different indicators for a extra complete evaluation.

-

Shifting Averages: Shifting averages, such because the 50-day and 200-day transferring averages, present insights into the general development. A value above the 200-day transferring common typically alerts a bullish development, whereas a value under it’d recommend a bearish development. Crossovers between transferring averages can even generate purchase or promote alerts.

-

Bollinger Bands: Bollinger Bands illustrate value volatility. When costs contact the higher band, it may recommend an overbought situation, whereas touching the decrease band may point out an oversold situation. The widening or narrowing of the bands additionally gives insights into volatility modifications.

-

Sectoral Composition: Understanding the sectoral composition of the Nifty Subsequent 50 is essential. Completely different sectors exhibit various sensitivities to financial cycles and market sentiment. For instance, a heavy weighting in expertise shares may make the index extra prone to modifications in international expertise tendencies. Analyzing the efficiency of particular person sectors throughout the index can present a extra granular understanding of its general motion.

Historic Efficiency and Tendencies:

The Nifty Subsequent 50 has traditionally exhibited larger volatility in comparison with the Nifty 50, reflecting the inherent threat related to mid-cap shares. Nevertheless, this larger volatility additionally presents the potential for larger returns. Over the long run, the index has usually proven constructive progress, although it has skilled durations of great corrections. Analyzing historic information, together with durations of financial enlargement and contraction, may help traders perceive the index’s resilience and potential response to totally different market situations. Evaluating its efficiency in opposition to the Nifty 50 and different benchmark indices gives useful context and helps assess its relative power.

Funding Implications:

The Nifty Subsequent 50 index provides a compelling funding proposition for a number of causes:

-

Development Potential: Mid-cap firms typically exhibit larger progress potential than their large-cap counterparts, pushed by their enlargement methods and market penetration alternatives. This presents important upside potential for traders.

-

Diversification: Investing within the Nifty Subsequent 50 gives diversification past the large-cap universe, decreasing general portfolio threat. It permits traders to faucet into a distinct section of the market with distinct progress traits.

-

Publicity to Rising Sectors: The Nifty Subsequent 50 typically contains firms working in rising and high-growth sectors, providing publicity to revolutionary and disruptive applied sciences and enterprise fashions.

-

Lengthy-Time period Development Story: India’s burgeoning economic system presents a compelling long-term progress narrative, and the Nifty Subsequent 50 provides a solution to take part on this progress story. Nevertheless, it is essential to do not forget that this long-term potential comes with inherent dangers.

Dangers and Concerns:

Whereas the Nifty Subsequent 50 provides engaging alternatives, it is important to acknowledge the related dangers:

-

Larger Volatility: Mid-cap shares are usually extra unstable than large-cap shares, which means value fluctuations will be extra important.

-

Liquidity Threat: A few of the constituent firms may need decrease liquidity in comparison with large-cap firms, making it doubtlessly difficult to purchase or promote shares rapidly at desired costs.

-

Firm-Particular Dangers: Mid-cap firms is perhaps extra prone to company-specific dangers, resembling operational challenges or administration modifications, which might considerably influence their efficiency.

-

Market Sentiment: Mid-cap shares are sometimes extra delicate to general market sentiment, which means they will expertise sharper declines throughout market corrections.

Conclusion:

The Nifty Subsequent 50 index presents a dynamic and doubtlessly rewarding funding alternative for traders searching for publicity to India’s vibrant mid-cap market. Nevertheless, understanding its traits, analyzing its chart successfully, and appreciating the related dangers are essential for making knowledgeable funding selections. A radical evaluation of historic efficiency, sectoral composition, and present market situations, mixed with a long-term funding horizon and applicable threat administration methods, is important for navigating the complexities of this compelling index. Bear in mind, skilled monetary recommendation ought to all the time be sought earlier than making any funding selections.

Closure

Thus, we hope this text has offered useful insights into Decoding the Nifty Subsequent 50: A Deep Dive into India’s Mid-Cap Powerhouse. We respect your consideration to our article. See you in our subsequent article!