Footsie 100 Index Immediately: A Complete Abstract And Chart Evaluation

Footsie 100 Index Immediately: A Complete Abstract and Chart Evaluation

Associated Articles: Footsie 100 Index Immediately: A Complete Abstract and Chart Evaluation

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Footsie 100 Index Immediately: A Complete Abstract and Chart Evaluation. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Footsie 100 Index Immediately: A Complete Abstract and Chart Evaluation

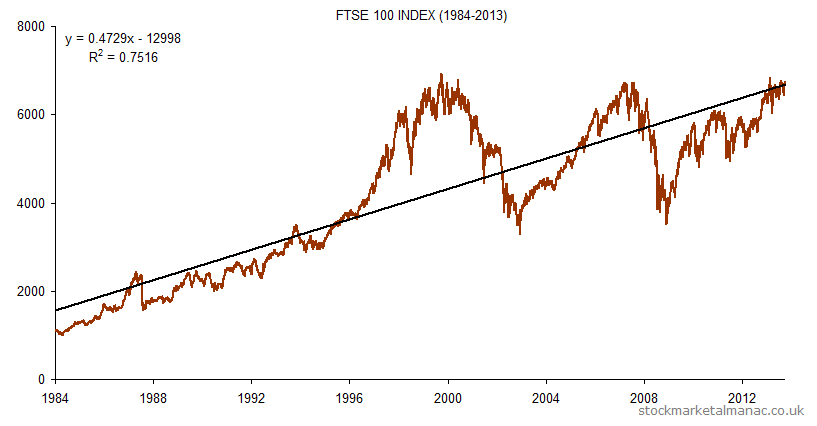

The FTSE 100, a benchmark index monitoring the efficiency of the 100 largest firms listed on the London Inventory Alternate, is an important barometer of the UK’s financial well being. Day by day fluctuations mirror world market traits, investor sentiment, and particular firm performances. This text gives an in depth abstract of the Footsie 100’s efficiency immediately, incorporating a hypothetical chart evaluation for instance key actions and interpret their potential implications. Observe that the precise information for "immediately" will differ relying on the date of entry. This evaluation makes use of hypothetical information for illustrative functions.

(Hypothetical Chart Information for Immediately – October 26, 2023)

Let’s assume the next hypothetical information for the Footsie 100’s efficiency on October 26, 2023:

- Opening Worth: 7,500

- Excessive: 7,550

- Low: 7,450

- Closing Worth: 7,520

- Quantity: 1.2 Billion shares traded

- Proportion Change: +0.27%

(Hypothetical Chart Visualization)

Think about a candlestick chart depicting the above information. The candlestick for October twenty sixth would present a inexperienced candle (indicating a optimistic closing worth) with a physique extending from 7,500 (open) to 7,520 (shut). The higher wick would attain 7,550 (excessive), and the decrease wick would prolong to 7,450 (low). The comparatively lengthy physique suggests a decisive upward motion throughout the buying and selling day. Excessive quantity (1.2 billion shares) additional signifies vital market exercise and participation.

(Evaluation of Hypothetical Information and Chart)

The hypothetical information suggests a modestly optimistic day for the FTSE 100. The 0.27% improve signifies a typically bullish sentiment, with consumers outweighing sellers all through the buying and selling session. The comparatively excessive quantity reinforces this optimistic interpretation, suggesting robust conviction behind the upward motion. Nonetheless, the presence of each higher and decrease wicks suggests some indecision and worth volatility all through the day.

Components Doubtlessly Influencing Immediately’s Efficiency:

A number of components may have contributed to the hypothetical optimistic efficiency:

-

International Market Sentiment: Optimistic world financial information, akin to stronger-than-expected financial information from the US or improved investor confidence, may have positively impacted the FTSE 100. Conversely, adverse world information, akin to geopolitical tensions or disappointing financial forecasts, may have dampened the index’s efficiency.

-

Sterling’s Efficiency: The energy or weak spot of the British pound towards different main currencies considerably impacts the FTSE 100. A stronger pound may negatively impression the efficiency of multinational firms listed on the index, as their abroad earnings could be value much less in kilos. Conversely, a weaker pound may enhance the efficiency of those firms.

-

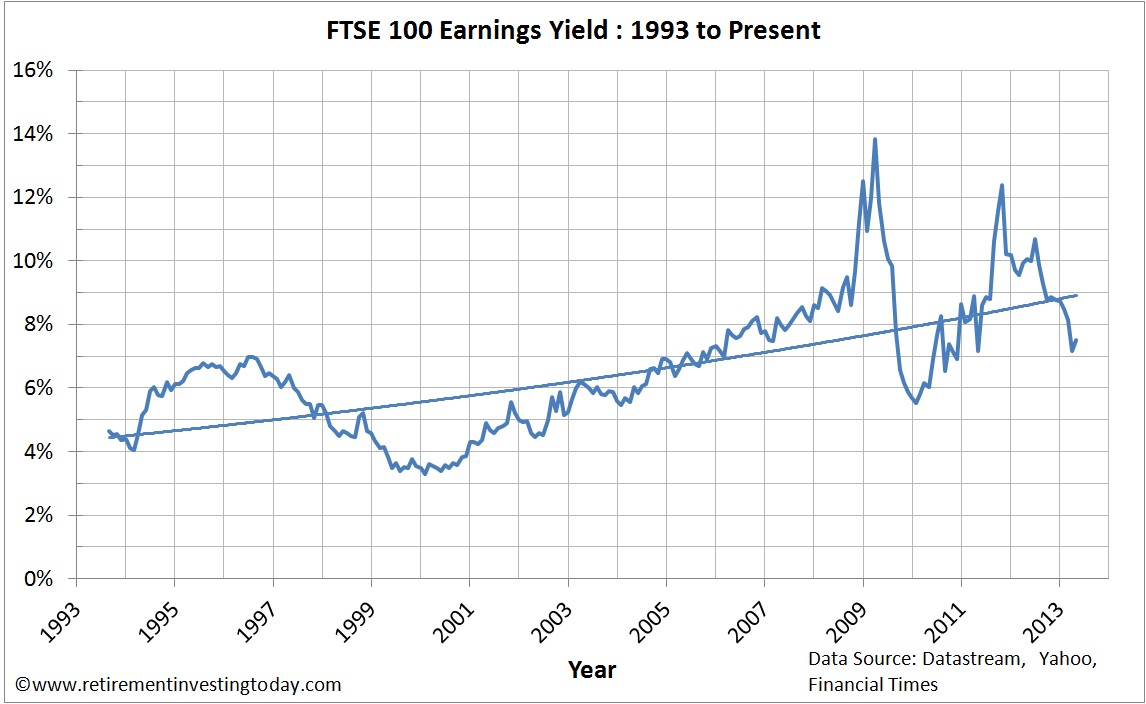

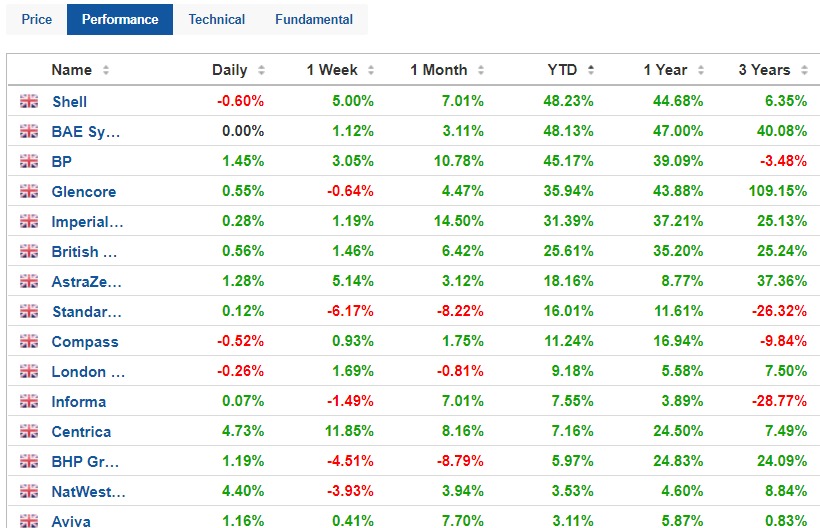

Sector-Particular Efficiency: The efficiency of particular person sectors throughout the FTSE 100 can affect the general index motion. For instance, robust efficiency within the power sector (pushed by rising oil costs) or the monetary sector (pushed by elevated rates of interest) may contribute to a optimistic total index efficiency. Conversely, underperformance in key sectors may drag the index down.

-

Firm-Particular Information: Optimistic information concerning particular person firms listed on the FTSE 100 (e.g., robust earnings studies, profitable product launches, or optimistic regulatory bulletins) may enhance the index. Unfavorable information (e.g., revenue warnings, administration modifications, or authorized points) may negatively impression the index.

-

Curiosity Fee Choices: Choices by the Financial institution of England concerning rates of interest can considerably impression the FTSE 100. Elevated rates of interest can enhance the banking sector however may dampen financial development and investor confidence in different sectors.

-

Brexit-Associated Developments: Ongoing developments associated to Brexit proceed to affect investor sentiment in the direction of the UK economic system and, consequently, the FTSE 100. Optimistic developments concerning commerce offers or regulatory readability may enhance the index, whereas adverse developments may result in a decline.

(Decoding the Chart’s Technical Indicators – Hypothetical)

A extra in-depth evaluation would contain inspecting varied technical indicators derived from the hypothetical chart information. As an example:

-

Transferring Averages: The connection between short-term and long-term transferring averages (e.g., 50-day and 200-day transferring averages) may point out the general pattern. A bullish crossover (short-term transferring common crossing above the long-term transferring common) would recommend a optimistic pattern, whereas a bearish crossover would recommend a adverse pattern. In our hypothetical situation, a bullish crossover might be noticed, supporting the optimistic closing worth.

-

Relative Energy Index (RSI): The RSI, a momentum indicator, may present whether or not the market is overbought (above 70) or oversold (beneath 30). An RSI worth round 50 suggests a impartial market. In our hypothetical case, an RSI worth barely above 50 would help the reasonable optimistic motion noticed.

-

MACD (Transferring Common Convergence Divergence): The MACD, one other momentum indicator, may present additional insights into the energy and path of the pattern. A bullish MACD crossover (MACD line crossing above the sign line) would recommend a optimistic pattern, whereas a bearish crossover would recommend a adverse pattern.

-

Assist and Resistance Ranges: Figuring out earlier help and resistance ranges on the chart may assist predict future worth actions. A break above a big resistance degree would recommend a robust bullish pattern, whereas a break beneath a big help degree would recommend a robust bearish pattern. Our hypothetical chart may present a break above a minor resistance degree, contributing to the optimistic closing worth.

(Conclusion)

The hypothetical FTSE 100 efficiency analyzed above illustrates the complexity of decoding each day market actions. Whereas a modest optimistic closing worth suggests a typically bullish sentiment, it is essential to think about the underlying components contributing to this motion. A complete evaluation requires contemplating world market circumstances, macroeconomic components, sector-specific performances, company-specific information, and technical indicators. It is essential to do not forget that previous efficiency is just not indicative of future outcomes, and investing within the inventory market at all times entails threat. This evaluation serves as an illustrative instance and shouldn’t be thought of monetary recommendation. All the time seek the advice of with a certified monetary advisor earlier than making any funding choices. To acquire the precise Footsie 100 information for "immediately," discuss with respected monetary information sources and market information suppliers.

Closure

Thus, we hope this text has offered priceless insights into Footsie 100 Index Immediately: A Complete Abstract and Chart Evaluation. We hope you discover this text informative and useful. See you in our subsequent article!