Decoding The Raffles Medical Share Value Chart: A 20-12 months Retrospective And Future Outlook

Decoding the Raffles Medical Share Value Chart: A 20-12 months Retrospective and Future Outlook

Associated Articles: Decoding the Raffles Medical Share Value Chart: A 20-12 months Retrospective and Future Outlook

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Decoding the Raffles Medical Share Value Chart: A 20-12 months Retrospective and Future Outlook. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Raffles Medical Share Value Chart: A 20-12 months Retrospective and Future Outlook

Raffles Medical Group (RMG), a number one built-in healthcare supplier in Singapore and the area, has seen its share value fluctuate considerably over the previous 20 years. Understanding the forces driving these actions requires an in depth evaluation of its chart, contemplating each macro-economic elements and the corporate’s particular efficiency. This text delves right into a complete examination of RMG’s share value historical past, highlighting key tendencies, influential occasions, and potential future trajectories.

The Early Years (2000-2008): Regular Progress Amidst World Uncertainty

The early 2000s offered a blended bag for RMG. The post-dot-com bubble burst and the 2008 international monetary disaster solid shadows over international markets. Nonetheless, RMG, with its deal with premium healthcare companies, demonstrated relative resilience. The share value chart from this era reveals a usually upward pattern, albeit with durations of consolidation and minor corrections. This stability could be attributed to a number of elements:

- Sturdy Home Demand: Singapore’s sturdy financial system and rising affluence fueled constant demand for personal healthcare companies. RMG’s established model and repute as a supplier of high-quality care ensured a gentle stream of sufferers.

- Strategic Acquisitions and Growth: RMG strategically expanded its community of clinics and hospitals each domestically and regionally, strengthening its market place and driving income progress. These expansionary strikes are sometimes mirrored in upward value actions on the chart.

- Restricted World Publicity: In comparison with firms with important worldwide operations, RMG’s comparatively localized focus insulated it considerably from the worst impacts of the worldwide monetary disaster.

Nonetheless, the chart additionally reveals durations of stagnation. These dips may very well be linked to broader market sentiment, investor considerations about healthcare prices, or maybe non permanent setbacks in particular enterprise segments. Analyzing the precise dates of those dips in opposition to contemporaneous information headlines and monetary reviews would offer a extra nuanced understanding.

The Increase Years (2009-2018): Regional Growth and Elevated Investor Confidence

The interval following the 2008 disaster witnessed a exceptional surge in RMG’s share value. This upward trajectory displays a confluence of constructive elements:

- Put up-Disaster Restoration: The worldwide financial system rebounded strongly, significantly in Asia, resulting in elevated disposable incomes and a higher willingness to spend money on healthcare.

- Profitable Regional Growth: RMG’s strategic growth into China and different Southeast Asian markets considerably broadened its income streams and enhanced its progress prospects. The chart doubtless reveals spikes correlating with profitable acquisitions or the opening of latest amenities in these areas.

- Elevated Investor Confidence: RMG’s constant monetary efficiency and strategic execution garnered the eye of each home and worldwide traders, driving up demand for its shares.

- Optimistic Business Developments: The getting old populations in Asia and the rising prevalence of persistent illnesses created a positive backdrop for the expansion of personal healthcare suppliers like RMG.

This era, nonetheless, wasn’t with out its challenges. The chart would possibly reveal non permanent corrections because of elements equivalent to elevated competitors, regulatory adjustments, or considerations about particular initiatives. A deeper dive into the corporate’s monetary statements throughout this era could be essential to understanding the underlying causes for these fluctuations.

Latest Developments (2019-Current): Navigating Uncertainty and the Pandemic

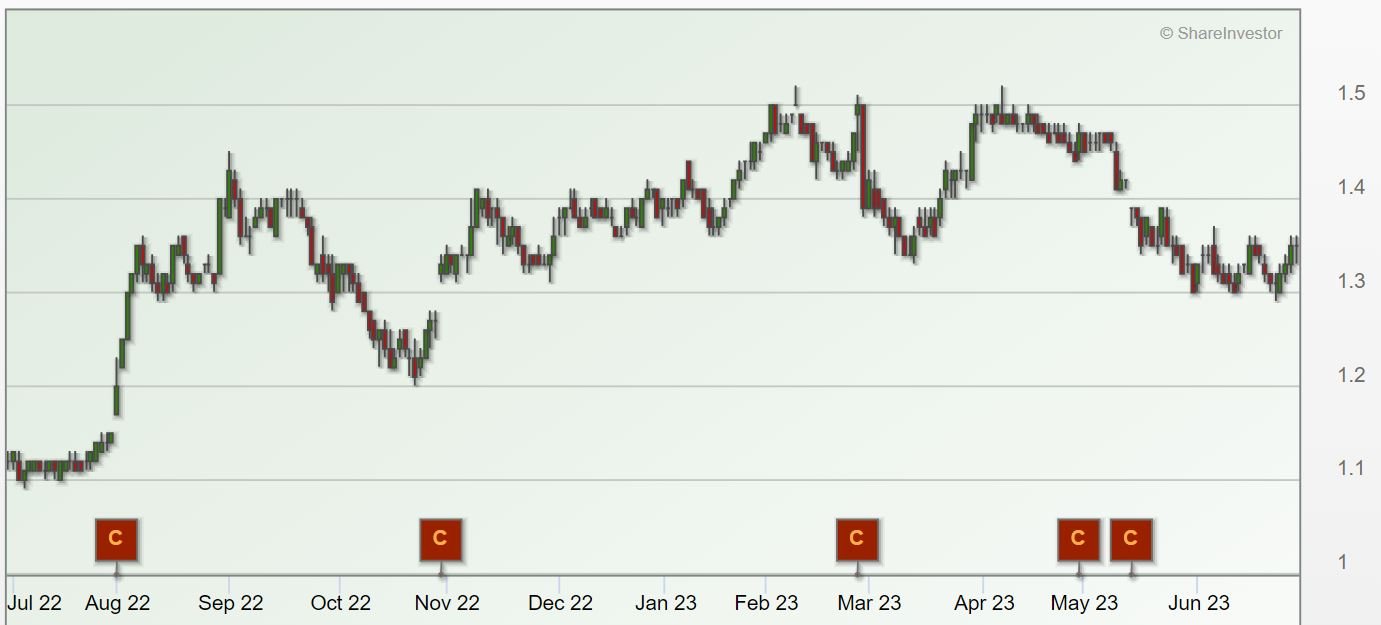

The latest interval has been characterised by higher volatility. The share value chart displays the influence of a number of important occasions:

- The COVID-19 Pandemic: The pandemic initially precipitated a downturn as elective procedures had been postponed and affected person volumes decreased. Nonetheless, RMG’s response to the pandemic, together with its position in COVID-19 testing and remedy, ultimately helped stabilize its efficiency. The chart ought to present a noticeable dip on the pandemic’s onset, adopted by a gradual restoration.

- Geopolitical Instability: Geopolitical uncertainties, equivalent to commerce tensions and regional conflicts, have additionally impacted investor sentiment and contributed to the volatility noticed within the share value.

- Inflationary Pressures: Rising inflation and rates of interest have affected healthcare prices and investor expectations, probably influencing the share value.

- Elevated Competitors: The healthcare sector is turning into more and more aggressive, with each established gamers and new entrants vying for market share. This aggressive strain may very well be mirrored in durations of slower progress or value consolidation.

Analyzing the Chart: Key Metrics and Indicators

To completely perceive the Raffles Medical share value chart, it is important to think about varied technical and elementary indicators:

- Transferring Averages: Analyzing transferring averages (e.g., 50-day, 200-day) may also help determine tendencies and potential help and resistance ranges.

- Relative Energy Index (RSI): The RSI can point out whether or not the inventory is overbought or oversold, offering insights into potential value reversals.

- Quantity: Buying and selling quantity can reveal the energy of value actions. Excessive quantity throughout upward tendencies suggests sturdy shopping for strain, whereas excessive quantity throughout downward tendencies suggests sturdy promoting strain.

- Earnings Per Share (EPS): Monitoring EPS progress is essential for assessing the corporate’s profitability and its capability to generate returns for shareholders.

- Value-to-Earnings Ratio (P/E): The P/E ratio compares the share value to the corporate’s earnings, offering a measure of valuation relative to its friends.

By combining technical evaluation of the chart with a radical examination of RMG’s monetary statements and business tendencies, traders can develop a extra knowledgeable perspective on the corporate’s future prospects.

Future Outlook: Alternatives and Challenges

Wanting forward, RMG faces each alternatives and challenges:

- Continued Regional Growth: Additional growth into high-growth markets in Asia stays a key progress driver.

- Technological Developments: Embracing technological developments in healthcare, equivalent to telehealth and digital well being options, shall be essential for sustaining a aggressive edge.

- Growing old Inhabitants: The getting old populations in Asia will proceed to drive demand for healthcare companies, offering a tailwind for RMG’s progress.

- Regulatory Modifications: Navigating evolving regulatory landscapes in several markets shall be essential for sustaining compliance and guaranteeing sustainable progress.

- Competitors: Intensifying competitors from each established gamers and new entrants would require RMG to always innovate and enhance its service choices.

Conclusion:

The Raffles Medical share value chart tells a narrative of progress, resilience, and adaptation. Whereas the previous 20 years have offered varied challenges, RMG has persistently demonstrated its capability to navigate uncertainty and capitalize on alternatives. Nonetheless, traders ought to rigorously think about the present market atmosphere and the corporate’s future methods earlier than making any funding selections. An intensive evaluation of the share value chart at the side of elementary evaluation and an understanding of the broader healthcare panorama is crucial for formulating a well-informed funding technique. The longer term trajectory of RMG’s share value will depend upon its capability to execute its strategic plans, adapt to altering market circumstances, and preserve its repute as a number one supplier of high-quality healthcare companies.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Raffles Medical Share Value Chart: A 20-12 months Retrospective and Future Outlook. We hope you discover this text informative and useful. See you in our subsequent article!