Decoding The QM Chart Sample: A Complete Information For Merchants

Decoding the QM Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the QM Chart Sample: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the QM Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the QM Chart Sample: A Complete Information for Merchants

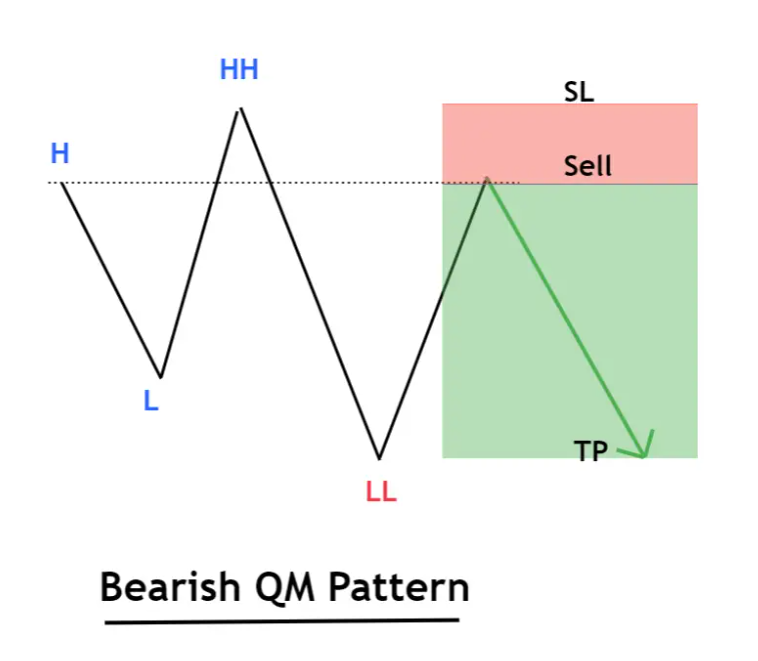

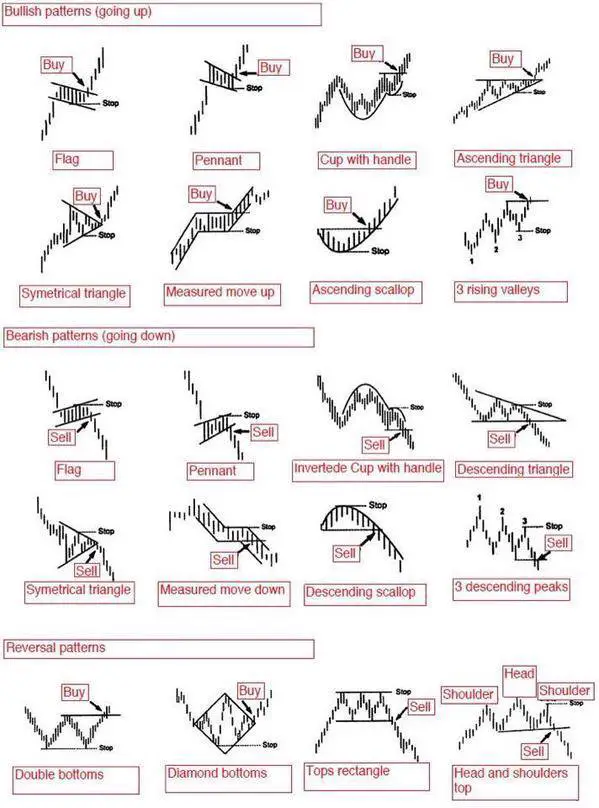

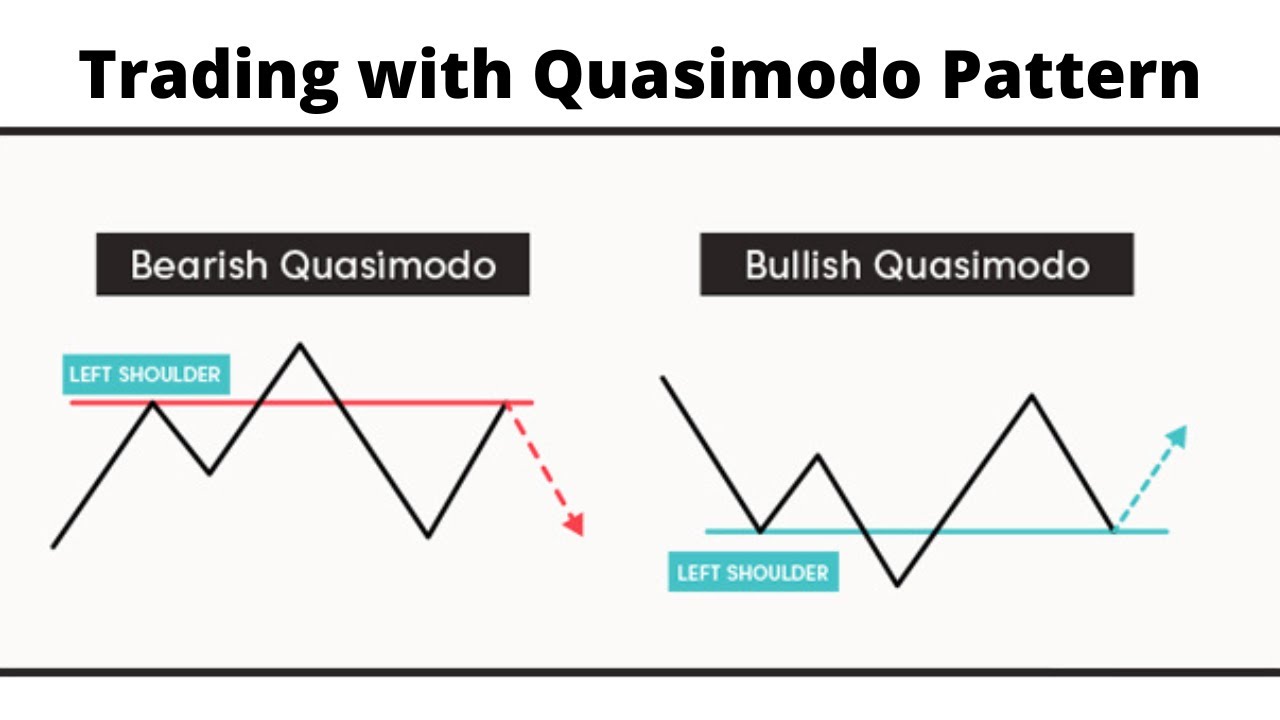

The QM chart sample, a comparatively less-discussed however doubtlessly highly effective device in technical evaluation, affords merchants a novel perspective on market dynamics. In contrast to well-known patterns like head and shoulders or double tops/bottoms, the QM sample focuses on figuring out momentum shifts and potential reversals based mostly on a particular sequence of candlestick formations. This text will delve deep into the intricacies of the QM sample, exploring its formation, identification, affirmation methods, threat administration issues, and sensible software.

Understanding the Fundamentals of the QM Sample

The QM sample, also known as the "Fast Transfer" sample, is a candlestick sample characterised by a fast value motion adopted by a interval of consolidation or sideways buying and selling. It is not a rigidly outlined sample with exact candlestick necessities like some others, however relatively a conceptual framework based mostly on observing market conduct. The core precept behind the QM sample is {that a} swift value motion, typically pushed by robust shopping for or promoting stress, ultimately exhausts itself, resulting in a short lived pause earlier than the subsequent directional transfer.

The sample sometimes consists of three key phases:

-

The Fast Transfer (QM): That is the preliminary fast value motion that triggers the sample. It may be an upward or downward transfer, represented by a collection of consecutive bullish or bearish candlesticks with vital value gaps or massive physique sizes. This part signifies a strong surge of momentum in a particular path.

-

The Consolidation Section: After the short transfer, the market enters a interval of consolidation or sideways buying and selling. This part is characterised by smaller candlestick our bodies, decrease buying and selling quantity, and a scarcity of clear directional bias. The consolidation part signifies a short lived exhaustion of the preliminary momentum. The size of this part can range considerably, starting from a number of hours to a number of days and even weeks.

-

The Breakout (Affirmation): The ultimate part of the QM sample entails a decisive breakout from the consolidation vary. This breakout confirms the continuation of the pattern established by the preliminary fast transfer. A bullish breakout happens when the worth decisively breaks above the resistance degree of the consolidation part, whereas a bearish breakout happens when the worth breaks under the assist degree.

Figuring out QM Patterns: A Sensible Method

Figuring out a QM sample requires a eager eye for market dynamics and an understanding of candlestick formations. This is a step-by-step method:

-

Recognizing the Fast Transfer: Start by figuring out a interval of fast value motion. Search for a collection of candlesticks with vital value adjustments and doubtlessly massive physique sizes. The path of this transfer will decide whether or not you are searching for a bullish or bearish QM sample. Take into account the context – is that this transfer uncommon for the asset’s typical volatility?

-

Observing the Consolidation: After the short transfer, search for a interval of sideways buying and selling or consolidation. This part is characterised by smaller candlestick our bodies, decrease buying and selling quantity in comparison with the short transfer, and value motion contained inside a comparatively tight vary. The consolidation part acts as a interval of relaxation earlier than the subsequent leg of the motion.

-

Recognizing the Breakout: Pay shut consideration to the worth motion on the boundaries of the consolidation vary. A decisive break above the resistance (for a bullish QM) or under the assist (for a bearish QM), accompanied by elevated quantity, indicators a possible continuation of the pattern. A weak breakout, or one which fails to carry, suggests the sample could have failed.

Affirmation Methods: Enhancing Buying and selling Accuracy

Whereas figuring out the QM sample is essential, affirmation methods are important to extend the likelihood of profitable trades. These methods assist filter out false indicators and enhance threat administration:

-

Quantity Affirmation: A major enhance in buying and selling quantity through the breakout part strengthens the sign. Excessive quantity confirms that the breakout isn’t merely a random value fluctuation however displays real market participation.

-

Technical Indicator Affirmation: Combining the QM sample with different technical indicators, comparable to transferring averages, RSI, or MACD, can present further affirmation. For instance, a bullish QM sample confirmed by a bullish crossover of transferring averages will increase the arrogance in an extended place.

-

Value Motion Affirmation: Search for candlestick patterns inside the breakout part that reinforce the directional bias. As an illustration, a bullish engulfing candlestick after a bullish breakout additional validates the upward pattern.

-

Help and Resistance Ranges: The breakout from the consolidation ought to ideally clear vital assist or resistance ranges, including additional weight to the sign.

Danger Administration and Commerce Execution

Profitable buying and selling with QM patterns requires a sturdy threat administration technique:

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. Place the stop-loss order just under the assist degree for lengthy positions and simply above the resistance degree for brief positions. The stop-loss degree must be based mostly on the chance tolerance and the scale of the potential reward.

-

Place Sizing: Decide the suitable place measurement based mostly on the chance tolerance and account measurement. Keep away from over-leveraging, as this will result in vital losses even with a well-defined buying and selling plan.

-

Take-Revenue Orders: Use take-profit orders to safe earnings as soon as the worth reaches a predetermined goal. The goal value must be based mostly on the potential reward and the risk-reward ratio.

-

Trailing Cease-Loss: Think about using a trailing stop-loss order to lock in earnings as the worth strikes in your favor. A trailing stop-loss order strikes with the worth, defending earnings whereas permitting for better potential good points.

Sensible Utility and Examples

The QM sample will be utilized throughout varied timeframes, from intraday to long-term swing buying and selling. The selection of timeframe depends upon the buying and selling fashion and threat tolerance. As an illustration, a day dealer would possibly concentrate on figuring out QM patterns on 5-minute or 15-minute charts, whereas a swing dealer would possibly search for them on each day or weekly charts.

Let’s take into account a hypothetical instance: A inventory experiences a fast upward transfer (the short transfer) over two days, considerably outpacing its typical volatility. That is adopted by a three-day consolidation interval the place the worth strikes inside a comparatively slender vary. A robust breakout above the higher boundary of the consolidation vary, accompanied by elevated quantity and a bullish engulfing candlestick, confirms a bullish QM sample. A dealer would possibly enter an extended place with a stop-loss order positioned under the assist degree of the consolidation and a take-profit order positioned at a predetermined goal based mostly on the risk-reward ratio.

Limitations and Issues

Whereas the QM sample is usually a priceless buying and selling device, it is important to acknowledge its limitations:

-

Subjectivity: The identification of QM patterns will be subjective, as there aren’t any strict guidelines for outlining the size of the short transfer or the consolidation part. Completely different merchants could interpret the identical value motion otherwise.

-

False Indicators: Like every technical sample, QM patterns can generate false indicators. Affirmation methods and threat administration are essential to attenuate the impression of false indicators.

-

Market Context: The effectiveness of the QM sample will be influenced by broader market circumstances. During times of excessive volatility or vital market occasions, the sample could also be much less dependable.

Conclusion

The QM chart sample offers a novel perspective on figuring out momentum shifts and potential reversals available in the market. By understanding its formation, using affirmation methods, and implementing a sturdy threat administration plan, merchants can leverage the QM sample to boost their buying and selling selections. Nevertheless, it is essential to do not forget that no technical sample ensures success, and thorough evaluation, mixed with a disciplined method, is important for constant profitability. The QM sample must be seen as one device in a broader technical evaluation toolkit, used along with different indicators and a deep understanding of market dynamics. Steady studying and adaptation are key to mastering this and every other technical buying and selling sample.

![[ChartTrail] QM Pattern คือ ? - การนำ Quasimodo Pattern มาใช้ในการเทรด](https://t1.blockdit.com/photos/2023/07/64a2c271e8b93b03ef4b290d_800x0xcover_JWogBAEs.jpg)

Closure

Thus, we hope this text has supplied priceless insights into Decoding the QM Chart Sample: A Complete Information for Merchants. We admire your consideration to our article. See you in our subsequent article!