Greenback Vs Euro Alternate Chart Right this moment

greenback vs euro alternate chart as we speak

Associated Articles: greenback vs euro alternate chart as we speak

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to greenback vs euro alternate chart as we speak. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Navigating the Shifting Sands: A Deep Dive into Right this moment’s Greenback vs. Euro Alternate Fee Chart

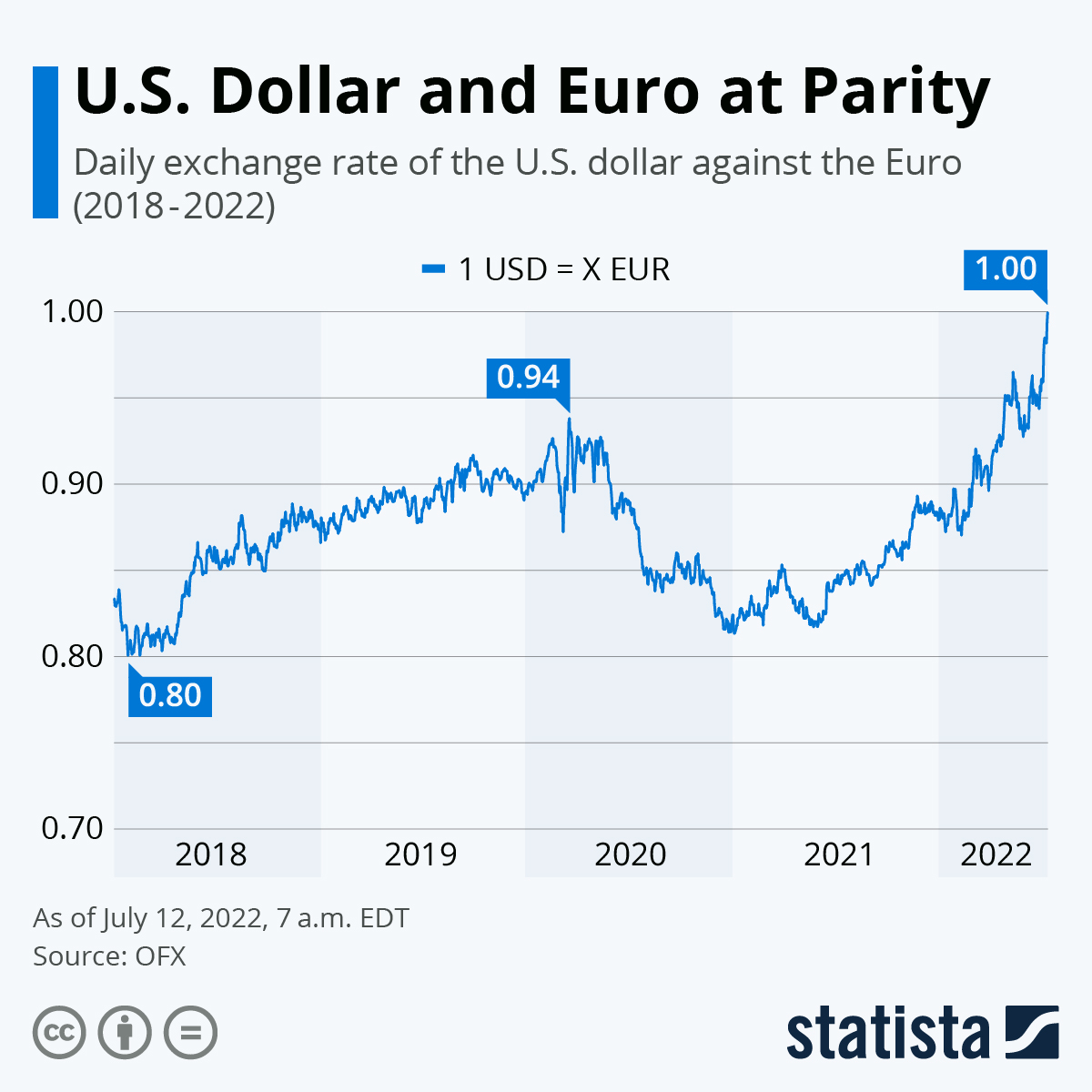

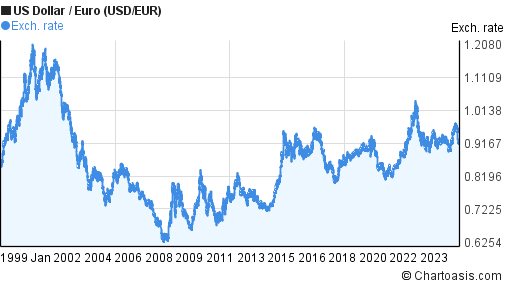

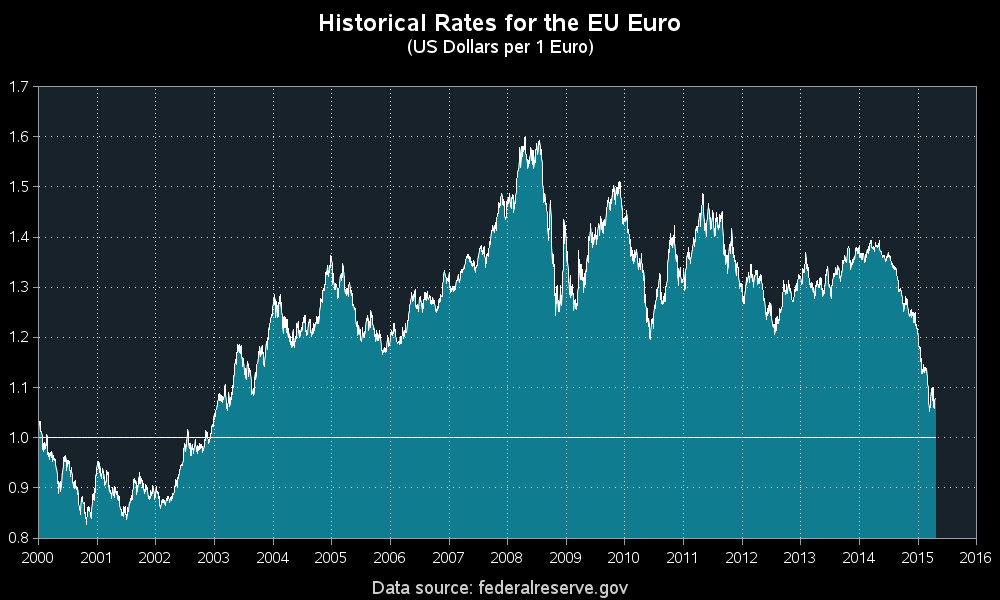

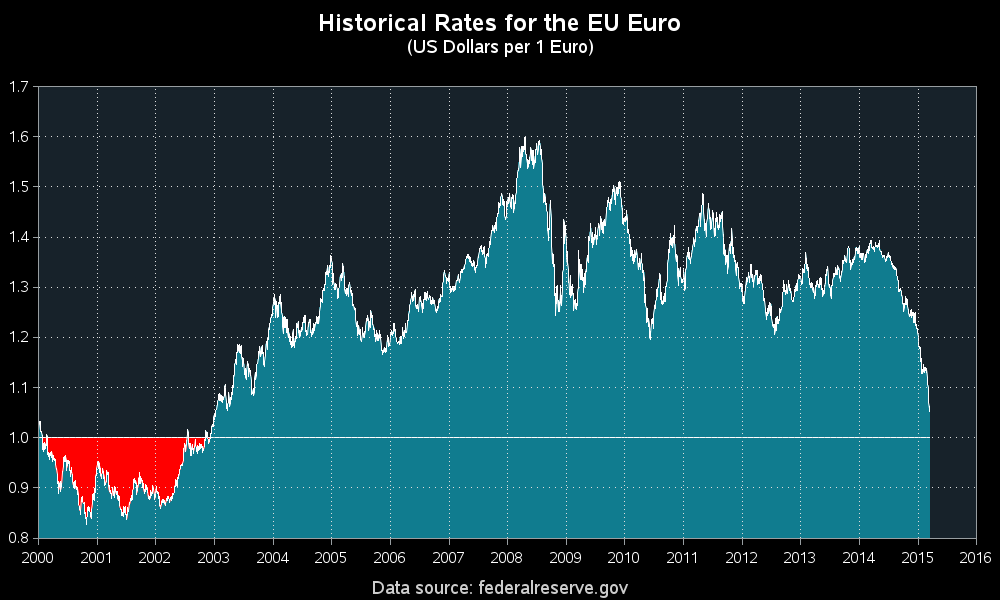

The connection between the US greenback (USD) and the euro (EUR) is a cornerstone of worldwide finance, influencing every little thing from worldwide commerce and funding to tourism and particular person funds. Understanding the every day fluctuations of their alternate price is essential for companies, buyers, and people alike. This text will delve into as we speak’s USD/EUR alternate price chart, exploring the components driving its motion and providing insights into potential future traits. Whereas offering particular numbers is unattainable because of the always altering nature of foreign exchange markets, we’ll analyze the everyday forces at play and the way they manifest within the chart’s patterns.

Understanding the Chart:

A typical USD/EUR alternate price chart shows the worth of 1 euro in US {dollars} over time. For example, a price of 1.1000 means one euro might be exchanged for 1.10 US {dollars}. The chart often presents this information graphically, usually utilizing candlestick or line graphs, permitting for visible interpretation of traits and volatility. Key parts to search for embrace:

-

Help and Resistance Ranges: These are worth ranges the place the alternate price has traditionally struggled to interrupt by means of. Help ranges characterize potential shopping for alternatives, whereas resistance ranges point out potential promoting pressures. These ranges are sometimes psychological (e.g., 1.10, 1.15) or primarily based on previous efficiency.

-

Pattern Strains: These traces join a collection of upper lows (uptrend) or decrease highs (downtrend), indicating the general path of the alternate price.

-

Shifting Averages: These are calculated averages of the alternate price over a particular interval (e.g., 50-day, 200-day). They easy out short-term fluctuations and assist establish longer-term traits.

-

Volatility: This refers back to the magnitude of worth swings. Excessive volatility suggests speedy and unpredictable adjustments, whereas low volatility signifies extra stability.

Components Influencing the USD/EUR Alternate Fee:

The USD/EUR alternate price is a fancy beast, influenced by a myriad of interconnected components. These might be broadly categorized as:

1. Financial Indicators:

-

Curiosity Charges: A better rate of interest within the US in comparison with the Eurozone typically attracts overseas funding, growing demand for the greenback and pushing the USD/EUR price increased. Conversely, increased rates of interest within the Eurozone would strengthen the euro. Central financial institution bulletins and expectations concerning future price adjustments considerably impression the alternate price.

-

Inflation: Excessive inflation erodes the buying energy of a foreign money. If inflation is considerably increased within the US than within the Eurozone, the euro could respect towards the greenback. Inflation information releases, such because the Client Worth Index (CPI), are carefully watched by merchants.

-

Gross Home Product (GDP): Stronger GDP progress within the US relative to the Eurozone typically helps the greenback. GDP figures mirror the general well being of an financial system and affect investor confidence.

-

Employment Information: Low unemployment charges and powerful job creation typically bolster a foreign money. Non-farm payroll numbers within the US and unemployment information within the Eurozone are vital indicators.

-

Commerce Balances: A big commerce deficit (importing greater than exporting) can weaken a foreign money. Commerce steadiness figures present insights into the general well being of a nation’s financial system and its worldwide competitiveness.

2. Geopolitical Occasions:

-

Political Instability: Political uncertainty in both the US or the Eurozone can result in elevated volatility and probably weaken the affected foreign money. Main political occasions, elections, and coverage adjustments can considerably impression the alternate price.

-

Worldwide Conflicts: International conflicts and tensions can set off "safe-haven" flows, driving buyers in the direction of the greenback, which is usually perceived as a safer asset throughout instances of uncertainty.

-

International Financial Shocks: Main financial occasions, similar to a worldwide recession or a major monetary disaster, can drastically alter the USD/EUR alternate price, usually inflicting sharp and unpredictable actions.

3. Market Sentiment and Hypothesis:

-

Investor Confidence: Constructive sentiment in the direction of the US financial system and its prospects typically strengthens the greenback. Conversely, unfavorable sentiment can weaken it.

-

Foreign money Hypothesis: Massive monetary establishments and particular person merchants actively speculate on foreign money actions, influencing the alternate price by means of their shopping for and promoting actions. This may amplify short-term fluctuations and create volatility.

-

Information and Media Protection: Market-moving information and media experiences can considerably impression the USD/EUR alternate price, significantly within the quick time period. Merchants carefully monitor monetary information retailers for updates and bulletins.

Decoding Right this moment’s Chart (Hypothetical Instance):

We could say a hypothetical situation as an example how these components would possibly play out on as we speak’s USD/EUR alternate price chart. Suppose the chart exhibits a latest downtrend, with the euro appreciating towards the greenback. Attainable explanations may embrace:

-

Greater Eurozone Curiosity Fee Expectations: The European Central Financial institution (ECB) is perhaps signaling future rate of interest hikes, attracting funding and strengthening the euro.

-

Weaker US Financial Information: Latest US financial experiences, similar to a disappointing GDP determine or rising unemployment, is perhaps dampening investor confidence within the greenback.

-

Geopolitical Uncertainty within the US: Political instability or an sudden worldwide occasion may very well be making a "flight to security," pushing buyers in the direction of the euro.

Conversely, an uptrend within the USD/EUR chart, with the greenback appreciating, may very well be attributed to components similar to:

-

Stronger US Financial Information: Constructive financial information, similar to strong job progress or higher-than-expected GDP figures, may increase investor confidence within the greenback.

-

Issues in regards to the Eurozone Financial system: Unfavorable information concerning the Eurozone financial system, similar to rising inflation or political instability, may weaken the euro.

-

Secure-Haven Demand for the Greenback: International uncertainty or a significant geopolitical occasion may drive buyers in the direction of the perceived security of the US greenback.

Conclusion:

The USD/EUR alternate price chart is a dynamic reflection of the complicated interaction between financial fundamentals, geopolitical occasions, and market sentiment. Whereas predicting future actions with certainty is unattainable, understanding the important thing drivers and analyzing the chart’s patterns can present worthwhile insights for knowledgeable decision-making. Staying knowledgeable about financial indicators, geopolitical developments, and market sentiment is essential for navigating the ever-shifting sands of the foreign exchange market. Keep in mind to seek the advice of respected monetary sources and take into account looking for skilled recommendation earlier than making any important monetary choices primarily based on alternate price fluctuations. The knowledge supplied on this article is for instructional functions solely and shouldn’t be thought of monetary recommendation.

Closure

Thus, we hope this text has supplied worthwhile insights into greenback vs euro alternate chart as we speak. We hope you discover this text informative and useful. See you in our subsequent article!