Decoding The Tick Chart: A Deep Dive Into Excessive-Frequency Market Knowledge Visualization

Decoding the Tick Chart: A Deep Dive into Excessive-Frequency Market Knowledge Visualization

Associated Articles: Decoding the Tick Chart: A Deep Dive into Excessive-Frequency Market Knowledge Visualization

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Tick Chart: A Deep Dive into Excessive-Frequency Market Knowledge Visualization. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Tick Chart: A Deep Dive into Excessive-Frequency Market Knowledge Visualization

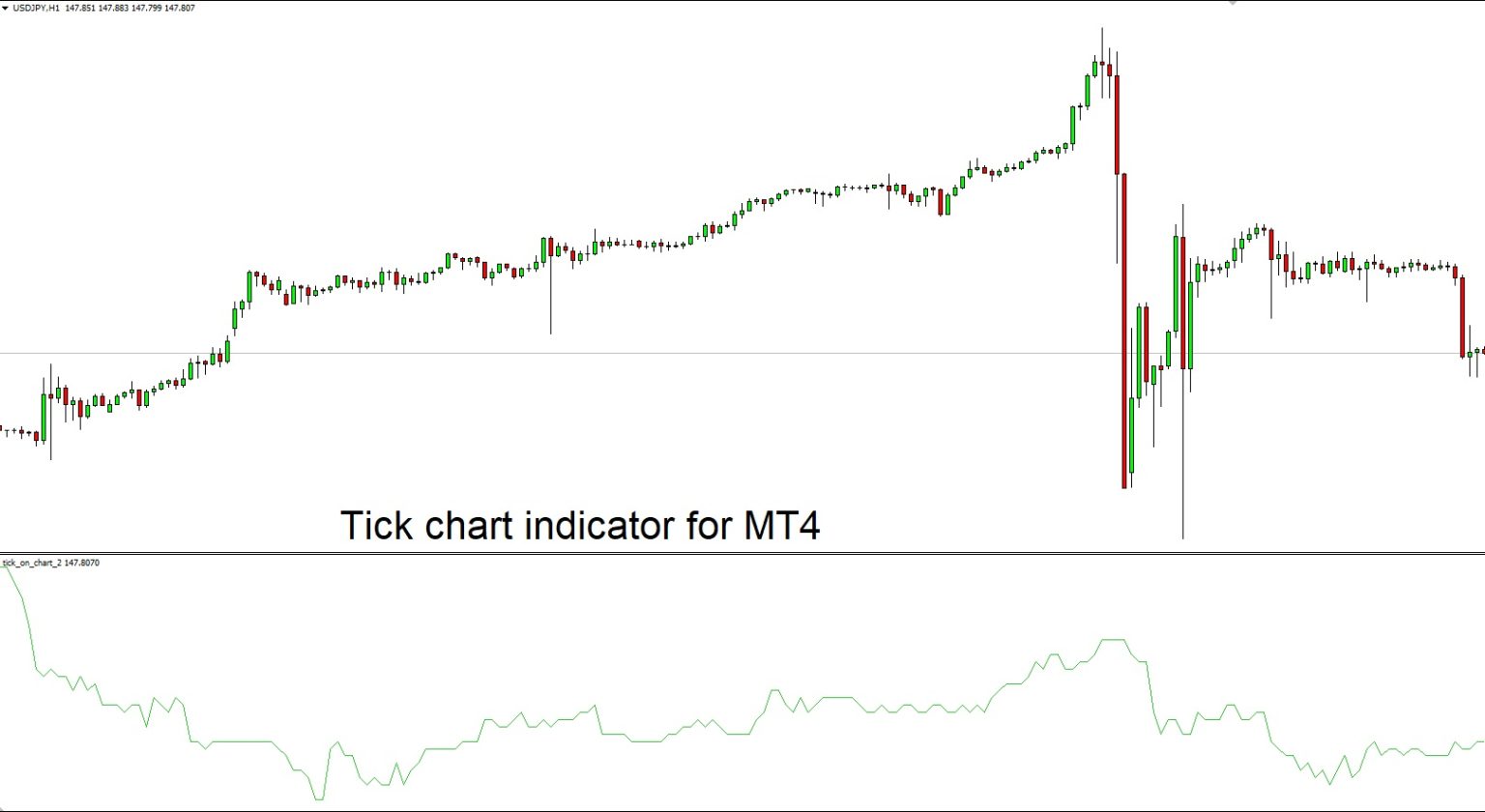

Tick charts, usually neglected in favor of extra conventional candlestick or bar charts, supply a novel perspective on market dynamics. Not like charts that combination value knowledge over particular time intervals (e.g., one-minute, five-minute, or day by day candlesticks), tick charts plot value actions based mostly on the variety of ticks. A tick represents a single commerce or value change – a basic constructing block of market exercise. This granular strategy reveals the underlying pulse of the market, offering insights usually obscured by time-based aggregation. This text will delve into the intricacies of tick charts, exploring their building, benefits, disadvantages, and sensible purposes in buying and selling and market evaluation.

Understanding the Fundamentals: What’s a Tick?

Earlier than diving into tick charts themselves, it is essential to grasp the idea of a "tick." A tick signifies a single change within the value of an asset. This might be a rise or lower, whatever the magnitude. For instance, if the worth of a inventory strikes from $10.00 to $10.01, that is one upward tick. If it then strikes to $10.02, that is one other upward tick. Equally, a transfer from $10.01 to $10.00 represents a downward tick.

The variety of ticks in a given interval displays the buying and selling quantity and volatility. A extremely energetic and risky market will generate many ticks, whereas a quiet market could have fewer. This inherent hyperlink between ticks and market exercise is the cornerstone of tick chart evaluation.

Setting up a Tick Chart: A Tick by Tick Strategy

Not like time-series charts, tick charts haven’t got a set time axis. As an alternative, the horizontal axis represents the cumulative variety of ticks. Every level on the chart represents a particular value stage reached after a sure variety of ticks. The vertical axis, as with different value charts, represents the worth of the asset.

Let’s illustrate with an instance. Suppose we’ve got the next sequence of trades:

- Worth: $10.00 (first tick)

- Worth: $10.02 (second tick)

- Worth: $10.01 (third tick)

- Worth: $10.03 (fourth tick)

- Worth: $10.04 (fifth tick)

- Worth: $10.03 (sixth tick)

A tick chart representing this knowledge would present a collection of factors related by strains. The x-axis would increment by one for every tick, whereas the y-axis would mirror the corresponding value. The chart would visually signify the worth development, tick by tick.

Variations in Tick Chart Building:

Whereas the elemental precept stays the identical, there are variations in how tick charts are constructed:

-

Easy Tick Charts: These are probably the most fundamental sort, plotting every tick individually. They provide the very best stage of granularity however can turn out to be visually cluttered, particularly in extremely energetic markets.

-

Quantity-Weighted Tick Charts: These charts take into account the quantity related to every tick. Bigger trades (increased quantity) might need a better affect on the chart’s look, reflecting the market’s underlying power or weak point.

-

Tick Charts with Worth Filters: To mitigate the muddle of high-frequency knowledge, some tick charts incorporate value filters. Solely ticks that exceed a predefined value threshold are plotted, decreasing noise and specializing in vital value actions.

Benefits of Utilizing Tick Charts:

Tick charts supply a number of benefits over time-based charts:

-

Deal with Worth Motion: By eliminating the time dimension, tick charts isolate value actions, permitting for a purer evaluation of provide and demand dynamics. The main focus shifts from when the worth moved to the way it moved.

-

Identification of Market Regime Adjustments: Tick charts can successfully spotlight shifts in market volatility. Intervals of excessive tick frequency usually point out elevated volatility, whereas intervals of low frequency recommend a calmer market.

-

Revealing Hidden Order Move: The buildup of ticks can reveal underlying order circulate patterns, providing insights into the steadiness between patrons and sellers. Speedy value adjustments with a excessive tick frequency usually sign sturdy directional stress.

-

Improved Sign-to-Noise Ratio (with filtering): Correctly filtered tick charts can cut back noise related to minor value fluctuations, making it simpler to determine vital traits and reversals.

-

Appropriate for Excessive-Frequency Buying and selling (HFT): Tick charts are notably well-suited for HFT methods, offering real-time insights into market microstructure and facilitating fast decision-making.

Disadvantages of Utilizing Tick Charts:

Regardless of their benefits, tick charts even have some limitations:

-

Visible Muddle: Unfiltered tick charts can turn out to be extraordinarily cluttered, particularly during times of excessive volatility, making them tough to interpret.

-

Knowledge Necessities: Tick charts require entry to high-frequency tick knowledge, which is probably not available or reasonably priced for all merchants.

-

Complexity: Understanding and decoding tick charts requires a deeper understanding of market microstructure and order circulate dynamics in comparison with conventional candlestick charts.

-

Lack of Time Context: The absence of a time axis could make it difficult to correlate value actions with particular occasions or information bulletins.

-

Potential for Overfitting: The excessive granularity of tick knowledge can result in overfitting if not used cautiously. Methods developed based mostly solely on tick charts may not generalize properly to completely different market circumstances.

Functions of Tick Charts in Buying and selling and Evaluation:

Tick charts discover purposes in varied buying and selling and analytical contexts:

-

Figuring out Help and Resistance Ranges: Concentrations of ticks at particular value ranges can point out sturdy assist or resistance zones.

-

Detecting Pattern Adjustments: Adjustments within the frequency and path of ticks can sign potential pattern reversals.

-

Analyzing Order Move Imbalances: The buildup of ticks can reveal imbalances in shopping for and promoting stress.

-

Creating Algorithmic Buying and selling Methods: Tick knowledge is essential for creating refined algorithmic buying and selling methods that react to market adjustments in real-time.

-

Backtesting Buying and selling Methods: Tick knowledge permits rigorous backtesting of buying and selling methods, permitting for an intensive analysis of their efficiency below varied market circumstances.

-

Market Microstructure Analysis: Tick knowledge performs a significant function in tutorial analysis specializing in market microstructure, liquidity, and order circulate dynamics.

Conclusion:

Tick charts supply a strong but usually underutilized software for market evaluation. Their granular strategy supplies a novel perspective on market dynamics, revealing insights usually obscured by time-based aggregation. Whereas they require a deeper understanding of market microstructure and should current challenges when it comes to visible muddle and knowledge necessities, the insights they provide could be invaluable for merchants and analysts searching for a deeper understanding of market habits. By fastidiously contemplating their benefits and downsides and utilizing applicable filtering strategies, tick charts can considerably improve one’s means to research and interpret market knowledge, finally resulting in extra knowledgeable buying and selling choices. Nevertheless, it is essential to keep in mind that tick charts needs to be used together with different analytical instruments and strategies for a complete market perspective. They aren’t a standalone answer however moderately a helpful addition to a dealer’s arsenal.

![[Download] Feibel Trading – Tick Chart Mastery - CoinerPals](https://static.wixstatic.com/media/0aabdd_b5435294149444e38335412d7b1c78a3~mv2.jpg/v1/fill/w_1349,h_310,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/0aabdd_b5435294149444e38335412d7b1c78a3~mv2.jpg)

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Tick Chart: A Deep Dive into Excessive-Frequency Market Knowledge Visualization. We hope you discover this text informative and useful. See you in our subsequent article!