Decoding The Scrap Copper Value Chart: A Complete Information

Decoding the Scrap Copper Value Chart: A Complete Information

Associated Articles: Decoding the Scrap Copper Value Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Scrap Copper Value Chart: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Scrap Copper Value Chart: A Complete Information

Copper, a reddish-brown metallic prized for its conductivity and malleability, performs a vital function in fashionable life. From electrical wiring and plumbing to electronics and vehicles, its purposes are ubiquitous. Consequently, the value of copper, significantly scrap copper, fluctuates considerably, influenced by a fancy interaction of world financial elements, provide chain dynamics, and technological developments. Understanding the scrap copper value chart requires navigating these intricacies. This text delves deep into the elements influencing scrap copper costs, offers insights into deciphering value charts, and discusses the implications for numerous stakeholders.

Understanding the Fundamentals: What Drives Scrap Copper Costs?

The scrap copper market is intrinsically linked to the first copper market, however with its personal distinctive traits. Whereas major copper is extracted from ore, scrap copper originates from recycled supplies, providing a extra sustainable and infrequently cost-effective different. A number of key elements affect the value of scrap copper:

-

World Financial Progress: A sturdy world financial system sometimes interprets to greater demand for copper throughout numerous sectors. Development, manufacturing, and infrastructure improvement all devour vital portions of copper, driving up costs for each major and scrap supplies. Recessions, however, result in decreased demand and decrease costs.

-

Industrial Manufacturing: Particular industrial sectors closely reliant on copper, like electronics and automotive manufacturing, exert vital affect. Elevated manufacturing in these sectors boosts copper demand, whereas slowdowns result in decreased consumption and value fluctuations.

-

Provide and Demand Dynamics: The elemental precept of provide and demand governs copper costs. Shortages in provide, whether or not resulting from disruptions in mining operations, geopolitical instability, or decreased recycling charges, can push costs upwards. Conversely, an oversupply can result in value declines.

-

Stock Ranges: The quantity of copper held in warehouses and inventories impacts costs. Excessive stock ranges usually counsel weaker demand, probably main to cost reductions. Low stock ranges, nevertheless, can sign tight provide and drive costs greater.

-

Forex Fluctuations: Copper is traded globally, primarily in US {dollars}. Fluctuations in trade charges can have an effect on the value of copper for patrons and sellers in several international locations. A stronger US greenback could make copper costlier for patrons utilizing different currencies.

-

Geopolitical Occasions: Political instability, commerce wars, and sanctions in copper-producing or consuming areas can disrupt provide chains and considerably impression costs. Any occasion impacting main copper-producing international locations like Chile, Peru, or the Democratic Republic of Congo may cause volatility.

-

Technological Developments: Technological improvements can affect each demand and provide. The event of extra environment friendly copper extraction strategies can improve provide, probably reducing costs. Conversely, new purposes for copper in rising applied sciences can enhance demand and improve costs.

-

Recycling Charges: The quantity of copper efficiently recycled straight impacts the provision of scrap copper. Increased recycling charges can alleviate strain on major copper manufacturing and probably average value will increase. Nevertheless, fluctuating scrap metallic assortment and processing effectivity can create inconsistencies in provide.

-

Hypothesis and Funding: Copper can be a commodity traded on futures markets, making it prone to hypothesis and funding actions. Massive-scale shopping for or promoting based mostly on market predictions can create vital value volatility, even within the absence of elementary shifts in provide and demand.

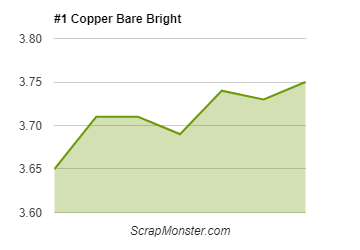

Deciphering the Scrap Copper Value Chart: A Visible Information

Analyzing a scrap copper value chart requires understanding a number of key features:

-

Value Axis: The vertical axis represents the value of scrap copper, sometimes expressed in US {dollars} per pound or tonne.

-

Time Axis: The horizontal axis represents time, sometimes displayed in days, weeks, months, or years.

-

Value Traits: Determine main traits comparable to upward traits (bullish), downward traits (bearish), and sideways or consolidation intervals.

-

Help and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt by way of. Help ranges characterize costs the place shopping for strain is robust, whereas resistance ranges characterize costs the place promoting strain is robust. Breaks above resistance or under assist can sign vital value actions.

-

Shifting Averages: These are calculated averages of costs over a selected interval (e.g., 50-day, 200-day shifting common). They clean out value fluctuations and assist determine the general pattern. Crossovers between shifting averages can be utilized as buying and selling alerts.

-

Quantity: The quantity of scrap copper traded is commonly displayed alongside the value chart. Excessive quantity throughout value actions confirms the power of the pattern, whereas low quantity suggests weaker momentum.

-

Indicators: Technical indicators, comparable to Relative Energy Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands, can present extra insights into value momentum, potential reversals, and overbought/oversold situations. Nevertheless, these indicators must be used along with elementary evaluation.

Implications for Stakeholders:

Understanding scrap copper value charts has vital implications for numerous stakeholders:

-

Scrap Steel Sellers: They should precisely predict value actions to optimize shopping for and promoting methods, maximizing income whereas managing stock threat.

-

Recycling Corporations: Value fluctuations straight impression their profitability. Correct value forecasting is essential for environment friendly operations and funding choices.

-

Producers: Fluctuating copper costs have an effect on their manufacturing prices. Hedging methods and long-term contracts may also help mitigate value dangers.

-

Buyers: Copper costs is usually a vital think about funding choices, significantly in commodities and associated ETFs. Understanding value drivers and technical evaluation is essential for profitable funding.

-

Governments and Policymakers: Copper value volatility can impression financial development and nationwide safety. Insurance policies associated to mining, recycling, and commerce can affect the copper market.

Conclusion:

The scrap copper value chart is a dynamic illustration of a fancy market influenced by quite a few elements. Understanding these elements, mastering chart evaluation methods, and using acceptable threat administration methods are important for navigating the complexities of this important commodity market. By fastidiously analyzing value traits, figuring out key assist and resistance ranges, and contemplating each elementary and technical indicators, stakeholders could make knowledgeable choices and successfully handle the dangers related to fluctuating scrap copper costs. Steady monitoring of world financial situations, geopolitical occasions, and technological developments is essential for correct value forecasting and profitable participation on this ever-evolving market.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Scrap Copper Value Chart: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!