Decoding The QQQ Stay Chart: A Complete Information For Buyers

Decoding the QQQ Stay Chart: A Complete Information for Buyers

Associated Articles: Decoding the QQQ Stay Chart: A Complete Information for Buyers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the QQQ Stay Chart: A Complete Information for Buyers. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Decoding the QQQ Stay Chart: A Complete Information for Buyers

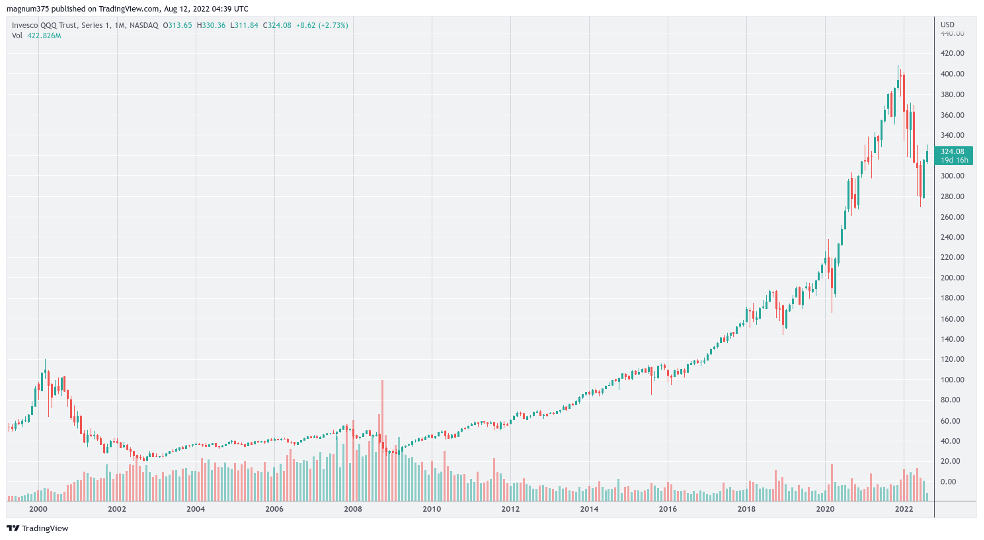

The Invesco QQQ Belief (QQQ) is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. This index contains 100 of the biggest non-financial firms listed on the Nasdaq Inventory Market, representing a major slice of the know-how sector and a broader swathe of the US financial system’s development engine. Consequently, the QQQ reside chart provides a dynamic and insightful view into the efficiency of this significant sector, making it a well-liked software for each seasoned traders and newcomers alike. Understanding tips on how to interpret this chart, nonetheless, requires a grasp of a number of key ideas and analytical methods.

This text will function a complete information to navigating the QQQ reside chart, exploring its intricacies, decoding its indicators, and highlighting its significance in funding technique. We’ll delve into numerous chart varieties, technical indicators, and elementary issues that may improve your understanding and probably enhance your buying and selling choices.

Understanding the QQQ Stay Chart’s Elements:

A typical QQQ reside chart shows the ETF’s value actions over time. The most typical chart varieties are:

-

Line Chart: This shows the closing value of QQQ for every interval (e.g., day by day, hourly, or minutely). It is easy to grasp however lacks the visible illustration of value vary.

-

Candlestick Chart: This offers a richer visible illustration, exhibiting the opening, closing, excessive, and low costs for every interval. The "physique" of the candlestick represents the value vary between the open and shut, whereas the "wicks" prolong to the excessive and low costs. Inexperienced (or white) candles sometimes point out a closing value larger than the opening value (upward motion), whereas crimson (or black) candles signify a closing value decrease than the opening value (downward motion). Candlestick patterns can reveal potential pattern reversals or continuations.

-

Bar Chart: Much like candlestick charts, bar charts show the open, excessive, low, and shut costs for every interval. Nevertheless, they use vertical bars as a substitute of candlesticks.

Technical Indicators and Their Utility:

Stay charts are sometimes enhanced with technical indicators that present extra insights into value tendencies and potential momentum shifts. A few of the mostly used indicators embody:

-

Transferring Averages (MA): These easy out value fluctuations to focus on underlying tendencies. Frequent varieties embody easy shifting averages (SMA) and exponential shifting averages (EMA). Crossovers between totally different MAs (e.g., a 50-day SMA crossing above a 200-day SMA) are sometimes interpreted as purchase indicators, whereas the other can sign a promote.

-

Relative Power Index (RSI): This momentum oscillator measures the magnitude of latest value adjustments to guage overbought or oversold circumstances. Readings above 70 are sometimes thought of overbought, suggesting a possible value reversal, whereas readings beneath 30 recommend oversold circumstances and potential upward motion.

-

MACD (Transferring Common Convergence Divergence): This indicator compares two shifting averages to determine adjustments in momentum. Crossovers of the MACD line above its sign line can point out bullish momentum, whereas crossovers beneath recommend bearish momentum.

-

Bollinger Bands: These bands plot normal deviations round a shifting common, visually representing value volatility. Worth actions outdoors the bands can recommend potential breakouts or reversals.

-

Quantity: Buying and selling quantity offers essential context to cost actions. Excessive quantity accompanying value will increase confirms the energy of the upward pattern, whereas excessive quantity throughout value declines confirms bearish momentum. Low quantity throughout value actions can recommend a scarcity of conviction and potential weak point within the pattern.

Decoding the QQQ Stay Chart: Sensible Functions

Combining chart patterns with technical indicators permits for a extra nuanced understanding of QQQ’s value motion. For instance:

-

Figuring out Tendencies: An upward-sloping shifting common coupled with persistently larger highs and better lows suggests a bullish pattern. The other signifies a bearish pattern.

-

Recognizing Potential Reversals: A bearish candlestick sample (e.g., a capturing star) forming at a resistance stage, coupled with an RSI above 70, might recommend an impending value reversal.

-

Confirming Breakouts: A breakout above a resistance stage accompanied by elevated quantity can sign a powerful upward transfer. Conversely, a breakdown beneath assist with excessive quantity can sign a major decline.

-

Managing Danger: Cease-loss orders, positioned beneath assist ranges, may also help restrict potential losses. Take-profit orders, positioned at resistance ranges or based mostly on technical indicators, may also help safe earnings.

Basic Evaluation and its Integration:

Whereas technical evaluation focuses on value charts and indicators, elementary evaluation considers the underlying components influencing QQQ’s efficiency. This consists of:

-

Financial Knowledge: Macroeconomic indicators like GDP development, inflation, rates of interest, and unemployment figures can considerably influence the know-how sector and, consequently, QQQ.

-

Business Tendencies: Technological developments, regulatory adjustments, and aggressive dynamics inside the know-how sector affect the efficiency of the businesses inside the Nasdaq-100.

-

Firm-Particular Information: Particular person firm efficiency inside the Nasdaq-100 immediately impacts QQQ’s general worth. Constructive information (e.g., robust earnings experiences, revolutionary product launches) can drive QQQ larger, whereas destructive information can result in declines.

Integrating elementary evaluation with technical evaluation offers a extra holistic view. As an illustration, robust elementary information can verify a bullish technical sample, rising confidence in a possible upward pattern.

Limitations and Cautions:

Whereas the QQQ reside chart and its related instruments present helpful insights, it is essential to acknowledge their limitations:

-

No Ensures: Technical evaluation isn’t foolproof. Alerts will be false, and value actions will be unpredictable.

-

Lagging Indicators: Some indicators, like shifting averages, lag behind value actions, probably resulting in delayed indicators.

-

Market Sentiment: Investor sentiment and market psychology can considerably affect value motion, typically defying purely technical or elementary evaluation.

-

Over-reliance on Indicators: Relying solely on technical indicators with out contemplating elementary components can result in poor funding choices.

Conclusion:

The QQQ reside chart provides a strong software for traders in search of to grasp and probably revenue from the efficiency of the know-how sector. By mastering the interpretation of chart patterns, technical indicators, and elementary components, traders can develop a extra knowledgeable and complete funding technique. Nevertheless, it is essential to do not forget that no single technique ensures success. A prudent method includes combining totally different analytical methods, managing danger successfully, and sustaining a long-term perspective. Steady studying and adaptation are key to navigating the dynamic world of investing and efficiently using the knowledge offered on the QQQ reside chart. At all times conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the QQQ Stay Chart: A Complete Information for Buyers. We hope you discover this text informative and helpful. See you in our subsequent article!