Decoding The UK Gas Worth Chart: A Complete Evaluation

Decoding the UK Gas Worth Chart: A Complete Evaluation

Associated Articles: Decoding the UK Gas Worth Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the UK Gas Worth Chart: A Complete Evaluation. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the UK Gas Worth Chart: A Complete Evaluation

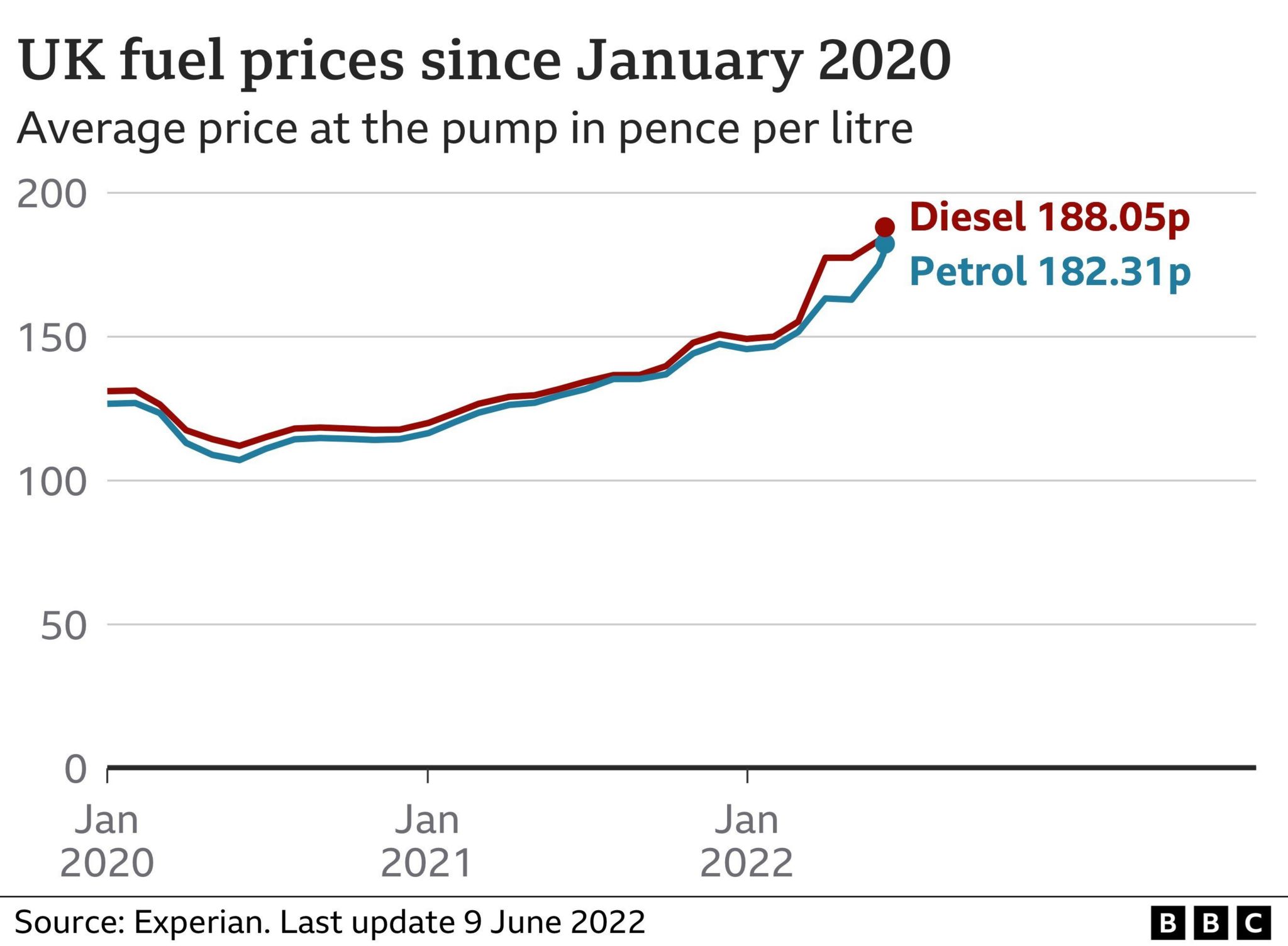

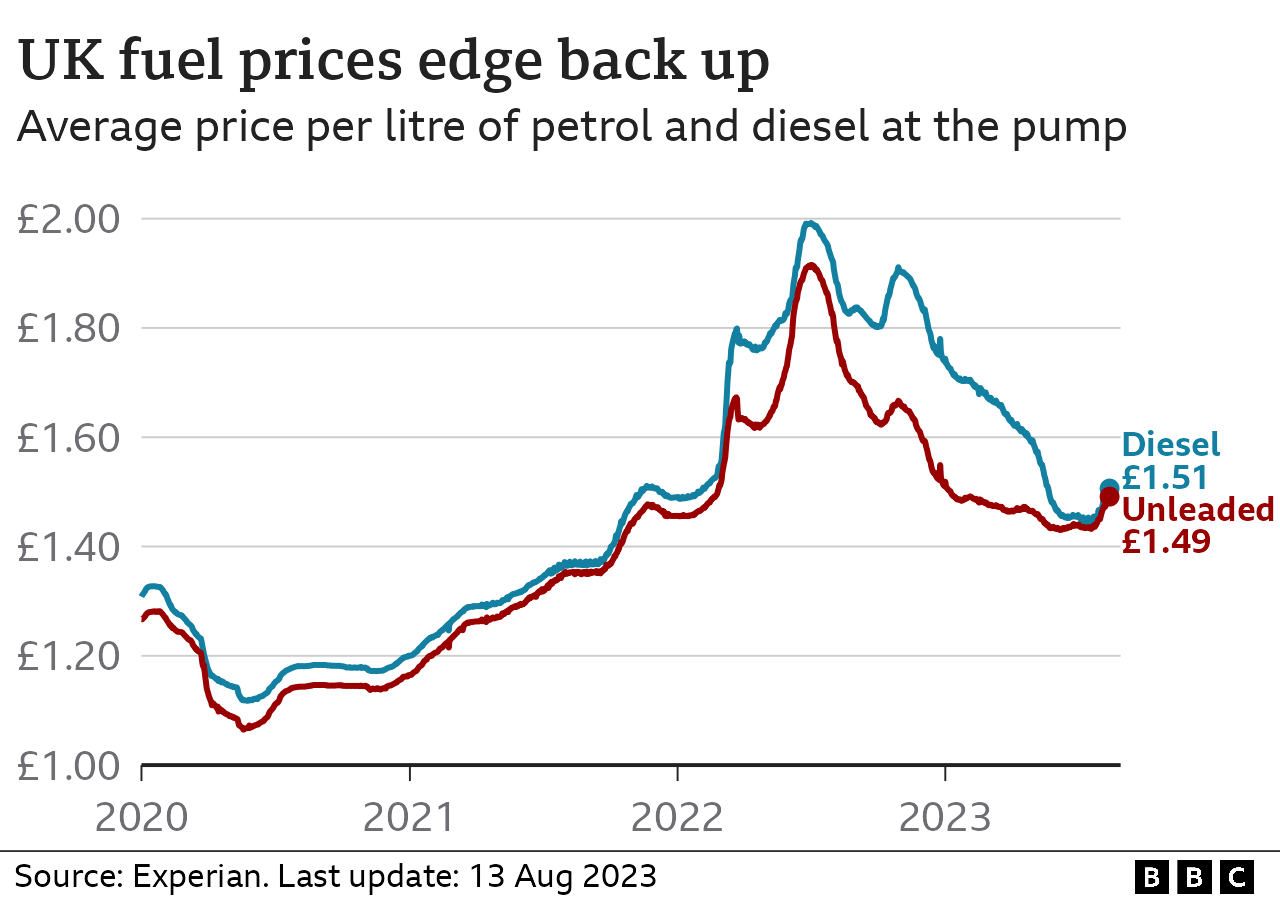

The UK gasoline value chart is a rollercoaster, reflecting a fancy interaction of worldwide occasions, authorities insurance policies, and market forces. Understanding its fluctuations is essential for customers, companies, and policymakers alike. This text delves deep into the components influencing UK gasoline costs, examines historic tendencies, and explores potential future eventualities.

The Complicated Equation of Gas Pricing:

The worth we pay on the pump is not merely the price of crude oil. It is a multifaceted equation encompassing a number of key parts:

-

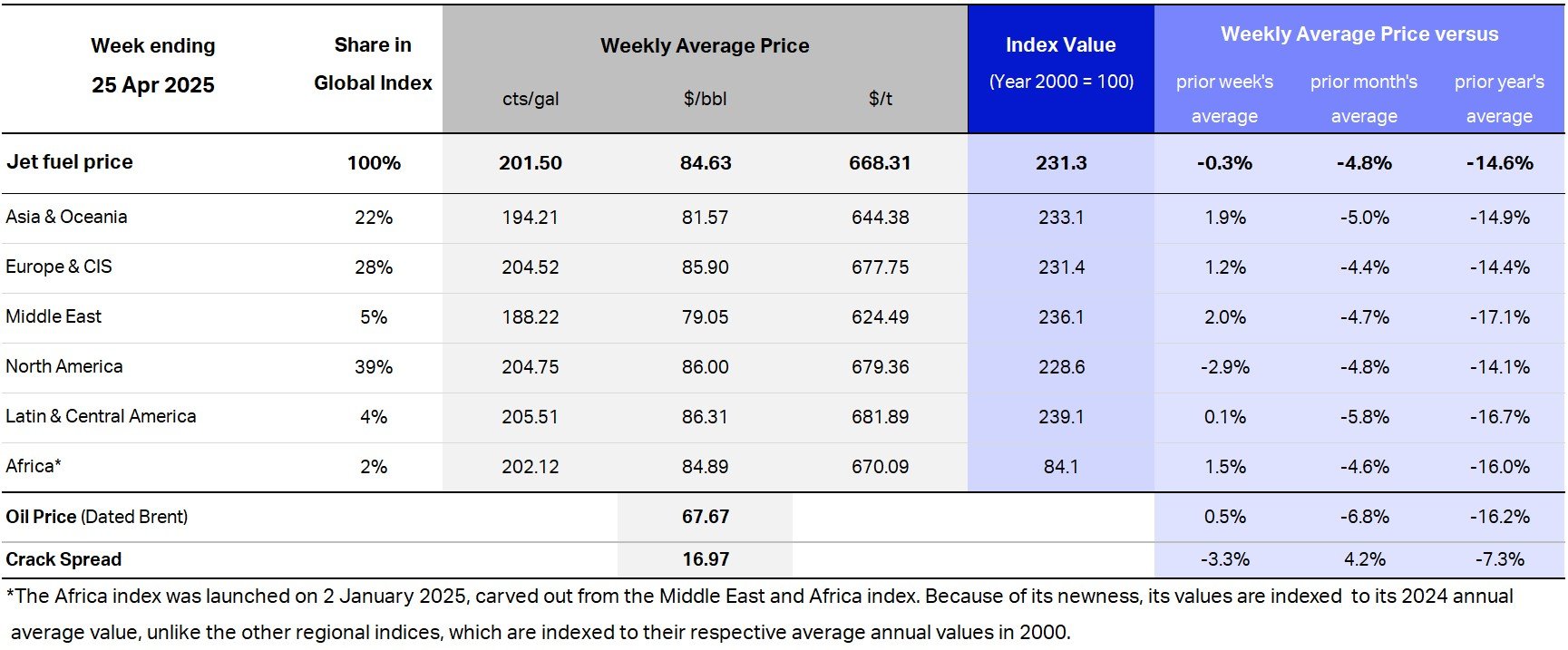

Crude Oil Worth: That is the inspiration. The worth of Brent crude oil, a world benchmark, closely influences the price of petrol and diesel. Geopolitical instability, OPEC choices (Group of the Petroleum Exporting International locations), international demand, and provide disruptions (e.g., pure disasters, sanctions) all impression Brent crude costs, instantly affecting UK gasoline prices. A surge in international demand, as an illustration, results in larger crude oil costs, that are then handed on to customers.

-

Refining Prices: Crude oil wants refining into petrol and diesel. This course of entails vital vitality consumption and operational bills. Adjustments in refinery capability, upkeep schedules, and vitality prices all contribute to the ultimate value. Elevated refining prices instantly translate into larger pump costs.

-

Transportation Prices: Getting the refined gasoline from refineries to petrol stations entails transportation through pipelines, tankers, and street haulage. Gas transportation prices are affected by gasoline costs themselves (a vicious cycle), driver wages, and the general effectivity of the logistics community. Will increase in gasoline costs for transportation naturally improve the ultimate retail value.

-

Taxes and Duties: The UK authorities levies vital taxes on gasoline, together with excise responsibility (a set quantity per litre) and VAT (Worth Added Tax, a share of the worth). These taxes represent a considerable portion of the ultimate value, and adjustments in tax charges instantly impression affordability. Authorities choices on tax ranges are sometimes influenced by budgetary wants and environmental concerns.

-

Retailer Margins: Petrol stations have to make a revenue. Their margins contribute to the ultimate value, though competitors amongst retailers often retains these margins comparatively constrained. Nonetheless, in periods of excessive demand or provide shortages, retailer margins may improve, including to the general value.

-

Change Charges: Since crude oil is commonly traded in US {dollars}, fluctuations within the GBP/USD alternate charge impression the price of importing crude oil. A weaker pound makes imports dearer, growing gasoline costs.

Historic Tendencies and Key Occasions:

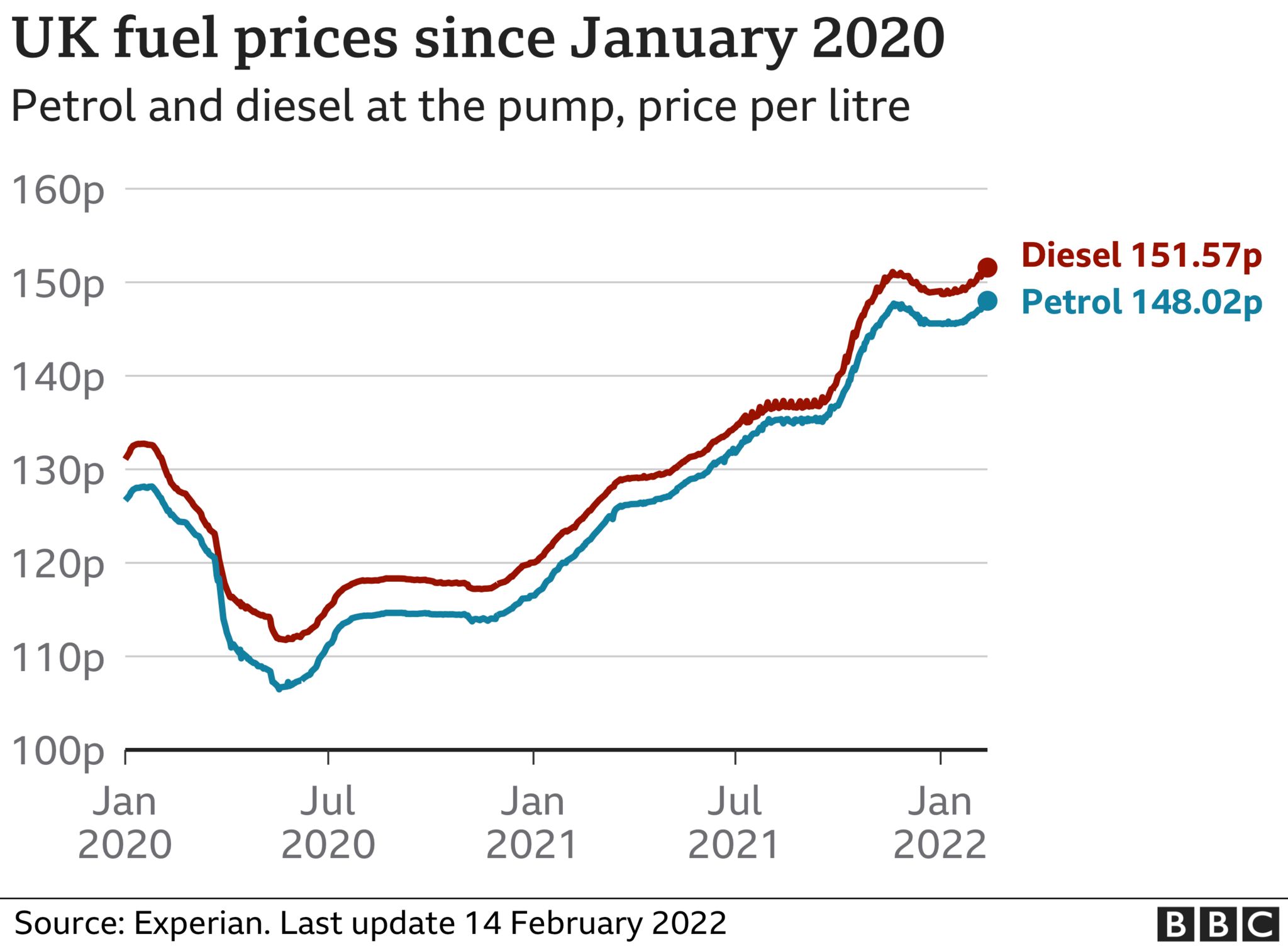

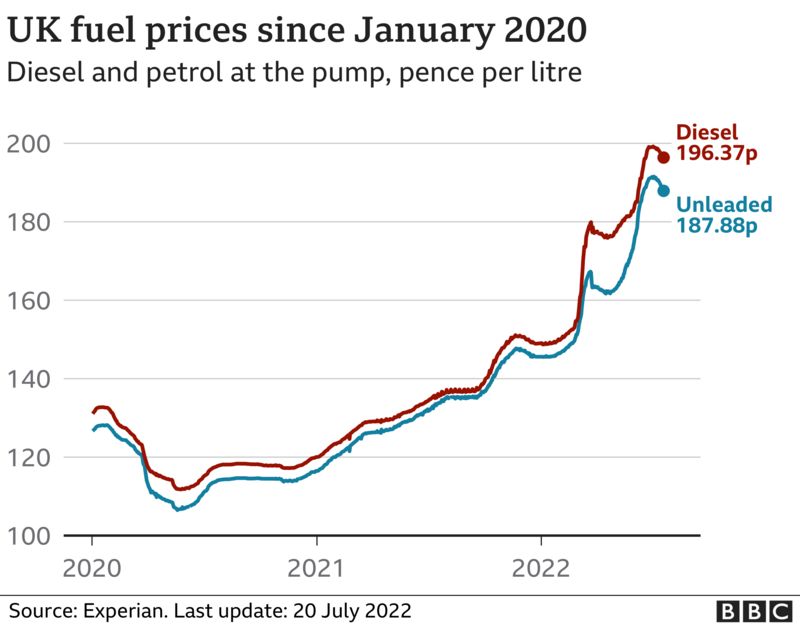

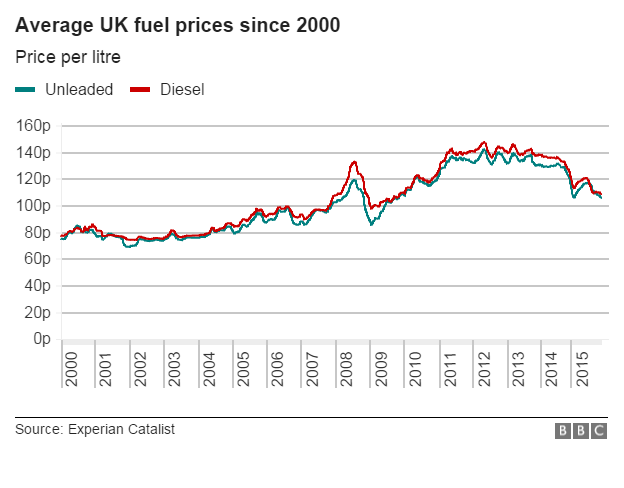

The UK gasoline value chart reveals a historical past of volatility. A number of key occasions have considerably formed these tendencies:

-

International Recessions: Throughout financial downturns, international demand for oil usually falls, resulting in decrease crude oil costs and, subsequently, decrease gasoline costs within the UK. The 2008 monetary disaster is a main instance.

-

Geopolitical Instability: Conflicts in oil-producing areas, such because the Iraq Struggle or the continuing scenario in Ukraine, usually disrupt provide chains and result in value spikes. These geopolitical occasions can have a big and rapid impression on UK gasoline costs.

-

OPEC Selections: OPEC’s choices on oil manufacturing quotas instantly affect international provide and demand. Manufacturing cuts result in larger costs, whereas elevated manufacturing can put downward stress on costs.

-

Authorities Insurance policies: Authorities insurance policies, comparable to gasoline responsibility adjustments or incentives for electrical automobiles, can considerably affect gasoline costs and consumption patterns. Adjustments in gasoline responsibility, as an illustration, have a direct and rapid impact on pump costs.

-

Technological Developments: Developments in oil extraction methods (e.g., fracking) can improve provide and probably decrease costs. Conversely, technological adjustments growing demand (e.g., the rise of SUVs) can push costs upwards.

-

Seasonal Variations: Gas demand tends to be larger throughout peak journey seasons (summer time holidays, Christmas), resulting in barely larger costs.

Analyzing the Present Panorama:

The present UK gasoline value panorama is formed by a confluence of things: the continuing warfare in Ukraine, international inflation, and the transition in direction of renewable vitality sources. The warfare in Ukraine has considerably disrupted international vitality markets, resulting in elevated volatility and better costs. International inflation additional exacerbates the scenario, growing the price of refining, transportation, and different features of the gasoline provide chain. The shift in direction of renewable vitality sources, whereas helpful for the setting, presents challenges within the brief time period because the transition necessitates funding and changes in vitality infrastructure.

Future Eventualities and Predictions:

Predicting future gasoline costs is inherently difficult because of the many interconnected components concerned. Nonetheless, a number of potential eventualities may be thought of:

-

Sustained Excessive Costs: If geopolitical instability persists and international demand stays sturdy, gasoline costs may stay elevated for the foreseeable future. This state of affairs poses vital challenges for customers and companies.

-

Gradual Decline: As international provide chains stabilize and renewable vitality sources turn into extra prevalent, gasoline costs may steadily decline. This state of affairs requires vital funding in renewable vitality infrastructure and a profitable transition away from fossil fuels.

-

Volatility and Uncertainty: The most probably state of affairs is one among continued volatility and uncertainty. Sudden geopolitical occasions, surprising provide disruptions, or adjustments in authorities insurance policies may result in sharp value fluctuations.

Mitigation Methods and Coverage Implications:

Addressing the challenges posed by unstable gasoline costs requires a multi-pronged method:

-

Diversification of Vitality Sources: Decreasing reliance on a single supply of vitality, comparable to imported crude oil, via investments in renewable vitality sources is essential.

-

Vitality Effectivity Measures: Bettering vitality effectivity in transportation, buildings, and industries can scale back general gasoline consumption and reduce value sensitivity.

-

Focused Authorities Help: Governments can present focused assist to weak households and companies affected by excessive gasoline costs via numerous schemes.

-

Funding in Public Transportation: Bettering public transportation infrastructure and making it extra accessible can scale back reliance on personal automobiles.

-

Selling Electrical Autos: Incentivizing the adoption of electrical automobiles and creating the required charging infrastructure can contribute to a long-term discount in gasoline dependence.

Conclusion:

The UK gasoline value chart is a mirrored image of a fancy and dynamic international vitality market. Understanding the components influencing these costs is essential for navigating the challenges and alternatives introduced by this unstable sector. A mixture of diversified vitality sources, vitality effectivity enhancements, strategic authorities insurance policies, and technological developments are important for mitigating the impression of fluctuating gasoline costs and guaranteeing a sustainable vitality future for the UK. Steady monitoring of worldwide occasions, market tendencies, and coverage adjustments is important to successfully interpret the gasoline value chart and anticipate future developments.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the UK Gas Worth Chart: A Complete Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!