Decoding The USD To MXN Chart: A Deep Dive Into The Mexican Peso’s Fluctuations

Decoding the USD to MXN Chart: A Deep Dive into the Mexican Peso’s Fluctuations

Associated Articles: Decoding the USD to MXN Chart: A Deep Dive into the Mexican Peso’s Fluctuations

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the USD to MXN Chart: A Deep Dive into the Mexican Peso’s Fluctuations. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the USD to MXN Chart: A Deep Dive into the Mexican Peso’s Fluctuations

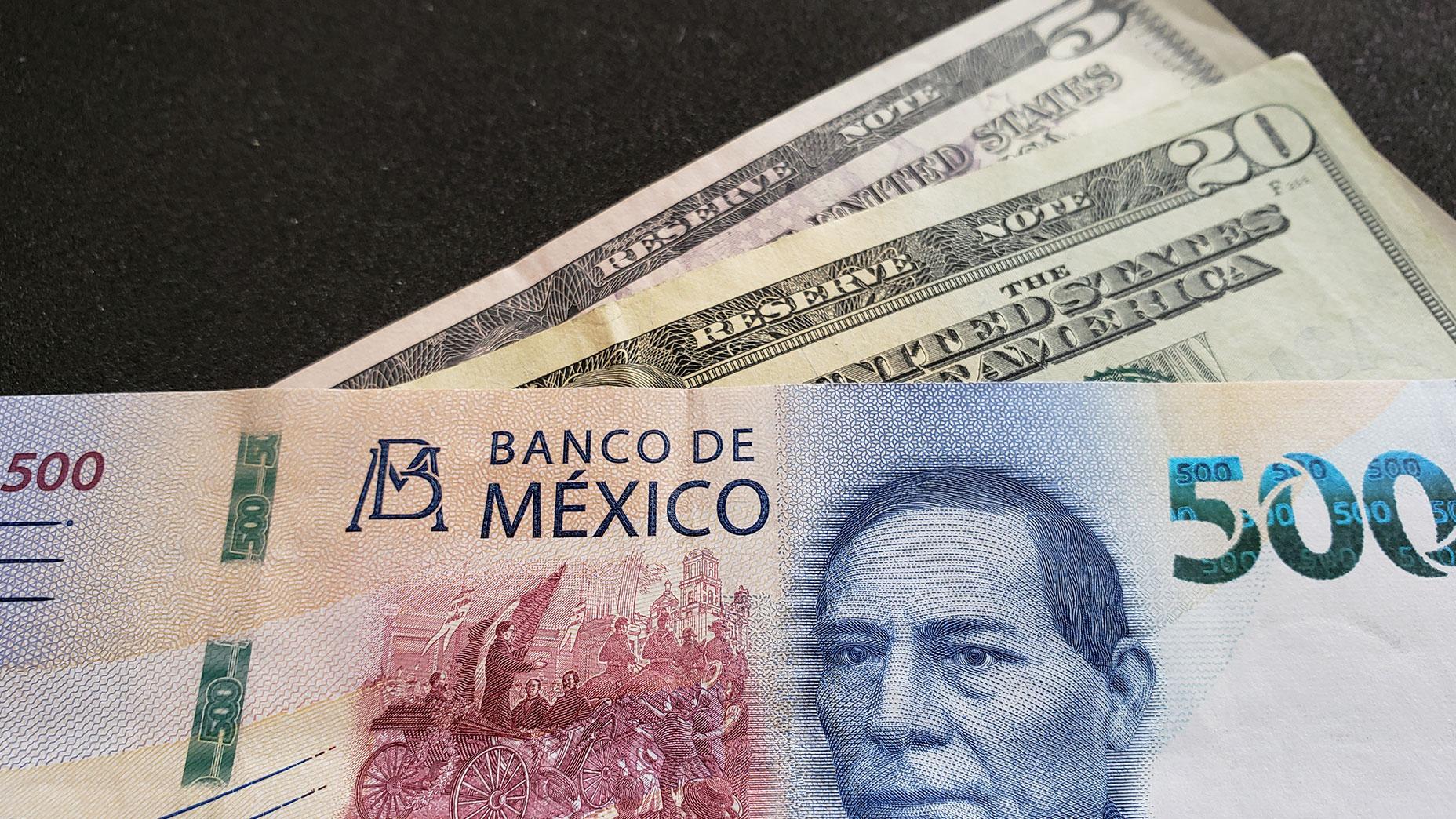

The trade fee between the US greenback (USD) and the Mexican peso (MXN) is a dynamic entity, consistently shifting resulting from a posh interaction of financial, political, and international components. Understanding the USD to MXN chart requires extra than simply glancing on the present quantity; it calls for a grasp of the underlying forces driving its fluctuations. This text will delve into the intricacies of this significant trade fee, exploring its historic tendencies, influencing components, and the implications for companies, vacationers, and traders.

Historic Perspective: A Rollercoaster Experience

The USD to MXN trade fee hasn’t been a gradual climb or decline. Its historical past is marked by intervals of great volatility, reflecting the financial realities of each nations. The Mexican peso, having skilled intervals of hyperinflation and forex crises, has demonstrated a outstanding resilience, although its worth relative to the greenback stays prone to shocks.

Analyzing historic charts reveals a number of key intervals:

-

The Tequila Disaster (1994-1995): This era noticed a dramatic devaluation of the peso, highlighting the vulnerability of rising markets to sudden capital flight and speculative assaults. The disaster resulted in a major widening of the USD to MXN trade fee, underscoring the significance of macroeconomic stability.

-

The 2008 International Monetary Disaster: The worldwide recession impacted Mexico, resulting in a weakening of the peso towards the greenback. Nevertheless, in comparison with different currencies, the peso’s decline was comparatively contained, reflecting the nation’s comparatively strong monetary sector.

-

Publish-2008 Restoration and Volatility: The years following the worldwide monetary disaster noticed intervals of relative stability punctuated by volatility associated to international occasions, commodity costs (significantly oil, a key Mexican export), and home political developments.

-

Current Tendencies (2020-Current): The COVID-19 pandemic initially triggered important uncertainty, resulting in peso depreciation. Nevertheless, subsequent financial restoration, coupled with components corresponding to remittances from Mexicans working overseas and overseas funding, have contributed to intervals of relative energy. The continued impression of world inflation and rate of interest changes by central banks in each the US and Mexico continues to form the USD to MXN trade fee.

Key Elements Influencing the USD to MXN Alternate Fee:

The every day fluctuations depicted on the USD to MXN chart should not random. They’re pushed by a confluence of things, together with:

-

Curiosity Fee Differentials: Variations in rates of interest between the US and Mexico considerably impression the trade fee. Increased rates of interest within the US usually entice overseas funding, rising demand for the greenback and strengthening it towards the peso. Conversely, increased charges in Mexico can entice capital, supporting the peso. Central financial institution insurance policies play a vital function on this dynamic.

-

Financial Development and Efficiency: Stronger financial progress in Mexico relative to the US tends to help the peso. Elements like GDP progress, inflation charges, and employment figures affect investor confidence and capital flows. A strong Mexican economic system attracts overseas funding, boosting demand for the peso.

-

Commodity Costs: Mexico is a major exporter of commodities, significantly oil. Fluctuations in international oil costs immediately impression the nation’s steadiness of funds and subsequently the trade fee. Increased oil costs usually profit the peso, whereas decrease costs weaken it.

-

Political Stability and Danger: Political uncertainty or instability in Mexico can result in capital flight and a weakening of the peso. Authorities insurance policies, elections, and social unrest all contribute to the notion of danger, influencing investor sentiment and the trade fee.

-

US Financial Circumstances: The well being of the US economic system has a major bearing on the USD to MXN trade fee. A powerful US economic system tends to strengthen the greenback, placing downward strain on the peso. Conversely, financial weak spot within the US can result in a weaker greenback and a stronger peso.

-

International Market Sentiment: International financial occasions and market sentiment may affect the USD to MXN trade fee. Elements like geopolitical tensions, international inflation, and shifts in investor danger urge for food can result in important fluctuations.

-

Remittances: Remittances from Mexicans working within the US represent a major supply of overseas trade for Mexico. Elevated remittances can present help for the peso.

-

Overseas Direct Funding (FDI): FDI into Mexico performs a vital function in strengthening the peso. Attracting overseas funding is determined by components like financial stability, regulatory atmosphere, and infrastructure.

Deciphering the USD to MXN Chart: Sensible Functions

Understanding the USD to MXN chart is essential for numerous stakeholders:

-

Vacationers: The trade fee immediately impacts the price of journey to Mexico for US residents. Monitoring the chart helps vacationers decide the most effective time to trade forex and maximize their spending energy.

-

Companies: Companies engaged in cross-border commerce between the US and Mexico must rigorously observe the trade fee to handle their monetary dangers. Fluctuations can considerably impression profitability and require efficient hedging methods.

-

Buyers: Buyers contemplating investments in Mexican property want to grasp the trade fee dangers. Fluctuations can impression the returns on their investments, requiring cautious consideration of forex hedging strategies.

-

Exporters and Importers: The trade fee considerably impacts the competitiveness of Mexican exports and the price of imports. A weaker peso can enhance exports, whereas a stronger peso could make imports cheaper.

Forecasting the USD to MXN Alternate Fee: A Tough Job

Predicting future actions within the USD to MXN trade fee is difficult. Whereas analyzing historic tendencies and understanding the influencing components offers precious insights, quite a few unpredictable occasions can considerably impression the trade fee. Subtle forecasting fashions typically incorporate numerous financial indicators and statistical strategies, however even these fashions should not foolproof.

Conclusion: A Dynamic Relationship Requiring Fixed Monitoring

The USD to MXN trade fee is a dynamic and complicated relationship reflecting the financial and political realities of two main economies. Understanding the historic tendencies, influencing components, and sensible purposes of this trade fee is essential for people, companies, and traders. Whereas predicting future actions is inherently troublesome, constant monitoring of the USD to MXN chart, coupled with a stable understanding of the underlying financial and political forces, permits for knowledgeable decision-making and efficient danger administration. Staying knowledgeable by way of respected monetary information sources and consulting with monetary professionals is significant for navigating the complexities of this ever-changing trade fee.

-638028268926843569.png)

-638091376749819412.png)

-638023100637444210.png)

Closure

Thus, we hope this text has supplied precious insights into Decoding the USD to MXN Chart: A Deep Dive into the Mexican Peso’s Fluctuations. We thanks for taking the time to learn this text. See you in our subsequent article!