Decoding The Reliance Industries Share Value Chart: A Two-Decade Journey

Decoding the Reliance Industries Share Value Chart: A Two-Decade Journey

Associated Articles: Decoding the Reliance Industries Share Value Chart: A Two-Decade Journey

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Reliance Industries Share Value Chart: A Two-Decade Journey. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Reliance Industries Share Value Chart: A Two-Decade Journey

Reliance Industries Restricted (RIL), India’s largest firm by market capitalization, boasts a share worth chart that is a captivating case research in company progress, strategic diversification, and market volatility. Analyzing its trajectory over the previous twenty years reveals not solely the corporate’s spectacular journey but in addition broader tendencies within the Indian economic system and world markets. This text delves deep into the RIL share worth chart, exploring key milestones, influencing components, and future projections.

The Early 2000s: Consolidation and Petrochemical Dominance:

The early 2000s noticed RIL largely targeted on its core petrochemical enterprise. The share worth, whereas exhibiting some fluctuations, usually adopted a gradual upward development, reflecting the burgeoning Indian economic system and rising demand for petrochemicals. This era wasn’t with out its challenges, together with world oil worth volatility, which immediately impacted RIL’s profitability. Nonetheless, the corporate’s environment friendly operations and powerful market place allowed it to navigate these challenges comparatively effectively. The chart throughout this era reveals a comparatively low volatility in comparison with later years, reflecting a extra predictable enterprise mannequin. Analyzing the chart from this period highlights the significance of constant earnings progress and operational effectivity in driving long-term share worth appreciation, even inside a cyclical trade.

The 2010s: Diversification and the Jio Revolution:

The 2010s marked a pivotal period for RIL, characterised by aggressive diversification past its conventional petrochemical stronghold. The launch of Reliance Jio Infocomm in 2016 triggered a dramatic shift within the share worth chart. The disruptive entry of Jio into the telecom sector, providing extremely low-cost information providers, despatched shockwaves by the trade and considerably boosted RIL’s valuation. The chart throughout this era exhibits a pointy upward trajectory, punctuated by intervals of consolidation and correction. This displays the inherent dangers and rewards related to disruptive innovation. The preliminary skepticism surrounding Jio’s bold plans progressively gave option to widespread acceptance as its subscriber base exploded, dramatically altering the aggressive panorama and boosting RIL’s income streams and market capitalization. Analyzing this part highlights the affect of strategic foresight and daring investments in new applied sciences on shareholder worth.

Components Influencing the Share Value:

A number of key components have constantly influenced the RIL share worth:

-

International Oil Costs: As a serious participant within the oil and gasoline sector, RIL’s profitability is immediately linked to world crude oil costs. Intervals of excessive oil costs usually translate into increased earnings and a stronger share worth, whereas low oil costs have the other impact. The chart clearly displays this correlation, with peaks and troughs usually aligning with world oil worth actions.

-

Petrochemical Demand: The demand for petrochemicals inside India and globally performs a vital function. Elevated industrial exercise and building translate into increased demand and thus increased RIL revenues. Analyzing the chart alongside world petrochemical demand indices reveals a robust optimistic correlation.

-

Jio’s Efficiency: The efficiency of Reliance Jio Infocomm is arguably the one most vital driver of RIL’s share worth in recent times. Jio’s subscriber additions, ARPU (common income per person), and total market share immediately affect RIL’s monetary outcomes and investor sentiment.

-

Authorities Insurance policies: Authorities laws and insurance policies associated to the oil and gasoline sector, telecom trade, and total financial setting have a major affect. Modifications in taxation, licensing, and infrastructure improvement can both increase or hinder RIL’s progress trajectory.

-

International Financial Circumstances: International financial progress and stability play a vital function. Intervals of world financial uncertainty or recession usually result in market corrections, impacting RIL’s share worth.

-

Investor Sentiment: Market sentiment and investor confidence in RIL’s future prospects are essential. Optimistic information relating to new ventures, technological developments, or strategic partnerships usually result in share worth appreciation, whereas unfavorable information can set off sell-offs.

Analyzing the Chart: Key Technical Indicators:

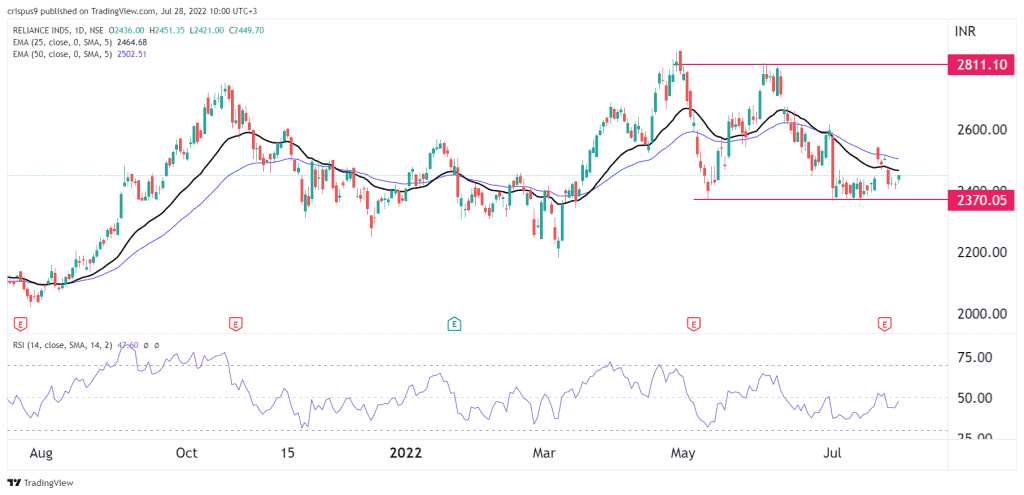

Technical evaluation of the RIL share worth chart can present beneficial insights. Finding out key indicators like shifting averages, assist and resistance ranges, and relative energy index (RSI) may also help determine potential tendencies and buying and selling alternatives. As an example, the 200-day shifting common can function a long-term development indicator, whereas RSI may also help gauge the energy of the present development and determine potential overbought or oversold circumstances. Nonetheless, it is essential to keep in mind that technical evaluation just isn’t foolproof and must be used along with elementary evaluation.

Future Projections:

Predicting future share costs is inherently difficult, however analyzing RIL’s present strategic initiatives and market place gives some clues. The corporate’s foray into renewable power, digital providers, and retail guarantees important progress potential. Nonetheless, challenges stay, together with intense competitors in these sectors and potential regulatory hurdles. The success of RIL’s diversification technique might be a key determinant of its future share worth efficiency. Moreover, world financial circumstances and geopolitical components will proceed to play a major function.

Conclusion:

The Reliance Industries share worth chart is a compelling narrative of company evolution and market dynamics. From its roots in petrochemicals to its present diversified portfolio, RIL’s journey displays each the alternatives and challenges of working in a dynamic world economic system. Analyzing the chart, contemplating the influencing components, and understanding the corporate’s strategic course are essential for traders in search of to know RIL’s potential and handle their threat successfully. Whereas previous efficiency just isn’t indicative of future outcomes, learning the historic trajectory gives beneficial insights into the components which have formed RIL’s success and might inform future funding choices. Steady monitoring of the chart, coupled with elementary and technical evaluation, stays important for navigating the complexities of this dynamic inventory.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the Reliance Industries Share Value Chart: A Two-Decade Journey. We respect your consideration to our article. See you in our subsequent article!