Decoding The Nifty RSI Chart: A Complete Information For Merchants

Decoding the Nifty RSI Chart: A Complete Information for Merchants

Associated Articles: Decoding the Nifty RSI Chart: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Nifty RSI Chart: A Complete Information for Merchants. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Nifty RSI Chart: A Complete Information for Merchants

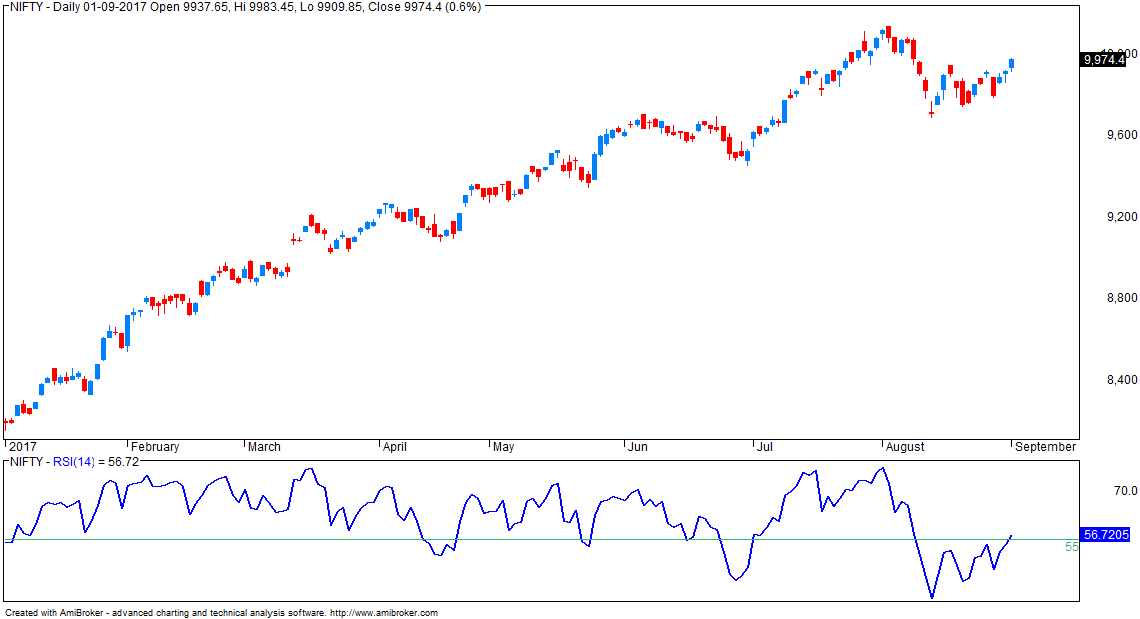

The Nifty 50 index, a barometer of the Indian inventory market’s efficiency, is carefully watched by thousands and thousands of buyers. Understanding its value actions is essential for making knowledgeable buying and selling selections. Whereas varied technical indicators exist, the Relative Energy Index (RSI) is a very fashionable device for gauging momentum and potential reversals within the Nifty’s trajectory. This text delves deep into the Nifty RSI chart, explaining its mechanics, interpretation, frequent buying and selling methods, limitations, and how one can combine it successfully into your buying and selling plan.

Understanding the RSI: A Momentum Oscillator

The RSI, developed by J. Welles Wilder Jr., is a momentum indicator that measures the magnitude of latest value modifications to guage overbought or oversold circumstances available in the market. It oscillates between 0 and 100, with values above 70 usually thought-about overbought and values beneath 30 thought-about oversold. These ranges, nevertheless, aren’t absolute purchase or promote alerts however fairly potential areas of value reversal.

The RSI calculation is predicated on the common positive aspects and losses over a selected interval, sometimes 14 days. A better RSI signifies stronger upward momentum, whereas a decrease RSI suggests stronger downward momentum. The method entails calculating the common achieve and common loss over the chosen interval, then utilizing these values to find out the Relative Energy (RS) and eventually the RSI.

Deciphering the Nifty RSI Chart:

The Nifty RSI chart is usually displayed alongside the Nifty 50 value chart. This enables merchants to visually correlate value motion with momentum. This is a breakdown of key interpretations:

-

Overbought Territory (RSI > 70): When the RSI climbs above 70, it suggests the Nifty is overbought and doubtlessly due for a correction. This does not assure a drop, however it will increase the chance of a pullback or consolidation. Merchants usually search for alternatives to promote or brief the Nifty on this area. Nonetheless, it is essential to keep in mind that robust bullish tendencies can maintain overbought circumstances for prolonged intervals.

-

Oversold Territory (RSI < 30): Conversely, an RSI beneath 30 suggests the Nifty is oversold, implying a possible bounce. This presents potential lengthy alternatives for merchants. Once more, this is not a assured sign; the Nifty might proceed its downward pattern. The context of the general market and different technical indicators needs to be thought-about.

-

Divergence: Some of the highly effective makes use of of the RSI is figuring out divergences. A bullish divergence happens when the worth makes decrease lows, however the RSI makes increased lows. This means weakening promoting stress and potential for a value reversal to the upside. A bearish divergence occurs when the worth makes increased highs, however the RSI makes decrease highs, indicating weakening shopping for stress and a possible value reversal downwards. Divergences are sometimes robust alerts, however affirmation from different indicators is all the time advisable.

-

Centerline Crossovers (RSI = 50): Crossovers of the 50 centerline may also present helpful insights. A transfer above 50 suggests strengthening bullish momentum, whereas a transfer beneath 50 signifies strengthening bearish momentum. These crossovers are sometimes much less important than overbought/oversold alerts or divergences, however they’ll contribute to the general image.

-

RSI Patterns: The RSI may also kind varied patterns, similar to head and shoulders, double tops/bottoms, and triangles, which may present further buying and selling alerts. These patterns, when mixed with RSI ranges and divergences, can considerably improve buying and selling accuracy.

Buying and selling Methods utilizing the Nifty RSI Chart:

Quite a few buying and selling methods make the most of the Nifty RSI chart. Listed below are a couple of examples:

-

Overbought/Oversold Reversal Buying and selling: This entails figuring out overbought or oversold circumstances and inserting trades primarily based on anticipated reversals. Nonetheless, this technique requires cautious threat administration, as false alerts can happen.

-

Divergence Buying and selling: This technique focuses on figuring out bullish or bearish divergences and buying and selling within the route of the anticipated reversal. Divergences are sometimes extra dependable than easy overbought/oversold alerts.

-

RSI mixed with different indicators: The RSI is best when used at the side of different technical indicators, similar to transferring averages, MACD, or Bollinger Bands. This offers a extra holistic view of the market and reduces the chance of false alerts. For example, a affirmation of an overbought RSI with a bearish crossover of a transferring common can strengthen a promote sign.

-

Pattern Following with RSI Affirmation: Merchants can use the RSI to verify the power of an present pattern. A powerful uptrend will sometimes present an RSI above 50, whereas a powerful downtrend will present an RSI beneath 50. This helps filter out weak tendencies and give attention to these with larger potential.

Limitations of the Nifty RSI Chart:

Whereas the RSI is a strong device, it is essential to acknowledge its limitations:

-

Lagging Indicator: The RSI is a lagging indicator, that means it reacts to cost actions fairly than predicting them. This may result in delayed alerts, particularly in fast-moving markets.

-

False Indicators: The RSI can generate false alerts, notably in sideways or ranging markets. Overbought and oversold circumstances can persist for prolonged intervals, resulting in whipsaws if not used cautiously.

-

Parameter Sensitivity: The RSI’s effectiveness can depend upon the chosen interval (normally 14 days). Totally different intervals can produce completely different alerts, requiring cautious experimentation and optimization.

-

Market Context: The RSI shouldn’t be utilized in isolation. It is essential to contemplate the general market context, information occasions, financial indicators, and different technical indicators earlier than making buying and selling selections.

Integrating the Nifty RSI into your Buying and selling Plan:

To successfully use the Nifty RSI, combine it right into a complete buying and selling plan that features:

-

Clear Buying and selling Goals: Outline your targets, threat tolerance, and funding horizon.

-

Market Evaluation: Conduct thorough elementary and technical evaluation of the Nifty 50 earlier than utilizing the RSI.

-

Threat Administration: Implement strict stop-loss orders to restrict potential losses. Place sizing is essential to stop important capital erosion from false alerts.

-

Backtesting: Backtest your RSI-based buying and selling methods on historic Nifty knowledge to evaluate their effectiveness and refine your strategy.

-

Journaling: Hold an in depth buying and selling journal to trace your trades, analyze your efficiency, and establish areas for enchancment.

Conclusion:

The Nifty RSI chart is a helpful device for merchants in search of to grasp momentum and potential reversals within the Nifty 50 index. Nonetheless, it is important to make use of it judiciously, contemplating its limitations and integrating it with different technical indicators and a sturdy buying and selling plan. By understanding its mechanics, deciphering its alerts appropriately, and managing threat successfully, merchants can leverage the Nifty RSI chart to reinforce their buying and selling selections and enhance their general profitability. Bear in mind, no single indicator offers foolproof alerts, and constant success requires a holistic strategy to market evaluation and threat administration. The Nifty RSI chart is a strong piece of the puzzle, however it’s just one a part of a a lot bigger image.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Nifty RSI Chart: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!