Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable)

Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable)

Associated Articles: Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable)

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable). Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable)

Foreign currency trading, the worldwide trade of currencies, thrives on predicting future value actions. Whereas elementary evaluation examines financial indicators and information occasions, technical evaluation focuses on deciphering value charts to establish patterns that counsel future tendencies. Chart patterns, visually identifiable formations on value charts, are a cornerstone of technical evaluation, providing merchants helpful insights into potential market shifts. This complete information explores varied foreign exchange chart patterns, their traits, and learn how to use them successfully in your buying and selling technique. A downloadable PDF model is accessible on the finish of this text.

Understanding Chart Patterns: The Basis of Technical Evaluation

Chart patterns are fashioned by the interaction of provide and demand. As patrons and sellers battle for management, value actions create distinct shapes on value charts. These formations, usually recurring, characterize predictable shifts in market sentiment and momentum. Recognizing these patterns permits merchants to anticipate potential value reversals or continuations, bettering the accuracy of their buying and selling choices.

Chart patterns are broadly categorized into two major teams:

-

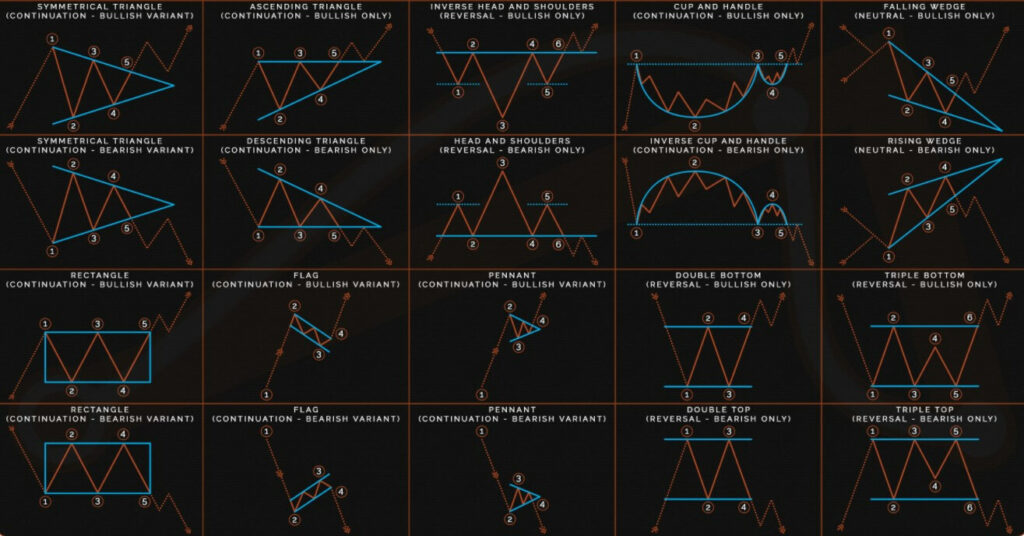

Continuation Patterns: These patterns counsel that the present development will proceed after a brief pause or consolidation. They characterize a interval of relaxation earlier than the development resumes its momentum. Examples embody triangles, flags, pennants, and rectangles.

-

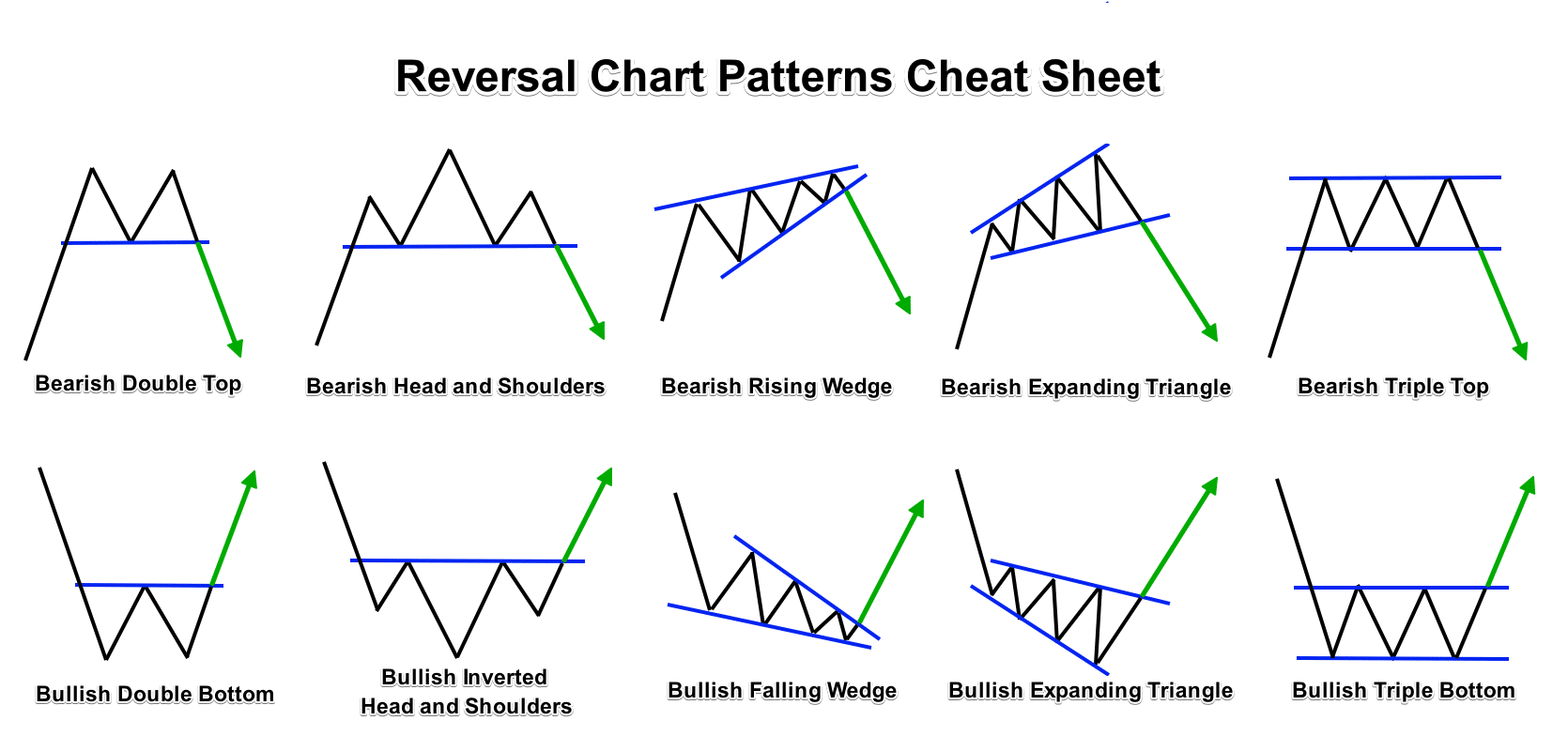

Reversal Patterns: These patterns point out a possible change within the prevailing development. They sign a shift in market sentiment, from bullish to bearish or vice versa. Head and shoulders, inverse head and shoulders, double tops, and double bottoms are basic reversal patterns.

Key Chart Sample Components:

Earlier than delving into particular patterns, it is essential to know the frequent components used to establish and interpret them:

-

Assist and Resistance Ranges: These are value ranges the place the value has traditionally struggled to interrupt via. Assist acts as a ground, stopping costs from falling additional, whereas resistance acts as a ceiling, stopping costs from rising greater. Breakouts above resistance or beneath help usually set off important value actions.

-

Trendlines: These are strains drawn connecting a collection of upper lows (uptrend) or decrease highs (downtrend). They characterize the general course of the value motion.

-

Quantity: Buying and selling quantity supplies context to cost actions. Excessive quantity throughout a breakout confirms the energy of the transfer, whereas low quantity suggests weak point.

-

Sample Completion: Most patterns have particular completion standards, comparable to a breakout from an outlined vary or a particular value goal. Understanding these standards is important for correct interpretation.

Detailed Evaluation of Frequent Foreign exchange Chart Patterns:

1. Continuation Patterns:

-

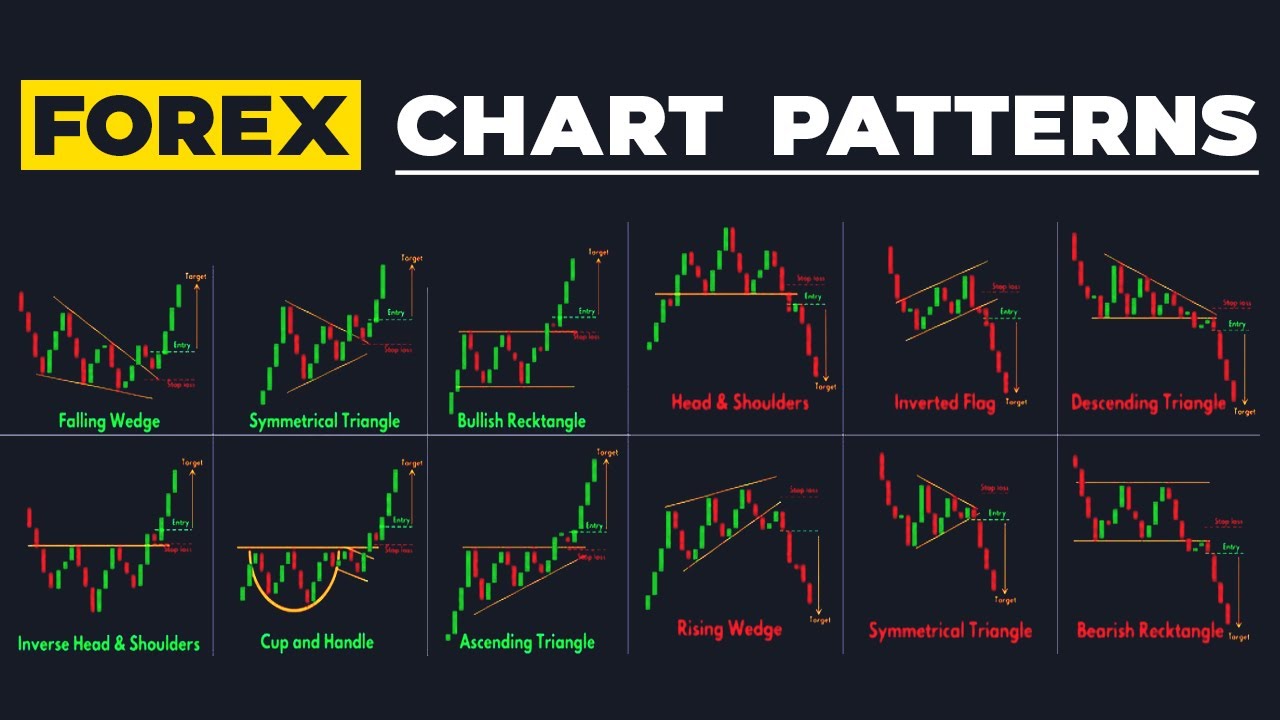

Triangles: These patterns are characterised by converging trendlines, forming a triangular form. They usually point out a interval of consolidation earlier than the development resumes within the course of the previous development. Symmetrical triangles are impartial, whereas ascending triangles counsel a bullish continuation and descending triangles a bearish continuation.

-

Flags and Pennants: These are characterised by a brief, comparatively tight consolidation interval inside a bigger development. Flags are characterised by parallel trendlines, whereas pennants have converging trendlines. Breakouts from flags and pennants usually proceed the prevailing development.

-

Rectangles: These patterns are characterised by two parallel horizontal strains representing help and resistance. Value consolidates inside this vary earlier than breaking out, usually persevering with the previous development.

2. Reversal Patterns:

-

Head and Shoulders: This can be a basic bearish reversal sample. It consists of three peaks, with the center peak (the pinnacle) being the best. A neckline connects the troughs of the left and proper shoulders. A break beneath the neckline confirms the reversal.

-

Inverse Head and Shoulders: This can be a bullish counterpart to the pinnacle and shoulders sample. It consists of three troughs, with the center trough (the pinnacle) being the bottom. A neckline connects the peaks of the left and proper shoulders. A break above the neckline confirms the reversal.

-

Double Tops and Double Bottoms: These patterns include two related peaks (double prime) or troughs (double backside) at roughly the identical value stage. A break beneath the neckline of a double prime or above the neckline of a double backside indicators a possible development reversal.

-

Triple Tops and Triple Bottoms: Much like double tops and bottoms, however with three peaks or troughs. These patterns usually verify stronger reversals.

Figuring out and Buying and selling Chart Patterns:

Efficiently buying and selling chart patterns requires follow and self-discipline. Listed below are some key concerns:

-

Chart Timeframes: Completely different timeframes reveal totally different patterns. Longer timeframes (every day, weekly) usually present bigger, extra important patterns, whereas shorter timeframes (hourly, 15-minute) reveal faster, smaller actions.

-

Affirmation: By no means rely solely on chart patterns. Verify potential trades utilizing different technical indicators (e.g., transferring averages, RSI, MACD) and elementary evaluation.

-

Danger Administration: At all times use applicable stop-loss orders to restrict potential losses. Decide your danger tolerance and place measurement accordingly.

-

Persistence and Self-discipline: Do not pressure trades. Anticipate clear affirmation of sample completion and a powerful breakout earlier than coming into a place. Stick with your buying and selling plan and keep away from emotional decision-making.

-

Follow: The easiest way to grasp chart sample recognition is thru follow. Backtest your methods on historic knowledge and use a demo account to refine your expertise earlier than buying and selling with actual cash.

Superior Chart Sample Concerns:

-

Sample Mixtures: A number of patterns can happen sequentially, offering stronger affirmation indicators.

-

False Breakouts: Generally, costs might break via help or resistance ranges solely to reverse rapidly. This can be a false breakout. Figuring out false breakouts requires cautious remark of quantity and value motion.

-

Context is Essential: The importance of a chart sample relies upon closely on the broader market context. Think about the general development, financial indicators, and information occasions when deciphering patterns.

Conclusion:

Foreign exchange chart patterns are a robust software for technical merchants. By understanding their traits and utilizing them at the side of different analytical strategies, merchants can enhance their forecasting accuracy and improve their buying and selling efficiency. Nonetheless, keep in mind that no buying and selling technique is foolproof. Steady studying, follow, and disciplined danger administration are important for fulfillment within the foreign exchange market.

(PDF Obtain Hyperlink: [Insert Link Here – This would be a link to a PDF version of this article. You would need to create the PDF separately using a word processor or PDF creation software])

This PDF will comprise your entire content material of this text, formatted for simple studying and printing. It serves as a handy reference information for foreign exchange merchants who want to be taught extra about chart patterns and incorporate them into their buying and selling methods. Bear in mind to all the time conduct thorough analysis and handle your danger successfully when buying and selling foreign exchange.

Closure

Thus, we hope this text has supplied helpful insights into Foreign exchange Chart Patterns: A Complete Information (PDF Downloadable). We hope you discover this text informative and useful. See you in our subsequent article!