Decoding The Rising Wedge: A Complete Information To This Bearish Chart Sample

Decoding the Rising Wedge: A Complete Information to this Bearish Chart Sample

Associated Articles: Decoding the Rising Wedge: A Complete Information to this Bearish Chart Sample

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Rising Wedge: A Complete Information to this Bearish Chart Sample. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Rising Wedge: A Complete Information to this Bearish Chart Sample

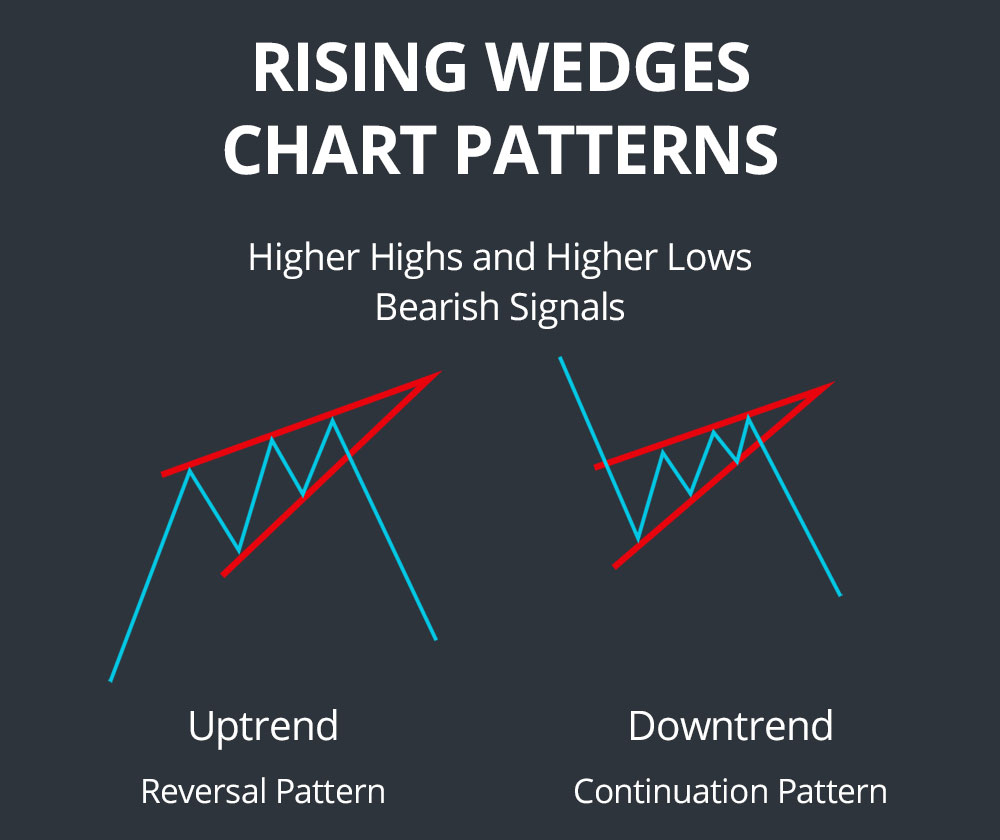

The rising wedge, a deceptively simple-looking chart sample, holds important weight in technical evaluation. Whereas its upward sloping strains may initially recommend bullish momentum, it is truly thought of a bearish reversal sample, indicating a possible shift from an uptrend to a downtrend. Understanding its formation, traits, and implications is essential for merchants in search of to navigate market volatility and make knowledgeable choices. This text delves deep into the rising wedge, exploring its intricacies and offering sensible methods for its identification and software.

Understanding the Formation of a Rising Wedge

A rising wedge is characterised by two converging upward-sloping trendlines. The higher trendline connects a collection of upper highs, whereas the decrease trendline connects a collection of upper lows. This creates a wedge form that narrows as the value motion progresses. The essential factor is the convergence; the strains are usually not parallel however steadily method one another, indicating diminishing worth volatility and a possible lack of bullish momentum.

The formation sometimes happens inside a longtime uptrend or after a major worth enhance. This makes its look notably important, because it suggests a possible exhaustion of the shopping for strain that fueled the earlier upward motion. The narrowing worth vary displays a battle between consumers and sellers, with sellers steadily gaining the higher hand.

Key Traits of a Rising Wedge Sample:

A number of key traits assist distinguish a rising wedge from different chart patterns:

-

Converging Trendlines: Probably the most defining characteristic is the upward slope of each trendlines, converging in the direction of some extent sooner or later. This convergence is the first indicator of weakening momentum.

-

Larger Highs and Larger Lows: Whereas the highs and lows are rising, the gap between them is shrinking. This reducing vary signifies the dwindling power behind the uptrend.

-

Lowering Quantity: Sometimes, a rising wedge is accompanied by reducing buying and selling quantity. This confirms the lack of momentum as fewer merchants are collaborating within the worth motion. This reducing quantity usually turns into extra pronounced because the sample nears its apex.

-

Timeframe Dependence: The time it takes for a rising wedge to kind can differ considerably, starting from days to weeks, months, and even years, relying on the asset and timeframe being analyzed. A shorter-term wedge may point out a short lived correction, whereas a longer-term sample suggests a extra important reversal.

-

Breakout Affirmation: Affirmation of the sample is often noticed when the value breaks beneath the decrease trendline. This breakout ought to ideally be accompanied by elevated buying and selling quantity, reinforcing the bearish sign.

Differentiating the Rising Wedge from Different Patterns:

It is essential to distinguish the rising wedge from comparable patterns to keep away from misinterpretations. For instance:

-

Ascending Triangle: Whereas each patterns contain upward-sloping trendlines, the ascending triangle contains a flat horizontal decrease trendline, whereas the rising wedge has an upward-sloping decrease trendline.

-

Symmetrical Triangle: The symmetrical triangle has converging trendlines, however they slope in reverse instructions, making a symmetrical form, in contrast to the rising wedge’s upward slope.

-

Flag Sample: Flag patterns are characterised by a short interval of consolidation inside a bigger pattern, usually with parallel trendlines. The rising wedge, however, reveals a converging sample indicating weakening momentum.

Buying and selling Methods for the Rising Wedge:

The rising wedge sample presents alternatives for each brief and lengthy positions, relying on the dealer’s threat tolerance and market outlook.

Quick Promoting Technique:

The commonest buying and selling technique employed with a rising wedge is brief promoting. The sample suggests a excessive likelihood of a worth drop as soon as the decrease trendline is damaged. Merchants can enter a brief place close to the decrease trendline, anticipating the breakout. A stop-loss order must be positioned above the higher trendline to restrict potential losses if the value unexpectedly reverses. The revenue goal will be set primarily based on the sample’s top, projected utilizing the gap between the higher and decrease trendlines.

Lengthy Place (Counter-Development Technique):

Whereas much less frequent, a protracted place will be thought of if the dealer believes the breakout beneath the decrease trendline is a short lived correction inside a bigger uptrend. This can be a higher-risk technique, requiring a eager understanding of market dynamics and a cautious evaluation of the general market context. Strict threat administration is crucial in such eventualities.

Threat Administration and Issues:

Buying and selling primarily based on chart patterns at all times entails threat. The rising wedge is not any exception. A number of elements must be thought of:

-

Quantity Affirmation: A breakout beneath the decrease trendline ought to ideally be accompanied by elevated quantity to substantiate the bearish sign. Low quantity breakouts will be false alerts.

-

Market Context: Analyzing the broader market circumstances is essential. A rising wedge in a strongly bullish market won’t result in a major worth drop.

-

False Breakouts: Costs can generally briefly break beneath the decrease trendline earlier than reversing. Merchants must be cautious of such false breakouts and think about using trailing stop-losses to guard income.

-

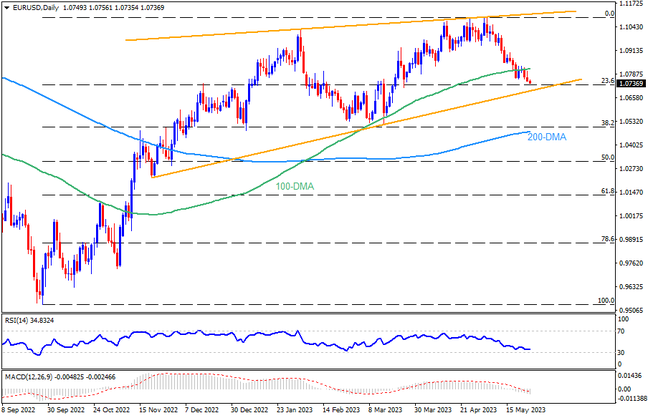

Affirmation with different Indicators: Combining the rising wedge sample with different technical indicators, equivalent to shifting averages, RSI, or MACD, can present stronger affirmation alerts and enhance buying and selling accuracy.

Sensible Instance:

Let’s think about a hypothetical situation. Think about the inventory of Firm X has been in an uptrend, however lately fashioned a rising wedge. The higher trendline connects larger highs, whereas the decrease trendline connects larger lows. The gap between the strains is steadily reducing, and buying and selling quantity can be declining. If the value breaks beneath the decrease trendline with elevated quantity, it confirms the bearish sign. A dealer may then enter a brief place, setting a stop-loss above the higher trendline and a revenue goal primarily based on the sample’s top.

Conclusion:

The rising wedge is a worthwhile instrument in a technical analyst’s arsenal. Whereas its upward sloping strains may initially appear bullish, its converging nature and reducing quantity usually point out weakening momentum and a possible bearish reversal. By understanding its formation, traits, and buying and selling implications, merchants can enhance their decision-making course of and handle threat successfully. Nonetheless, it is essential to do not forget that no chart sample ensures success. Combining the rising wedge evaluation with different technical indicators and a radical understanding of market context is essential for maximizing the possibilities of worthwhile trades. All the time follow diligent threat administration to mitigate potential losses.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Rising Wedge: A Complete Information to this Bearish Chart Sample. We recognize your consideration to our article. See you in our subsequent article!