Decoding The Inventory Market Cycle: A Complete Information To Charts And Indicators

Decoding the Inventory Market Cycle: A Complete Information to Charts and Indicators

Associated Articles: Decoding the Inventory Market Cycle: A Complete Information to Charts and Indicators

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Inventory Market Cycle: A Complete Information to Charts and Indicators. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Inventory Market Cycle: A Complete Information to Charts and Indicators

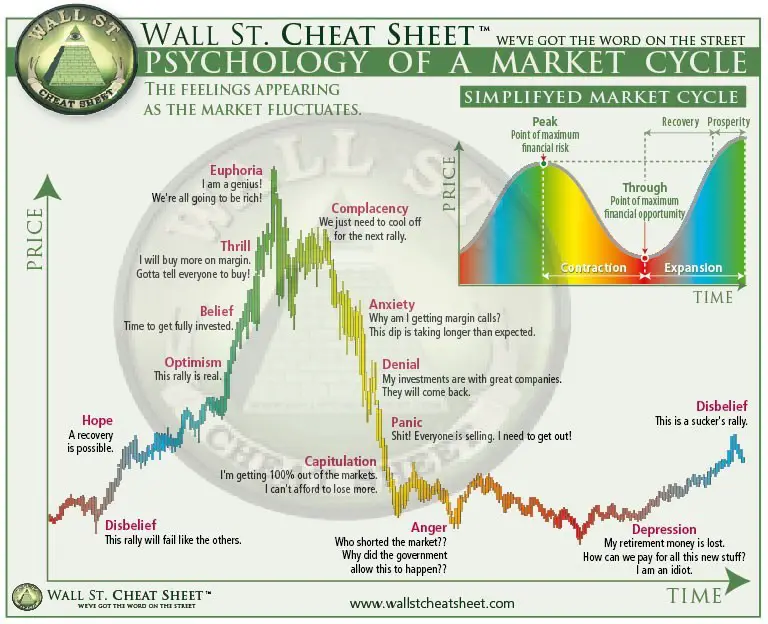

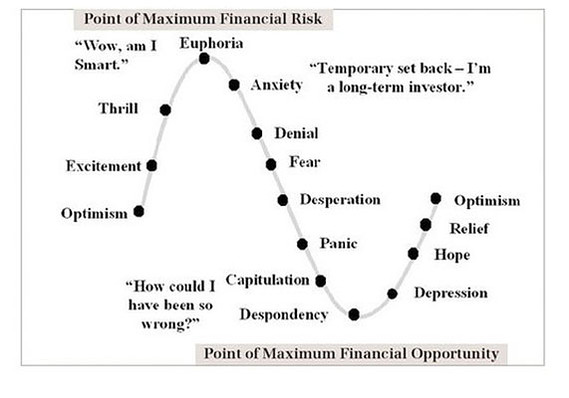

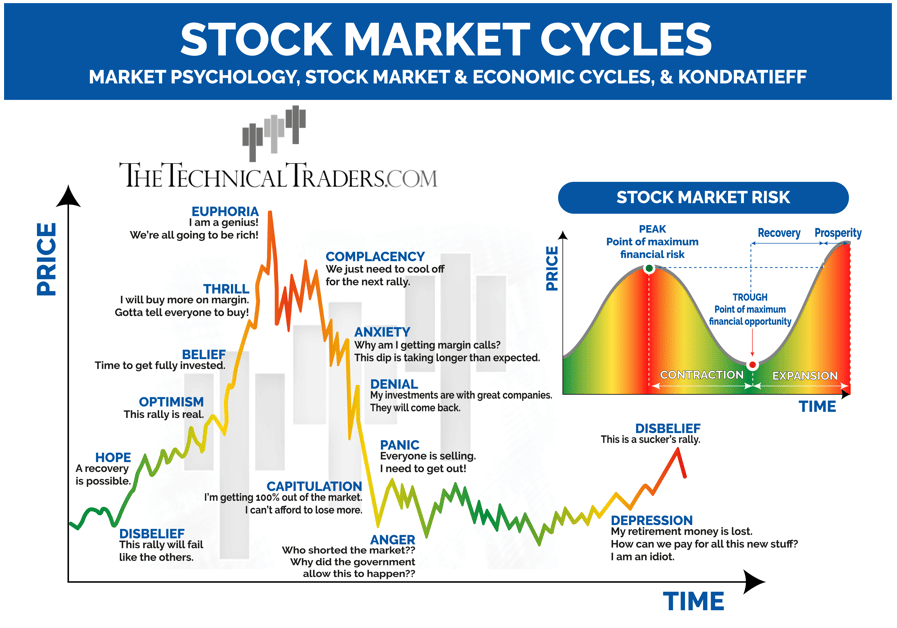

The inventory market, a fancy ecosystem pushed by investor sentiment, financial indicators, and unexpected occasions, operates in cyclical patterns. Understanding these cycles is essential for traders aiming to navigate the market successfully and maximize returns. Whereas predicting the precise timing of market peaks and troughs stays elusive, analyzing historic knowledge via numerous charts and indicators supplies useful insights into the present market section and potential future traits. This text delves into the intricacies of inventory market cycle charts, exploring their building, interpretation, and limitations.

The 4 Phases of the Typical Inventory Market Cycle:

The inventory market cycle is usually depicted as a four-stage course of:

-

Enlargement: This section is characterised by rising costs, growing investor confidence, and robust financial progress. Companies thrive, earnings soar, and employment charges are excessive. The market is bullish, and traders are optimistic about future returns. This stage can final for a number of years, fueled by optimistic financial momentum and growing investor participation.

-

Peak: The height represents the end result of the growth section. Costs attain their highest level earlier than the inevitable downturn. At this stage, valuations change into stretched, hypothesis runs rampant, and indicators of financial overheating change into obvious (e.g., inflation, rising rates of interest). Whereas figuring out the precise peak in real-time is tough, retrospective evaluation usually reveals indicators of overvaluation, comparable to excessive price-to-earnings (P/E) ratios and extreme market optimism.

-

Contraction (or Recession): This stage marks the start of the decline. Costs fall as investor confidence erodes, financial progress slows, and companies face challenges. This section might be characterised by elevated volatility, widespread promoting strain, and doubtlessly important losses for traders. The size and severity of the contraction fluctuate relying on the underlying financial elements and the magnitude of the previous growth.

-

Trough: The trough represents the bottom level within the cycle. Costs have bottomed out, and whereas pessimism should prevail, the market begins to point out indicators of stabilization. This section usually presents engaging shopping for alternatives for long-term traders, as asset costs are considerably discounted. Nonetheless, figuring out the true backside in real-time stays a problem.

Charting the Cycles: Varied Approaches

A number of charting strategies are employed to visualise and analyze inventory market cycles. These embrace:

-

Easy Line Charts: These charts plot the worth of a particular index (e.g., S&P 500, Dow Jones Industrial Common) over time. Whereas easy, they supply a transparent visible illustration of value actions and might spotlight main peaks and troughs. Nonetheless, they lack the nuanced data offered by extra subtle charts.

-

Candlestick Charts: These charts provide a extra detailed view of value motion, incorporating open, excessive, low, and shutting costs for every interval (e.g., day by day, weekly). The visible illustration of those knowledge factors permits for a greater understanding of the market’s sentiment and momentum throughout particular intervals. Candlestick patterns, comparable to dojis, hammers, and engulfing patterns, can present insights into potential development reversals.

-

Level and Determine Charts: These charts focus solely on value adjustments, ignoring time. They use Xs and Os to symbolize value will increase and reduces, respectively, and are useful for figuring out assist and resistance ranges, in addition to potential development adjustments. Their time-agnostic nature permits for a clearer identification of great value actions regardless of the timeframe.

-

Cycle Charts: These charts purpose to determine repeating patterns in value actions over longer intervals. They make use of numerous mathematical strategies, comparable to Fourier evaluation, to decompose value knowledge into cyclical elements. Whereas doubtlessly revealing underlying cyclical patterns, their interpretation might be advanced and requires specialised information.

Indicators for Cycle Evaluation:

Past easy value charts, numerous technical and elementary indicators can assist in figuring out the present section of the market cycle:

-

Shifting Averages: These indicators easy out value fluctuations, offering a clearer image of the underlying development. The connection between completely different transferring averages (e.g., 50-day and 200-day) can sign potential purchase or promote indicators. A bullish crossover happens when a shorter-term transferring common crosses above a longer-term transferring common, whereas a bearish crossover is the other.

-

Relative Energy Index (RSI): This momentum indicator measures the magnitude of latest value adjustments to judge overbought or oversold circumstances. RSI values above 70 sometimes recommend an overbought market, whereas values under 30 point out an oversold market. These ranges usually are not absolute indicators however quite present clues about potential development reversals.

-

MACD (Shifting Common Convergence Divergence): This indicator compares two transferring averages to determine adjustments in momentum. MACD crossovers and divergence between the MACD line and the worth can present insights into potential development adjustments.

-

Financial Indicators: Elementary indicators, comparable to GDP progress, inflation charges, unemployment figures, and shopper confidence, are essential for understanding the broader financial surroundings and its influence on the inventory market. These indicators may also help to contextualize value actions and predict potential shifts available in the market cycle.

-

Market Breadth: This indicator measures the variety of shares advancing versus declining. A widening divergence between the market index and market breadth can sign potential weak point or power available in the market.

Limitations and Issues:

Whereas charting and indicators present useful instruments for understanding inventory market cycles, it is essential to acknowledge their limitations:

-

No Good Prediction: Market cycles are advanced and influenced by quite a few unpredictable elements. No chart or indicator can assure correct prediction of future market actions.

-

Hindsight Bias: Analyzing previous cycles might be deceptive, because it’s simpler to determine patterns retrospectively than in real-time.

-

Market Sentiment: Investor sentiment performs a vital position in driving market cycles. Worry and greed can amplify value actions, making correct prediction difficult.

-

Black Swan Occasions: Unexpected occasions, comparable to geopolitical crises or pure disasters, can considerably disrupt market cycles and render earlier evaluation irrelevant.

Conclusion:

Understanding inventory market cycles is an important side of profitable investing. By using numerous charting strategies and indicators, traders can acquire useful insights into the present market section and potential future traits. Nonetheless, it is essential to keep in mind that no technique ensures good prediction. A holistic strategy, combining technical evaluation with elementary evaluation and an intensive understanding of the broader financial context, is important for navigating the complexities of the inventory market and making knowledgeable funding choices. Steady studying, adaptation, and danger administration are paramount for long-term success on this dynamic surroundings. Keep in mind to at all times seek the advice of with a certified monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered useful insights into Decoding the Inventory Market Cycle: A Complete Information to Charts and Indicators. We thanks for taking the time to learn this text. See you in our subsequent article!