Decoding The Yahoo Finance NSE Knowledge Chart: A Complete Information For Buyers

Decoding the Yahoo Finance NSE Knowledge Chart: A Complete Information for Buyers

Associated Articles: Decoding the Yahoo Finance NSE Knowledge Chart: A Complete Information for Buyers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Yahoo Finance NSE Knowledge Chart: A Complete Information for Buyers. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Decoding the Yahoo Finance NSE Knowledge Chart: A Complete Information for Buyers

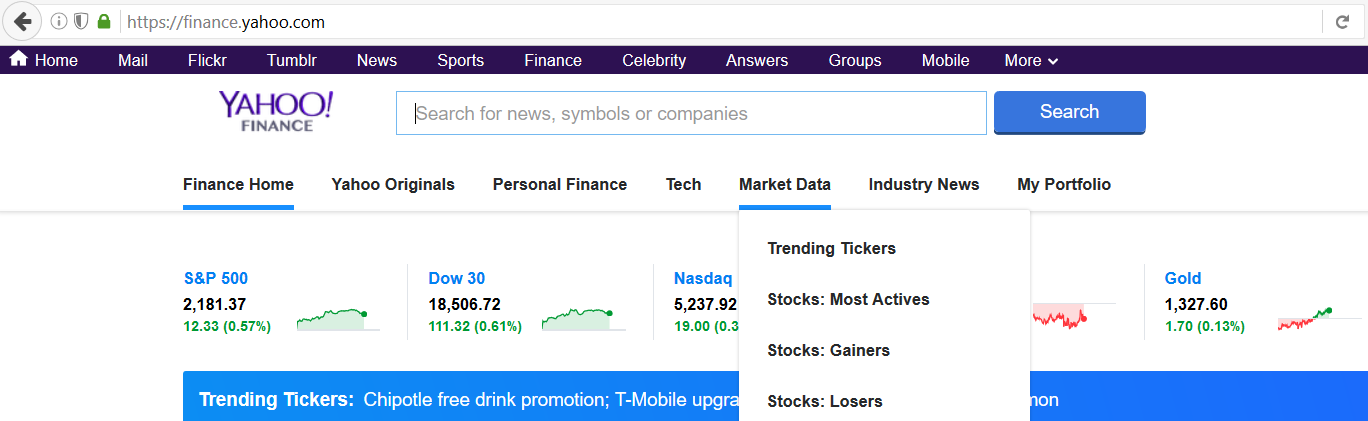

Yahoo Finance has turn out to be a go-to useful resource for tens of millions of buyers worldwide, providing a wealth of monetary data, together with detailed charting capabilities for the Nationwide Inventory Alternate of India (NSE). Understanding tips on how to interpret the Yahoo Finance NSE information chart is essential for making knowledgeable funding selections. This text will delve into the assorted facets of the chart, explaining its elements, functionalities, and tips on how to leverage its information for efficient inventory evaluation.

Understanding the Fundamentals: Chart Sorts and Indicators

The Yahoo Finance NSE chart provides a wide range of chart sorts, every offering a singular perspective on worth actions. The commonest embody:

-

Line Chart: This shows the closing worth of a safety over a selected interval, connecting the information factors with a line. It is excellent for visualizing long-term tendencies and figuring out general worth route.

-

Candlestick Chart: This presents extra detailed data than a line chart, exhibiting the opening, closing, excessive, and low costs for every interval (sometimes a day). The "physique" of the candlestick represents the value vary between the open and shut, whereas the "wicks" (higher and decrease shadows) point out the excessive and low costs. Candlestick charts are wonderful for figuring out patterns and reversals.

-

Bar Chart: Much like candlestick charts, bar charts symbolize the excessive, low, open, and shut costs for a given interval. Nonetheless, as an alternative of a candlestick physique, they use a vertical bar.

-

Space Chart: This chart shows the cumulative worth of a safety over time, filling the realm between the road and the x-axis. It is helpful for visualizing the entire development or decline of an funding.

Past the chart sorts, Yahoo Finance gives a plethora of technical indicators that may be overlaid on the chart to boost evaluation. These indicators are mathematical calculations primarily based on historic worth and quantity information, designed to determine potential tendencies, assist and resistance ranges, and momentum adjustments. Some standard indicators embody:

-

Transferring Averages (MA): These clean out worth fluctuations, revealing underlying tendencies. Widespread sorts embody easy shifting averages (SMA), exponential shifting averages (EMA), and weighted shifting averages (WMA).

-

Relative Energy Index (RSI): This measures the magnitude of current worth adjustments to guage overbought or oversold circumstances. RSI values above 70 typically recommend an overbought market, whereas values under 30 point out an oversold market.

-

MACD (Transferring Common Convergence Divergence): This indicator makes use of shifting averages to determine momentum adjustments and potential development reversals. MACD crossovers (when the MACD line crosses the sign line) are sometimes thought of important buying and selling indicators.

-

Bollinger Bands: These bands plot customary deviations round a shifting common, indicating volatility and potential worth reversal factors. Costs touching the higher band might recommend an overbought situation, whereas costs touching the decrease band might point out an oversold situation.

-

Quantity Indicators: These indicators analyze buying and selling quantity alongside worth actions, offering insights into the energy of worth tendencies. Excessive quantity throughout worth will increase suggests sturdy shopping for stress, whereas excessive quantity throughout worth decreases signifies sturdy promoting stress.

Navigating the Yahoo Finance NSE Chart Interface

The Yahoo Finance NSE chart interface is comparatively user-friendly. Key options embody:

-

Time Interval Choice: Customers can select the time-frame for the chart, starting from intraday (minutes, hours) to long-term (months, years). This enables for evaluation at totally different time scales.

-

Indicator Choice: A wide selection of technical indicators might be added or faraway from the chart with a easy click on. Customers can customise the settings of every indicator to fine-tune their evaluation.

-

Drawing Instruments: Yahoo Finance gives drawing instruments corresponding to development traces, Fibonacci retracements, and horizontal traces, permitting customers to visually determine assist and resistance ranges, potential worth targets, and chart patterns.

-

Knowledge Obtain: The chart information might be downloaded in numerous codecs (e.g., CSV) for additional evaluation utilizing spreadsheet software program or different technical evaluation platforms.

-

Comparative Evaluation: Customers can evaluate the efficiency of a number of NSE shares on the identical chart, facilitating relative energy evaluation.

Deciphering Chart Patterns and Indicators

Mastering chart interpretation requires follow and expertise. Nonetheless, recognizing widespread chart patterns and understanding the indicators generated by technical indicators can considerably improve your analytical expertise. Some key patterns embody:

-

Head and Shoulders: This reversal sample suggests a possible shift from an uptrend to a downtrend.

-

Double Prime/Backside: These patterns point out potential development reversals.

-

Triangles: These patterns typically precede a breakout in both route.

-

Flags and Pennants: These consolidation patterns recommend a continuation of the present development.

It is essential to keep in mind that technical evaluation shouldn’t be a crystal ball. Whereas chart patterns and indicators can present precious insights, they need to be used at the side of basic evaluation and different elements to make knowledgeable funding selections. Over-reliance on technical evaluation alone can result in inaccurate predictions and potential losses.

Using Yahoo Finance NSE Knowledge for Danger Administration

Yahoo Finance’s charting instruments are additionally instrumental in managing funding threat. By analyzing historic worth volatility and utilizing indicators like Bollinger Bands and RSI, buyers can assess the danger related to a specific safety. Understanding volatility helps decide applicable place sizing and stop-loss orders to restrict potential losses.

Limitations of Yahoo Finance NSE Knowledge

Whereas Yahoo Finance provides a precious useful resource for NSE information, it is important to pay attention to its limitations:

-

Knowledge Delays: Actual-time information might not at all times be out there, and there is perhaps slight delays in comparison with skilled buying and selling platforms.

-

Restricted Elementary Knowledge: Whereas Yahoo Finance gives some basic information, it might not be as complete as devoted monetary analysis platforms.

-

Dependence on Exterior Knowledge Sources: Yahoo Finance depends on exterior information suppliers, and the accuracy and reliability of the information rely on the accuracy of those sources.

Conclusion

Yahoo Finance’s NSE information chart is a strong software for buyers of all ranges. By understanding the assorted chart sorts, technical indicators, and drawing instruments, buyers can acquire precious insights into market tendencies and make extra knowledgeable funding selections. Nonetheless, it is essential to keep in mind that technical evaluation must be used at the side of basic evaluation and a sound threat administration technique. Steady studying and follow are key to mastering the artwork of chart interpretation and leveraging the total potential of Yahoo Finance’s charting capabilities for profitable investing within the NSE. Bear in mind to at all times conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied precious insights into Decoding the Yahoo Finance NSE Knowledge Chart: A Complete Information for Buyers. We thanks for taking the time to learn this text. See you in our subsequent article!