Decoding The WTI Worth Chart: A Complete Information To Understanding Crude Oil’s Volatility

Decoding the WTI Worth Chart: A Complete Information to Understanding Crude Oil’s Volatility

Associated Articles: Decoding the WTI Worth Chart: A Complete Information to Understanding Crude Oil’s Volatility

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the WTI Worth Chart: A Complete Information to Understanding Crude Oil’s Volatility. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the WTI Worth Chart: A Complete Information to Understanding Crude Oil’s Volatility

The West Texas Intermediate (WTI) crude oil value chart is a dynamic visible illustration of a posh market, reflecting world financial well being, geopolitical tensions, and the ever-shifting steadiness of provide and demand. Understanding its intricacies is essential for buyers, merchants, and anybody affected by power costs. This text delves into the important thing elements influencing the WTI value chart, its historic traits, frequent chart patterns, and the instruments used for evaluation, offering a complete information for navigating this risky market.

Understanding the WTI Crude Oil Market:

WTI, particularly WTI Cushing, is a benchmark crude oil grade primarily traded on the New York Mercantile Alternate (NYMEX). Its value serves as a world reference level, influencing the worth of different crude oil grades and impacting the price of gasoline, diesel, heating oil, and quite a few petrochemical merchandise. The value is decided via the interaction of consumers and sellers in a extremely liquid and clear market. Nevertheless, this transparency would not negate the inherent volatility. Quite a few elements, each predictable and unpredictable, contribute to the worth fluctuations seen on the WTI chart.

Key Components Influencing the WTI Worth Chart:

A number of interconnected elements contribute to the fluctuations noticed within the WTI value chart. These could be broadly categorized as:

-

Provide and Demand: That is the elemental driver. Elevated world demand, usually pushed by financial development in rising markets, tends to push costs greater. Conversely, a surplus in provide, maybe because of elevated manufacturing by OPEC+ nations or surprising disruptions in demand (e.g., a world recession), can result in value declines. The chart usually displays the fixed tug-of-war between these forces.

-

OPEC+ Actions: The Group of the Petroleum Exporting International locations (OPEC), together with its allies (OPEC+), holds vital sway over world oil provide. Selections relating to manufacturing quotas, introduced throughout their conferences, immediately influence the WTI value. Sudden manufacturing cuts or will increase could cause dramatic shifts within the chart’s trajectory.

-

Geopolitical Occasions: Political instability in main oil-producing areas, conflicts, sanctions, and even the specter of disruptions can considerably influence provide and, consequently, costs. The WTI chart usually displays heightened volatility in periods of geopolitical uncertainty. Examples embrace the Iraq Struggle, the Iranian nuclear program, and the continued battle in Ukraine.

-

Financial Progress and Recession: World financial development fuels power demand, driving costs greater. Conversely, financial downturns or recessions result in decreased demand, leading to decrease costs. The WTI chart usually serves as a number one indicator of financial well being, with sharp declines usually previous or accompanying recessions.

-

US Greenback Energy: The WTI value is denominated in US {dollars}. A stronger greenback makes oil costlier for consumers utilizing different currencies, probably lowering demand and placing downward stress on costs. Conversely, a weaker greenback can enhance demand and costs.

-

Technological Developments: Improvements in oil extraction applied sciences (e.g., fracking) can considerably influence provide. Elevated effectivity and accessibility of oil reserves can result in value decreases, whereas technological setbacks could cause value will increase.

-

Seasonal Components: Demand for heating oil in winter months usually results in greater costs, whereas summer time months may see a slight dip because of decreased heating oil consumption. These differences due to the season are sometimes mirrored within the WTI chart’s delicate traits.

-

Hypothesis and Funding: The futures market performs a major position in shaping WTI costs. Speculative buying and selling and investments primarily based on anticipated future value actions can create volatility, usually impartial of the underlying fundamentals of provide and demand.

Analyzing the WTI Worth Chart: Instruments and Strategies:

Analyzing the WTI value chart requires a mix of technical and elementary evaluation.

-

Technical Evaluation: This includes finding out previous value actions and quantity to determine patterns and predict future value traits. Frequent instruments embrace:

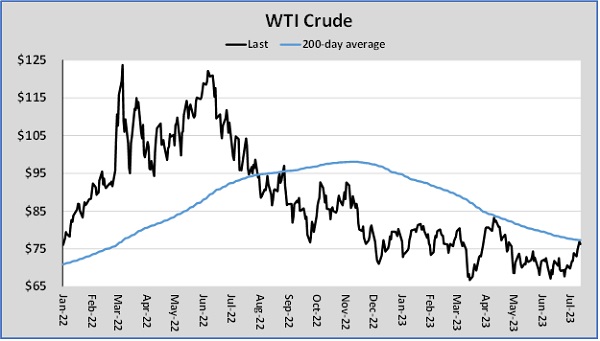

- Transferring Averages: These clean out value fluctuations, highlighting underlying traits. Generally used shifting averages embrace 50-day, 100-day, and 200-day averages.

- Relative Energy Index (RSI): This indicator measures the magnitude of latest value adjustments to judge overbought or oversold situations.

- MACD (Transferring Common Convergence Divergence): This momentum indicator identifies adjustments within the energy, path, momentum, and period of a pattern.

- Help and Resistance Ranges: These are value ranges the place the worth has traditionally struggled to interrupt via. Help ranges signify potential shopping for alternatives, whereas resistance ranges point out potential promoting alternatives.

- Chart Patterns: Recognizing patterns like head and shoulders, double tops/bottoms, triangles, and flags can present insights into potential value actions.

-

Elementary Evaluation: This includes assessing the elements talked about earlier – provide and demand, geopolitical occasions, financial situations, and many others. – to grasp the underlying forces driving the worth. This usually includes analyzing information experiences, authorities information, and business experiences.

Historic Tendencies and Notable Occasions:

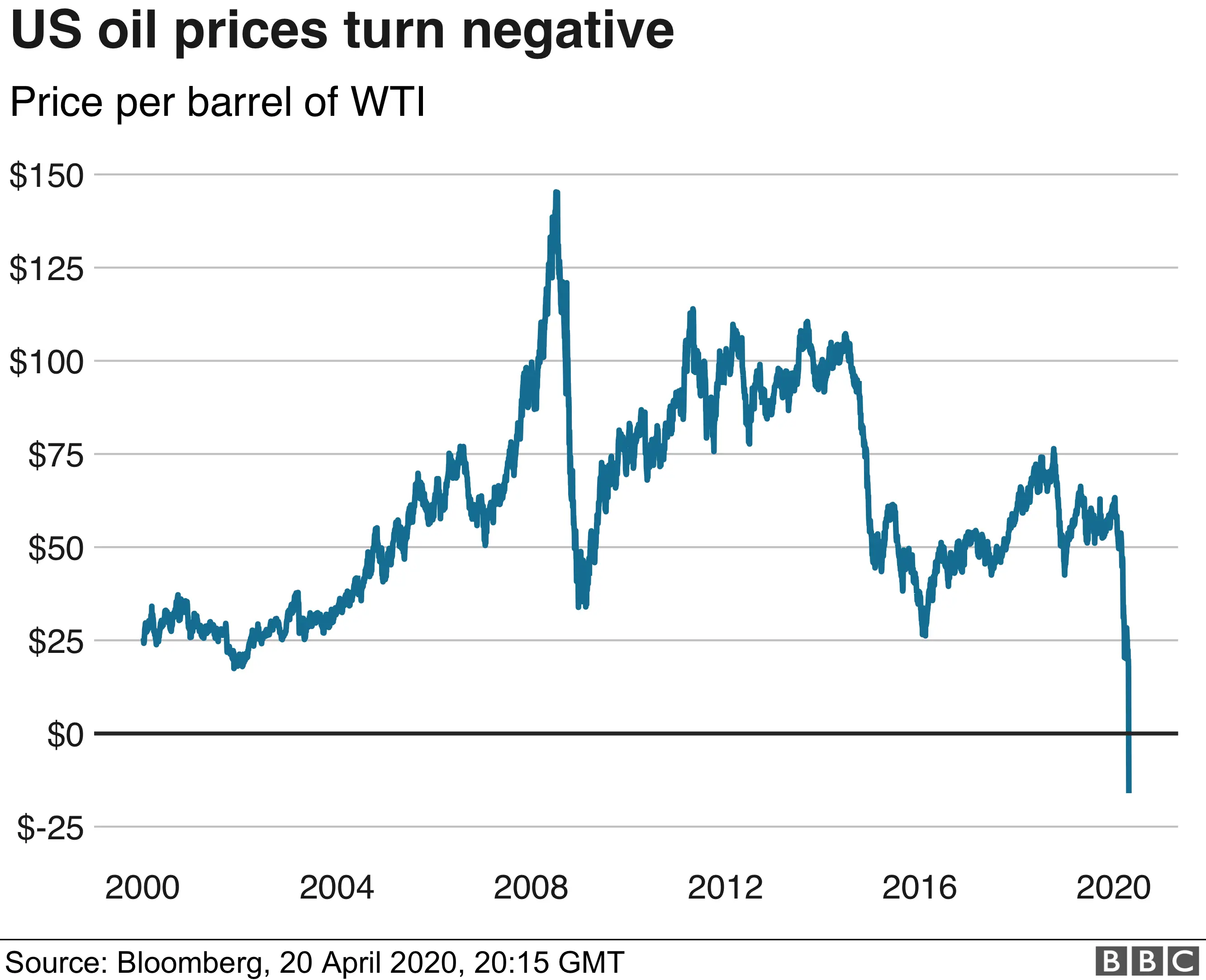

The WTI value chart displays a historical past of great value swings, formed by varied occasions and elements. For instance, the oil value shocks of the Seventies, pushed by OPEC actions and geopolitical instability, resulted in dramatic value will increase. Equally, the 2008 monetary disaster led to a pointy decline in oil costs, adopted by a interval of restoration. Extra just lately, the COVID-19 pandemic induced an unprecedented collapse in demand, leading to damaging oil costs for a quick interval, a really outstanding occasion mirrored starkly on the WTI chart. The continued warfare in Ukraine has additionally considerably impacted WTI costs, highlighting the continued affect of geopolitical occasions.

Deciphering the Chart’s Volatility:

The WTI value chart’s volatility is a defining attribute. Understanding this volatility is essential for knowledgeable decision-making. Components equivalent to surprising provide disruptions, sudden adjustments in geopolitical landscapes, and speculative buying and selling all contribute to those value swings. Nevertheless, by understanding the underlying elements and using applicable analytical instruments, buyers and merchants can higher navigate this volatility and probably mitigate dangers.

Conclusion:

The WTI value chart is a posh and dynamic device, providing a window into the worldwide power market. By understanding the elements influencing the worth, using applicable analytical methods, and staying knowledgeable about present occasions, people can achieve invaluable insights into the market’s habits and make extra knowledgeable selections. Whereas predicting future value actions with certainty stays unattainable, a radical understanding of the WTI value chart and its underlying dynamics considerably improves the probabilities of navigating this risky however essential market efficiently. Steady studying and adaptation are key to efficiently deciphering the ever-evolving narrative depicted on the WTI value chart.

Closure

Thus, we hope this text has offered invaluable insights into Decoding the WTI Worth Chart: A Complete Information to Understanding Crude Oil’s Volatility. We thanks for taking the time to learn this text. See you in our subsequent article!