Decoding The Rollercoaster: A Complete Evaluation Of Month-to-month Fuel Costs

Decoding the Rollercoaster: A Complete Evaluation of Month-to-month Fuel Costs

Associated Articles: Decoding the Rollercoaster: A Complete Evaluation of Month-to-month Fuel Costs

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Rollercoaster: A Complete Evaluation of Month-to-month Fuel Costs. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Decoding the Rollercoaster: A Complete Evaluation of Month-to-month Fuel Costs

The value of gasoline, a ubiquitous commodity influencing on a regular basis life, is a dynamic entity topic to a fancy interaction of worldwide and native elements. Understanding these value fluctuations is essential for customers, companies, and policymakers alike. This text delves into the intricacies of month-to-month fuel value charts, analyzing historic traits, figuring out key influencing elements, and exploring potential future situations. We’ll study the info by means of a multifaceted lens, contemplating geopolitical occasions, financial circumstances, differences due to the season, and technological developments.

A Historic Perspective: Charting the Ups and Downs

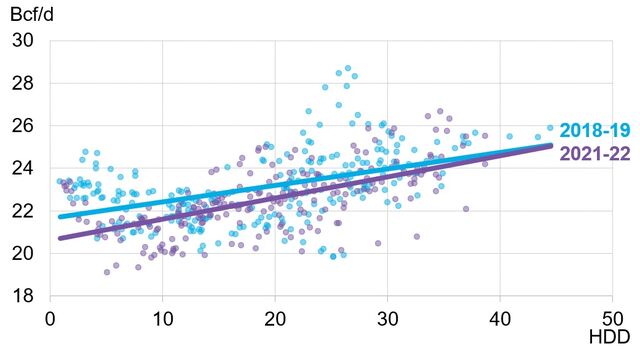

Making a complete month-to-month fuel value chart requires accessing dependable historic knowledge, ideally from a good supply such because the U.S. Power Data Administration (EIA) or comparable organizations for different nations. These charts usually show the common value per gallon (or equal unit) over a specified interval, typically visualized as a line graph. Analyzing such a chart reveals a number of recurring patterns:

-

Seasonal Fluctuations: Fuel costs typically exhibit differences due to the season, usually rising throughout the summer time driving season (as a consequence of elevated demand) and falling throughout the colder months. This can be a constant development noticed throughout many areas. The extent of those fluctuations can range relying on elements like local weather and regional tourism patterns.

-

Financial Cycles: Financial booms typically correlate with greater fuel costs, as elevated financial exercise interprets into greater demand. Conversely, financial downturns can result in decrease costs as a consequence of lowered consumption. Recessions, for instance, usually witness a short lived dip in fuel costs.

-

Geopolitical Occasions: International occasions, notably these impacting oil manufacturing and distribution, exert a big affect on fuel costs. Political instability in oil-producing areas, wars, sanctions, and disruptions to provide chains can result in dramatic value spikes. The 1973 oil disaster and the 2022 Russian invasion of Ukraine function stark examples of this phenomenon.

-

Technological Developments: Technological enhancements in oil extraction (e.g., fracking) and refining processes can impression fuel costs. Elevated effectivity in extraction can doubtlessly result in decrease costs, whereas technological setbacks can have the other impact.

-

Refining Capability and Distribution: The capability of refineries to course of crude oil into gasoline and the effectivity of the distribution community additionally play a job. Bottlenecks or disruptions in these areas can result in localized and even widespread value will increase.

Key Components Influencing Month-to-month Fuel Value Charts:

A number of elements contribute to the month-to-month fluctuations noticed in fuel value charts:

-

Crude Oil Costs: The value of crude oil is essentially the most important determinant of gasoline costs. Crude oil is the uncooked materials from which gasoline is produced, and its value immediately impacts the price of refining and distribution. International crude oil costs are influenced by provide and demand dynamics within the worldwide market. OPEC (Group of the Petroleum Exporting International locations) performs an important position in regulating world oil provide, and its choices considerably impression costs.

-

Refining Prices: The price of refining crude oil into gasoline includes power consumption, labor prices, and upkeep bills. These prices are handed on to customers, influencing the ultimate value on the pump. Modifications in refining capability and technological developments can have an effect on these prices.

-

Taxes and Laws: Governments impose numerous taxes and laws on gasoline, contributing to the ultimate value. These taxes can range considerably between nations and even inside totally different areas of the identical nation. Environmental laws additionally impression refining processes and might affect prices.

-

Distribution and Advertising and marketing Prices: The price of transporting gasoline from refineries to fuel stations, together with trucking, pipeline transportation, and storage, contributes to the ultimate value. Advertising and marketing and branding prices additionally play a job.

-

Hypothesis and Market Sentiment: Futures markets for oil and gasoline enable for hypothesis, which may affect costs. Market sentiment, pushed by information and occasions, can result in value volatility, impartial of underlying provide and demand fundamentals.

Analyzing Month-to-month Fuel Value Charts: A Sensible Strategy

To successfully analyze month-to-month fuel value charts, think about the next steps:

-

Determine the Knowledge Supply: Guarantee the info comes from a reputable and dependable supply, reminiscent of authorities businesses or established power market knowledge suppliers.

-

Take into account the Timeframe: Analyze the info over a sufficiently lengthy interval to determine traits and patterns. Quick-term fluctuations will be deceptive with out contemplating the broader context.

-

Account for Exterior Components: Correlate the worth actions with important world occasions, financial indicators, and seasonal adjustments to know the underlying drivers.

-

Examine with Different Knowledge: Examine the fuel value knowledge with different related financial indicators, reminiscent of inflation, unemployment charges, and shopper spending, to achieve a extra complete perspective.

-

Search for Correlations: Determine any correlations between fuel costs and different elements, reminiscent of crude oil costs, change charges, or geopolitical occasions.

Predicting Future Fuel Costs: A Advanced Enterprise

Predicting future fuel costs is a difficult job as a result of complexity and volatility of the elements concerned. Whereas refined econometric fashions can be utilized to forecast costs, they’re inherently restricted by the unpredictable nature of worldwide occasions and market sentiment. Nevertheless, by rigorously analyzing historic traits and contemplating present market circumstances, one can develop knowledgeable estimations. Key elements to think about for future predictions embody:

-

International Oil Provide and Demand: Forecasts of worldwide oil manufacturing and consumption are essential for predicting future costs. Components reminiscent of OPEC insurance policies, technological developments, and financial development will play a big position.

-

Geopolitical Stability: Political stability in oil-producing areas is a key issue. Any geopolitical instability or disruptions to provide chains can result in important value will increase.

-

Financial Progress: Robust financial development usually results in greater power demand and consequently greater fuel costs.

-

Technological Improvements: Advances in renewable power applied sciences may doubtlessly cut back reliance on fossil fuels, impacting future fuel costs.

-

Authorities Insurance policies: Authorities insurance policies associated to power manufacturing, taxation, and environmental laws may affect future fuel costs.

Conclusion:

Month-to-month fuel value charts supply a helpful window into the complicated dynamics of the power market. By understanding the historic traits, key influencing elements, and potential future situations, customers, companies, and policymakers could make extra knowledgeable choices. Whereas predicting future costs with full accuracy stays difficult, an intensive evaluation of historic knowledge and a consideration of present market circumstances can present helpful insights for navigating the ever-changing panorama of gasoline costs. Steady monitoring of those charts, coupled with a eager consciousness of worldwide occasions and financial indicators, is important for understanding and responding to fluctuations on this very important commodity.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Rollercoaster: A Complete Evaluation of Month-to-month Fuel Costs. We respect your consideration to our article. See you in our subsequent article!