Decoding The Rising Wedge: A Complete Information To This Bearish Chart Sample

Decoding the Rising Wedge: A Complete Information to This Bearish Chart Sample

Associated Articles: Decoding the Rising Wedge: A Complete Information to This Bearish Chart Sample

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Rising Wedge: A Complete Information to This Bearish Chart Sample. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the Rising Wedge: A Complete Information to This Bearish Chart Sample

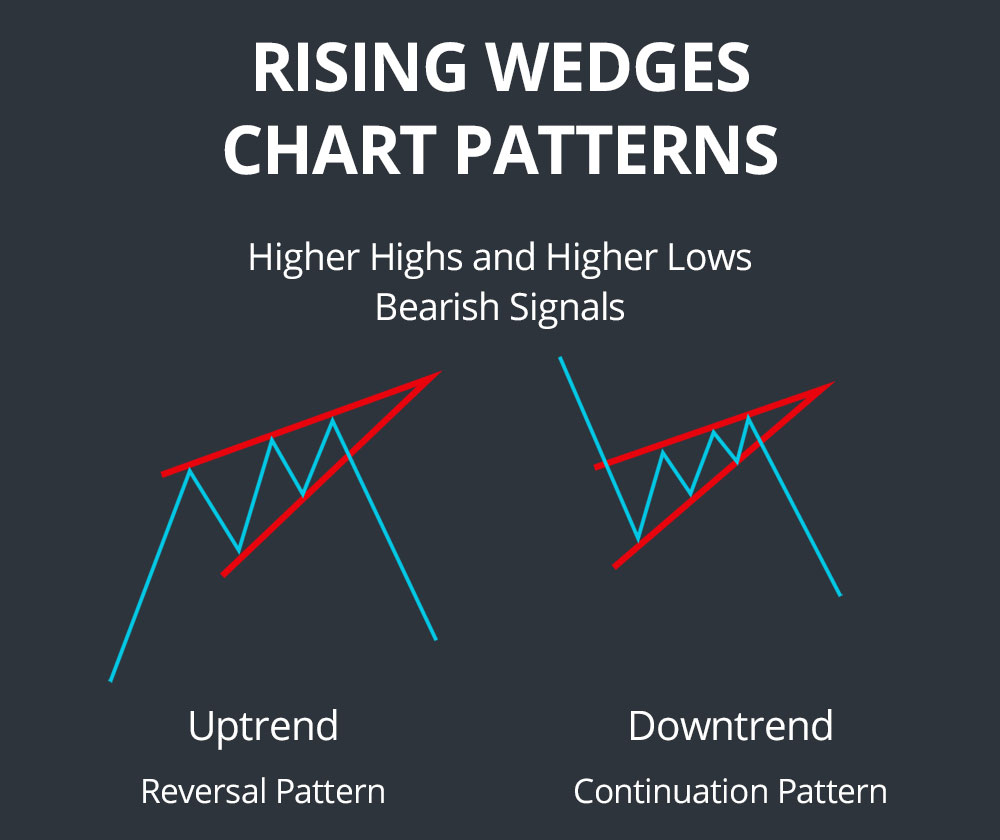

The rising wedge is a technical chart sample that usually alerts a bearish reversal. Characterised by converging upward-sloping trendlines, it suggests a weakening uptrend and a possible shift in the direction of downward momentum. Whereas not a foolproof predictor, understanding the rising wedge’s formation, interpretation, and implications can considerably improve a dealer’s capability to anticipate market turns and handle danger successfully. This text will delve deep into the rising wedge, exploring its traits, identification strategies, affirmation methods, and sensible buying and selling functions.

Understanding the Formation of a Rising Wedge

A rising wedge is fashioned by two converging upward-sloping trendlines. The higher trendline connects a sequence of upper highs, whereas the decrease trendline connects a sequence of upper lows. This creates a wedge form that narrows as the worth motion progresses. The important thing attribute differentiating it from different wedge patterns is the upward slope of each trendlines; this upward inclination signifies a weakening shopping for strain regardless of the general upward worth motion.

The formation usually develops inside a longtime uptrend, suggesting a possible exhaustion of the bullish momentum. As the worth fluctuates throughout the more and more constricted wedge, the vary of worth motion decreases, indicating indecision and a lack of conviction amongst patrons. This narrowing worth vary is an important indicator of the sample’s improvement and potential bearish implications.

Figuring out a Rising Wedge: Key Traits and Concerns

Figuring out a rising wedge requires cautious commentary and an understanding of its defining options:

-

Converging Upward Trendlines: Probably the most essential factor is the presence of two upward-sloping trendlines converging in the direction of one another. These trendlines must be comparatively parallel, with a constant slope. The nearer the trendlines get, the stronger the bearish sign.

-

Larger Highs and Larger Lows (however diminishing good points): Whereas the worth makes larger highs and better lows, the magnitude of those strikes diminishes over time. The good points turn into progressively smaller, indicating weakening bullish momentum. This shrinking amplitude is a key indicator of the sample’s bearish potential.

-

Lowering Quantity: Typically, a rising wedge is accompanied by lowering buying and selling quantity. This means dwindling participation from patrons and a possible lack of curiosity within the asset. Decreased quantity confirms the weakening bullish strain and strengthens the bearish sign. Nevertheless, it is necessary to notice that quantity will not be at all times a definitive indicator and must be thought-about alongside different elements.

-

Timeframe Concerns: Rising wedges can type on numerous timeframes, from short-term intraday charts to long-term weekly or month-to-month charts. The timeframe influences the potential length and magnitude of the following worth motion. A rising wedge fashioned on a each day chart, for instance, would possibly recommend a medium-term bearish reversal, whereas one fashioned on a weekly chart might suggest a longer-term downtrend.

-

False Breakouts: It is essential to concentrate on the opportunity of false breakouts. The worth would possibly break above the higher trendline, making a false sense of bullish continuation earlier than reversing sharply downwards. Subsequently, confirming the breakout with further indicators and ready for a transparent worth reversal is important to keep away from untimely entries.

Affirmation Methods and Danger Administration

Whereas the rising wedge sample itself suggests a bearish reversal, confirming the sign with further indicators strengthens the buying and selling setup and reduces danger. Some widespread affirmation methods embrace:

-

Quantity Affirmation: A big lower in quantity throughout the breakout beneath the decrease trendline offers sturdy affirmation of the bearish sign. This means an absence of shopping for help and strengthens the chance of a sustained downtrend.

-

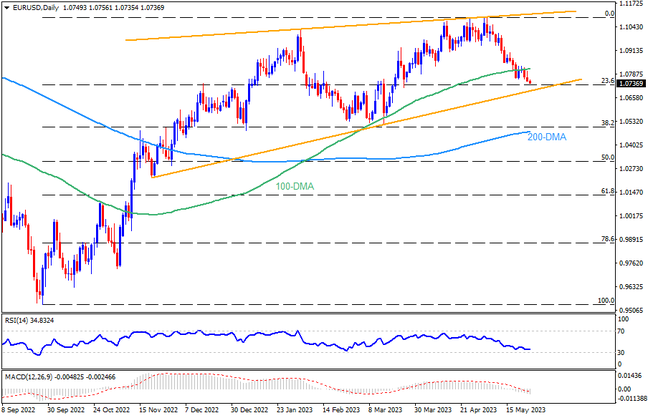

Technical Indicators: Indicators just like the Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), and Stochastic Oscillator can present further affirmation. These indicators ought to ideally present bearish divergence, the place the worth makes larger highs, however the indicator fails to make corresponding larger highs. This divergence alerts weakening momentum and elevated bearish strain.

-

Value Motion Affirmation: A decisive break beneath the decrease trendline, accompanied by elevated promoting quantity and a transparent reversal candlestick sample (e.g., a bearish engulfing sample or a capturing star), offers sturdy affirmation of the sample’s validity.

-

Help and Resistance Ranges: Figuring out key help and resistance ranges can assist decide potential worth targets after the breakout. The decrease trendline itself usually acts as resistance after the breakout, whereas earlier help ranges can turn into potential worth targets for the downtrend.

Danger Administration is paramount: At all times use stop-loss orders to restrict potential losses. A stop-loss order must be positioned barely beneath the decrease trendline to attenuate danger in case the breakout fails or the sample proves to be a false sign. Correct place sizing can be essential to handle danger successfully.

Buying and selling Methods and Value Targets

As soon as a rising wedge sample is confirmed, a number of buying and selling methods may be employed:

-

Brief Promoting: The commonest technique is to quick promote the asset upon a confirmed breakout beneath the decrease trendline. This entails borrowing the asset and promoting it, hoping to purchase it again at a cheaper price sooner or later.

-

Cease-Loss Orders: A vital facet of any buying and selling technique is the location of stop-loss orders to restrict potential losses. For a brief place, the stop-loss order must be positioned barely above the higher trendline or at a current swing excessive.

-

Revenue Targets: Potential revenue targets may be decided utilizing numerous strategies, reminiscent of measuring the peak of the wedge and projecting it downwards from the breakout level. Different potential targets embrace earlier help ranges or Fibonacci retracement ranges.

-

Trailing Cease-Loss: As the worth strikes downwards, a trailing stop-loss order can be utilized to guard income and lock in good points. This entails transferring the stop-loss order upwards as the worth strikes in your favor.

Limitations and Concerns

It is essential to do not forget that the rising wedge, like all technical sample, will not be a assured predictor of future worth actions. False breakouts can happen, and different market elements can affect the worth motion. Subsequently, it is important to mix the rising wedge sample with different types of evaluation, reminiscent of basic evaluation and danger administration strategies, to enhance buying and selling choices.

Moreover, the accuracy of the sample’s prediction is dependent upon a number of elements, together with the readability of the trendlines, the amount affirmation, and the general market context. A poorly outlined sample or an absence of affirmation alerts might result in inaccurate predictions and potential losses.

Conclusion

The rising wedge is a worthwhile technical chart sample that may sign a possible bearish reversal. By understanding its formation, traits, and affirmation methods, merchants can improve their capability to anticipate market turns and handle danger successfully. Nevertheless, it is essential to do not forget that the rising wedge will not be a foolproof predictor, and it must be used at the side of different types of evaluation and danger administration strategies to make knowledgeable buying and selling choices. Combining technical evaluation with basic evaluation and a sturdy danger administration plan is important for achievement in any market setting. At all times do not forget that buying and selling entails inherent danger, and losses are a chance. Thorough analysis, steady studying, and disciplined danger administration are important for long-term success in buying and selling.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Rising Wedge: A Complete Information to This Bearish Chart Sample. We respect your consideration to our article. See you in our subsequent article!