Decoding The Philippine Gasoline Worth Chart: A Rollercoaster Journey Of Provide, Demand, And World Politics

Decoding the Philippine Gasoline Worth Chart: A Rollercoaster Journey of Provide, Demand, and World Politics

Associated Articles: Decoding the Philippine Gasoline Worth Chart: A Rollercoaster Journey of Provide, Demand, and World Politics

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Philippine Gasoline Worth Chart: A Rollercoaster Journey of Provide, Demand, and World Politics. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the Philippine Gasoline Worth Chart: A Rollercoaster Journey of Provide, Demand, and World Politics

The Philippine gasoline worth chart is a posh tapestry woven from threads of world crude oil costs, native market dynamics, taxes, and authorities insurance policies. Understanding its fluctuations is essential for Filipino shoppers, companies, and the economic system as a complete, as gasoline prices considerably influence transportation, manufacturing, and the price of dwelling. This text delves deep into the components influencing the worth of gasoline within the Philippines, offering a complete overview of the historic developments and future projections.

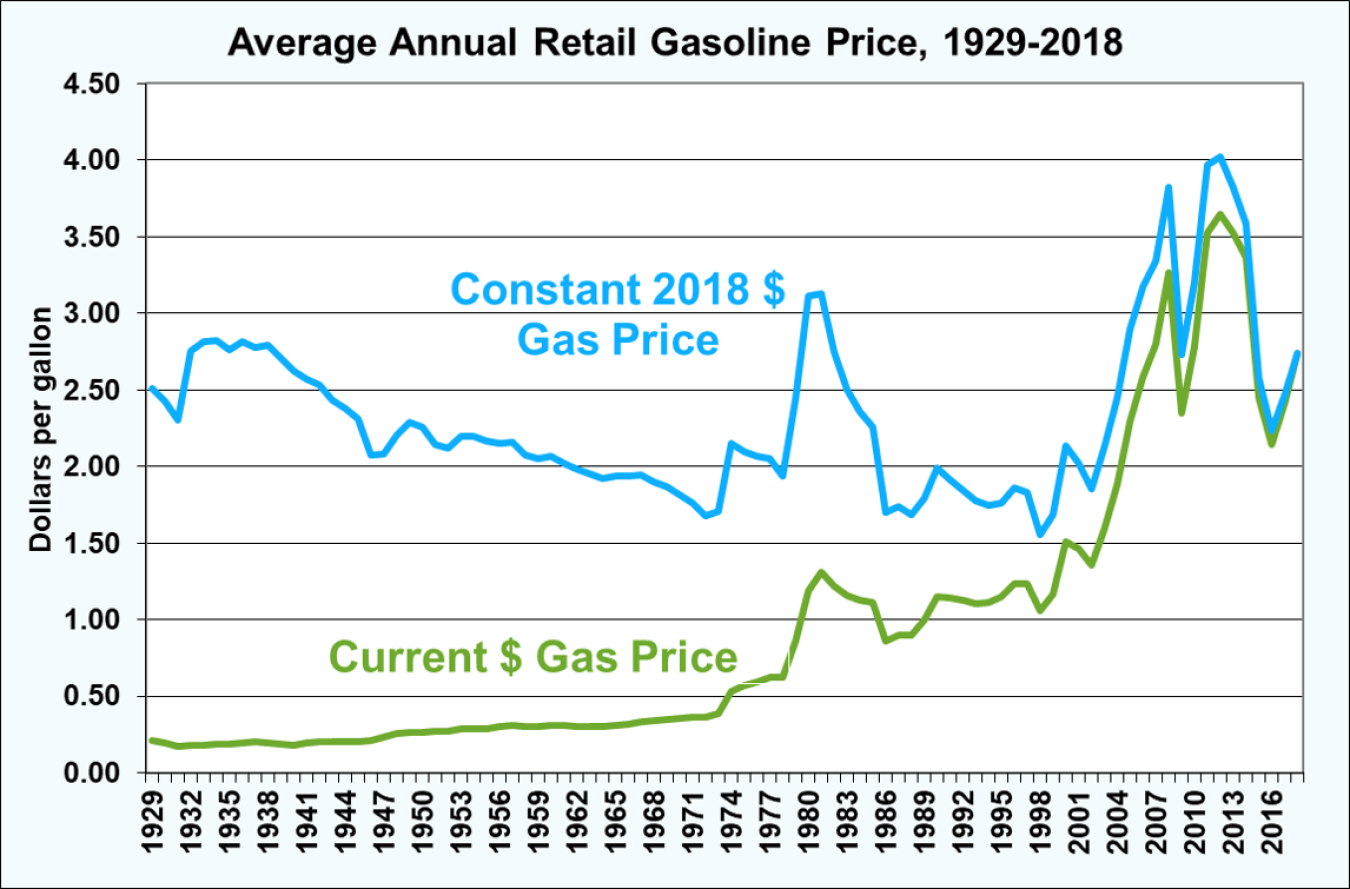

A Historic Perspective: The Ups and Downs

The Philippine gasoline worth chart, when considered over the previous twenty years, reveals a sample of sharp peaks and valleys. These fluctuations aren’t random; they’re instantly correlated with world occasions and home insurance policies. The early 2000s noticed comparatively secure costs, punctuated by occasional spikes triggered by geopolitical instability in oil-producing areas, such because the Iraq Struggle. The worldwide monetary disaster of 2008 despatched shockwaves by the power market, resulting in a dramatic drop in gasoline costs earlier than a subsequent rebound.

The interval following the worldwide monetary disaster noticed a interval of relative volatility, with costs influenced by components such because the power of the Philippine peso in opposition to the US greenback (as oil is priced in USD), OPEC manufacturing quotas, and surprising occasions like pure disasters affecting oil manufacturing or refining capability. The Arab Spring uprisings and the following conflicts in Libya and Syria additional exacerbated worth volatility.

Extra not too long ago, the COVID-19 pandemic initially led to a dramatic plunge in gasoline costs as world demand plummeted on account of lockdowns and journey restrictions. Nevertheless, this was short-lived. As economies reopened, demand surged, resulting in a speedy improve in costs. The continued struggle in Ukraine, a big exporter of oil and gasoline, has additional sophisticated the state of affairs, inflicting unprecedented worth spikes all through 2022 and into 2023. This highlights the interconnectedness of world politics and the Philippine gasoline market.

Key Elements Influencing Philippine Gasoline Costs:

A number of interconnected components contribute to the risky nature of the Philippine gasoline worth chart:

-

World Crude Oil Costs: That is probably the most vital issue. The worth of crude oil within the worldwide market, primarily decided by provide and demand, instantly impacts the price of refining gasoline. Any improve in crude oil costs interprets to greater gasoline costs within the Philippines, and vice versa. Geopolitical occasions, OPEC selections, and surprising provide disruptions (e.g., hurricanes, pipeline failures) all play a vital function.

-

Alternate Charges: Since oil is priced in US {dollars}, the worth of the Philippine peso in opposition to the greenback considerably impacts the price of imported crude oil and refined gasoline. A weaker peso means greater import prices and, consequently, greater gasoline costs. Financial insurance policies and world market developments affect the trade fee.

-

Taxes and Duties: The Philippine authorities levies numerous taxes and duties on gasoline, together with excise taxes, value-added tax (VAT), and different charges. These taxes represent a considerable portion of the ultimate worth shoppers pay on the pump. Adjustments in tax charges instantly influence the worth chart.

-

Refining Prices and Margins: The price of refining crude oil into gasoline, together with operational bills and revenue margins for refineries, additionally contributes to the ultimate worth. Competitors amongst refineries and the effectivity of the refining course of affect these prices.

-

Distribution and Advertising and marketing Prices: Transportation, storage, and advertising prices add to the ultimate worth shoppers pay. These prices can differ relying on location and logistical components.

-

Authorities Rules: Authorities insurance policies, similar to worth controls (although not often carried out for prolonged durations) and subsidies, can affect gasoline costs. Nevertheless, such interventions usually have unintended penalties and might distort the market.

-

Home Demand: The extent of home demand for gasoline additionally performs a task. Increased demand, pushed by financial development and elevated automobile possession, can put upward strain on costs.

Analyzing the Chart: Developments and Patterns:

An in depth evaluation of the Philippine gasoline worth chart reveals a number of recurring patterns:

-

Seasonality: Demand for gasoline tends to be greater throughout peak journey seasons, resulting in barely greater costs.

-

Correlation with World Occasions: Main geopolitical occasions, financial crises, and pure disasters usually set off vital worth spikes.

-

Lag Impact: Adjustments in world crude oil costs do not at all times instantly translate into adjustments in Philippine gasoline costs. There’s usually a lag on account of contracts, stock ranges, and the time it takes for changes to be made all through the provision chain.

-

Impression of Authorities Insurance policies: Adjustments in tax charges or different authorities interventions can result in sudden shifts within the worth chart.

The Way forward for Philippine Gasoline Costs:

Predicting future gasoline costs with certainty is unattainable, given the advanced interaction of world and native components. Nevertheless, a number of developments counsel potential situations:

-

Continued Volatility: Given the continued geopolitical uncertainty and the transition in the direction of cleaner power sources, volatility in gasoline costs is prone to persist.

-

Stress from Local weather Change Insurance policies: Rising world considerations about local weather change are resulting in stricter environmental rules and a push in the direction of electrical autos. This might probably dampen demand for gasoline in the long run, although the transition shall be gradual.

-

Technological Developments: Improvements in refining expertise and the event of other fuels may affect gasoline costs sooner or later.

-

Financial Progress and Growth: Continued financial development within the Philippines will seemingly improve demand for gasoline, placing upward strain on costs.

Conclusion:

The Philippine gasoline worth chart is a dynamic reflection of world and native forces. Understanding the components that contribute to its fluctuations is important for knowledgeable decision-making by shoppers, companies, and policymakers. Whereas predicting the long run with precision is unattainable, acknowledging the interaction of world crude oil costs, trade charges, taxes, and home demand permits for a extra nuanced understanding of this important facet of the Philippine economic system. Steady monitoring of those components and adapting to evolving market situations shall be essential for navigating the challenges and alternatives offered by the ever-changing panorama of gasoline costs within the Philippines. Moreover, exploring and investing in various power sources and selling power effectivity are essential steps in the direction of mitigating the influence of risky gasoline costs on the Filipino inhabitants and the nation’s economic system.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Philippine Gasoline Worth Chart: A Rollercoaster Journey of Provide, Demand, and World Politics. We admire your consideration to our article. See you in our subsequent article!