Deconstructing The QQQ All-Time Chart: A 25-Yr Journey Via Tech’s Triumphs And Tribulations

Deconstructing the QQQ All-Time Chart: A 25-Yr Journey Via Tech’s Triumphs and Tribulations

Associated Articles: Deconstructing the QQQ All-Time Chart: A 25-Yr Journey Via Tech’s Triumphs and Tribulations

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Deconstructing the QQQ All-Time Chart: A 25-Yr Journey Via Tech’s Triumphs and Tribulations. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Deconstructing the QQQ All-Time Chart: A 25-Yr Journey Via Tech’s Triumphs and Tribulations

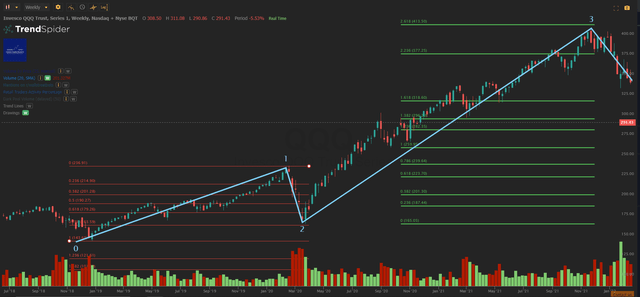

The Invesco QQQ Belief (QQQ) is extra than simply an exchange-traded fund (ETF); it is a barometer of the Nasdaq-100 index, a concentrated illustration of the American know-how sector’s dynamism and volatility. Analyzing its all-time chart affords a compelling narrative of technological innovation, financial shifts, and the inherent dangers and rewards of investing on this high-growth, high-risk sector. This text delves deep into the QQQ’s historic efficiency, analyzing key intervals of development and decline, figuring out important market occasions that formed its trajectory, and providing insights for buyers contemplating its inclusion of their portfolios.

The Early Years (1999-2002): The Dot-Com Growth and Bust

QQQ’s inception in March 1999 coincided with the height of the dot-com bubble. The chart reveals a dramatic ascent, fueled by rampant hypothesis and investor euphoria surrounding internet-based firms. Many corporations, missing sustainable enterprise fashions, noticed their valuations skyrocket, mirroring the speedy rise in QQQ. This era highlights an important lesson: speedy development is not all the time sustainable. The following bursting of the bubble, starting in 2000, led to a devastating correction, with QQQ plummeting by over 80% from its peak. This dramatic fall underscores the dangers related to investing in a sector closely reliant on speculative development and prone to market sentiment shifts. The early 2000s noticed QQQ buying and selling at considerably depressed ranges, a stark reminder of the risks of chasing hype over fundamentals.

The Restoration and Consolidation (2003-2007): Discovering Footing Amidst Uncertainty

The interval following the dot-com crash noticed a gradual however regular restoration for QQQ. The chart reveals a gradual upward pattern, albeit with intervals of consolidation and volatility. This restoration wasn’t solely pushed by the tech sector’s resurgence; it was additionally influenced by broader financial elements, together with low rates of interest and authorities stimulus. The emergence of influential firms like Google (GOOGL), which went public in 2004, helped to rejuvenate investor confidence. Nonetheless, the restoration was not linear. Geopolitical occasions, such because the Iraq Conflict, and financial anxieties contributed to market fluctuations, reflecting the intricate interaction between international occasions and QQQ’s efficiency.

The International Monetary Disaster and its Aftermath (2008-2012): Navigating a Excellent Storm

The 2008 international monetary disaster offered a big problem to QQQ. The chart shows a pointy decline, because the subprime mortgage disaster and ensuing credit score crunch triggered a widespread market panic. The interconnectedness of the worldwide monetary system amplified the impression, resulting in a big drop in QQQ’s worth. Nonetheless, the following authorities interventions, together with quantitative easing (QE), performed an important function in stabilizing the markets and stopping an entire collapse. The restoration from the monetary disaster was slower than the dot-com restoration, reflecting the deeper systemic points at play. The chart reveals a chronic interval of sideways buying and selling earlier than the following important upward pattern started.

The Submit-Disaster Growth (2013-2020): The Rise of the FAANGs and Past

The interval following the monetary disaster witnessed an unprecedented surge in QQQ’s worth. The rise of the FAANG shares (Fb, Apple, Amazon, Netflix, and Google) performed a pivotal function on this development. These firms benefited from the growing adoption of cellular know-how, cloud computing, and e-commerce, driving important income development and market capitalization enlargement. The chart reveals a sustained upward trajectory, punctuated by occasional corrections, reflecting the general energy of the tech sector and the growing affect of those dominant gamers. This era additionally noticed the emergence of different tech giants, additional solidifying the Nasdaq-100’s place as a number one indicator of technological innovation.

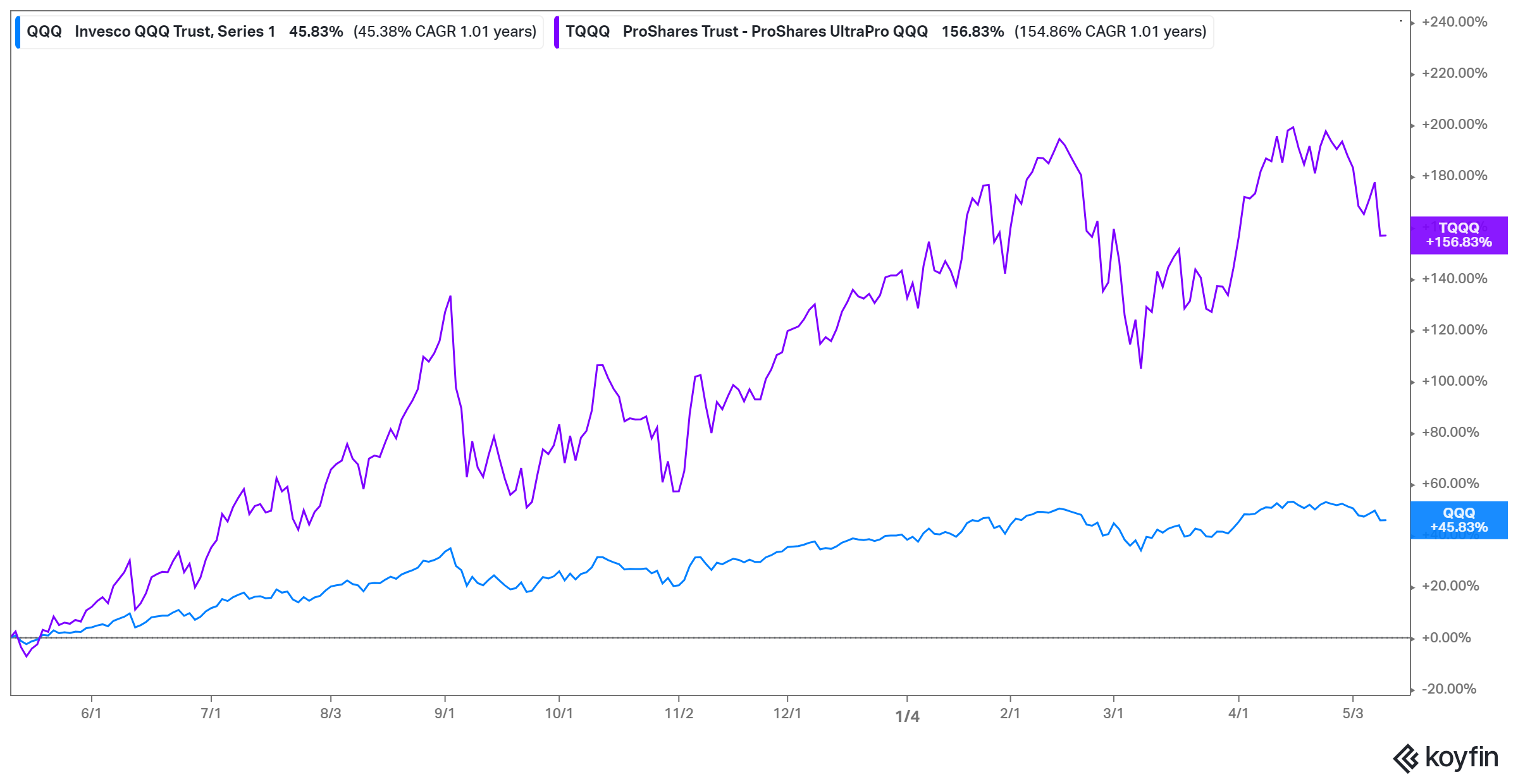

The Pandemic and Past (2020-Current): Volatility and Resilience

The COVID-19 pandemic initially triggered a pointy decline in QQQ, as market uncertainty and financial lockdowns led to widespread sell-offs. Nonetheless, the chart reveals a outstanding restoration, pushed by the elevated demand for technology-related services through the pandemic. Distant work, on-line training, and e-commerce skilled exponential development, benefiting firms throughout the Nasdaq-100. The following interval witnessed important volatility, with considerations about inflation, rising rates of interest, and geopolitical instability impacting market sentiment. This highlights the continuing challenges of investing in a sector delicate to macroeconomic situations. The current efficiency demonstrates the resilience of the tech sector, but additionally its susceptibility to broader financial shifts.

Key Takeaways and Implications for Traders:

Analyzing the QQQ all-time chart affords a number of key insights for buyers:

- Lengthy-Time period Development Potential: Regardless of intervals of serious volatility, QQQ has demonstrated a robust long-term upward pattern, reflecting the enduring development of the know-how sector.

- Excessive Threat, Excessive Reward: Investing in QQQ carries important danger as a result of its focus within the know-how sector. Its volatility necessitates a long-term funding horizon and a danger tolerance acceptable for this asset class.

- Market Timing is Tough: Attempting to time the market primarily based on short-term fluctuations is commonly unsuccessful. An extended-term technique centered on constant funding is mostly simpler.

- Diversification is Essential: Whereas QQQ affords publicity to a diversified group of tech firms, it is important to diversify throughout different asset lessons to mitigate danger.

- Elementary Evaluation Issues: Whereas development is essential, it is essential to evaluate the underlying fundamentals of the businesses throughout the Nasdaq-100 to establish sustainable long-term development alternatives.

Conclusion:

The QQQ all-time chart is a fascinating visible illustration of the know-how sector’s evolution. It showcases intervals of explosive development, devastating crashes, and memorable resilience. Understanding the historic context, key market occasions, and inherent dangers related to this ETF is essential for buyers contemplating its inclusion of their portfolios. A well-informed funding technique, combining long-term imaginative and prescient, acceptable danger tolerance, and a diversified method, is crucial for navigating the dynamic panorama of the know-how sector and maximizing the potential rewards supplied by QQQ. The chart serves not solely as a historic file but additionally as a useful instrument for understanding the complexities and alternatives inside this ever-evolving market.

Closure

Thus, we hope this text has offered useful insights into Deconstructing the QQQ All-Time Chart: A 25-Yr Journey Via Tech’s Triumphs and Tribulations. We thanks for taking the time to learn this text. See you in our subsequent article!