Decoding The TD 97 Mutual Fund Worth Chart: A Complete Evaluation

Decoding the TD 97 Mutual Fund Worth Chart: A Complete Evaluation

Associated Articles: Decoding the TD 97 Mutual Fund Worth Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the TD 97 Mutual Fund Worth Chart: A Complete Evaluation. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the TD 97 Mutual Fund Worth Chart: A Complete Evaluation

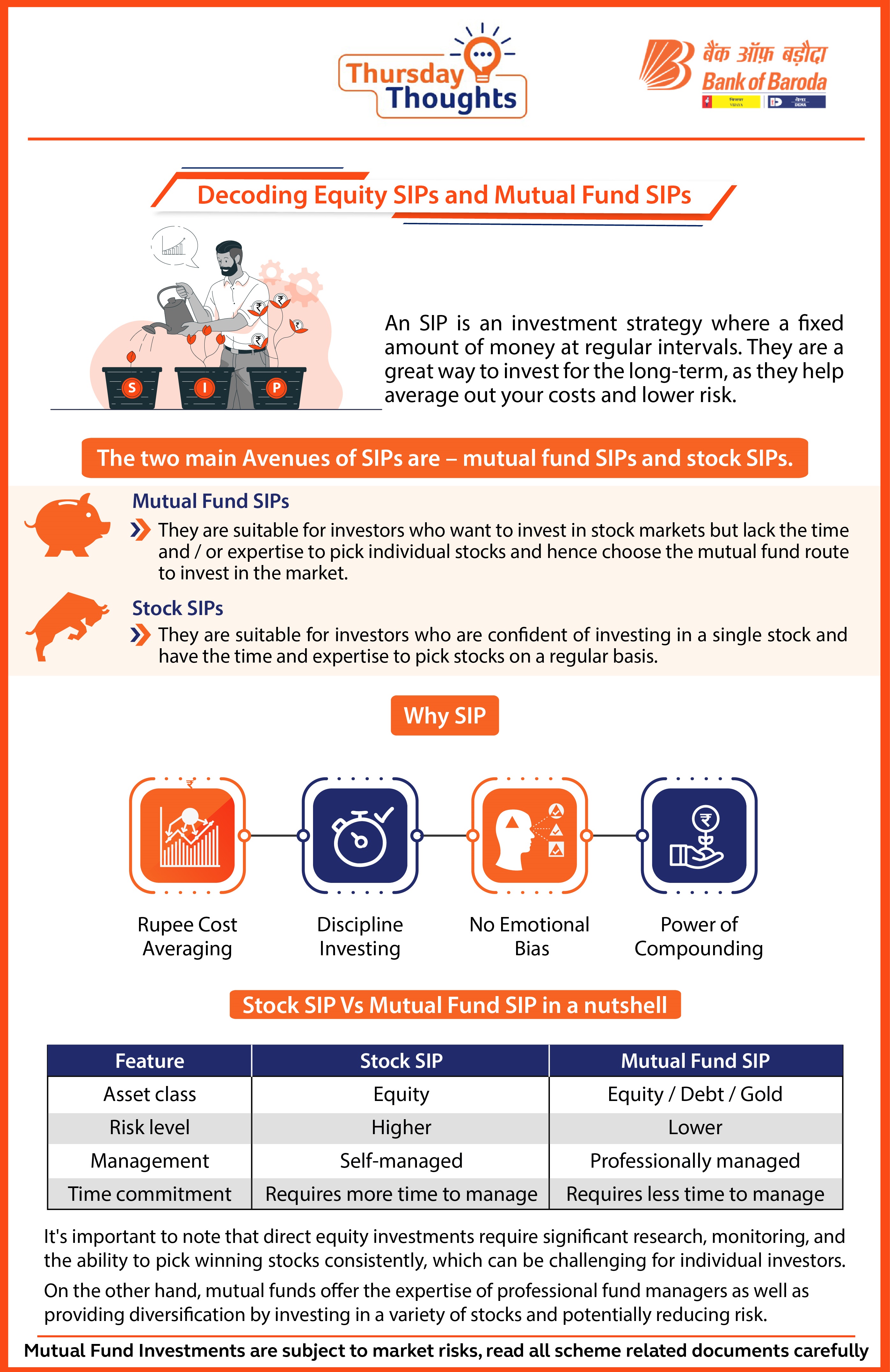

The TD 97 Mutual Fund, whereas not a publicly traded entity with available, always up to date worth charts like a inventory, affords insights into its efficiency by way of varied monetary reporting mechanisms. Understanding its historic efficiency requires analyzing its web asset worth (NAV) over time, usually supplied in periodic statements or by way of the fund firm’s web site. This text will discover easy methods to interpret the knowledge obtainable, discussing the components influencing the TD 97’s NAV, the significance of long-term perspective, and the constraints of relying solely on worth charts (or NAV charts on this case).

Understanding the NAV: The Equal of a Worth Chart

For mutual funds, the NAV acts because the equal of a inventory’s worth. It represents the online worth of the fund’s property minus its liabilities, divided by the variety of excellent shares. A rising NAV signifies that the fund’s investments have grown in worth, whereas a falling NAV signifies a decline. Not like shares traded all through the day, mutual fund NAVs are usually calculated on the finish of every buying and selling day, reflecting the closing costs of the underlying property held throughout the fund.

Subsequently, a "TD 97 Mutual Fund Worth Chart" would truly be a chart depicting the fund’s NAV over time. To assemble such a chart, you would want historic NAV information, which may often be obtained from:

- TD Ameritrade’s web site: If TD 97 is a fund provided by way of TD Ameritrade, their web site ought to present historic NAV information, typically in downloadable codecs like CSV.

- Fund truth sheets and annual reviews: These paperwork, often obtainable on the fund firm’s web site, comprise historic NAV data.

- Monetary information web sites: Some monetary information web sites could supply historic fund information, however make sure the supply is dependable.

Decoding the TD 97 NAV Chart: Key Concerns

After getting the historic NAV information, plotting it on a chart will reveal the fund’s efficiency over time. A number of key elements want consideration when deciphering this chart:

-

Time Horizon: Essentially the most essential aspect is the time horizon. Quick-term fluctuations are regular and might be deceptive. Analyzing the NAV over an extended interval (5, 10, and even 20 years) offers a extra correct image of the fund’s long-term development potential and threat profile. Quick-term dips needs to be seen throughout the context of the general pattern.

-

Benchmark Comparability: To gauge the TD 97’s efficiency successfully, evaluate its NAV chart towards a related benchmark. This may very well be a broad market index (just like the S&P 500 for a US fairness fund), a sector-specific index (if the fund focuses on a specific sector), or the same mutual fund with a comparable funding technique. This comparability reveals whether or not the fund has outperformed, underperformed, or matched its benchmark.

-

Expense Ratio: The expense ratio, a vital issue affecting a fund’s efficiency, needs to be thought-about. A better expense ratio eats into returns, so even when the NAV chart exhibits development, the precise returns to buyers will probably be decrease after accounting for bills. Evaluate the TD 97’s expense ratio to related funds to evaluate its competitiveness.

-

Funding Technique: The TD 97’s funding technique considerably influences its NAV chart. A growth-focused fund will possible exhibit extra volatility than a value-focused fund. Understanding the fund’s underlying holdings (shares, bonds, and so on.) and its funding method helps contextualize the NAV actions. A conservative fund would possibly present slower development but additionally much less volatility.

-

Financial Components: Exterior financial components closely impression mutual fund efficiency. Recessions, rate of interest adjustments, inflation, and geopolitical occasions can all have an effect on the NAV. Understanding the financial local weather throughout completely different durations represented on the chart is important for deciphering the NAV actions precisely.

Limitations of Relying Solely on the NAV Chart

Whereas the NAV chart offers precious data, it is essential to recollect its limitations:

-

Previous efficiency is just not indicative of future outcomes: A historic NAV chart exhibiting sturdy development does not assure future success. Market situations change, and the fund’s administration group may additionally change, impacting future efficiency.

-

Lack of Contextual Info: The NAV chart alone does not present the complete image. It does not present the fund’s threat profile, expense ratio, turnover fee, or the standard of its administration group. These components are essential for making knowledgeable funding choices.

-

Ignoring Qualitative Components: The NAV chart does not seize qualitative components just like the fund supervisor’s experience, the fund’s funding philosophy, or its threat administration practices. These components can considerably impression long-term efficiency.

Past the Chart: A Holistic Method to Funding Evaluation

A complete evaluation of the TD 97 mutual fund requires going past merely trying on the NAV chart. Buyers ought to take into account:

-

Fund Prospectus: The prospectus offers detailed details about the fund’s funding goals, methods, dangers, and bills. It is a essential doc for understanding the fund’s traits.

-

Fund Supervisor’s Monitor Report: Analysis the fund supervisor’s expertise, funding philosophy, and previous efficiency with different funds. A talented and skilled supervisor can considerably impression a fund’s success.

-

Threat Tolerance: Assess your individual threat tolerance earlier than investing in any mutual fund. The TD 97’s historic volatility, as mirrored in its NAV chart, may also help decide if it aligns along with your threat profile.

-

Diversification: Think about how the TD 97 matches into your total funding portfolio. Diversification throughout completely different asset lessons and funds is essential for mitigating threat.

Conclusion:

The TD 97 Mutual Fund’s NAV chart, whereas a precious device, shouldn’t be the only foundation for funding choices. A radical evaluation requires contemplating the fund’s funding technique, expense ratio, threat profile, benchmark efficiency, and the broader financial context. By combining the knowledge gleaned from the NAV chart with a complete understanding of the fund’s traits and your individual funding targets, you can also make a extra knowledgeable and well-reasoned funding resolution. Keep in mind to seek the advice of with a professional monetary advisor earlier than making any funding selections. They may also help you assess your threat tolerance, develop a diversified portfolio, and choose investments that align along with your monetary targets.

Closure

Thus, we hope this text has supplied precious insights into Decoding the TD 97 Mutual Fund Worth Chart: A Complete Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!